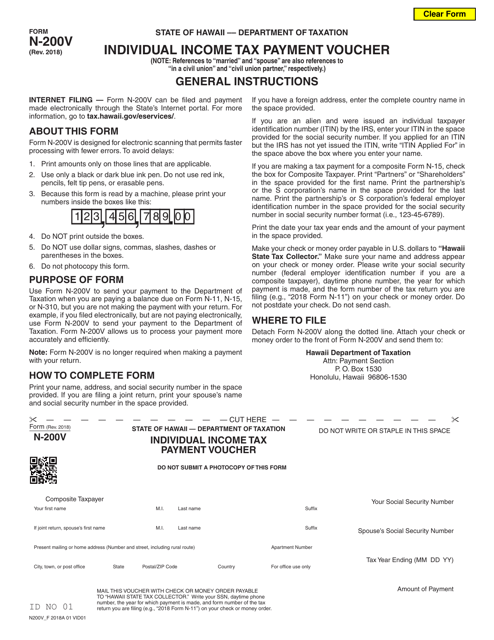

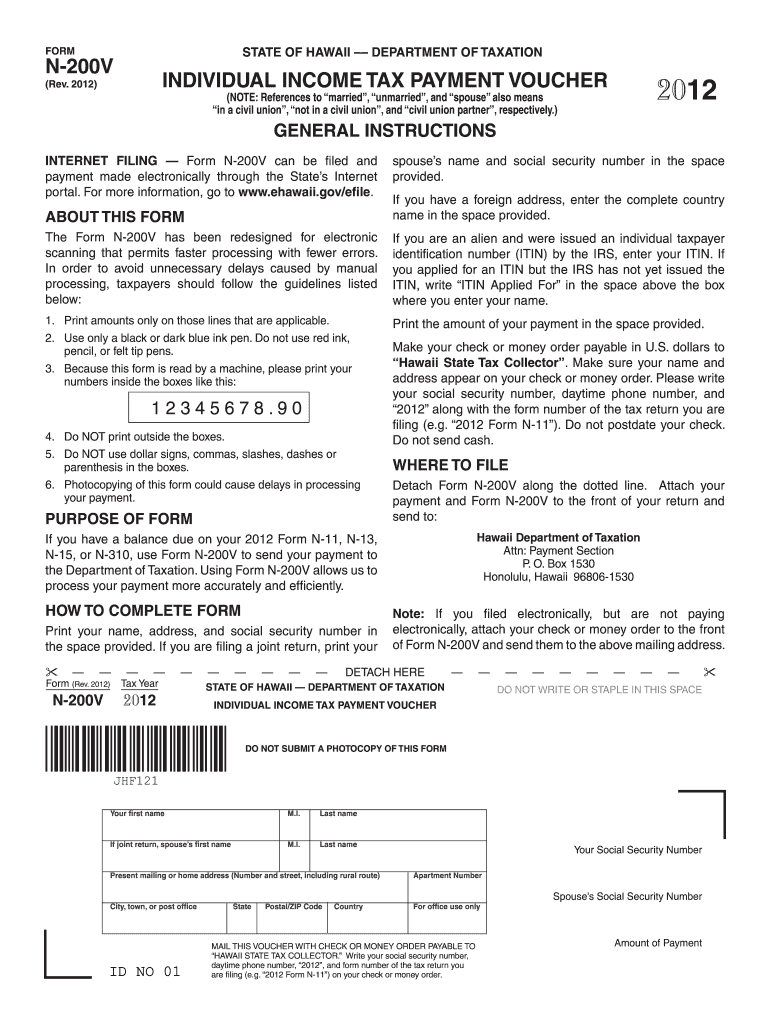

Form N 200V

Form N 200V - If you cannot pay the full amount of taxes you owe, you should still file. Web (1) you expect to owe at least $500 in tax for the current year, after subtracting your withholding and credits. If using a private delivery service, send your returns to the street address above for the submission processing center. How to complete form print your name and social security number in the space provided. Web • hawaii adopted the following provisions of the consolidated appropriations act (caa): If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and. Underpayment of estimated tax by individuals, estates and trusts:. (2) you expect your withholding and credits to be less than the. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is. The signing of this form binds the applicant to the terms of this permit.

