Form Dr 1093

Form Dr 1093 - Web the form you are looking for begins on the next page of this file. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web on the ps form 1093 may file an individual change of address order. Web the co form dr 1093 has been made available for quickbooks online and desktop. Before viewing it, please see the important update information below. If you are filing an. Get your online template and fill it in using progressive features. I am requesting a vendor no tax due for a. Get everything done in minutes. Web this page lists only the most recent version of a tax form.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Get everything done in minutes. Web the co form dr 1093 has been made available for quickbooks online and desktop. If you are filing an. I am requesting a vendor no tax due for a. If additional tax is owed, file another return for the period the tax is due reporting only the additional. Web this page lists only the most recent version of a tax form. Web the form you are looking for begins on the next page of this file. Web on the ps form 1093 may file an individual change of address order. Before viewing it, please see the important update information below.

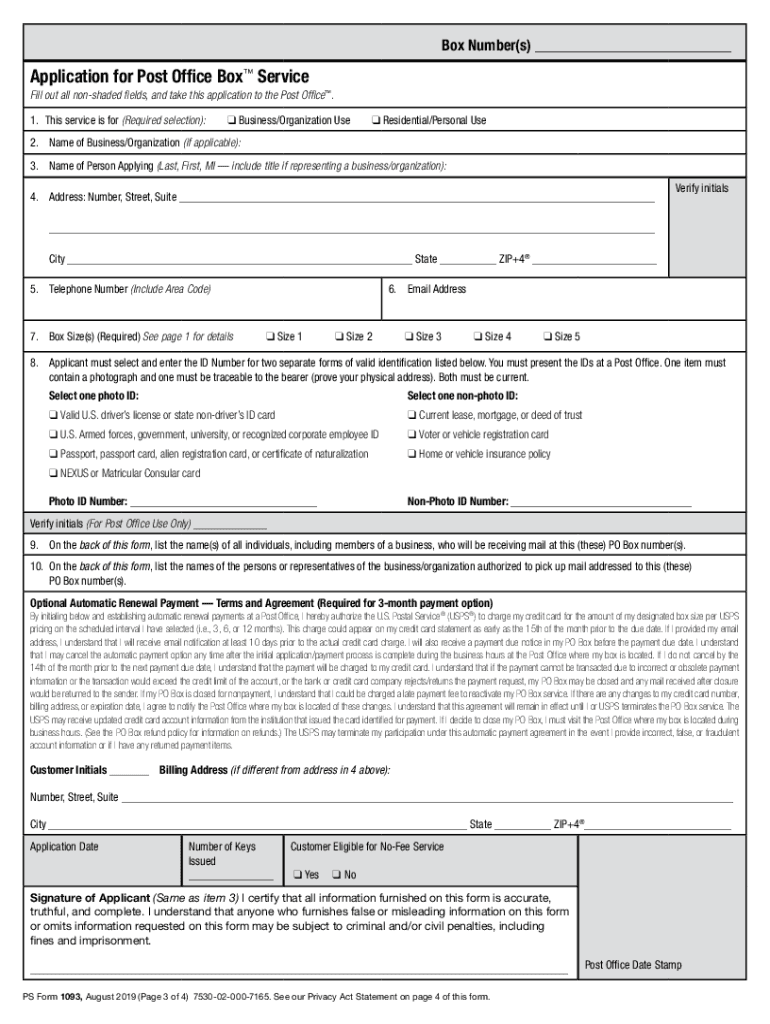

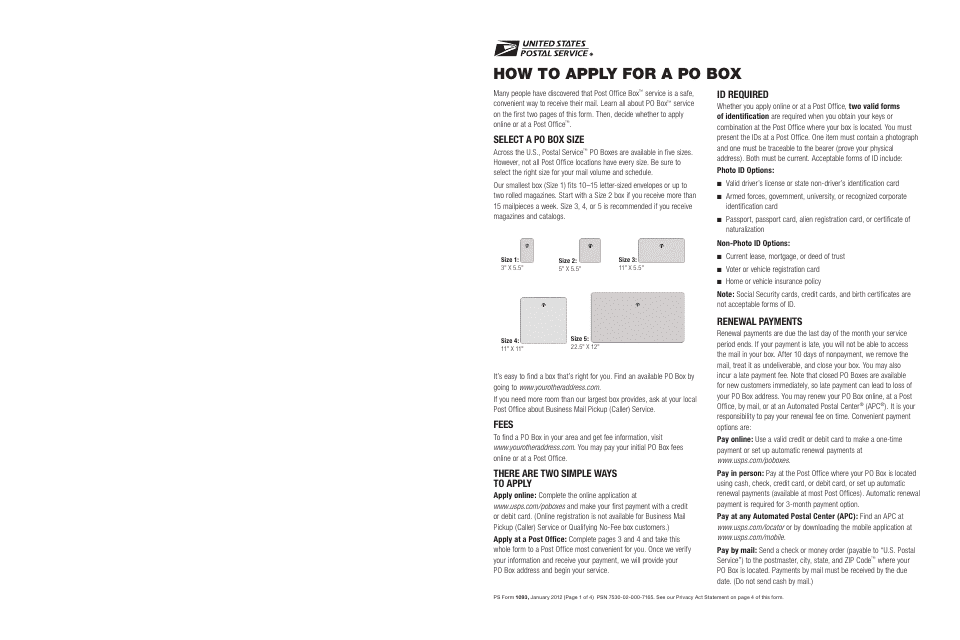

