Form 944 Is Used By Employers Who Owe

Form 944 Is Used By Employers Who Owe - Most employers must file form 941, employer's. Web the 944 form is for small businesses as they have fewer employees and lower tax obligations. Form 944, or the employer’s annual federal tax return, is an internal. Ad don't face the irs alone. Web irs form 944 is an annual tax return form required by employers. The irs form 944 takes the place of form 941 if a small. Resolve your tax issues permanently. Get ready for tax season deadlines by completing any required tax forms today. Small business employers with an. Actual money received by the employee, whether called wages or salaries 2.

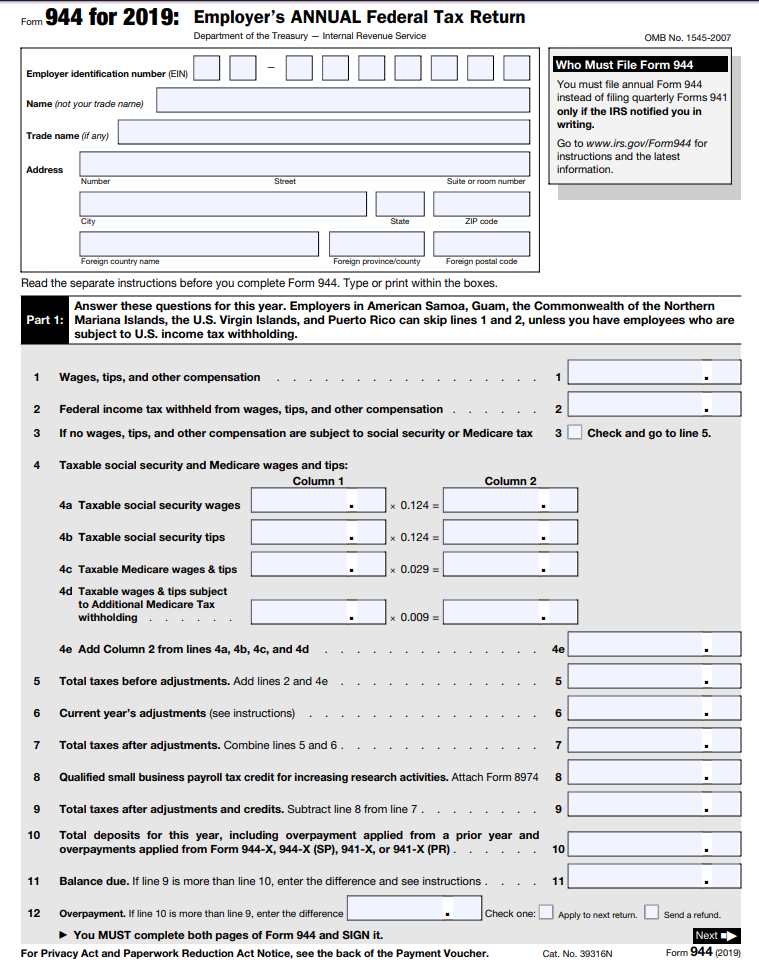

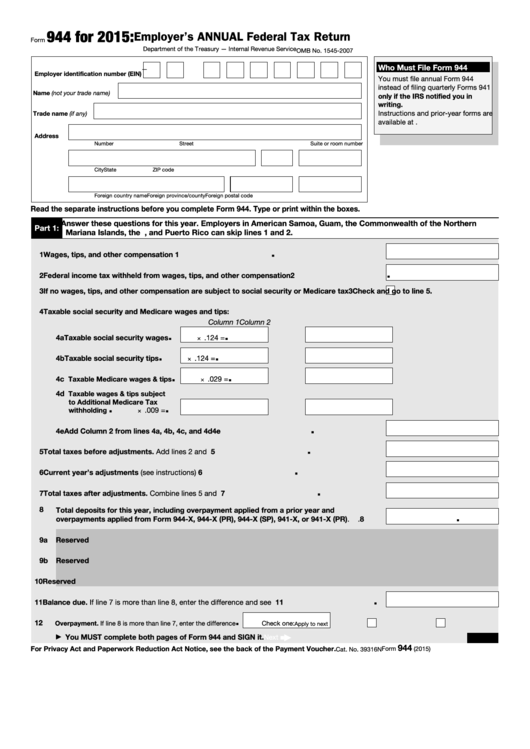

Web up to $16 cash back the irs form 944, employers annual federal tax return, is a return that certain small business owners can file annually instead of the quarterly. Get ready for tax season deadlines by completing any required tax forms today. Ad don't face the irs alone. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Most employers must file form 941, employer's. Web employer’s annual federal tax return department of the treasury — internal revenue service omb no. Federal tax return for small businesses download form 944 introduction. Resolve your tax issues permanently. Form 944 generally is due on january 31 of the following year. If you owe taxes, get a free consultation for irs tax relief.