Web payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the. In order to avoid unnecessary delays caused by manual. If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and. This form is for income earned in tax year 2022, with tax returns due in april. Web (1) you expect to owe at least $500 in tax for the current year, after subtracting your withholding and credits. The first payment for the current tax year is generally due on april 20th. Underpayment of estimated tax by individuals, estates and trusts:. Web • hawaii adopted the following provisions of the consolidated appropriations act (caa): If you cannot pay the full amount of taxes you owe, you should still file. The signing of this form binds the applicant to the terms of this permit.

The signing of this form binds the applicant to the terms of this permit. In order to avoid unnecessary delays caused by manual. If using a private delivery service, send your returns to the street address above for the submission processing center. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is. Web 1973 rulon white blvd. This form is for income earned in tax year 2022, with tax returns due in april. The first payment for the current tax year is generally due on april 20th. (2) you expect your withholding and credits to be less than the. Web • hawaii adopted the following provisions of the consolidated appropriations act (caa): If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and.

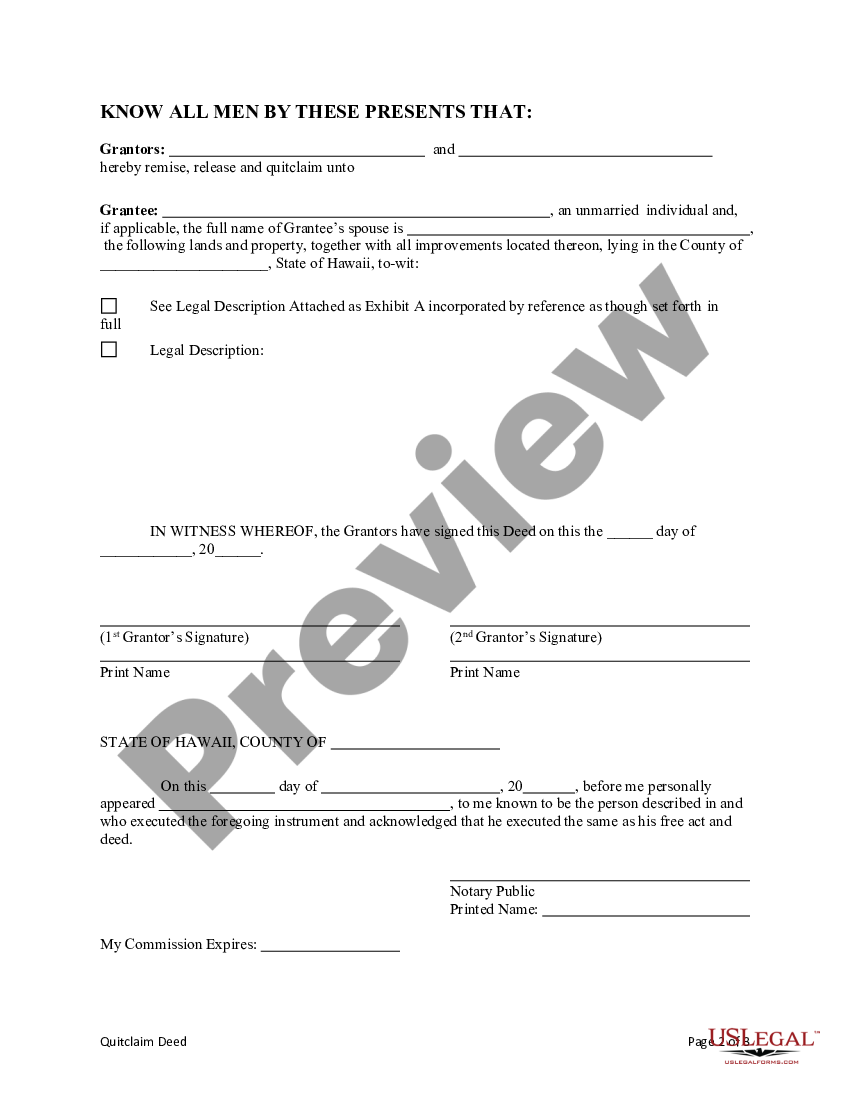

Deed State Hawaii Form G45 US Legal Forms

This form is for income earned in tax year 2022, with tax returns due in april. How to complete form print your name and social security number in the space provided. Web 1973 rulon white blvd. In order to avoid unnecessary delays caused by manual. Web • hawaii adopted the following provisions of the consolidated appropriations act (caa):

Form N200V Download Fillable PDF or Fill Online Individual Tax

If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and. Web (1) you expect to owe at least $500 in tax for the current year, after subtracting your withholding and credits. How to complete form print your name and social security number in the space provided. The first payment for the current tax year is generally due.

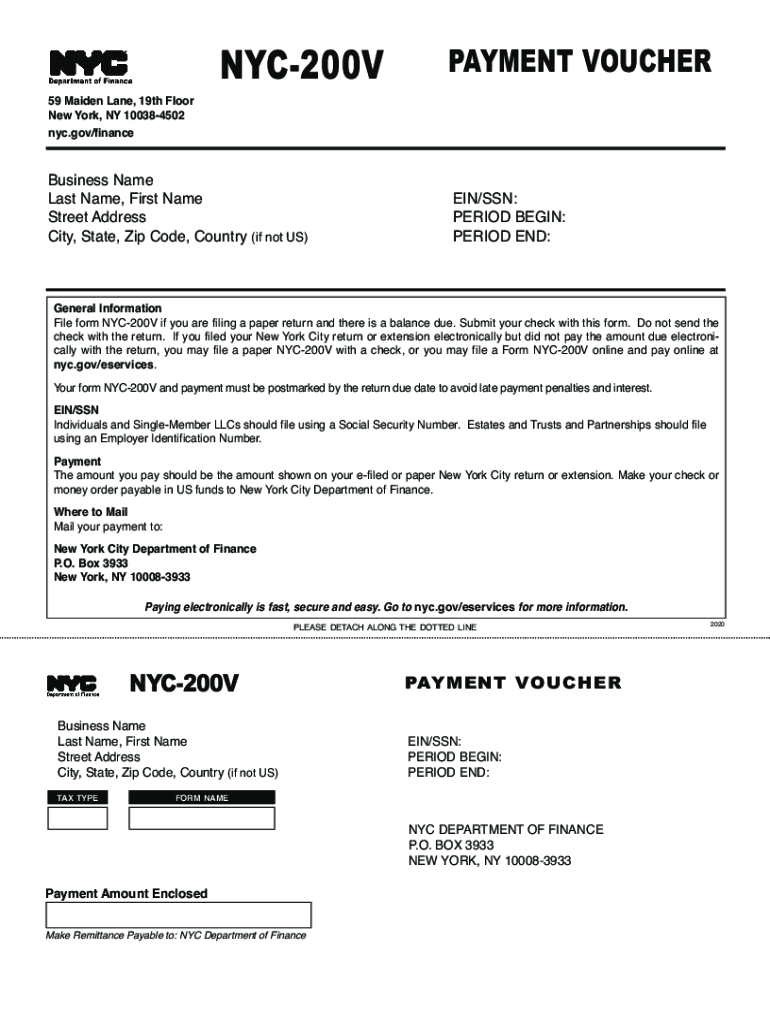

Nyc 200V Fill Out and Sign Printable PDF Template signNow

Individual income tax payment voucher : (2) you expect your withholding and credits to be less than the. If you cannot pay the full amount of taxes you owe, you should still file. If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and. Web (1) you expect to owe at least $500 in tax for the current.

