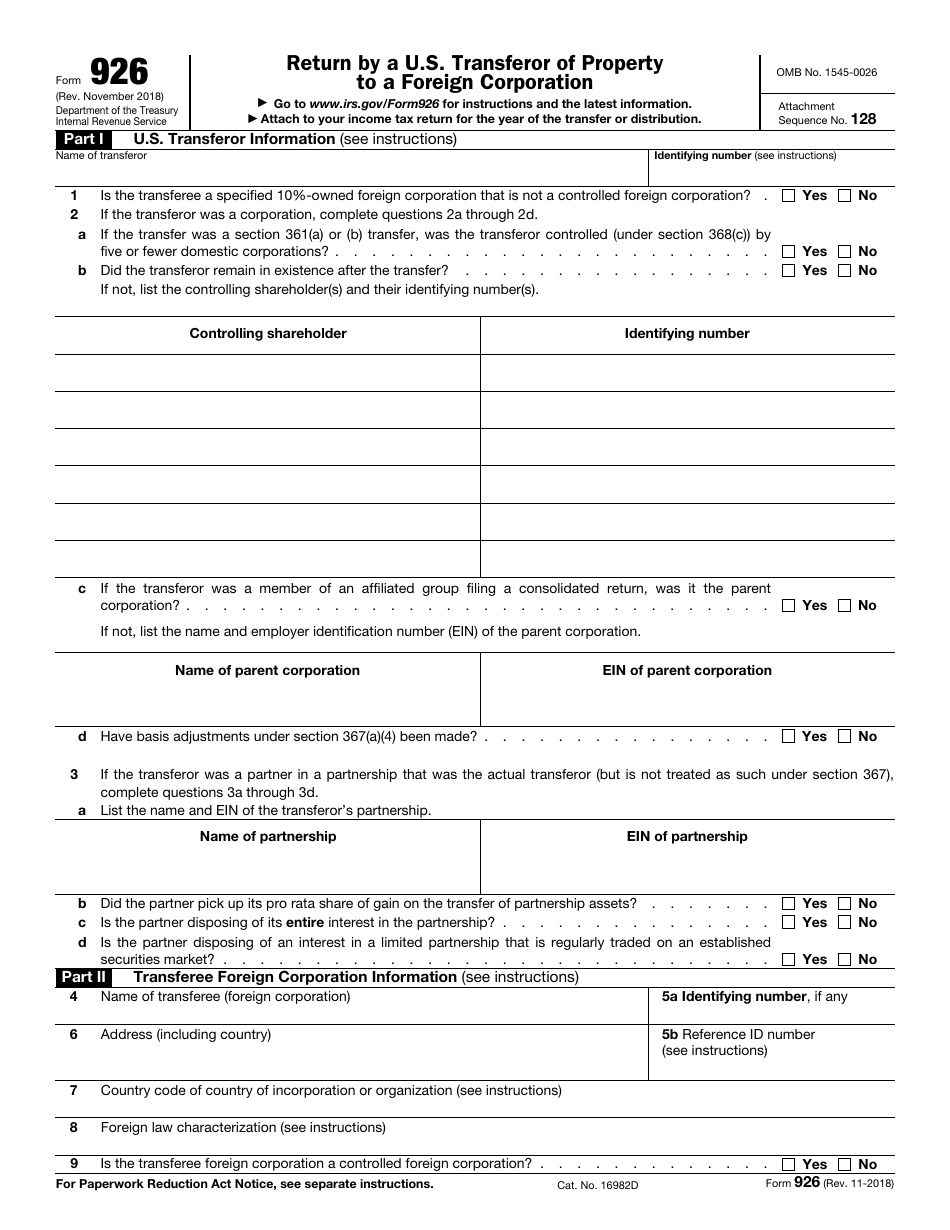

Form 926 Instructions

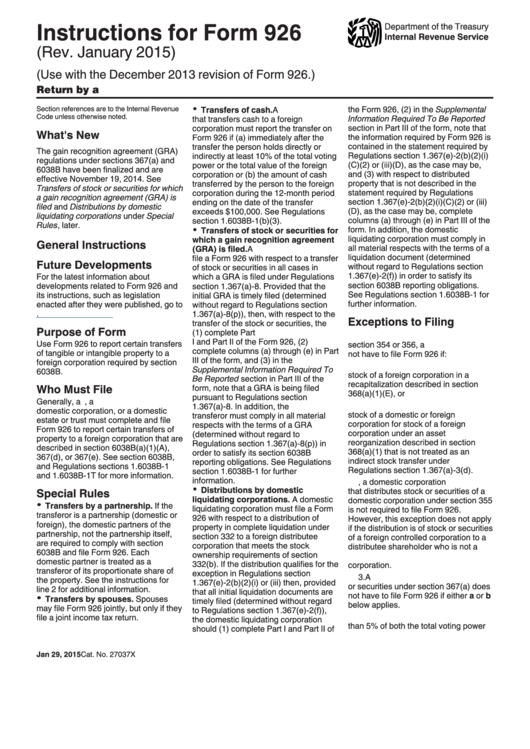

Form 926 Instructions - Spouses may file form 926 jointly, but only if they file a joint income tax return. And, unless an exception, exclusion, or limitation applies, irs form 926 must be filed by any of the following that meet the reporting threshold requirements: Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file. See the instructions for line 2 for additional information. See the instructions for line 3 for additional information. Web irs form 926 is the form u.s. Attach to your income tax return for the year of the transfer or distribution. Web to properly tax foreign income, the irs requires taxpayers to file different forms that provide information about a taxpayer’s foreign assets and transactions. Citizen or resident, a domestic corporation, or a domestic estate or trust. Each domestic partner is treated as a transferor of its proportionate share of the property.

November 2018) department of the treasury internal revenue service. This would include transfers of cash over $100,000 to a foreign corporation, or if the transfer of cash resulted in owning more than 10% of the foreign corporation’s stock. Form 926 is not limited to individuals. Attach to your income tax return for the year of the transfer or distribution. Person that transfers cash to a foreign Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Web instructions for form 982 (12/2021) download pdf. Instructions for form 990 return of organization exempt from income tax (2022) download pdf. Web what is form 926 used for. Person that transfers cash to a foreign corporation must report the transfer on form 926 if (a) immediately after

