Form 941X 2020

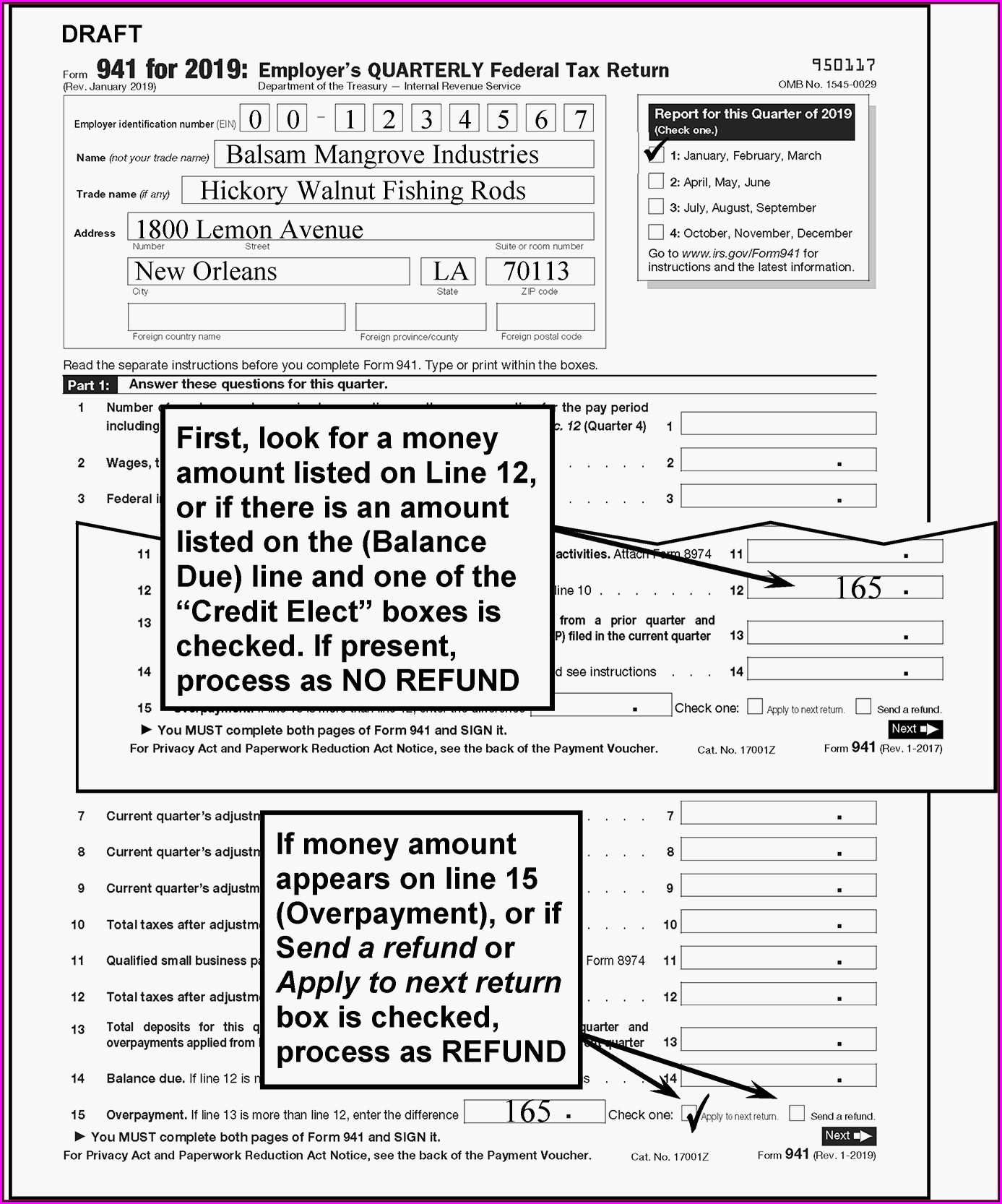

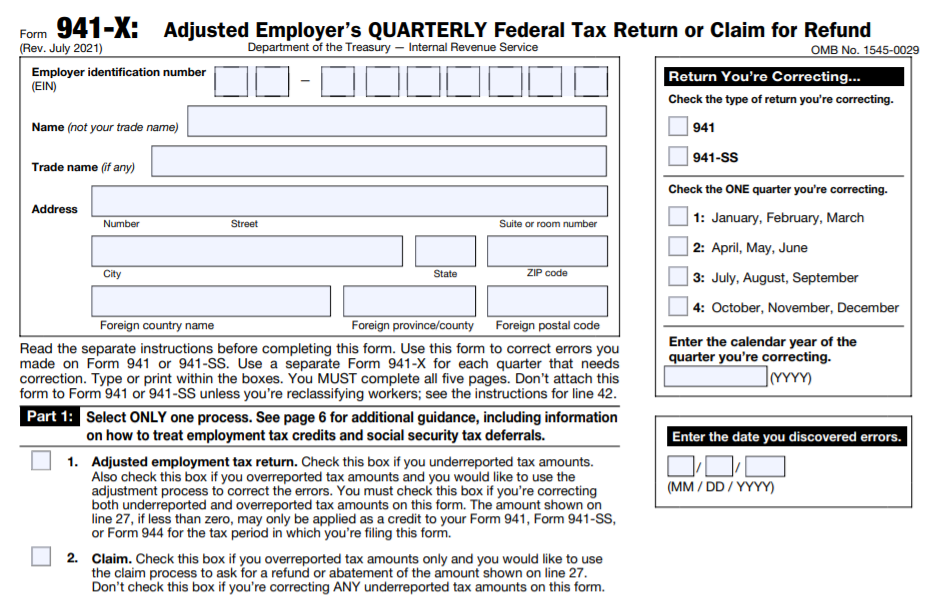

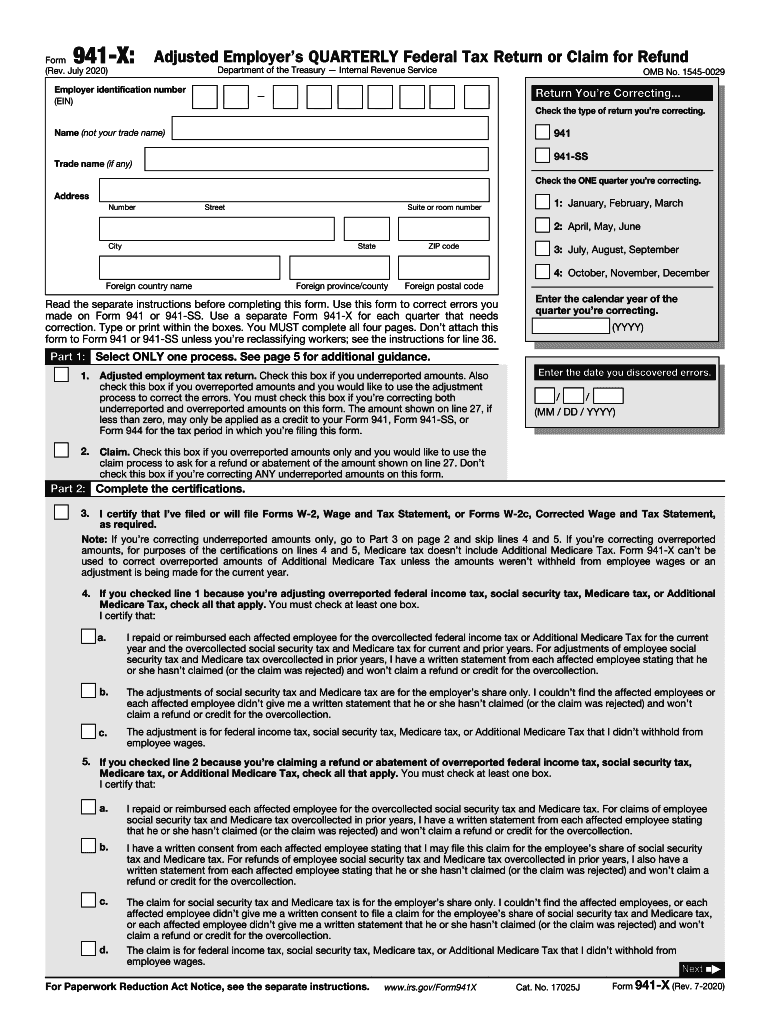

Form 941X 2020 - Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. If you are located in. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Upload, modify or create forms. Complete, edit or print tax forms instantly. Web click the orange get form option to begin modifying. Try it for free now! October 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. April, may, june enter the calendar year of the quarter you’re correcting. Get instant irs status quick processing no.

