Form 990 Due Date 2023

Form 990 Due Date 2023 - Web file charities and nonprofits return due dates for exempt organizations: Web monday, april 25, 2022 by justin d. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. Web find the right 990 form for your organization. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web irs form 990 and similar forms. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. For organizations on a calendar. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. For a calendar year organization (where the accounting year ends on december 31st), the due date for form 990 / 990.

Web when is form 990 due? The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. For a calendar year organization (where the accounting year ends on december 31st), the due date for form 990 / 990. Web file charities and nonprofits return due dates for exempt organizations: To use the table, you must know. Web find the right 990 form for your organization. Web 990 series forms are due on july 17, 2023! Web calendar year organization filing deadline. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

Web irs form 990 and similar forms. Web monday, april 25, 2022 by justin d. To use the table, you must know. Web more about the deadline. Web resources form 990 due date calculator 1 choose your appropriate form to find the due date. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. For a calendar year organization (where the accounting year ends on december 31st), the due date for form 990 / 990. Web upcoming 2023 form 990 deadline:

Today is Your Form 990 Deadline! It's Your Last Chance to Extend Your

To use the table, you must know. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. For a calendar year organization (where the accounting year ends on december 31st), the due date for form 990 / 990. Web 990 series forms are due on july.

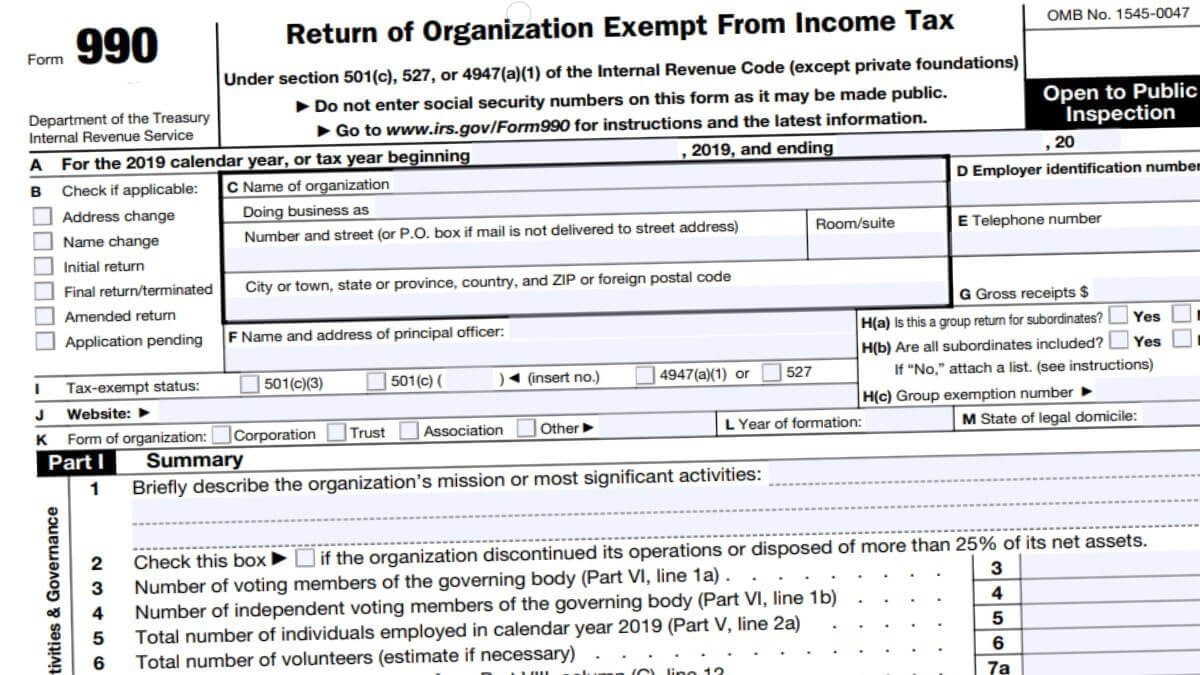

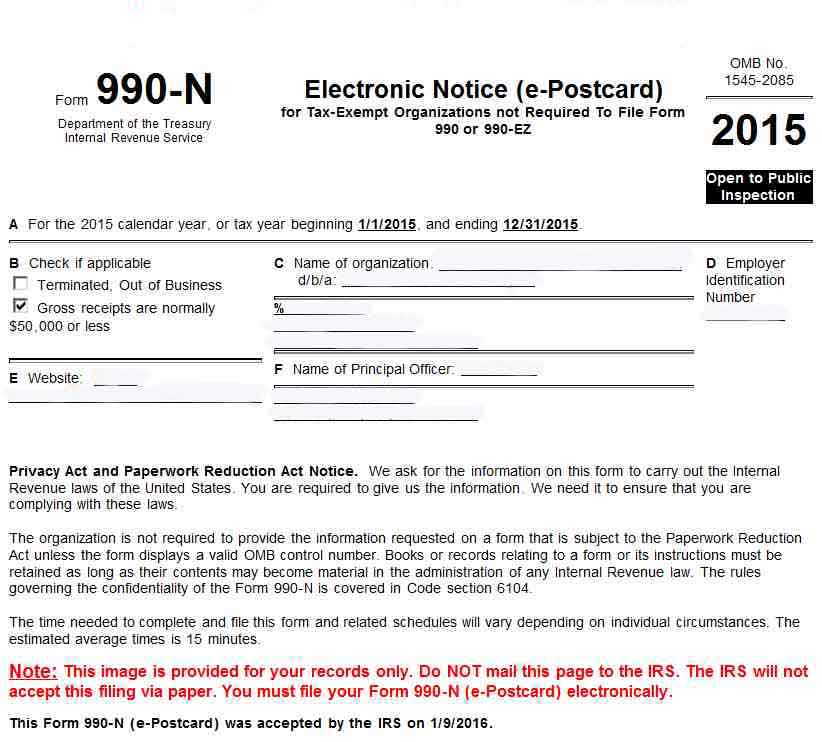

How To Never Mistake IRS Form 990 and Form 990N Again

The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. Web find the right 990 form for your organization. Web irs form 990 and similar forms. For a calendar year organization (where the accounting year ends on december 31st), the due date for form 990 /.

Printable 990 N Form Printable Form 2022

Web calendar year organization filing deadline. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web file charities and nonprofits return due dates for exempt organizations: Web find the right 990 form for your organization. Due to the large volume.

2020 Form IRS 990 Fill Online, Printable, Fillable, Blank pdfFiller

Form 990 due date calculator find your 990 filings deadline and the applicable extended due date Web more about the deadline. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023.

Form 990 IRS NonProfit Tax Returns & Tax Form 990 Community Tax

