Form 8958 Required

Form 8958 Required - Web if however, you have requirement to file form 8958, you will need to mail in your tax return as it cannot be electronically filed. Income allocation information is required when electronically filing a return with. You did not file a joint return for the tax year. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required for married. The laws of your state govern whether you have community or separate property and income. You did not include the item of community income in gross income. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web bought with separate funds. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your.

Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report. Web publication 555 (03/2020), community property revised: Web common questions about entering form 8958 income for community property allocation in lacerte. The program will reallocate the income, deductions, and tax from the adjustment screens. Web according to page 2 of irs publication 555 community property, you would only complete form 8958 if you were domiciled in a community property state. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web the adjustment worksheet generates form 8958 which is included with your tax return. Web if however, you have requirement to file form 8958, you will need to mail in your tax return as it cannot be electronically filed.

You did not include the item of community income in gross income. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Income allocation information is required when electronically filing a return with. Web this article will help resolve the following diagnostic: Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. Web the adjustment worksheet generates form 8958 which is included with your tax return. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your. Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report. The laws of your state govern whether you have community or separate property and income. Web common questions about entering form 8958 income for community property allocation in lacerte.

Tax preparation Stock Photos, Royalty Free Tax preparation Images

Web the adjustment worksheet generates form 8958 which is included with your tax return. Web according to page 2 of irs publication 555 community property, you would only complete form 8958 if you were domiciled in a community property state. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you.

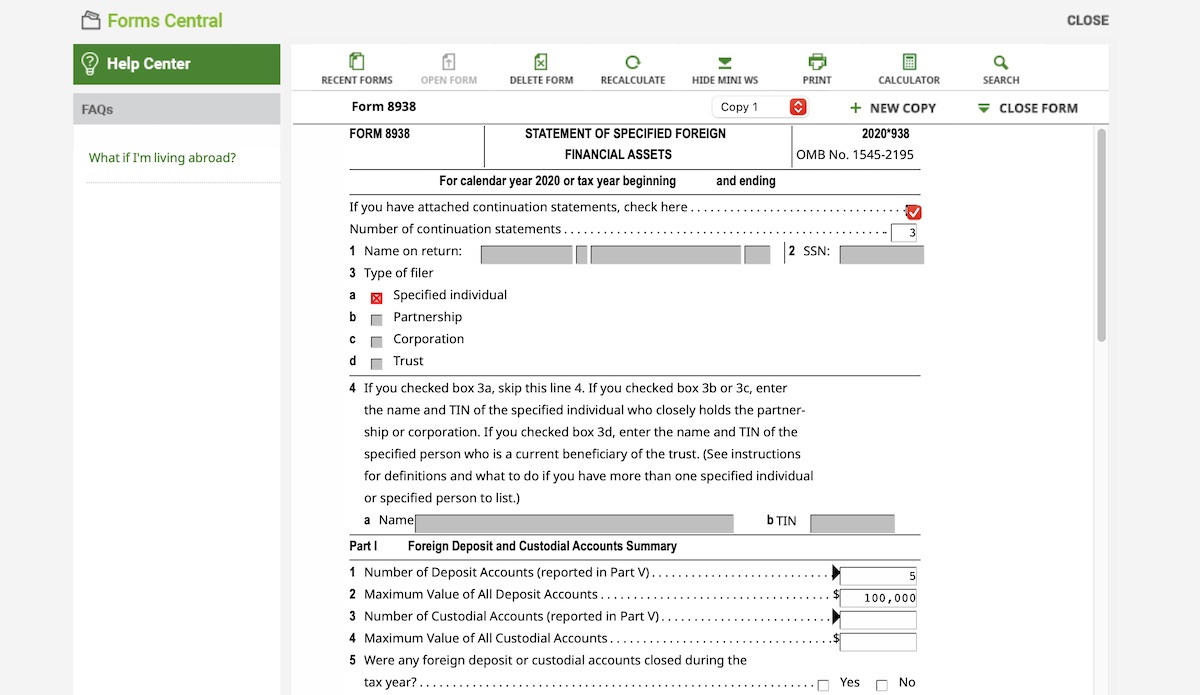

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required for married. Your marital status isn't reflected as. Web if however, you have requirement to file form 8958, you will need to mail in your tax return as it cannot be electronically filed. You.

수질배출부과금징수유예 및 분납신청 샘플, 양식 다운로드

Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required for married. Income allocation information is required when electronically filing a return with. Web bought with separate funds. Web if your resident state is a community property state, and you file a federal tax.