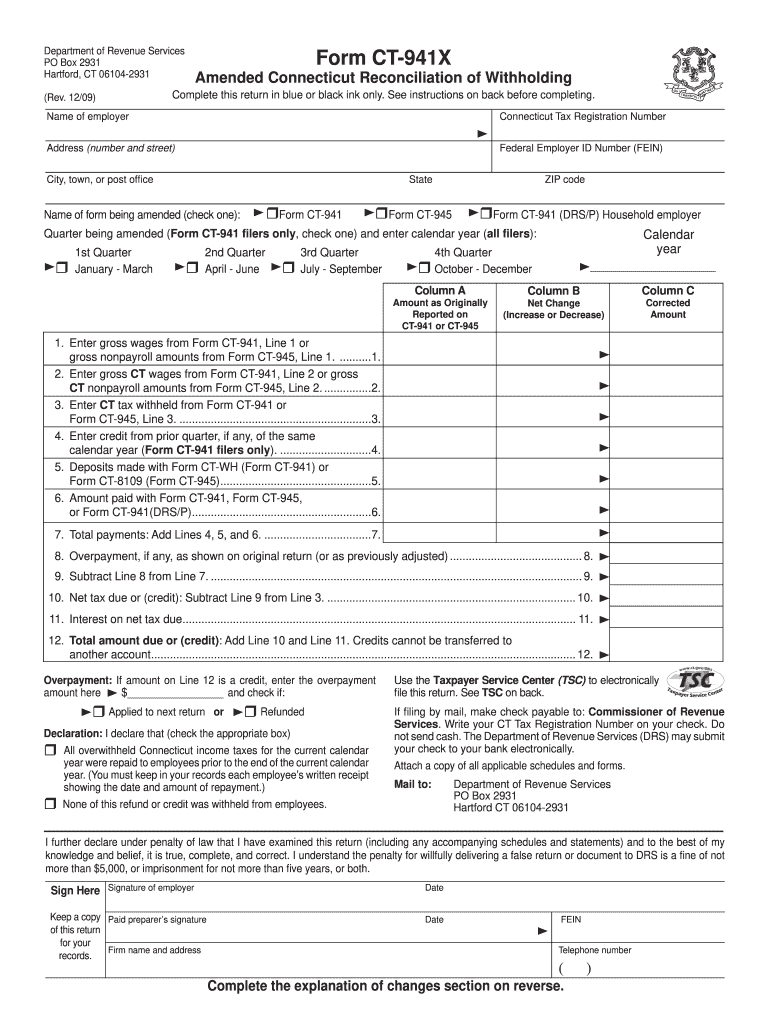

If you are located in. Complete, edit or print tax forms instantly. Which form should you file? Web click the orange get form option to begin modifying. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. Switch on the wizard mode in the top toolbar to obtain extra recommendations. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. October 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. The final version is expected to be available by the end of september.

