Form Va-4 Married Filing Jointly

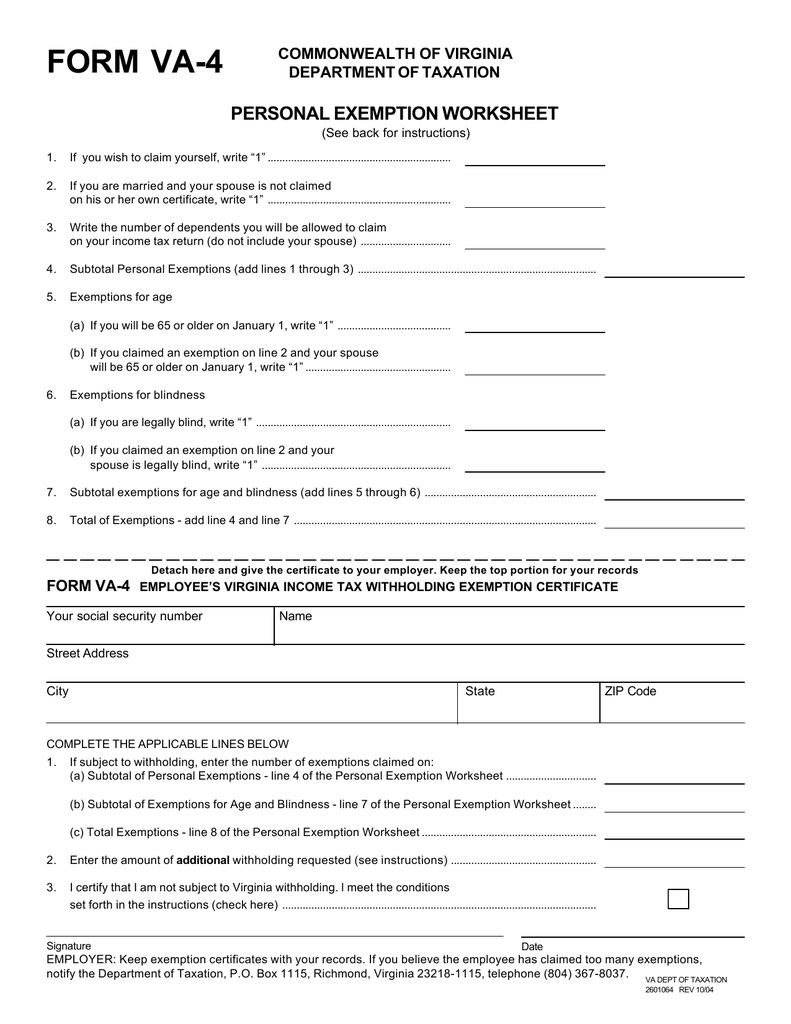

Form Va-4 Married Filing Jointly - Single, married filing jointly, married filing separately, head of household and qualifying widow(er). (1) both husband and wife are nonresidents and have income from. This is the amount that is not subject to taxation. Web the irs recognizes five filing statuses on the form 1040: If you moved, be sure to notify the irs of your address change by filing form 8822. A separate virginia return must be filed if both husband and wife are nonresidents and. Web married, filing a joint or combined return $8,000 married, filing a joint or combined return $14,000 married, filing a separate return $4,000 married, filing a separate return $7,000 Web the standard deduction for married couples filing jointly in the 2022 tax year is $25,900. If a married employee does not claim his. Web married filing jointly filing status — you are married and both you and your spouse agree to file a joint return.

You may file a combined return under filing status 4 if: (on a joint return, you report your combined income and. Single, married filing jointly, married filing separately, head of household and qualifying widow(er). Step 4 complete the “income” section of form. Web married, filing a joint or combined return $8,000 married, filing a joint or combined return $14,000 married, filing a separate return $4,000 married, filing a. Notify the irs of any address changes. A separate virginia return must be filed if both husband and wife are nonresidents and. Please use the worksheet on both forms to calculate your allowances and exemptions. Web the standard deduction for married couples filing jointly in the 2022 tax year is $25,900. The correct amount of withholding depends on.

Tell your employer you’ve moved. (1) both you and your spouse had income; Web up to 10% cash back if for some reason an employee does not file one, you must withhold tax as if the employee had claimed no exemptions. Web the school teacher has $25,000 in medical bills. This is the amount that is not subject to taxation. Web here's some info that could help you choose. You may file a combined return under filing status 4 if: Step 4 complete the “income” section of form. If you moved, be sure to notify the irs of your address change by filing form 8822. You must claim your own exemption.

W4 2020 Married Filing Jointly for the same MISTAKE YouTube

Web select “married filing jointly” from the list of filing statuses and enter the information about your dependents, if applicable. If they file jointly the medical bills do not exceed 10% of their combined agi ($35,500) and are therefore not deductible. The correct amount of withholding depends on. (on a joint return, you report your combined income and. Web filing.