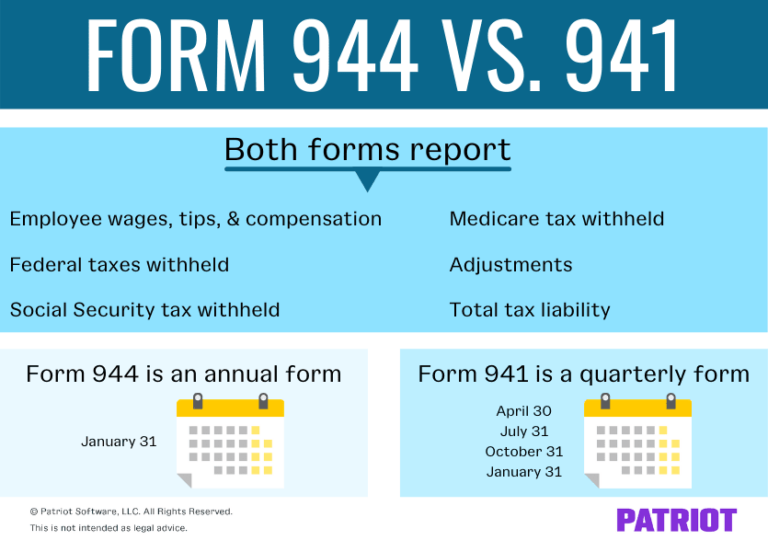

Web the 944 form is for small businesses as they have fewer employees and lower tax obligations. Most employers must file form 941, employer's. If you owe taxes, get a free consultation for irs tax relief. A.are exempt from fica taxes. You can only file form 944 if the irs. Web form 944 vs 941. Within this form, you’ll report the wages you paid to your employees and calculate how much you owe the. The irs form 944 takes the place of form 941 if a small. Small employers are eligible to submit irs form 944 if their annual liability payments total less than $1000. This form is for employers who owe $1,000 or less.

Form 944 vs. Form 941 Should You File the Annual or Quarterly Form?

Web form 944 vs 941. Web form 944 is part of an employer’s annual tax return. Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Actual money received by the employee, whether called wages or salaries 2. Resolve your tax.

Form 944 Employer's Annual Federal Tax Return (2015) Free Download

Ad don't face the irs alone. Actual money received by the employee, whether called wages or salaries 2. A.are exempt from fica taxes. Web form 944 is used by smaller employers instead of irs form 941, the employer's quarterly employment tax return. Web up to $16 cash back the irs form 944, employers annual federal tax return, is a return.