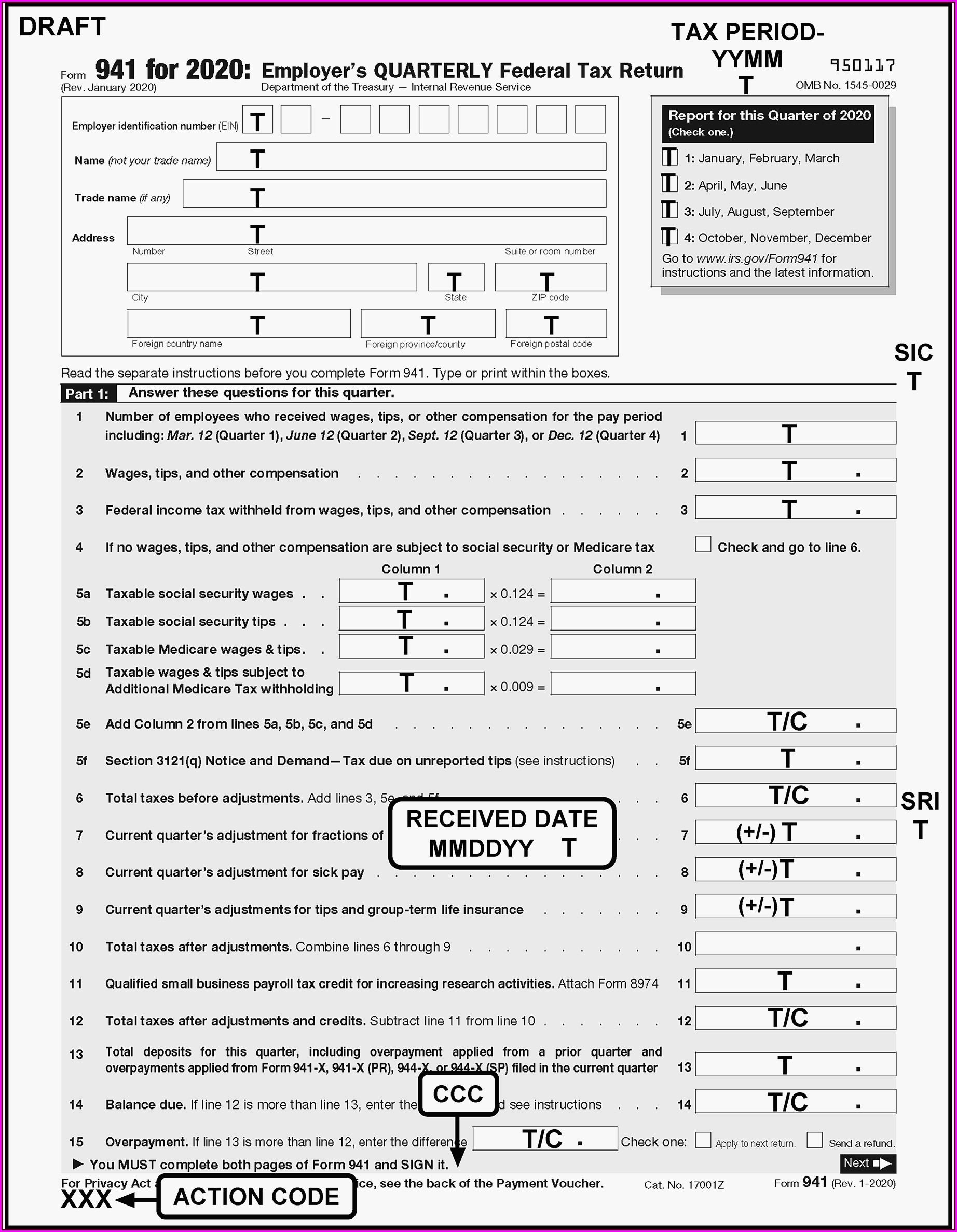

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. April, may, june enter the calendar year of the quarter you’re correcting. There is a draft version of the irs form 941x (rev. Web tax & compliance. The final version is expected to be available by the end of september. Try it for free now! If you are located in. Switch on the wizard mode in the top toolbar to obtain extra recommendations. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Which form should you file?

The NoWorry Guide To File Form 941 During Tax Year 2020 Blog

Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Try it for free now! Web tax & compliance. April, may, june enter the calendar year of the quarter you’re correcting. Switch on the wizard mode in the top toolbar to obtain extra recommendations.

7 Awesome Reasons To File Your Form 941 With TaxBandits Blog TaxBandits

April, may, june enter the calendar year of the quarter you’re correcting. The final version is expected to be available by the end of september. Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Upload, modify or create forms. Which form should you file?