Www.irs.gov/form926 for instructions and the latest information. Each domestic partner is treated as a transferor of its proportionate share of the property. Web to properly tax foreign income, the irs requires taxpayers to file different forms that provide information about a taxpayer’s foreign assets and transactions. Person that transfers cash to a foreign corporation must report the transfer on form 926 if (a) immediately after Web information about form 926, return by a u.s. Instructions for form 990 return of organization exempt from income tax (2022) download pdf. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. One of these forms is form 926. Spouses may file form 926 jointly, but only if they file a joint income tax return. Form 926 is used by a taxpayer to report property transfers to a foreign corporation.

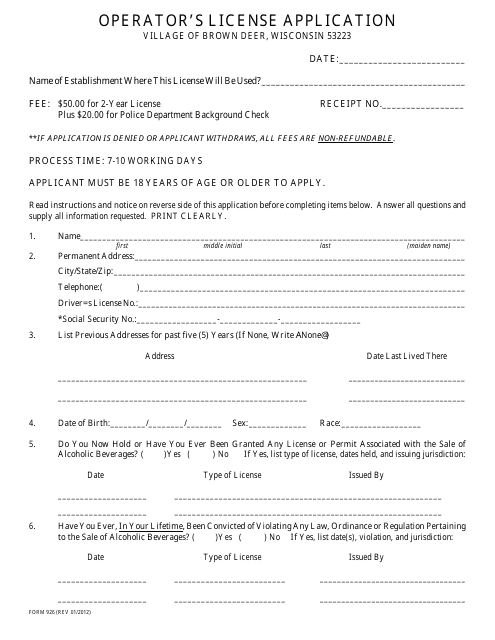

Form 926 Download Printable PDF or Fill Online Operator's License

Www.irs.gov/form926 for instructions and the latest information. Each domestic partner is treated as a transferor of its proportionate share of the property. Attach to your income tax return for the year of the transfer or distribution. Form 926 is used by a taxpayer to report property transfers to a foreign corporation. November 2018) department of the treasury internal revenue service.