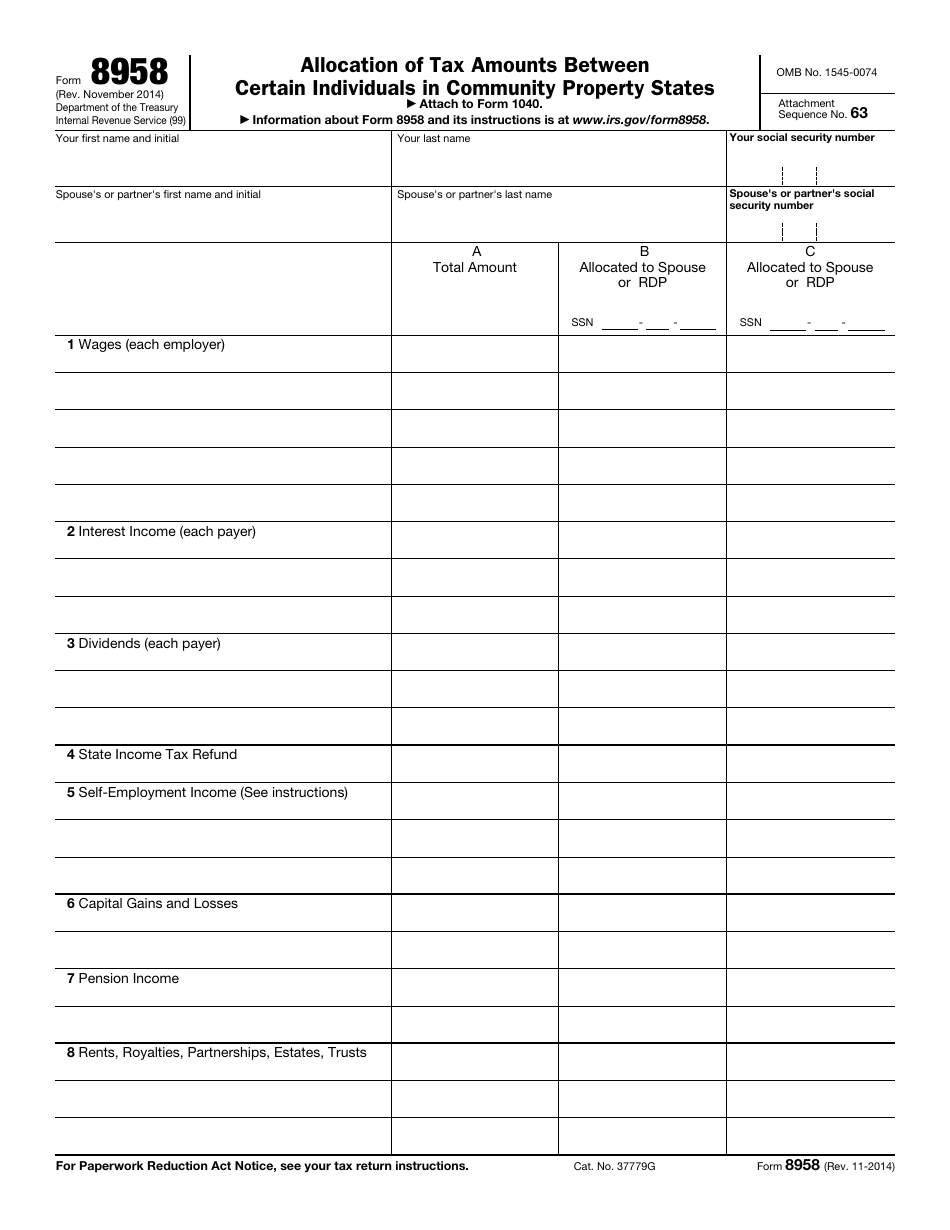

IRS Form 8958 Download Fillable PDF or Fill Online Allocation of Tax

The program will reallocate the income, deductions, and tax from the adjustment screens. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Web if however, you have requirement to file form 8958, you will need to mail.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web according to page 2 of irs publication 555 community property, you would only complete form 8958 if you were domiciled in a community property state. Web the adjustment worksheet generates form 8958 which is included with your tax return. The program will reallocate the income, deductions, and tax from the adjustment screens. Web to enter form 8958 in the.

Form 8958 Fill Out and Sign Printable PDF Template signNow

Your marital status isn't reflected as. Web this article will help resolve the following diagnostic: Income allocation information is required when electronically filing a return with. The program will reallocate the income, deductions, and tax from the adjustment screens. Web if however, you have requirement to file form 8958, you will need to mail in your tax return as it.

p555 by Paul Thompson Issuu

Income allocation information is required when electronically filing a return with. The program will reallocate the income, deductions, and tax from the adjustment screens. You did not include the item of community income in gross income. Web bought with separate funds. Web if however, you have requirement to file form 8958, you will need to mail in your tax return.

Fill Free fillable Form 8958 2019 Allocation of Tax Amounts PDF form

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report. The laws of your state govern whether you have community or separate property and income. Web publication 555 (03/2020), community property revised: Web use this screen to enter information used.

Form 8958 Allocation of Tax Amounts between Certain Individuals in

Web the adjustment worksheet generates form 8958 which is included with your tax return. You did not file a joint return for the tax year. Web to enter form 8958 in the taxact program (this allocation worksheet does not need to be completed if you are only filing the state returns separately and filing a joint federal. Income allocation information.

De 2501 Part B Printable

Web this article will help resolve the following diagnostic: Web according to page 2 of irs publication 555 community property, you would only complete form 8958 if you were domiciled in a community property state. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is.

Web To Enter Form 8958 In The Taxact Program (This Allocation Worksheet Does Not Need To Be Completed If You Are Only Filing The State Returns Separately And Filing A Joint Federal.

The laws of your state govern whether you have community or separate property and income. Web use this screen to enter information used to complete form 8958, allocation of tax amounts between certain individuals in community property states, which is required for married. Web if however, you have requirement to file form 8958, you will need to mail in your tax return as it cannot be electronically filed. Web common questions about entering form 8958 income for community property allocation in lacerte.

Web According To Page 2 Of Irs Publication 555 Community Property, You Would Only Complete Form 8958 If You Were Domiciled In A Community Property State.

The program will reallocate the income, deductions, and tax from the adjustment screens. Income allocation information is required when electronically filing a return with. Web 1 best answer thomasm125 expert alumni your community property income will be your normal income for the year plus or minus an adjustment for your. Web the adjustment worksheet generates form 8958 which is included with your tax return.

Web This Article Will Help Resolve The Following Diagnostic:

Web if your resident state is a community property state, and you file a federal tax return separately from your spouse or registered domestic partner, use form 8958 to report. Web bought with separate funds. Web form 8958 is also needed for the two separately filed tax returns of registered domestic partners in a community property state who are filing as single, head of household, or. You did not include the item of community income in gross income.

Your Marital Status Isn't Reflected As.

Web publication 555 (03/2020), community property revised: You did not file a joint return for the tax year.