Form 8995 Instruction

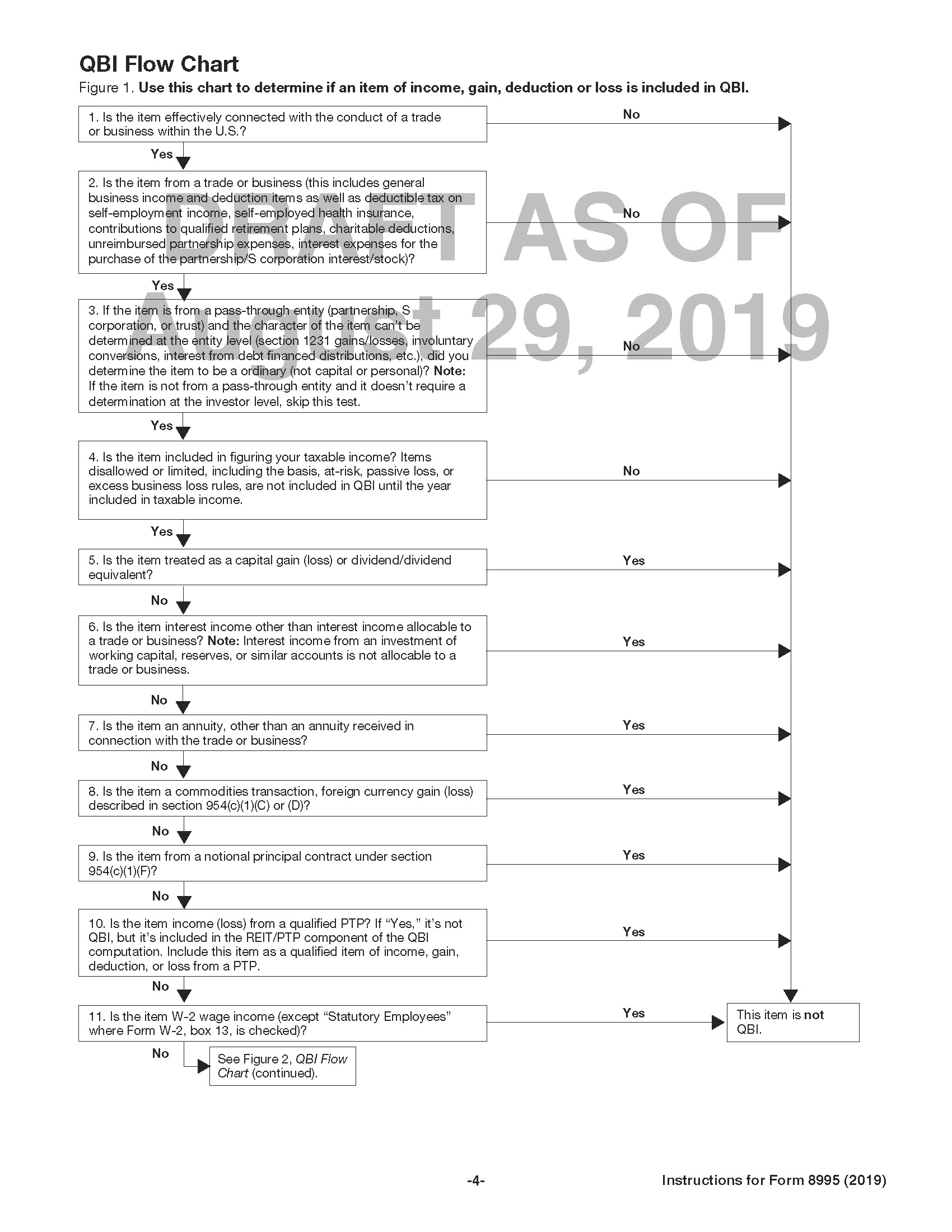

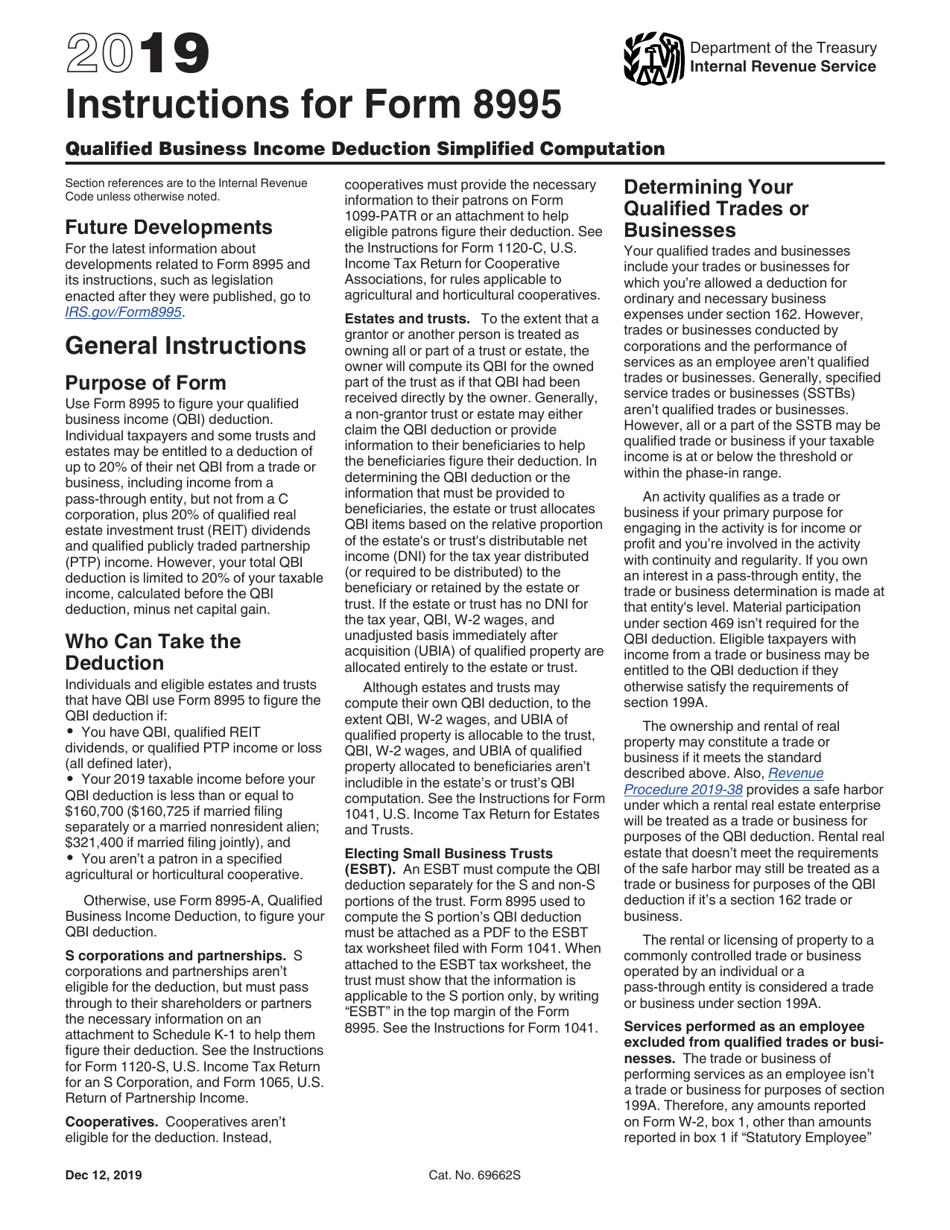

Form 8995 Instruction - Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. By familiarizing yourself with the form's. The 2019 form 8995 instructions provide: Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Department of the treasury internal revenue service. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Individual taxpayers and some trusts and estates may be. Include the following schedules (their specific instructions are. You can access it on the internal revenue service’s official website. Web how can i find irs form 8995 instructions?