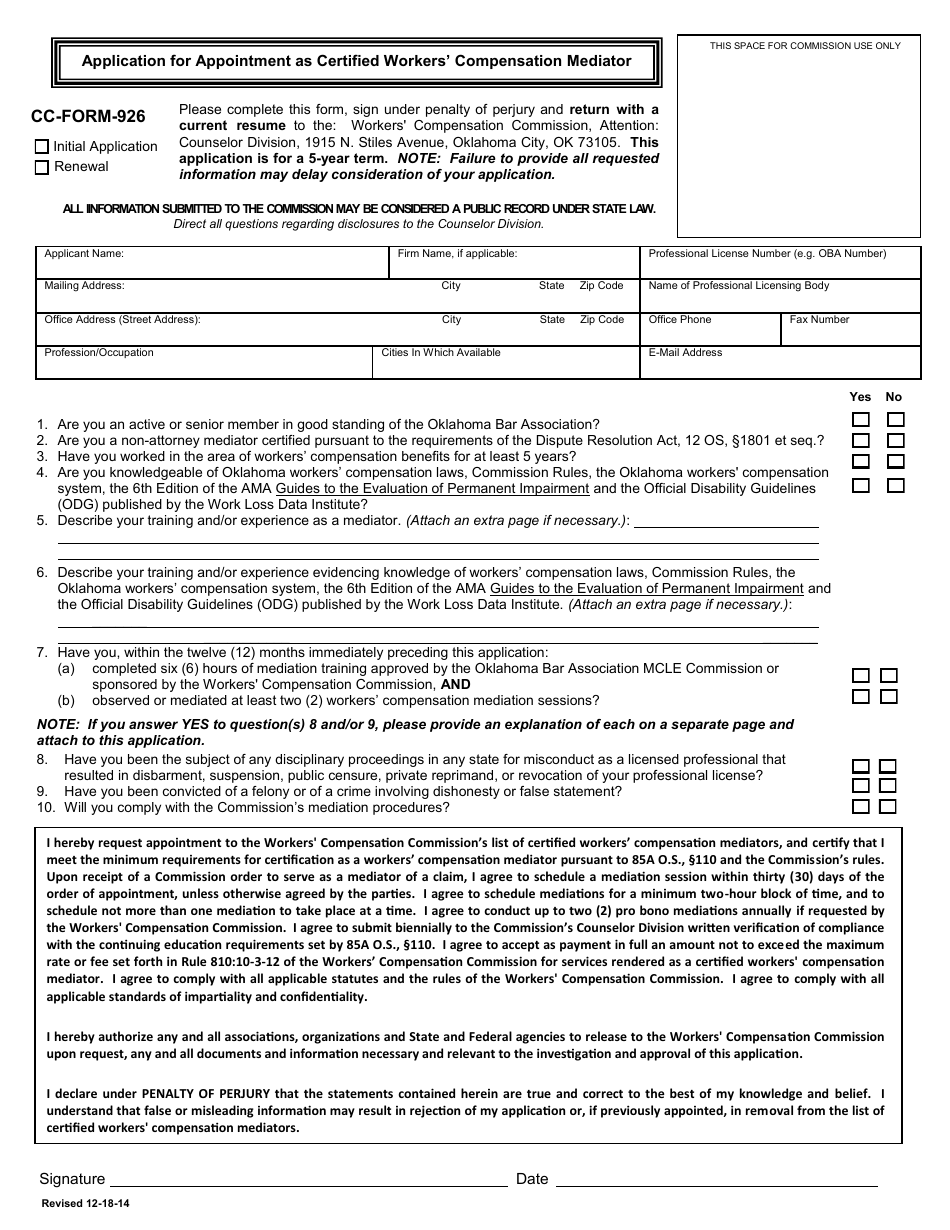

CC Form 926 Download Fillable PDF or Fill Online Application for

This would include transfers of cash over $100,000 to a foreign corporation, or if the transfer of cash resulted in owning more than 10% of the foreign corporation’s stock. Web 6038b and file form 926. See the instructions for line 2 for additional information. Person that transfers cash to a foreign Transferor of property to a foreign corporation go to.

