Form 8949 Code X

Form 8949 Code X - Web overview of form 8949: Web support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Solved•by turbotax•6685•updated april 12, 2023. You can check this using the following steps: Select the appropriate designation from the drop list for the field applicable check box on form 8949: Sales and other dispositions of capital assets is a form used by individuals, partnerships, companies, trusts, and estates. Report the transaction on form 8949 as you would if you were the actual owner, but enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any resulting loss as a. Then, check the appropriate box on 8949. Web 1= qualified small business stock (exclusion or rollover) if you have a code q generating and there aren't any entries for stock dispositions indicated as qualified small business stock, then you may have an amount entered in the screen. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss.

Web open the 8949 screen (on the income tab). Web these adjustment codes are listed below along with information explaining the situation each code represents, as well as information regarding how to properly report the adjustment amount in your return. These adjustment codes will be included on form 8949, which will print along with schedule d. The 8949 form can be quite daunting for newbie taxpayers. Web what is irs form 8949? File form 8949 with the schedule d for the return you are filing. Sales and other dispositions of capital assets is a form used by individuals, partnerships, companies, trusts, and estates. At the top of the 8949 form, you’ll see some initial information, you need to fill that information. Web overview of form 8949: Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges.

Review the irs instructions for form 8949 for a complete list of. Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. If the sale resulted in a gain but was not eligible for the exclusion, it will be reported on the appropriate form 8949 as a gain. Web open the 8949 screen (on the income tab). Web overview of form 8949: At the top of the 8949 form, you’ll see some initial information, you need to fill that information. Follow the instructions for the code you need to generate below. Key takeaways the primary purpose of irs form 8949 is to report sales and exchanges of capital assets. Web use form 8949 to report sales and exchanges of capital assets. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g.

