Franchise And Excise Tax Tennessee Form

Franchise And Excise Tax Tennessee Form - Web 3 | page overview.45 Web the franchise tax is based on the greater of: Web any depreciation under the provisions of irc section 168 not permitted for excise tax purposes due to tennessee permanently decoupling from federal bonus depreciation. Web franchise tax (25¢ per $100.00 or major fraction thereof on the greater of lines 1 or 2; Ad register and subscribe now to work on your excise tax declaration & more fillable forms. Web in general, the franchise tax is based on the greater of tennessee apportioned. Net worth (assets less liabilities) or; The book value (cost less accumulated. Please use the link below. 1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee.

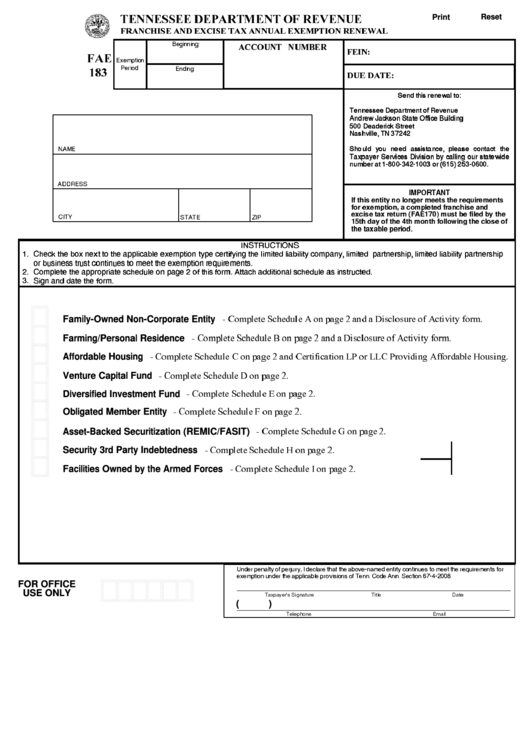

Web franchise tax (25¢ per $100.00 or major fraction thereof on the greater of lines 1 or 2; Web the franchise tax is based on the greater of: Net worth (assets less liabilities) or; Web 2 | page contents chapter 1: The book value (cost less accumulated. Web the franchise tax rate is 0.25% times the greater of a business’s net worth or real and tangible property. 1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee. Please use the link below. Web any depreciation under the provisions of irc section 168 not permitted for excise tax purposes due to tennessee permanently decoupling from federal bonus depreciation. Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th.