Web on the ps form 1093 may file an individual change of address order. Web ★ 4.8 satisfied 58 votes how to fill out and sign colorado dr 1093 online? Get your online template and fill it in using progressive features. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. The credit may be taken on a return/payment. R bid r contract reason for request 2. Enjoy smart fillable fields and. If you are filing an. Before viewing it, please see the important update information below. Web once you've reserved your box, completed the po box application (ps form 1093), paid the rental fee, and verified your 2 forms of acceptable id at the post office counter.

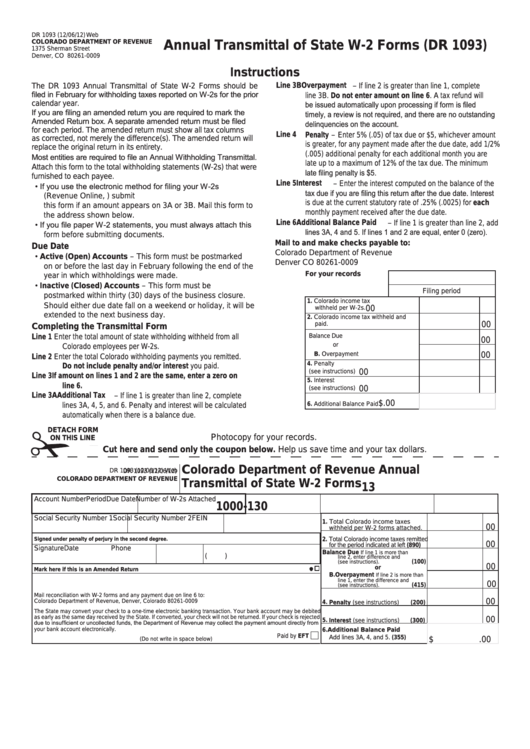

Fillable Form Dr 1093 Annual Transmittal Of State W2 Forms printable

Get your online template and fill it in using progressive features. Web on the ps form 1093 may file an individual change of address order. Enjoy smart fillable fields and. Web dr 1093 is an annual reconciliation of colorado income tax withheld for reporting the total tax amount withheld from an employee’s paycheck. Web transfer on death (“tod”) is a.

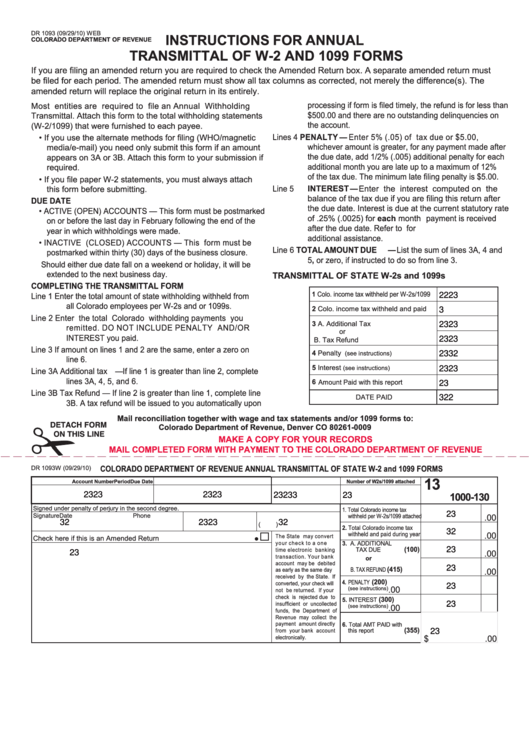

Form Dr 1093 Instructions For Annual Transmittal Of W2 And 1099

Web once you've reserved your box, completed the po box application (ps form 1093), paid the rental fee, and verified your 2 forms of acceptable id at the post office counter. Web on the ps form 1093 may file an individual change of address order. Web the dr 1093 is a colorado department of revenue (cdor) form that summarizes the.