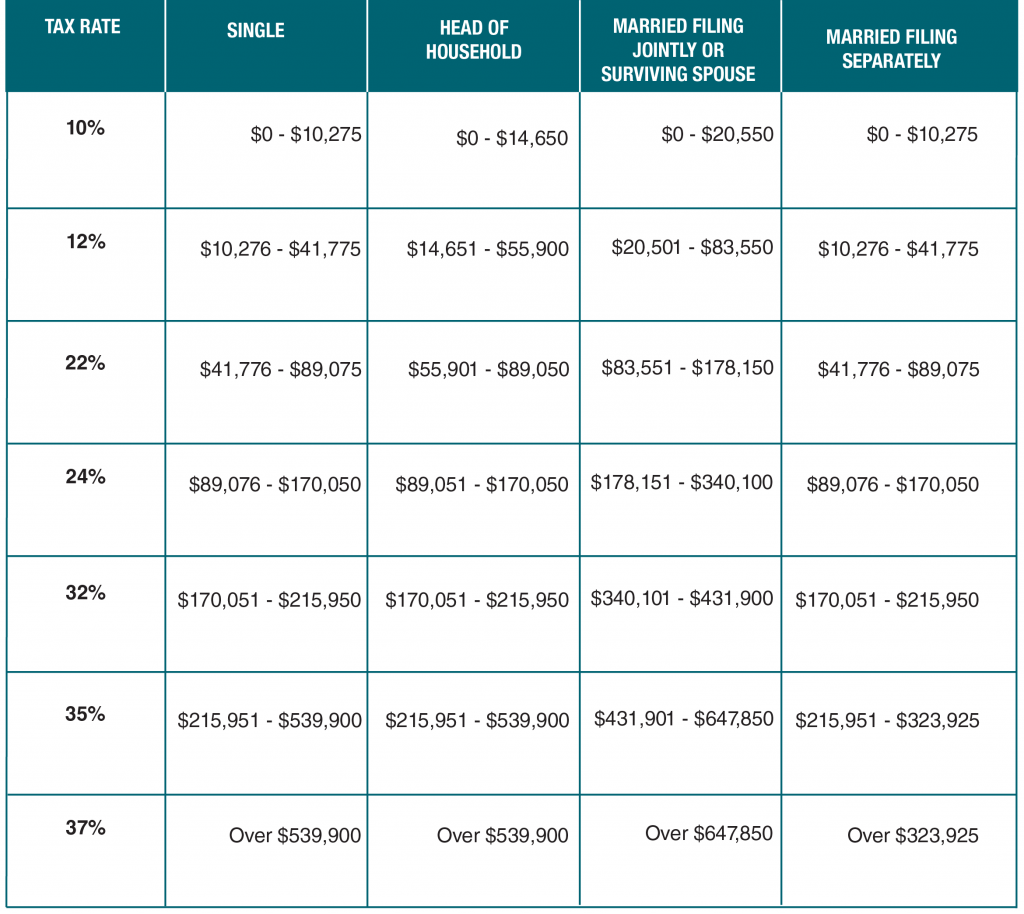

2022 Tax Tables Married Filing Jointly Printable Form, Templates and

Please use the worksheet on both forms to calculate your allowances and exemptions. Web filing status description standard deduction; A separate virginia return must be filed if both husband and wife are nonresidents and. Web the standard deduction for married couples filing jointly in the 2022 tax year is $25,900. Tell your employer you’ve moved.

Federal Withholding Tax Filing Jointly Federal Withholding Tables 2021

Please use the worksheet on both forms to calculate your allowances and exemptions. Web the irs recognizes five filing statuses on the form 1040: Web the standard deduction for married couples filing jointly in the 2022 tax year is $25,900. Web select “married filing jointly” from the list of filing statuses and enter the information about your dependents, if applicable..

Form Va 4 slidesharedocs

You must claim your own exemption. Those who file jointly typically receive more tax benefits than those who are married filing separately. You may file a combined return under filing status 4 if: Web up to 10% cash back if for some reason an employee does not file one, you must withhold tax as if the employee had claimed no.