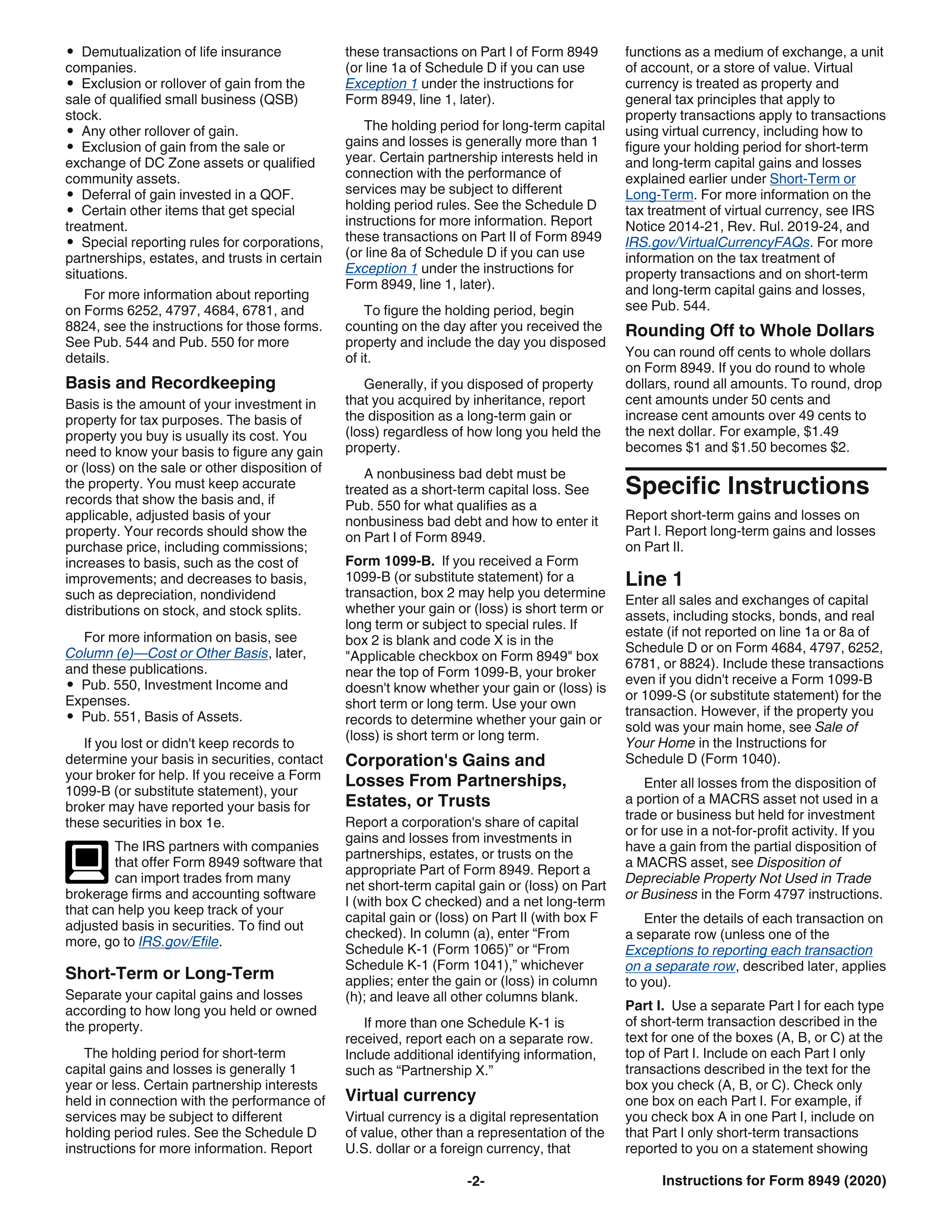

IRS Form 8949 instructions.

Select the appropriate designation from the drop list for the field applicable check box on form 8949: If the sale resulted in a gain but was not eligible for the exclusion, it will be reported on the appropriate form 8949 as a gain. You can check this using the following steps: Form 8949 (sales and other dispositions of capital assets).

