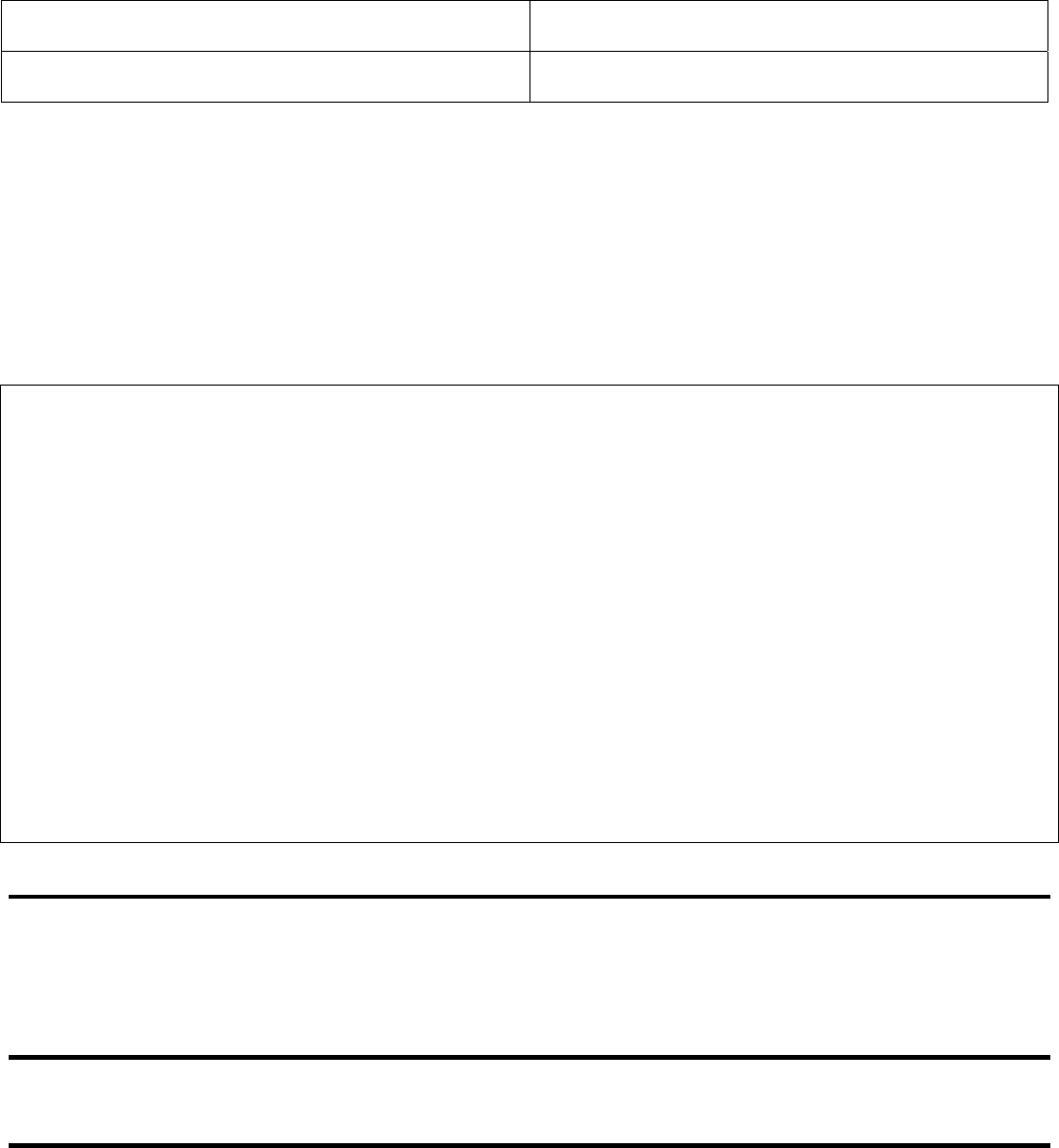

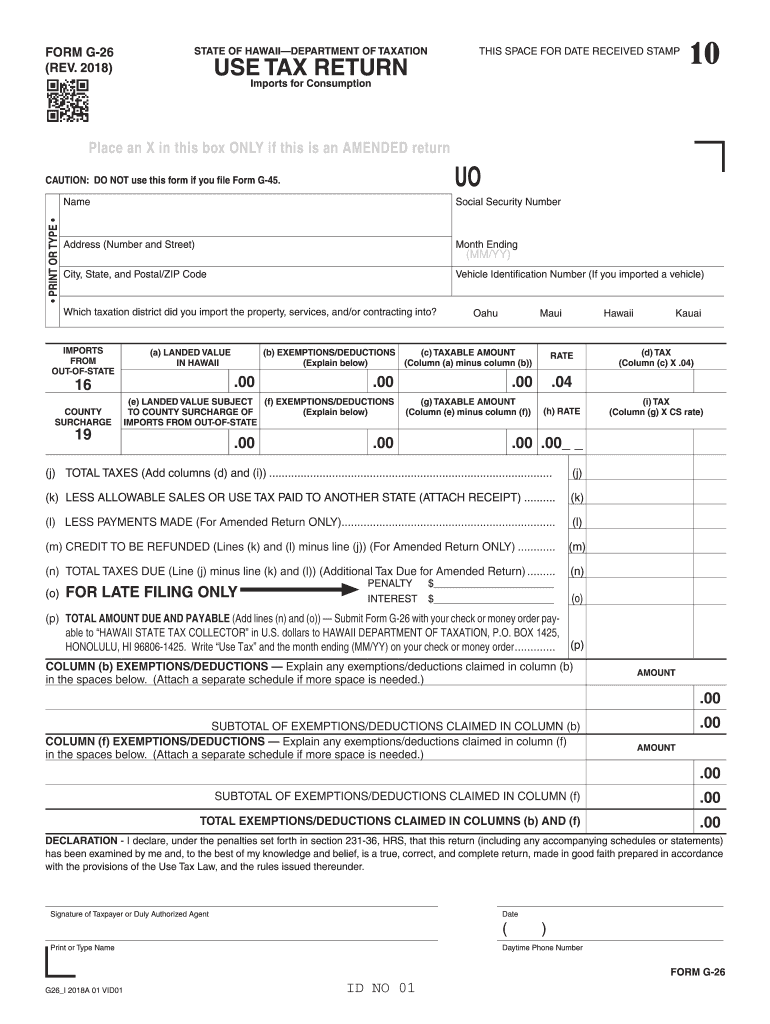

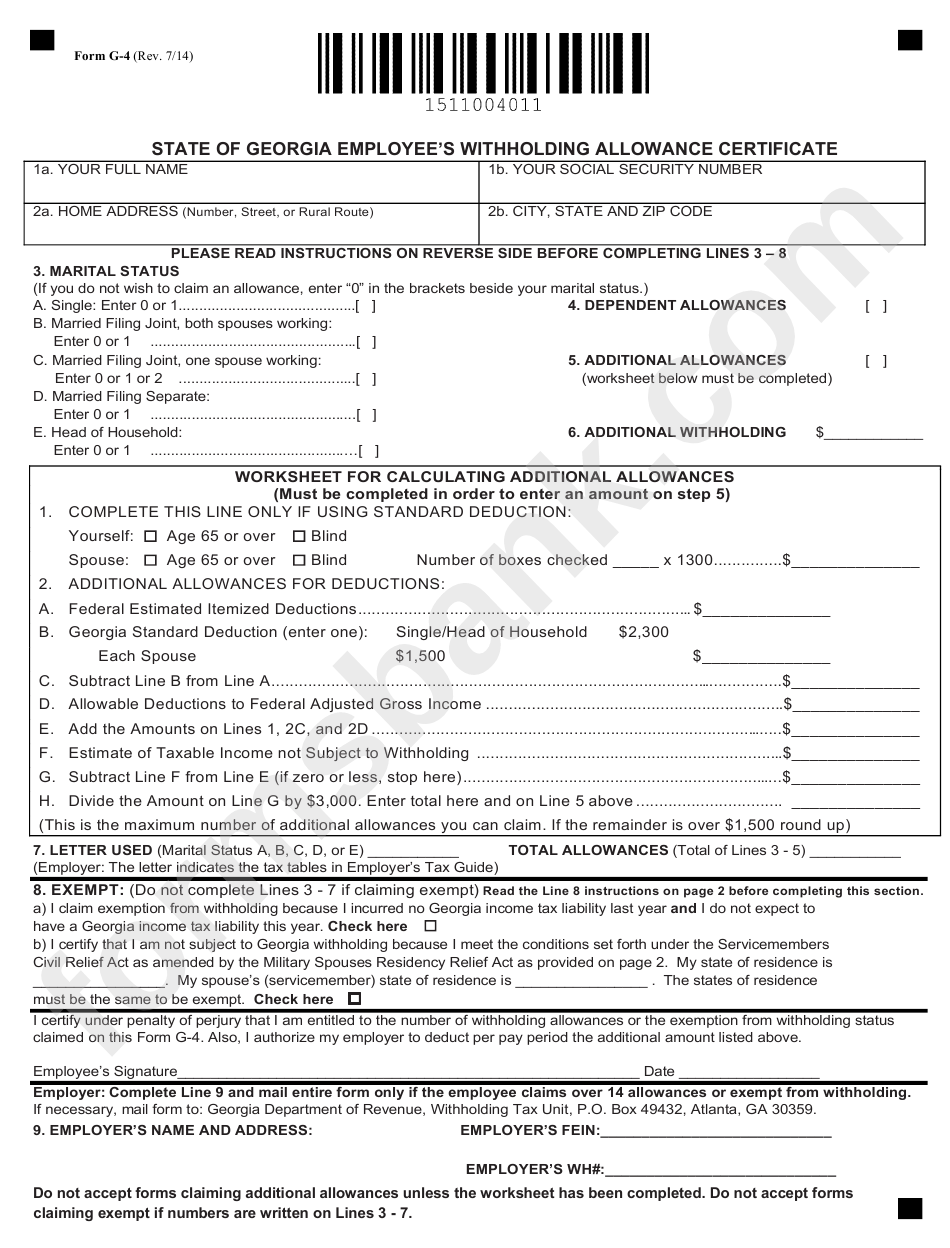

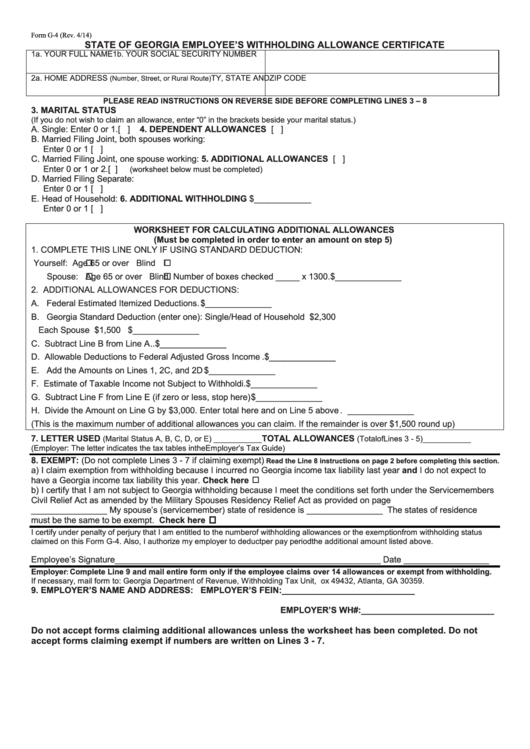

Form G 4 Georgia

Form G 4 Georgia - For recipients of income from annuities, pensions, and certain other deferred compensation plans. The forms will be effective with the first paycheck. The amount on line 4 of form 500ez (or line 16 of form 500) was $0 (zero). Your tax liability is the amount on. For the first time since july 2014, the georgia department of revenue recently released. Therefore, you do not qualify to claim exempt. Easily fill out pdf blank, edit, and sign them. State of georgia employees form is 2 pages long and contains: Save or instantly send your ready documents. Its purpose is to inform a.