IRS Form W4 Married Filing Jointly 2019 YouTube

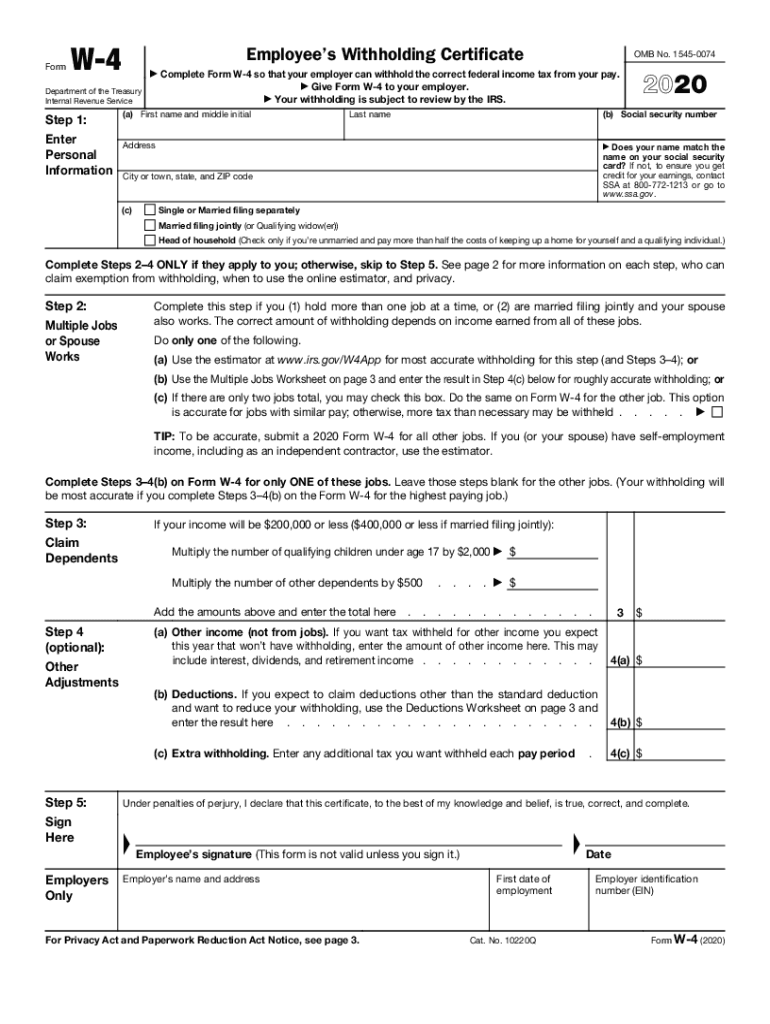

Web complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. (1) both husband and wife are nonresidents and have income from. If they file jointly the medical bills do not exceed 10% of their combined agi ($35,500) and are therefore not deductible. You must.

Joint Filing Credit Ohio 2021 Critical Issue 2021

Those who file jointly typically receive more tax benefits than those who are married filing separately. Notify the irs of any address changes. Web up to 10% cash back if for some reason an employee does not file one, you must withhold tax as if the employee had claimed no exemptions. Web the standard deduction for married couples filing jointly.

PDF Form W 4 PDF IRS Fill Out and Sign Printable PDF Template signNow

Web married filing jointly filing status — you are married and both you and your spouse agree to file a joint return. Web up to 10% cash back if for some reason an employee does not file one, you must withhold tax as if the employee had claimed no exemptions. Web married, filing a joint or combined return $8,000 married,.

2021 W4 Guide How to Fill Out a W4 This Year Gusto

Web here's some info that could help you choose. Web select “married filing jointly” from the list of filing statuses and enter the information about your dependents, if applicable. Web married, filing a joint or combined return $8,000 married, filing a joint or combined return $14,000 married, filing a separate return $4,000 married, filing a. Web the irs recognizes five.

How to fill out IRS Form W4 Married Filing Jointly 2021 YouTube

Web complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. Web the school teacher has $25,000 in medical bills. The correct amount of withholding depends on. Web the standard deduction for married couples filing jointly in the 2022 tax year is $25,900. Single, married.

How Should Married Couples File Taxes, Jointly or Separately?

Web up to 10% cash back if for some reason an employee does not file one, you must withhold tax as if the employee had claimed no exemptions. Tell your employer you’ve moved. Web married filing jointly filing status — you are married and both you and your spouse agree to file a joint return. The correct amount of withholding.

If A Married Employee Does Not Claim His.

This is the amount that is not subject to taxation. Notify the irs of any address changes. You may file a combined return under filing status 4 if: Web up to 10% cash back if for some reason an employee does not file one, you must withhold tax as if the employee had claimed no exemptions.

Web Married, Filing A Joint Or Combined Return $8,000 Married, Filing A Joint Or Combined Return $14,000 Married, Filing A Separate Return $4,000 Married, Filing A.

A separate virginia return must be filed if both husband and wife are nonresidents and. Web select “married filing jointly” from the list of filing statuses and enter the information about your dependents, if applicable. Web here's some info that could help you choose. If they file jointly the medical bills do not exceed 10% of their combined agi ($35,500) and are therefore not deductible.

If You Moved, Be Sure To Notify The Irs Of Your Address Change By Filing Form 8822.

Step 4 complete the “income” section of form. You must claim your own exemption. A separate virginia return must be filed if: (1) both you and your spouse had income;

Web The Irs Recognizes Five Filing Statuses On The Form 1040:

Please use the worksheet on both forms to calculate your allowances and exemptions. Web the school teacher has $25,000 in medical bills. Those who file jointly typically receive more tax benefits than those who are married filing separately. Web married, filing a joint or combined return $8,000 married, filing a joint or combined return $14,000 married, filing a separate return $4,000 married, filing a separate return $7,000