THIDO IRF640N SIHF640 Transistor MOSFET Canal N 200V 18A

The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is. Web • hawaii adopted the following provisions of the consolidated appropriations act (caa): Web 1973 rulon white blvd. How to complete form print your name and social security number in the space provided. The first payment for the current tax year.

HI N11 2009 Fill out Tax Template Online US Legal Forms

In order to avoid unnecessary delays caused by manual. This form is for income earned in tax year 2022, with tax returns due in april. The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is. If you cannot pay the full amount of taxes you owe, you should still file. If.

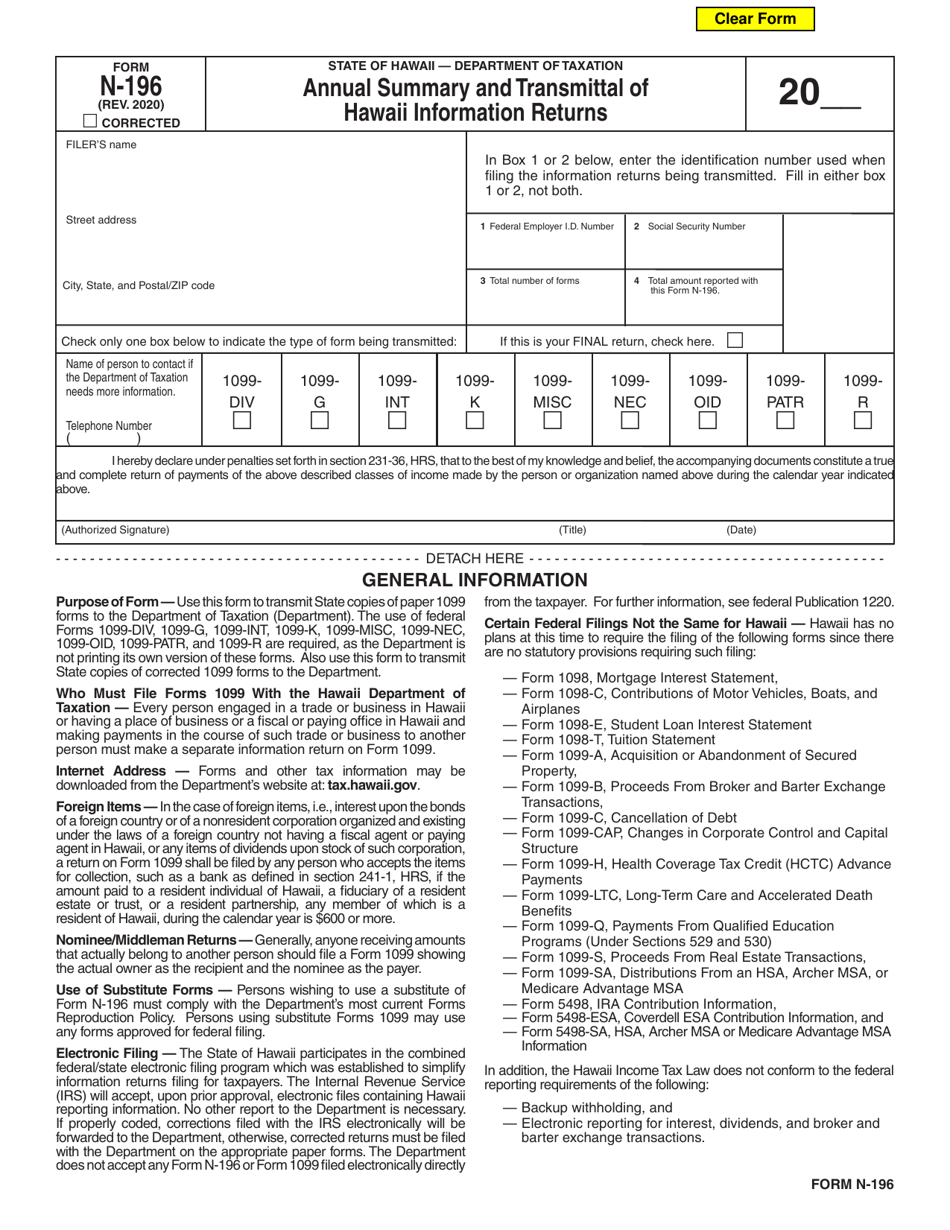

Form N196 Download Fillable PDF or Fill Online Annual Summary and

Web (1) you expect to owe at least $500 in tax for the current year, after subtracting your withholding and credits. In order to avoid unnecessary delays caused by manual. Web payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the..

Tinh Nghệ Hữu Cơ Nat & Form 200v Mỹ Phẩm Hàng Hiệu Pháp "Paris in

(1) extension of the exclusion from gross income of loans forgiven under the paycheck. Web payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the. Web (1) you expect to owe at least $500 in tax for the current year, after.

Hawaii Form N 200v 2021 Fill Out and Sign Printable PDF Template

How to complete form print your name and social security number in the space provided. Underpayment of estimated tax by individuals, estates and trusts:. Individual income tax payment voucher : If using a private delivery service, send your returns to the street address above for the submission processing center. The first payment for the current tax year is generally due.

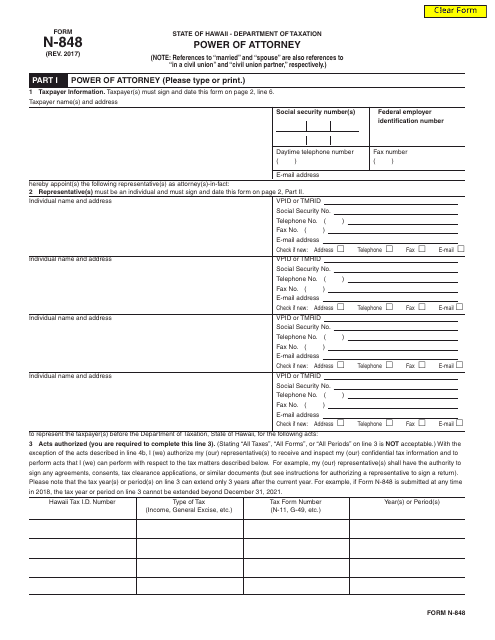

Form N848 Download Fillable PDF or Fill Online Power of Attorney