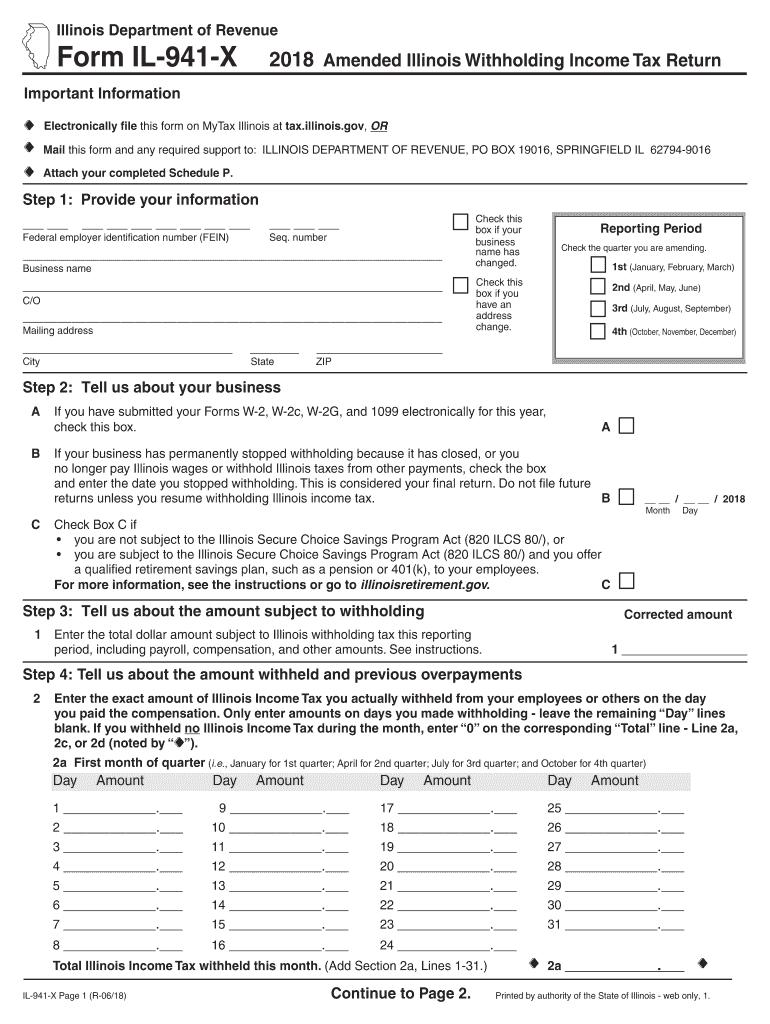

2020 Form IRS Instructions 941 Fill Online, Printable, Fillable, Blank

Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using. April, may, june enter the calendar year of the quarter you’re correcting. Web click the orange get form option to begin modifying. January 2020) employer’s quarterly federal tax return department of the.

Simple Form 941X 2018 Fill Out and Sign Printable PDF Template signNow

Try it for free now! January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Web about form 941, employer's quarterly federal tax return. April, may, june enter the calendar year of the quarter you’re correcting.

Irs.gov Forms 941 X Form Resume Examples 1ZV8dXoV3X

October 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. There is a draft version of the irs form 941x (rev. Complete, edit or print tax forms instantly. Which form should you file? Web click the orange get form option to begin modifying.

Irs.gov Form 941x Form Resume Examples yKVBjnRVMB

Which form should you file? Web tax & compliance. Upload, modify or create forms. Get instant irs status quick processing no. Web consequently, most employers will need to instead file an amended return or claim for refund for the quarters ended in june, september and december of 2020 using.

Worksheet 2 941x

Get instant irs status quick processing no. Upload, modify or create forms. Web tax & compliance. Which form should you file? Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,.

Ct Form 941 X Fill Out and Sign Printable PDF Template signNow

There is a draft version of the irs form 941x (rev. Get instant irs status quick processing no. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Which form should you file? The final version is expected to be available by the end of september.

941x Fill out & sign online DocHub

Web tax & compliance. Try it for free now! Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. Which form should you file?

StepbyStep How to Guide to Filing Your 941X ERTC Baron Payroll

Which form should you file? Report income taxes, social security tax, or medicare tax withheld from employee's paychecks. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Try it for free now! Switch on the wizard mode in the top toolbar to obtain extra recommendations.

Try It For Free Now!

Upload, modify or create forms. October 2020) adjusted employer’s quarterly federal tax return or claim for refund department of the treasury — internal revenue service omb no. Complete, edit or print tax forms instantly. If you are located in.

Report Income Taxes, Social Security Tax, Or Medicare Tax Withheld From Employee's Paychecks.

The final version is expected to be available by the end of september. Switch on the wizard mode in the top toolbar to obtain extra recommendations. Connecticut, delaware, district of columbia, florida, georgia, illinois, indiana, kentucky, maine,. Web about form 941, employer's quarterly federal tax return.

Web Consequently, Most Employers Will Need To Instead File An Amended Return Or Claim For Refund For The Quarters Ended In June, September And December Of 2020 Using.

January 2020) employer’s quarterly federal tax return department of the treasury — internal revenue service 950117 omb no. April, may, june enter the calendar year of the quarter you’re correcting. There is a draft version of the irs form 941x (rev. Get instant irs status quick processing no.

Web Click The Orange Get Form Option To Begin Modifying.

Which form should you file? Web tax & compliance.