These vendors must collect and remit tax on all retail sales of goods received in georgia by the purchaser and must file sales and use tax returns as required. The forms will be effective with the first paycheck. Web your employer withheld $500 of georgia income tax from your wages. For recipients of income from annuities, pensions, and certain other deferred compensation plans. 7/14) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. Save or instantly send your ready documents. Start filling out the template. This form is for income earned in tax year 2022, with tax returns due in april. For the first time since july 2014, the georgia department of revenue recently released. The amount on line 4 of form 500ez (or line 16 of form 500) was $0 (zero).

Save or instantly send your ready documents. Your tax liability is the amount on line 4 (or line 16); Use this form to tell. For recipients of income from annuities, pensions, and certain other deferred compensation plans. These vendors must collect and remit tax on all retail sales of goods received in georgia by the purchaser and must file sales and use tax returns as required. Start filling out the template. This form is for income earned in tax year 2022, with tax returns due in april. Web your employer withheld $500 of georgia income tax from your wages. Do not withhold georgia state income tax from my. For recipients of income from annuities, pensions, and certain other deferred compensation plans.

Form Type Archives Page 1847 of 2481 PDFSimpli

Easily fill out pdf blank, edit, and sign them. For recipients of income from annuities, pensions, and certain other deferred compensation plans. Save or instantly send your ready documents. Start filling out the template. This form is for income earned in tax year 2022, with tax returns due in april.

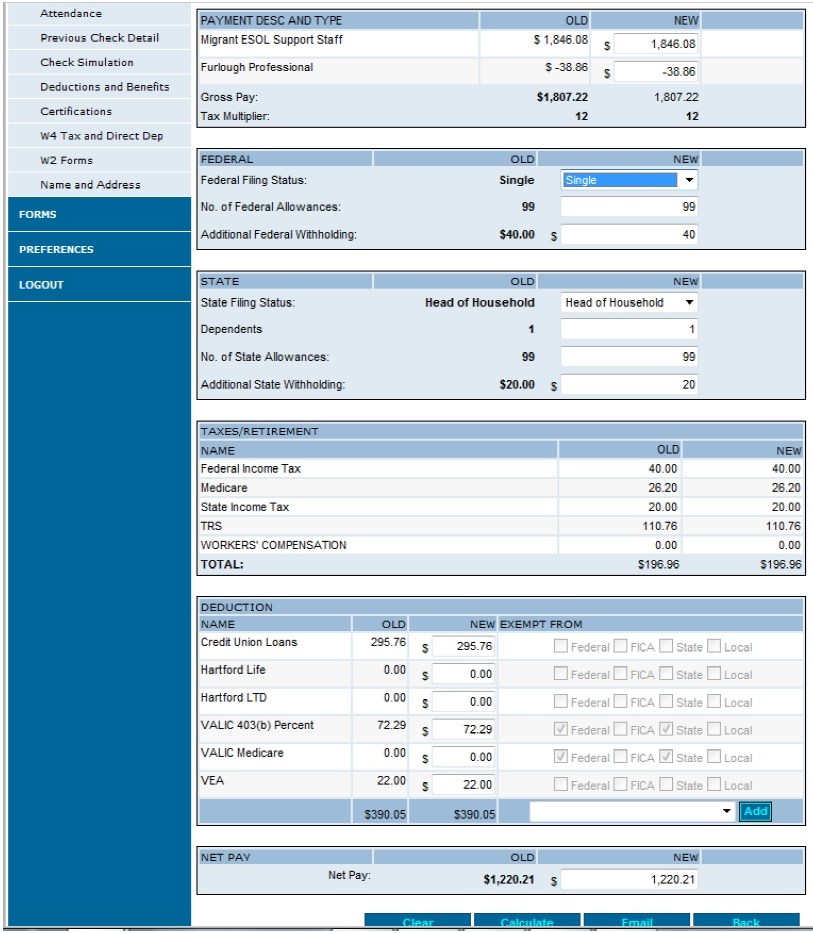

WFR State Fixes 2022 Resourcing Edge

12/09) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. Start filling out the template. 7/14) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. Your tax liability is the amount on line 4 (or line 16); The amount on line 4 of form 500ez (or line 16 of form.