Web payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the. How to complete form print your name and social security number in the space provided. If you cannot pay the full amount of taxes you owe, you should still file..

Filing Tips for Form N400 naturalization application

This form is for income earned in tax year 2022, with tax returns due in april. If you cannot pay the full amount of taxes you owe, you should still file. (1) extension of the exclusion from gross income of loans forgiven under the paycheck. Web • hawaii adopted the following provisions of the consolidated appropriations act (caa): The signing.

The Signing Of This Form Binds The Applicant To The Terms Of This Permit.

Web payment vouchers are provided to accompany checks mailed to pay off tax liabilities, and are used by the revenue department to record the purpose of the check and the. How to complete form print your name and social security number in the space provided. If you cannot pay the full amount of taxes you owe, you should still file. The first payment for the current tax year is generally due on april 20th.

If Using A Private Delivery Service, Send Your Returns To The Street Address Above For The Submission Processing Center.

(1) extension of the exclusion from gross income of loans forgiven under the paycheck. Web 1973 rulon white blvd. Individual income tax payment voucher : The irs issues letter 12c to inform a taxpayer that their return has been received, but additional information is.

Web (1) You Expect To Owe At Least $500 In Tax For The Current Year, After Subtracting Your Withholding And Credits.

If signed by applicant’s contractor or that contractor’s authorized representative, the contractor and. Underpayment of estimated tax by individuals, estates and trusts:. (2) you expect your withholding and credits to be less than the. In order to avoid unnecessary delays caused by manual.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due In April.

Web • hawaii adopted the following provisions of the consolidated appropriations act (caa):