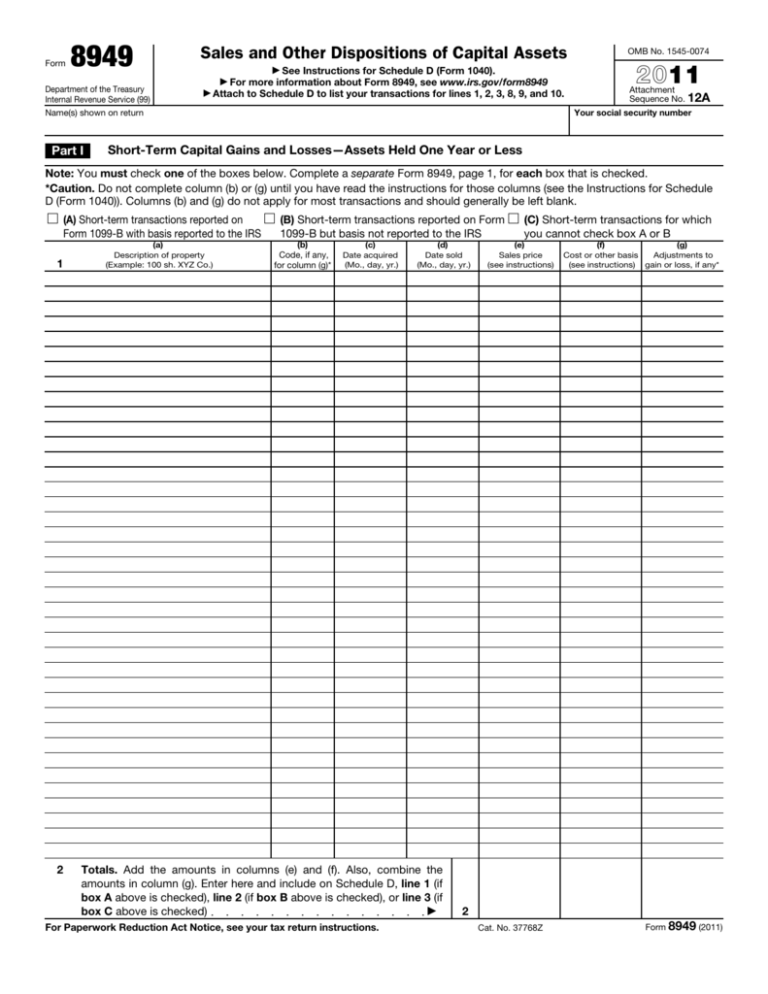

File IRS Form 8949 to Report Your Capital Gains or Losses

At the top of the 8949 form, you’ll see some initial information, you need to fill that information. Web open the 8949 screen (on the income tab). Web 1= qualified small business stock (exclusion or rollover) if you have a code q generating and there aren't any entries for stock dispositions indicated as qualified small business stock, then you may.

Can You Please Help Me Fill Out Form 8949? So I Kn...

Report the transaction on form 8949 as you would if you were the actual owner, but enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any resulting loss as a. Form 8949 is filed along with schedule d. Key takeaways the primary purpose of irs form 8949 is to report sales and exchanges of capital.

Form 8949 Pillsbury Tax Page

Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges. Key takeaways the primary purpose of irs form 8949 is to report sales and exchanges of capital assets. Select the appropriate designation from the drop list for the field applicable check box on form 8949: Web these adjustment codes are.

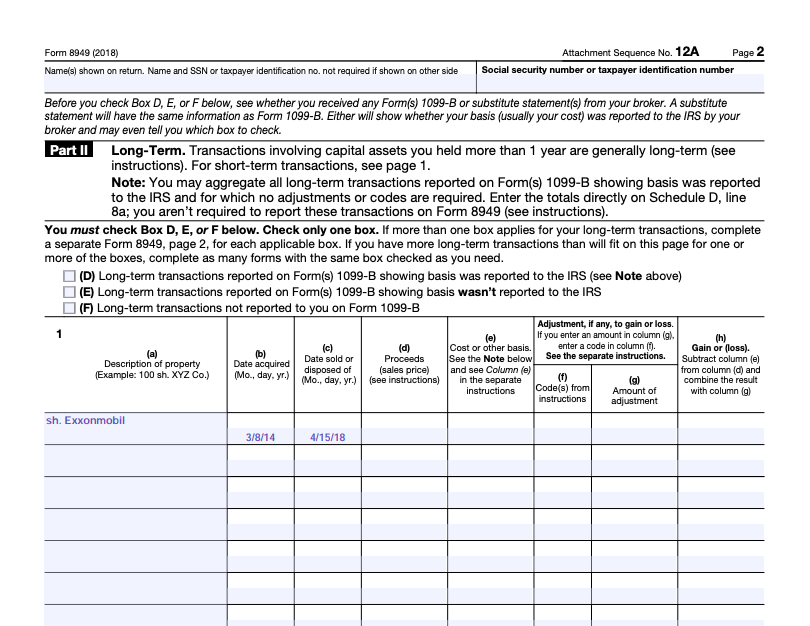

In the following Form 8949 example,the highlighted section below shows

Web open the 8949 screen (on the income tab). Web support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Follow the instructions for the code you need to generate below. Review the irs instructions for form 8949 for a complete list of. For a complete list of column (f) requirements, see the how to.

Tax Form 8949 Instructions for Reporting Capital Gains and Losses

Web support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. Key takeaways the primary purpose of irs form 8949 is to report sales.

Your Crypto Tax Questions Answered by a Tax Attorney & CPA

Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Report the sale or exchange on form 8949 as you would if you were not. The 8949 form can be quite daunting for newbie taxpayers. Web support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). These.

Online IRS Instructions 8949 2019 Fillable and Editable PDF Template

Report the sale or exchange on form 8949 as you would if you were not. Select the appropriate designation from the drop list for the field applicable check box on form 8949: These adjustment codes will be included on form 8949, which will print along with schedule d. Web where is form 8949? Form 8949 (sales and other dispositions of.