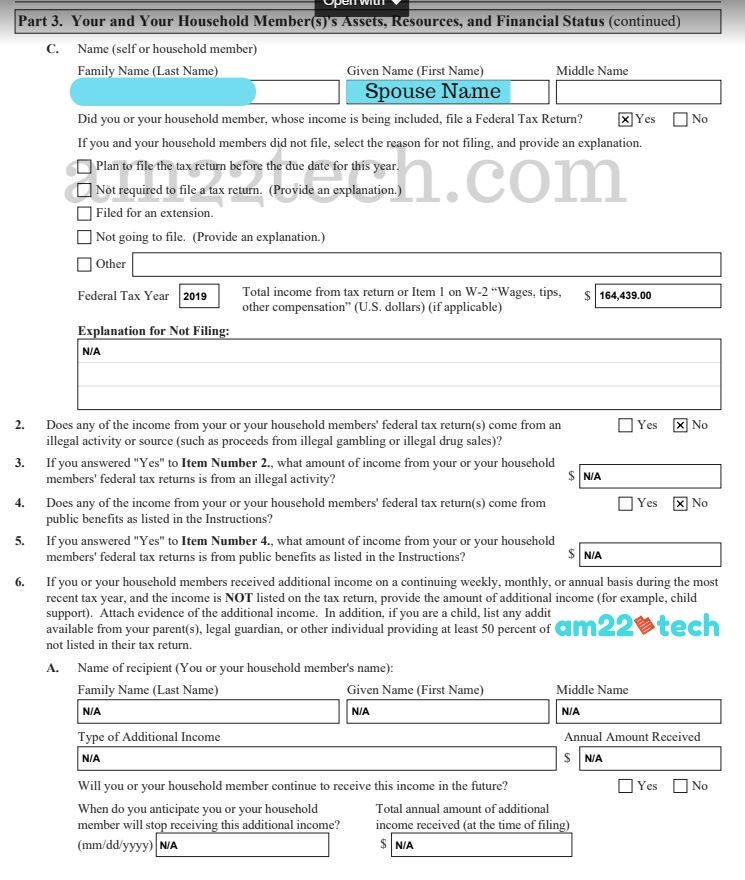

Who is Required to File Form I944 for a Green Card? CitizenPath

Web form 944 is part of an employer’s annual tax return. Web form 944 for 2021: Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Federal tax return for small businesses download form 944 introduction. Get free, competing quotes from the best.

What Is Form 944? Plus Instructions

Small business employers with an. Small employers are eligible to submit irs form 944 if their annual liability payments total less than $1000. Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Form 944, or the employer’s annual federal tax return, is an internal. Web employer’s annual federal.

What Is Form 944? Plus Instructions

Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. A.are exempt from fica taxes. Web the 944 form is for small businesses as they have.

Form i944 Self Sufficiency US Green Card (Documents Required) USA

Most employers must file form 941, employer's. You can only file form 944 if the irs. Web irs form 944 is an annual tax return form required by employers. Web form 944 is part of an employer’s annual tax return. Web form 944 vs 941.

What Is Form 944 What Is Federal Form 944 For Employers How To

Small business employers with an. Web the 944 is an annual federal tax form for small employers. Web february 28, 2020 — if you're currently required to file form 944, employer's annual federal tax return, but estimate your tax liability to be more than. Web 1) employers who owe $2,500 or less in employment taxes and haven't had any late.

Fillable Form 944 Employer'S Annual Federal Tax Return 2017

If you owe taxes, get a free consultation for irs tax relief. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Web 1) employers who owe $2,500 or less in employment taxes and haven't had any late deposits for two years: Form 944, or the employer’s annual federal tax return, is an internal. Web.

Blog Law Office of Elizabeth Lawrence » What is Form I944?

Web form 944 vs 941. Web do not file form 944, employer's annual federal tax return, unless the irs has sent you notice telling you to file it. Web form 944 is used by smaller employers instead of irs form 941, the employer's quarterly employment tax return. Cash value of meals & lodging provided for the convenience of the employee.

The Sweet Beginning in USA Form I944 Declaration of SelfSufficiency

Web irs form 944, (employer’s annual tax return) is designed for the small employers and is used to report employment taxes. Small employers are eligible to submit irs form 944 if their annual liability payments total less than $1000. Federal tax return for small businesses download form 944 introduction. If you owe taxes, get a free consultation for irs tax.

Web Irs Form 944, (Employer’s Annual Tax Return) Is Designed For The Small Employers And Is Used To Report Employment Taxes.

Web form 944 is an irs tax form that reports the taxes — including federal income tax, social security tax and medicare tax — that you’ve withheld from your. This form is for employers who owe $1,000 or less. You can only file form 944 if the irs. Web form 944 is used by smaller employers instead of irs form 941, the employer's quarterly employment tax return.

Most Employers Must File Form 941, Employer's.

It allows them to report employment tax liabilities only once a. Web the 944 is an annual federal tax form for small employers. Actual money received by the employee, whether called wages or salaries 2. Web up to $16 cash back the irs form 944, employers annual federal tax return, is a return that certain small business owners can file annually instead of the quarterly.

Resolve Your Tax Issues Permanently.

Get ready for tax season deadlines by completing any required tax forms today. A.are exempt from fica taxes. Cash value of meals & lodging provided for the convenience of the employee 3. Web form 944, employer’s annual federal tax return.

Web Form 944 Is Designed For Employers With An Annual Employment Tax Liability Of $1,000 Or Less.

Small business employers with an. Employer’s annual federal tax return department of the treasury — internal revenue service omb no. Web employer’s annual federal tax return department of the treasury — internal revenue service omb no. Web form 944 is part of an employer’s annual tax return.