Free Form G PDF 194KB 2 Page(s)

Web up to 5% cash back georgia tax return this year and will not have a tax liability. Your tax liability is the amount on. Web the amount on line 4 of form 500ez (or line 16 of form 500) was $100. Start filling out the template. Use this form to tell.

Form G4 State Of Employee'S Withholding Allowance

Access the fillable pdf document with a click. Do not withhold georgia state income tax from my. Web the amount on line 4 of form 500ez (or line 16 of form 500) was $100. You can download or print current or past. For recipients of income from annuities, pensions, and certain other deferred compensation plans.

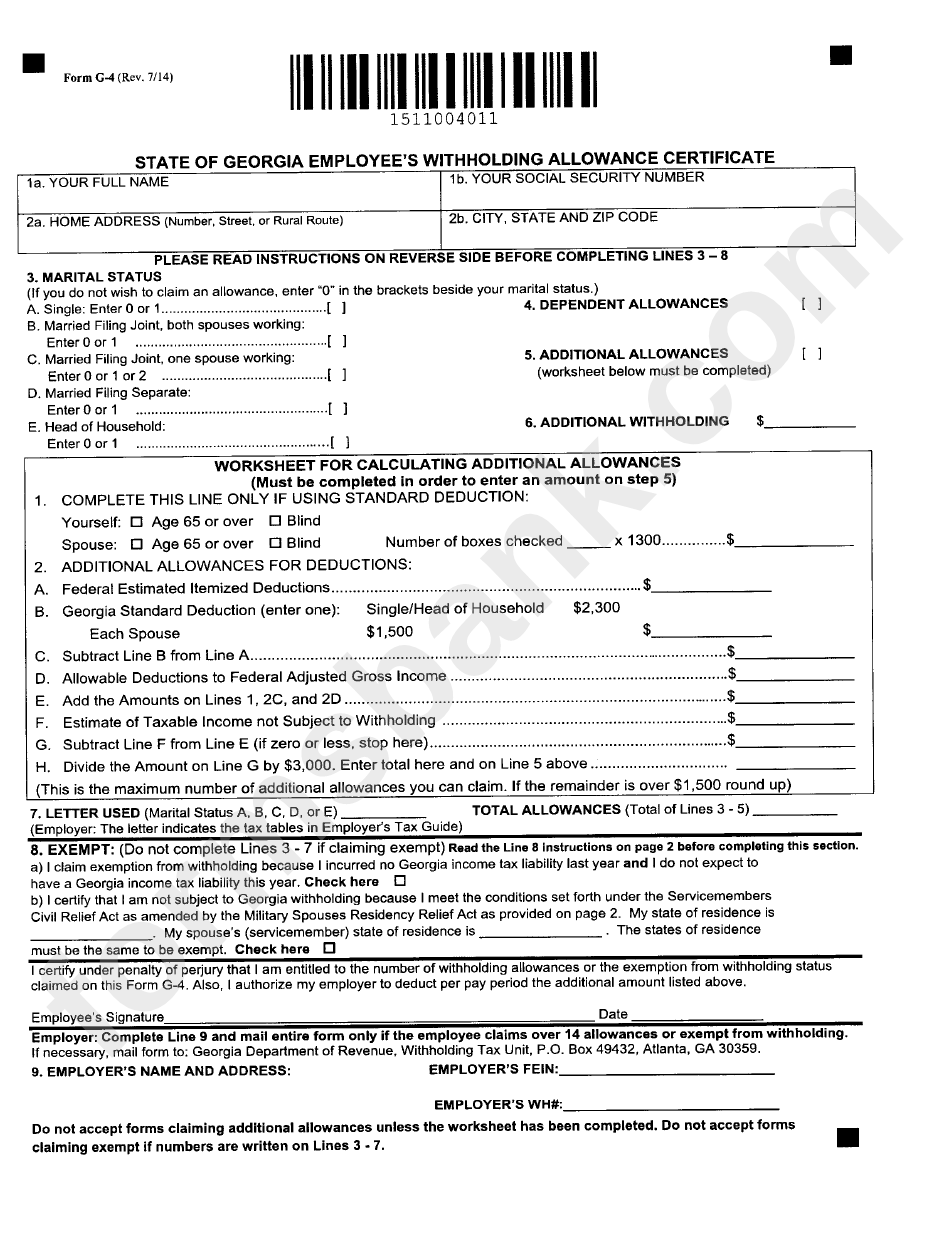

2018 Form HI G26 Fill Online, Printable, Fillable, Blank pdfFiller

State of georgia employees form is 2 pages long and contains: 7/14) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. Save or instantly send your ready documents. You can not claim exempt if you did not file a georgia income tax return for the previous tax year. Web up to 5% cash back georgia.

Form G4 State Of Employee'S Withholding Allowance

12/09) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. Therefore, you do not qualify to claim exempt. State of georgia employees form is 2 pages long and contains: If you do not provide. For recipients of income from annuities, pensions, and certain other deferred compensation plans.

VCS Employee Portal Valdosta City Schools

For recipients of income from annuities, pensions, and certain other deferred compensation plans. Your tax liability is the amount on line 4 (or line 16); State of georgia employees form is 2 pages long and contains: This form is for income earned in tax year 2022, with tax returns due in april. Use this form to tell.

Fillable Form G4 State Of Employee'S Withholding Allowance

For the first time since july 2014, the georgia department of revenue recently released. Web up to 5% cash back georgia tax return this year and will not have a tax liability. 7/14) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. You can not claim exempt if you did not file a georgia income.

Ga Employee Withholding Form 2022 2023

