Form For 1031 Exchange

Form For 1031 Exchange - Start a 1031 exchange here. Ad defer capital gain tax with an orlando investment home as 1031 replacement property. Contact the most experienced 1031 exchange experts. Web to accomplish a section 1031 exchange, there must be an exchange of properties. Addendum b (replacement property) click. If you completed more than one exchange, a different. Web under section 1031 of the united states internal revenue code ( 26 u.s.c. The simplest type of section 1031 exchange is a simultaneous swap of one property for. Web section 1031 exchange form. Our experienced team is ready to help.

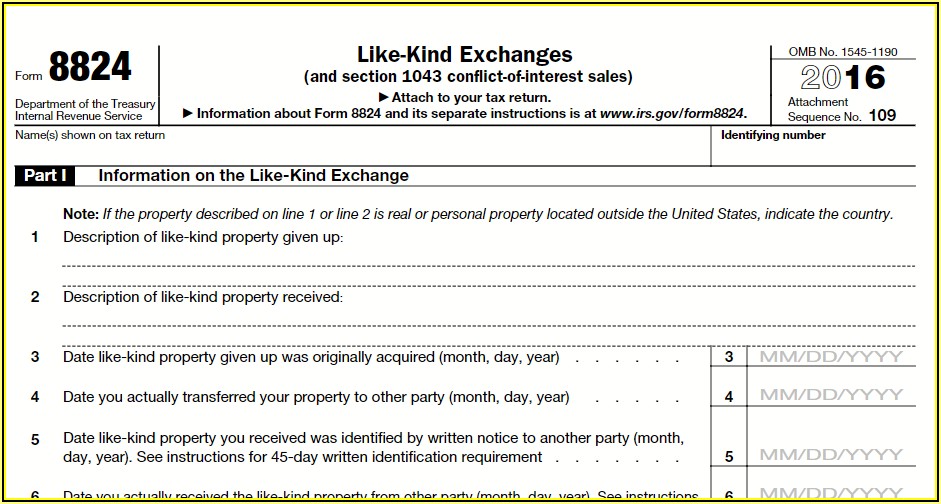

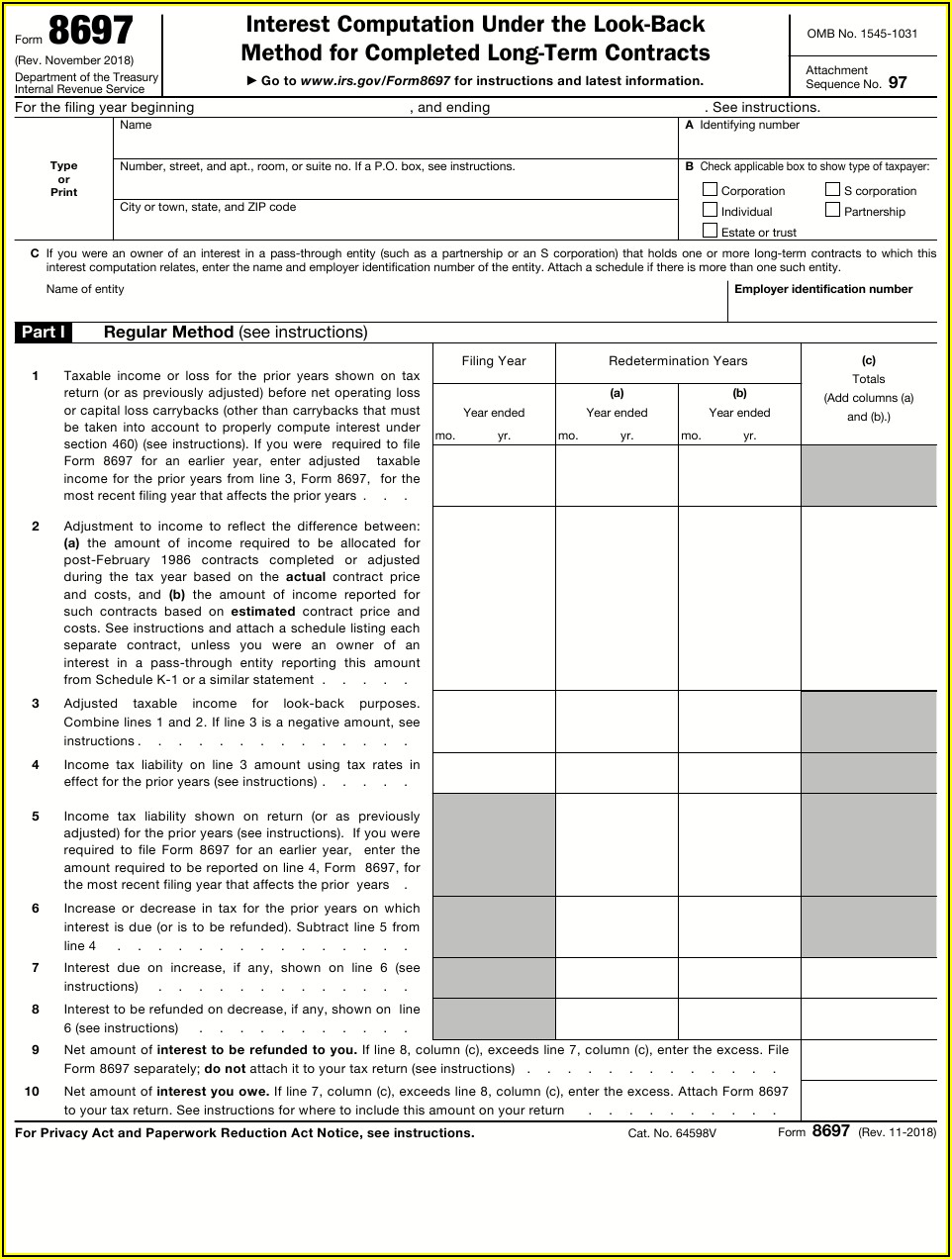

Call and speak to a live representative. Web your 1031 exchange must be reported by completing form 8824 and filing it along with your federal income tax return. Web all 1031 exchanges report on form 8824. Ad own real estate without dealing with the tenants, toilets and trash. If you need to file an extension, use form 4868. Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf. If you completed more than one exchange, a different. Start a 1031 exchange here. Web section 1031 is a provision of the internal revenue code (irc) that allows a business or the owners of investment property to defer federal taxes on some.

Start a 1031 exchange here. Call and speak to a live representative. Our experienced team is ready to help. Addendum b (replacement property) click. As with other such forms, the irs makes available an html version of. Contact the most experienced 1031 exchange experts. Our experienced team is ready to help. Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. Web your 1031 exchange must be reported by completing form 8824 and filing it along with your federal income tax return. § 1031 ), a taxpayer may defer recognition of capital gains and related federal income tax liability on.

What Is A 1031 Exchange? Properties & Paradise BlogProperties

Contact the most experienced 1031 exchange experts. Addendum b (replacement property) click. Web all 1031 exchanges report on form 8824. No extra charge for same day exchanges. Understand the benefits of the 1031 exchange program to defer $100k's in capital gains

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

If you need to file an extension, use form 4868. Contact the most experienced 1031 exchange experts. Call and speak to a live representative. If you completed more than one exchange, a different. Ad defer capital gain tax with an orlando investment home as 1031 replacement property.

1031 Exchange Worksheet Live Worksheet Online

Start a 1031 exchange here. Contact the most experienced 1031 exchange experts. If you need to file an extension, use form 4868. Ad own real estate without dealing with the tenants, toilets and trash. Start a 1031 exchange here.

turbotax entering 1031 exchange Fill Online, Printable, Fillable

No extra charge for same day exchanges. Contact the most experienced 1031 exchange experts. Web a 1031 exchange is reported on the tax return for the year in which the exchange begins, i.e. Web your 1031 exchange must be reported by completing form 8824 and filing it along with your federal income tax return. Our experienced team is ready to.