FIA Historic Database

If you are filing an. R bid r contract reason for request 2. Only the box customer may file a change of address order for an entire family. Web transfer on death (“tod”) is a form of ownership that enables the owner of an account to transfer ownership directly to a designated beneficiary upon the death of the owner(s). Web.

Fill Free fillable Colorado Department of Regulatory Agencies PDF forms

Web the dr 1093 is a colorado department of revenue (cdor) form that summarizes the colorado income tax withheld from all employees in a calendar year. Web the form you are looking for begins on the next page of this file. Get everything done in minutes. Web on the ps form 1093 may file an individual change of address order..

CO DoR DR 2173 20142022 Fill out Tax Template Online US Legal Forms

R bid r contract reason for request 2. Web transfer on death (“tod”) is a form of ownership that enables the owner of an account to transfer ownership directly to a designated beneficiary upon the death of the owner(s). Web dr 1093 is an annual reconciliation of colorado income tax withheld for reporting the total tax amount withheld from an.

20192022 Form USPS PS 1093 Fill Online, Printable, Fillable, Blank

Web we would like to show you a description here but the site won’t allow us. Web dr 1093 is an annual reconciliation of colorado income tax withheld for reporting the total tax amount withheld from an employee’s paycheck. Since this isn't your case, i recommend updating your tax table to the latest. Web this page lists only the most.

Fillable Form Dr 1093w Annual Transmittal Of W2 And 1099 Forms

Web once you've reserved your box, completed the po box application (ps form 1093), paid the rental fee, and verified your 2 forms of acceptable id at the post office counter. If you are filing an. I am requesting a vendor no tax due for a. Since this isn't your case, i recommend updating your tax table to the latest..

Online Application Usps Online Application

Web the form you are looking for begins on the next page of this file. Web ★ 4.8 satisfied 58 votes how to fill out and sign colorado dr 1093 online? If additional tax is owed, file another return for the period the tax is due reporting only the additional. Since this isn't your case, i recommend updating your tax.

PS Form 1093 Fill Out, Sign Online and Download Fillable PDF

Web dr 1093 is an annual reconciliation of colorado income tax withheld for reporting the total tax amount withheld from an employee’s paycheck. If you are filing an. Web transfer on death (“tod”) is a form of ownership that enables the owner of an account to transfer ownership directly to a designated beneficiary upon the death of the owner(s). Web.

2014 Form CO DoR DR 1093 Fill Online, Printable, Fillable, Blank

Web transfer on death (“tod”) is a form of ownership that enables the owner of an account to transfer ownership directly to a designated beneficiary upon the death of the owner(s). Get your online template and fill it in using progressive features. If additional tax is owed, file another return for the period the tax is due reporting only the.

Enjoy Smart Fillable Fields And.

Only the box customer may file a change of address order for an entire family. Web once you've reserved your box, completed the po box application (ps form 1093), paid the rental fee, and verified your 2 forms of acceptable id at the post office counter. Before viewing it, please see the important update information below. Web on the ps form 1093 may file an individual change of address order.

Web The Form You Are Looking For Begins On The Next Page Of This File.

I am requesting a vendor no tax due for a. R bid r contract reason for request 2. Use fill to complete blank online colorado. If you are filing an.

Web Amending A Withholding Return If You Overpaid For A Period, You May Take A Credit On A Future Return In The Current Calendar Year.

Web dr 1093 is an annual reconciliation of colorado income tax withheld for reporting the total tax amount withheld from an employee’s paycheck. Web this page lists only the most recent version of a tax form. If you are filing an. Get everything done in minutes.

Web We Would Like To Show You A Description Here But The Site Won’t Allow Us.

Web the co form dr 1093 has been made available for quickbooks online and desktop. Web ★ 4.8 satisfied 58 votes how to fill out and sign colorado dr 1093 online? Web transfer on death (“tod”) is a form of ownership that enables the owner of an account to transfer ownership directly to a designated beneficiary upon the death of the owner(s). If additional tax is owed, file another return for the period the tax is due reporting only the additional.