Web the amount on line 4 of form 500ez (or line 16 of form 500) was $100. This form is for income earned in tax year 2022, with tax returns due in april. Do not withhold georgia state income tax from my. For the first time since july 2014, the georgia department of revenue recently released. Your tax liability is.

Form G Form G Locking Pins, Index Plungers Standard Parts Brauer

The amount on line 4 of form 500ez (or line 16 of form 500) was $0 (zero). Therefore, you do not qualify to claim exempt. 12/09) state of georgia employee’s withholding allowance certificate please read instructions on reverse side before. For recipients of income from annuities, pensions, and certain other deferred compensation plans. Use this form to tell.

For Recipients Of Income From Annuities, Pensions, And Certain Other Deferred Compensation Plans.

The forms will be effective with the first paycheck. Easily fill out pdf blank, edit, and sign them. Your tax liability is the amount on. If you do not provide.

7/14) State Of Georgia Employee’s Withholding Allowance Certificate Please Read Instructions On Reverse Side Before.

Web up to 5% cash back georgia tax return this year and will not have a tax liability. Do not withhold georgia state income tax from my. Web your employer withheld $500 of georgia income tax from your wages. For the first time since july 2014, the georgia department of revenue recently released.

For Recipients Of Income From Annuities, Pensions, And Certain Other Deferred Compensation Plans.

Start filling out the template. Your tax liability is the amount on line 4 (or line 16); You can download or print current or past. State of georgia employees form is 2 pages long and contains:

12/09) State Of Georgia Employee’s Withholding Allowance Certificate Please Read Instructions On Reverse Side Before.

Web the amount on line 4 of form 500ez (or line 16 of form 500) was $100. These vendors must collect and remit tax on all retail sales of goods received in georgia by the purchaser and must file sales and use tax returns as required. Save or instantly send your ready documents. This form is for income earned in tax year 2022, with tax returns due in april.