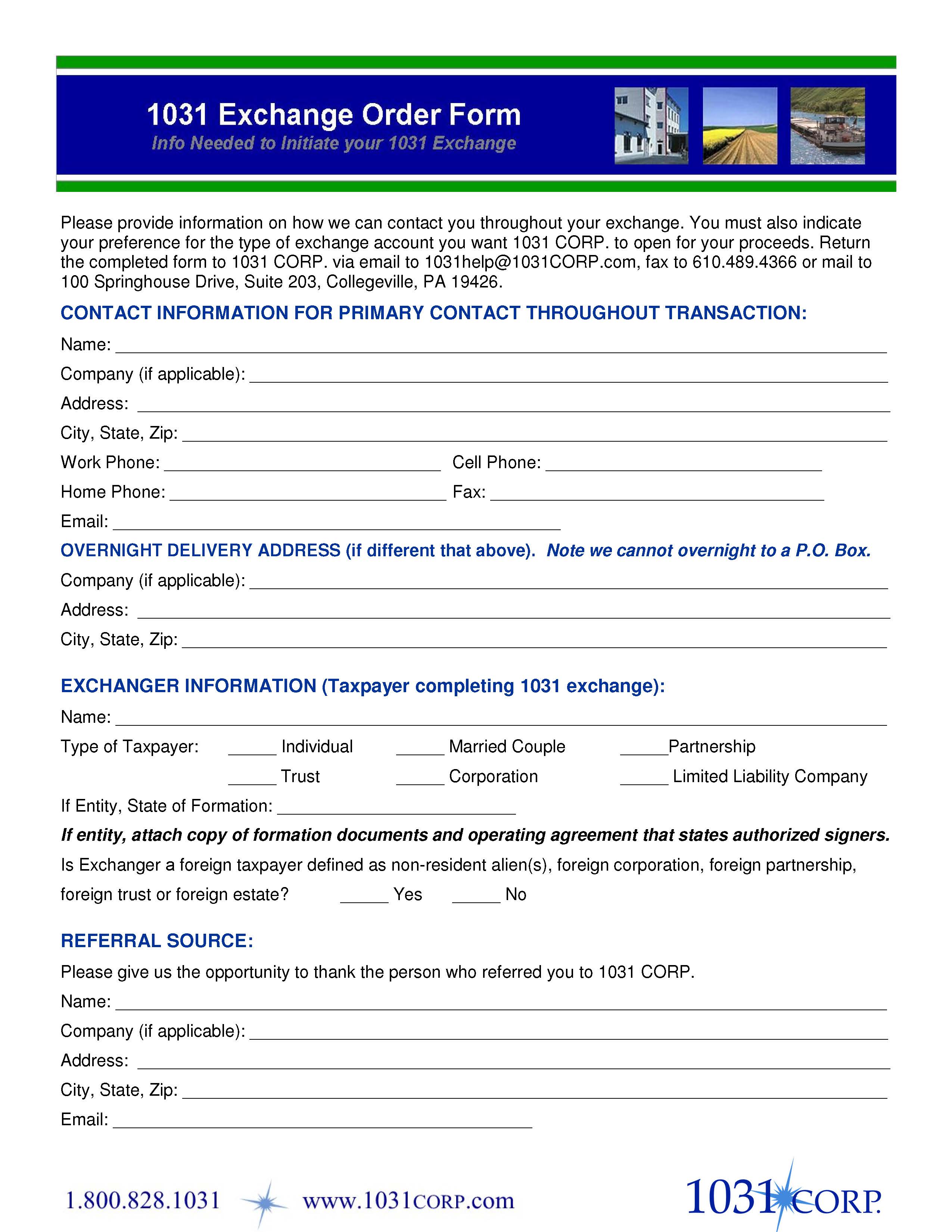

1031 Exchange Order Form

As with other such forms, the irs makes available an html version of. Our experienced team is ready to help. Section 1031 of the irc defines a 1031 exchange as when you exchange real. Ad defer capital gain tax with an orlando investment home as 1031 replacement property. If you completed more than one exchange, a different.

1031 Exchange Documents Form Fill Out and Sign Printable PDF Template

If you completed more than one exchange, a different. Web all 1031 exchanges report on form 8824. Our experienced team is ready to help. Ad own real estate without dealing with the tenants, toilets and trash. Web to accomplish a section 1031 exchange, there must be an exchange of properties.

Irs Form Section 1031 Universal Network

Web all 1031 exchanges report on form 8824. Start a 1031 exchange here. Ad own real estate without dealing with the tenants, toilets and trash. If you need to file an extension, use form 4868. Section 1031 of the irc defines a 1031 exchange as when you exchange real.

1031 Exchange Order Form

As with other such forms, the irs makes available an html version of. Section 1031 of the irc defines a 1031 exchange as when you exchange real. Web your 1031 exchange must be reported by completing form 8824 and filing it along with your federal income tax return. Addendum b (replacement property) click. No extra charge for same day exchanges.