For organizations on a calendar. Web resources form 990 due date calculator 1 choose your appropriate form to find the due date. Web more about the deadline. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web file charities and nonprofits return due dates for exempt organizations:

What Is A 990 Tax Form For Nonprofits Douroubi

2 the month your tax year ends december 31 (calendar) other than december. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. Web when is form 990 due? Web calendar year organization filing deadline. For organizations with an accounting tax period starting on april 1, 2022, and ending on.

2016 Form 990 Due This Monday for Land Trusts Filing on Calendar Year

Web find the right 990 form for your organization. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. Web the irs filing deadline for organizations with a fiscal year end date of 2/28/2023 is midnight eastern time on monday, july 17, 2023. For a calendar.

What You Need To Meet the Form 990 Due Date 2019 Blog TaxBandits

The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. Web irs form 990 and similar forms. Due to the large volume. Web monday, april 25, 2022 by justin d. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date

The Form 990 Deadline is Approaching! Avoid IRS Penalties

Web 990 series forms are due on july 17, 2023! Web more about the deadline. For organizations on a calendar. Web monday, april 25, 2022 by justin d. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year.

Web Monday, April 25, 2022 By Justin D.

Web more about the deadline. Form 990 is due on the 15th day of the 5th month following the end of the organization's taxable year. For organizations on a calendar. Web calendar year organization filing deadline.

For A Calendar Year Organization (Where The Accounting Year Ends On December 31St), The Due Date For Form 990 / 990.

Web irs form 990 and similar forms. The internal revenue service (irs) has postponed the due date for the form 990 and similar forms to 60 days past your nonprofit’s normal. Due to the large volume. Web file charities and nonprofits return due dates for exempt organizations:

Web 990 Series Forms Are Due On July 17, 2023!

Web resources form 990 due date calculator 1 choose your appropriate form to find the due date. Web upcoming 2023 form 990 deadline: Web find the right 990 form for your organization. Form 990 due date calculator find your 990 filings deadline and the applicable extended due date

Web The Irs Filing Deadline For Organizations With A Fiscal Year End Date Of 2/28/2023 Is Midnight Eastern Time On Monday, July 17, 2023.

2 the month your tax year ends december 31 (calendar) other than december. For organizations with an accounting tax period starting on april 1, 2022, and ending on march 31, 2023, form 990 is due by august 15, 2023. Web when is form 990 due? To use the table, you must know.

.PNG)