IRS Form 926 What You Need To Know Silver Tax Group

Www.irs.gov/form926 for instructions and the latest information. November 2018) department of the treasury internal revenue service. Form 926 is used to report certain transfers of property to a foreign corporation. Instructions for form 990 return of organization exempt from income tax (2022) download pdf. Each domestic partner is treated as a transferor of its proportionate share of the property.

Instructions For Form 926

This would include transfers of cash over $100,000 to a foreign corporation, or if the transfer of cash resulted in owning more than 10% of the foreign corporation’s stock. Attach to your income tax return for the year of the transfer or distribution. Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Spouses.

Instructions For Form 926 printable pdf download

Form 926 is used by a taxpayer to report property transfers to a foreign corporation. Web 6038b and file form 926. This would include transfers of cash over $100,000 to a foreign corporation, or if the transfer of cash resulted in owning more than 10% of the foreign corporation’s stock. Form 926 is not limited to individuals. One of these.

Form 926 Return by a U.S. Transferor of Property to a Foreign

Citizen or resident, a domestic corporation, or a domestic estate or trust. Spouses may file form 926 jointly, but only if they file a joint income tax return. Person that transfers cash to a foreign Person that transfers cash to a foreign corporation must report the transfer on form 926 if (a) immediately after Web irs form 926 is the.

Form 926Return by a U.S. Transferor of Property to a Foreign Corpora…

Person that transfers cash to a foreign November 2018) department of the treasury internal revenue service. Www.irs.gov/form926 for instructions and the latest information. Transferor of property to a foreign corporation, to report any exchanges or transfers of property described in section 6038b(a)(1)(a) to a foreign corporation. Attach to your income tax return for the year of the transfer or distribution.

IRS Form 926 Download Fillable PDF or Fill Online Return by a U.S

Form 926 is used to report certain transfers of property to a foreign corporation. Www.irs.gov/form926 for instructions and the latest information. Each domestic partner is treated as a transferor of its proportionate share of the property. Attach to your income tax return for the year of the transfer or distribution. Web irs form 926 is the form u.s.

American Breast Care Weighted First Form 926 ladygracenew

Transferor of property to a foreign corporation go to. Persons, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. Form 926 is not limited to individuals. See the instructions for line 2 for additional information. Spouses may file form 926 jointly, but only if they file a joint income tax return.

Online IRS Instructions 843 2013 2019 Fillable and Editable PDF

Web to properly tax foreign income, the irs requires taxpayers to file different forms that provide information about a taxpayer’s foreign assets and transactions. Each domestic partner is treated as a transferor of its proportionate share of the property. See the instructions for line 3 for additional information. Persons, domestic corporations or domestic estates or trusts must file form 926,.

Web Information About Form 926, Return By A U.s.

Web what is form 926 used for. Transferor of property to a foreign corporation, including recent updates, related forms, and instructions on how to file. Web 6038b and file form 926. Transferor of property to a foreign corporation, to report any exchanges or transfers of property described in section 6038b(a)(1)(a) to a foreign corporation.

And, Unless An Exception, Exclusion, Or Limitation Applies, Irs Form 926 Must Be Filed By Any Of The Following That Meet The Reporting Threshold Requirements:

Person that transfers cash to a foreign Citizens and entities file to report certain exchanges or transfers of property to a foreign corporation. Spouses may file form 926 jointly, but only if they file a joint income tax return. Citizen or resident, a domestic corporation, or a domestic estate or trust.

This Would Include Transfers Of Cash Over $100,000 To A Foreign Corporation, Or If The Transfer Of Cash Resulted In Owning More Than 10% Of The Foreign Corporation’s Stock.

See the instructions for line 3 for additional information. Instructions for form 990 return of organization exempt from income tax (2022) instruction in html. Persons, domestic corporations or domestic estates or trusts must file form 926, return by a u.s. November 2018) department of the treasury internal revenue service.

Attach To Your Income Tax Return For The Year Of The Transfer Or Distribution.

Form 926 is used to report certain transfers of property to a foreign corporation. One of these forms is form 926. Www.irs.gov/form926 for instructions and the latest information. Form 926 is used by a taxpayer to report property transfers to a foreign corporation.