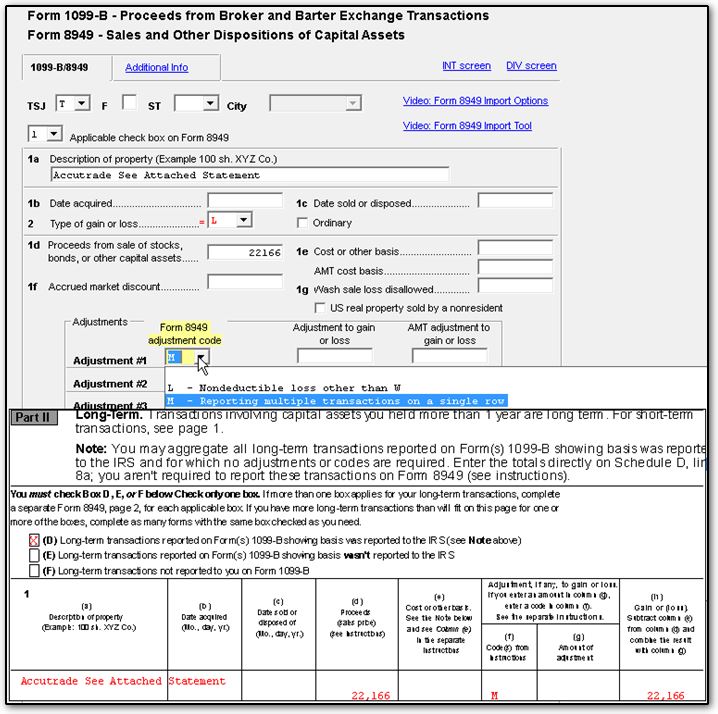

8949 Import Transactions, PDI Indicator or PDF Attachment (1099B

It is used to report capital gains and losses from sales and exchanges of capital assets to the internal revenue service (irs). Follow the instructions for the code you need to generate below. Web open the 8949 screen (on the income tab). Web where is form 8949? You can check this using the following steps:

Online generation of Schedule D and Form 8949 for 10.00

Report the sale or exchange on form 8949 as you would if you were not. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss. At the top of the 8949 form, you’ll see some initial information, you need.

Web Overview Of Form 8949:

Then, check the appropriate box on 8949. Review the irs instructions for form 8949 for a complete list of. Web 12 rows report the gain or loss in the correct part of form 8949. Web these adjustment codes are listed below along with information explaining the situation each code represents, as well as information regarding how to properly report the adjustment amount in your return.

Web Open The 8949 Screen (On The Income Tab).

Report the transaction on form 8949 as you would if you were the actual owner, but enter any resulting gain as a negative adjustment (in parentheses) in column (g) or any resulting loss as a. Web what is irs form 8949? For a complete list of column (f) requirements, see the how to complete form 8949, columns (f) and (g) section of the form 8949 instructions. Web gain, form 8949 will show the adjustment as a negative number in the amount of the net gain, with adjustment code h and basis type f and no net gain/loss.

Report The Sale Or Exchange On Form 8949 As You Would If You Were Not.

Follow the instructions for the code you need to generate below. Web form 8949, column (f) reports a code explaining any adjustments to gain or loss in column g. Select the appropriate designation from the drop list for the field applicable check box on form 8949: Form 8949 is filed along with schedule d.

Web Where Is Form 8949?

Web 1= qualified small business stock (exclusion or rollover) if you have a code q generating and there aren't any entries for stock dispositions indicated as qualified small business stock, then you may have an amount entered in the screen. Web support form 8949 adjustment codes (1040) form 8949 adjustment codes are reported in column (f). Select check box a, b, or c in part i for short term trades: Form 8949 (sales and other dispositions of capital assets) records the details of your capital asset (investment) sales or exchanges.