Department of the treasury internal revenue service. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. Use separate schedules a, b, c, and/or d, as. Individual taxpayers and some trusts and estates may be. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction. The taxpayer has to use document to report certain. Attach to your tax return. Include the following schedules (their specific instructions are.

The 2019 form 8995 instructions provide: Individual taxpayers and some trusts and estates may be. Web how can i find irs form 8995 instructions? Include the following schedules (their specific instructions are. Individual taxpayers and some trusts and estates may be. The instructions provide detailed information on. Attach to your tax return. Use separate schedules a, b, c, and/or d, as. As with most tax issues, the. Department of the treasury internal revenue service.

Draft Instructions to 2019 Form 8995 Contain More Informal IRS Guidance

As with most tax issues, the. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Include the following schedules (their specific instructions are. Individual taxpayers and some trusts and estates may be. Use separate schedules a, b, c, and/or d, as.

What Is Form 8995 And 8995a Ethel Hernandez's Templates

Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart. Use this form to figure your qualified business income deduction. Use separate schedules a, b, c, and/or.

Form 8995 Basics & Beyond

Department of the treasury internal revenue service. Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a. Use this form to figure your qualified business income deduction. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and.

IRS Form 8995 Download Fillable PDF or Fill Online Qualified Business

Web the taxpayer should use irs form 8995 with instructions if the taxpayer has a branch or a subsidiary in a foreign country. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï The taxpayer has to use document to report certain. Web the 2020 draft instructions to form 8995 contain a.

Draft 2019 Form 1120S Instructions Adds New K1 Statements for §199A

The taxpayer has to use document to report certain. Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a. Attach to your tax return. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax.

8995 A Fill and Sign Printable Template Online US Legal Forms

As with most tax issues, the. Attach to your tax return. Include the following schedules (their specific instructions are. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Individual taxpayers and some trusts and estates may be.

Download Instructions for IRS Form 8995 Qualified Business

Web how can i find irs form 8995 instructions? As with most tax issues, the. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings. The 2019 form 8995 instructions provide: Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600.

Form 8995 Fill Out and Sign Printable PDF Template signNow

You can access it on the internal revenue service’s official website. As with most tax issues, the. Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings. The taxpayer has to use document to report certain. Web the 2020 draft instructions to form 8995 contain a significant change from their.

Solved Rob Wriggle operates a small plumbing supplies business as a

Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Attach to your tax return. Individual taxpayers and some trusts and estates may be. Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a. Include.

Draft Instructions to 2019 Form 8995 Contain More Informal IRS Guidance

Individual taxpayers and some trusts and estates may be. Web how can i find irs form 8995 instructions? Include the following schedules (their specific instructions are. Individual taxpayers and some trusts and estates may be. Attach to your tax return.

Web How Can I Find Irs Form 8995 Instructions?

You can access it on the internal revenue service’s official website. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¿ à à ¼ deduction for qualified business income »æ·èêã»äê å¼ ê¾» è»·éëèï Attach to your tax return. Web general instructions purpose of form use form 8995 to figure your qualified business income (qbi) deduction.

As With Most Tax Issues, The.

Use this form to figure your qualified business income deduction. The 2019 form 8995 instructions provide: Individual taxpayers and some trusts and estates may be. Use this form if your taxable income, before your qualified business income deduction, is at or below $163,300 ($326,600 if married filing jointly), and you aren’t a.

Web General Instructions Purpose Of Form Use Form 8995 To Figure Your Qualified Business Income (Qbi) Deduction.

The instructions provide detailed information on. Include the following schedules (their specific instructions are. Individual taxpayers and some trusts and estates may be. Web the 2020 draft instructions to form 8995 contain a significant change from their 2019 counterpart.

Department Of The Treasury Internal Revenue Service.

Web in conclusion, understanding tax form 8995 instructions is essential in maximizing your qbi deduction and ensuring accurate tax filings. Web the taxpayer should use irs form 8995 with instructions if the taxpayer has a branch or a subsidiary in a foreign country. Use separate schedules a, b, c, and/or d, as. The taxpayer has to use document to report certain.