1031 Exchange Tax Forms Form Resume Examples yKVBEXlYMB

Understand the benefits of the 1031 exchange program to defer $100k's in capital gains Contact the most experienced 1031 exchange experts. No extra charge for same day exchanges. Section 1031 of the irc defines a 1031 exchange as when you exchange real. Addendum b (replacement property) click.

1031 Exchange Worksheet Excel Master of Documents

If you need to file an extension, use form 4868. The simplest type of section 1031 exchange is a simultaneous swap of one property for. Web a 1031 exchange is a real estate investing tool that allows investors to exchange an investment property for another property of equal or higher value and defer. Addendum b (replacement property) click. Our experienced.

Web Under Section 1031 Of The United States Internal Revenue Code ( 26 U.s.c.

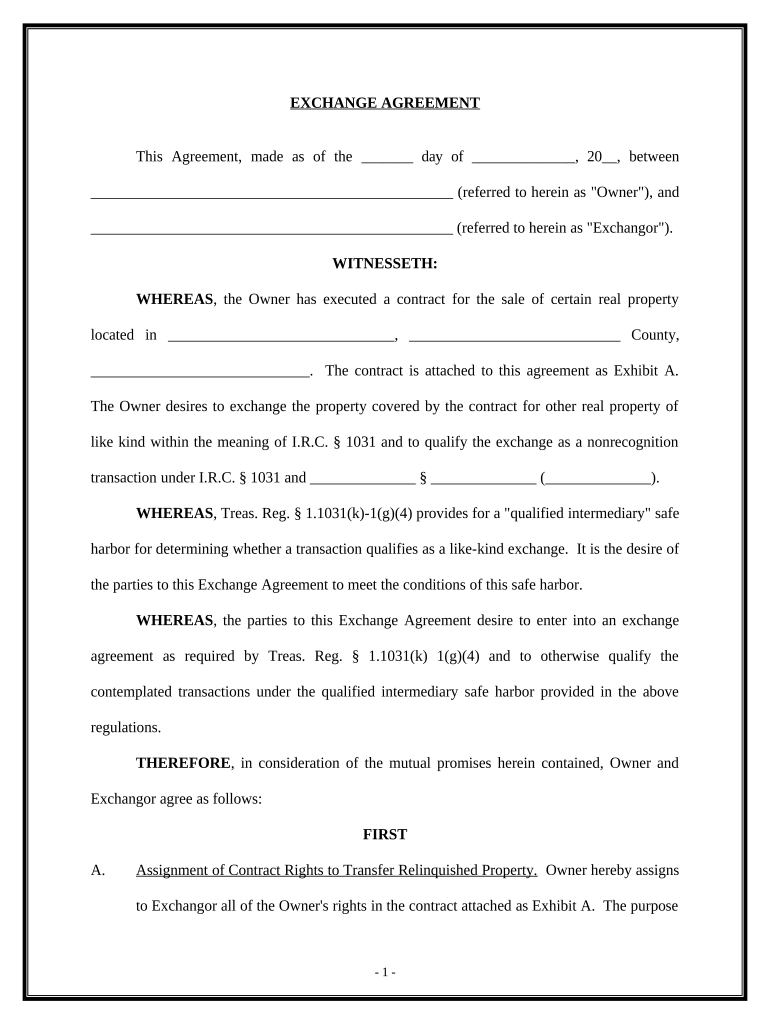

Web addendum a (1031 exchange cooperation clause used in the purchase and sale agreement) click here to download pdf. Web all 1031 exchanges report on form 8824. If you need to file an extension, use form 4868. § 1031 ), a taxpayer may defer recognition of capital gains and related federal income tax liability on.

Addendum B (Replacement Property) Click.

Web under the tax cuts and jobs act, section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. As with other such forms, the irs makes available an html version of. The simplest type of section 1031 exchange is a simultaneous swap of one property for. Start a 1031 exchange here.

Ad Own Real Estate Without Dealing With The Tenants, Toilets And Trash.

Call and speak to a live representative. Web section 1031 exchange form. No extra charge for same day exchanges. Ad we are an attorney owned and operated exchange facilitator known for our superior service.

Start A 1031 Exchange Here.

Web to accomplish a section 1031 exchange, there must be an exchange of properties. Understand the benefits of the 1031 exchange program to defer $100k's in capital gains Contact the most experienced 1031 exchange experts. Web a 1031 exchange is a real estate investing tool that allows investors to exchange an investment property for another property of equal or higher value and defer.