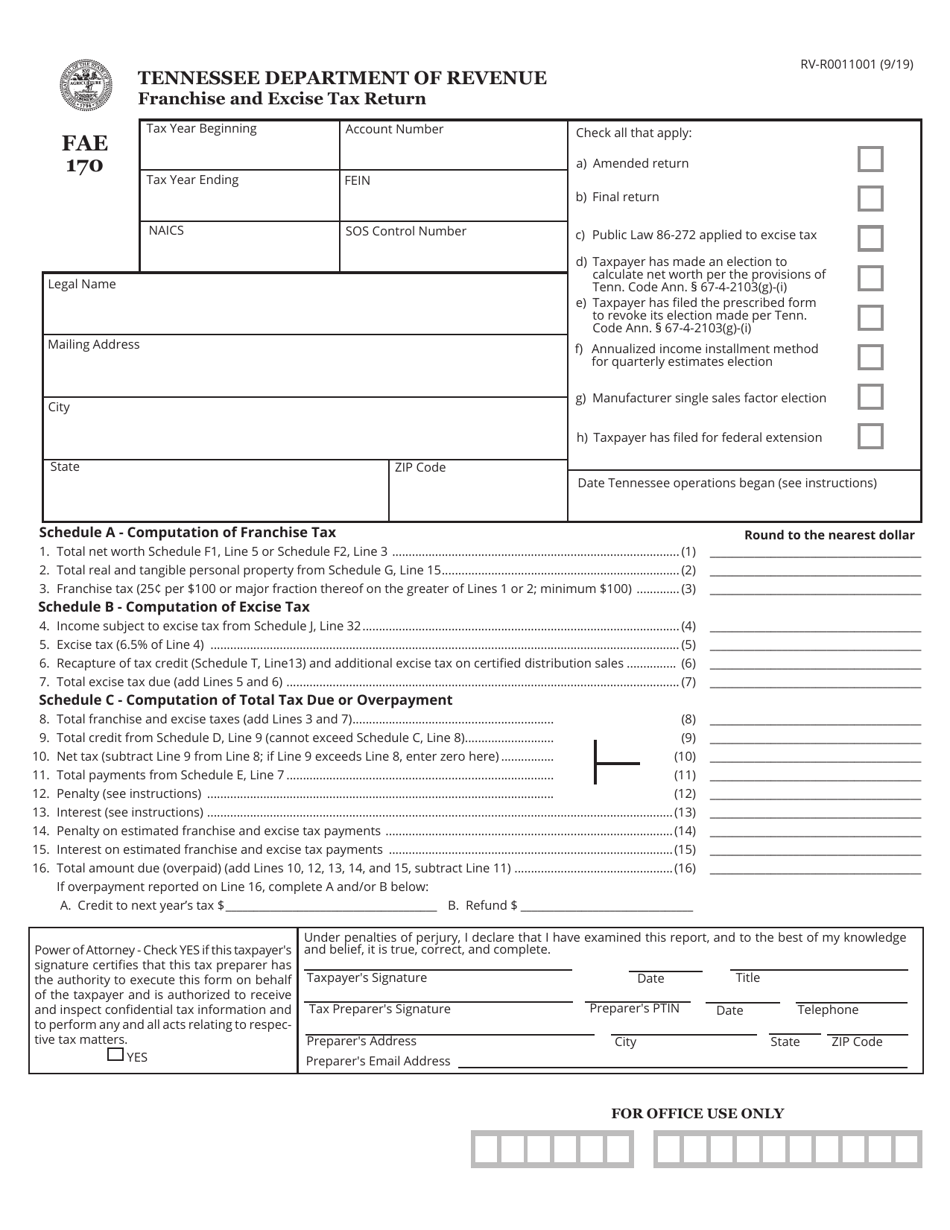

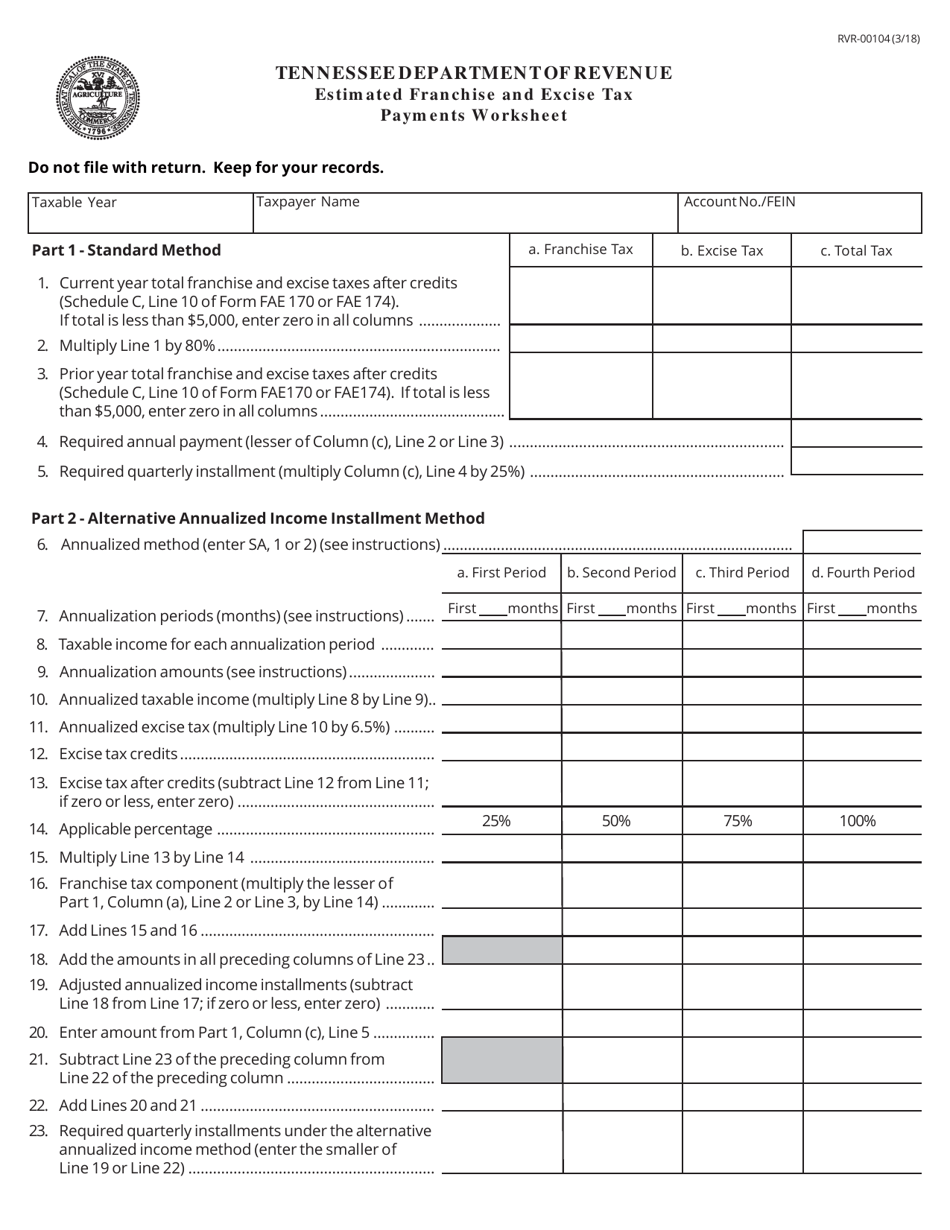

Web 2 | page contents chapter 1: Web 3 | page overview.45 Complete, edit or print tax forms instantly. Taxpayers with a franchise, excise tax liability of $5,000 or more in the prior tax year who expect a franchise, excise tax. Tennessee taxes | form fae 170 | taxact support. Web in general, the franchise tax is based on the greater of tennessee apportioned. Web when filing the franchise and excise tax return on tntap, a taxpayer should check “yes” when asked “have you filed for an extension?” taxpayers who qualify for an. The book value (cost less accumulated. Web the following entity types may be required to file the franchise and excise tax return: Web the franchise tax is based on the greater of:

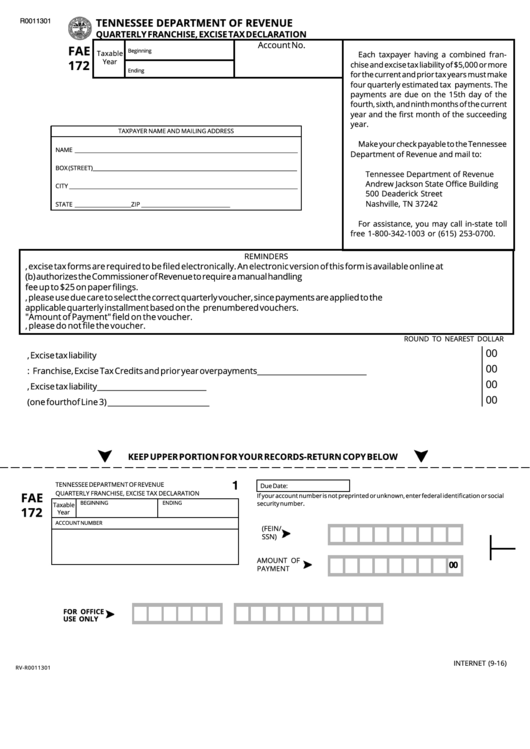

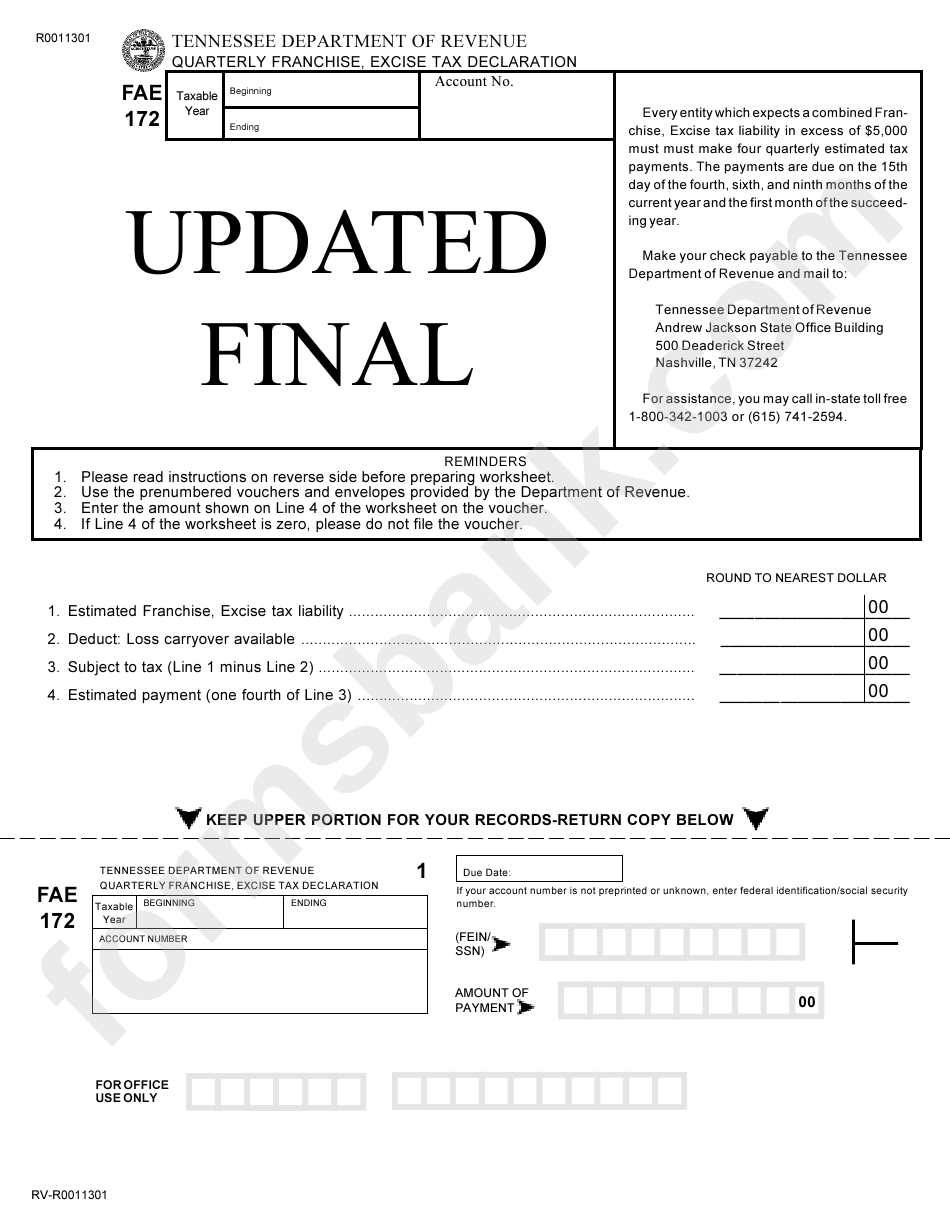

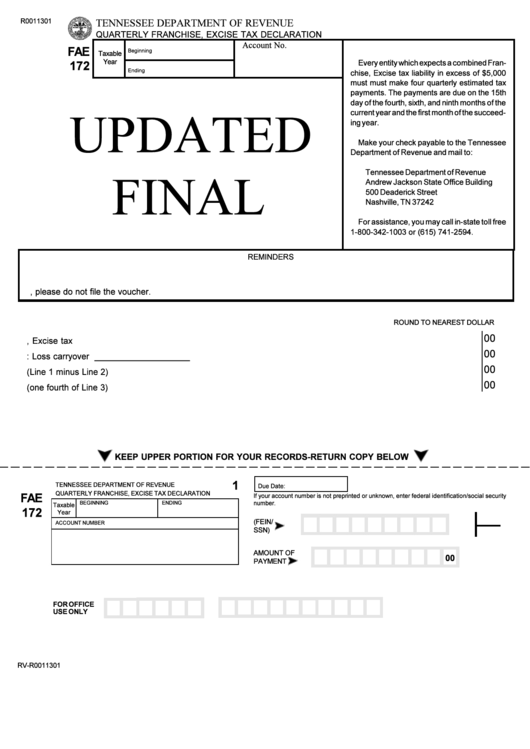

Form Fae 172 Quarterly Franchise, Excise Tax Declaration Tennessee

Get ready for tax season deadlines by completing any required tax forms today. Web 2 | page contents chapter 1: Web the following entity types may be required to file the franchise and excise tax return: Web any depreciation under the provisions of irc section 168 not permitted for excise tax purposes due to tennessee permanently decoupling from federal bonus.

Form Fae 172 Quarterly Franchise, Excise Tax Declaration printable

Please use the link below. Who must make estimated tax payments: Web the franchise tax rate is 0.25% times the greater of a business’s net worth or real and tangible property. Ad register and subscribe now to work on your excise tax declaration & more fillable forms. The minimum tax is $100.

tn franchise and excise tax guide Deafening Bloggers Pictures

Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. Web in general, the franchise tax is based on the greater of tennessee apportioned. Web the franchise tax rate is 0.25% times the greater of a business’s net worth or real and tangible property. The book.

Form FAE170 (RVR0011001) Download Printable PDF or Fill Online

Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. Tennessee taxes | form fae 170 | taxact support. Web 2 | page contents chapter 1: The book value (cost less accumulated. Web when filing the franchise and excise tax return on tntap, a taxpayer should.

Tn Franchise And Excise Tax Guide My Tax

Web franchise tax (25¢ per $100.00 or major fraction thereof on the greater of lines 1 or 2; Net worth (assets less liabilities) or; Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. Ad register and subscribe now to work on your excise tax declaration.

Form Fae 172 Quarterly Franchise, Excise Tax Declaration printable

Web income tax due for partnerships tennessee forms and schedules form inc 250—individual income tax return form inc 251—application for extension of time to file individual. Net worth (assets less liabilities) or; Web 2 | page contents chapter 1: Get ready for tax season deadlines by completing any required tax forms today. Taxpayers with a franchise, excise tax liability of.

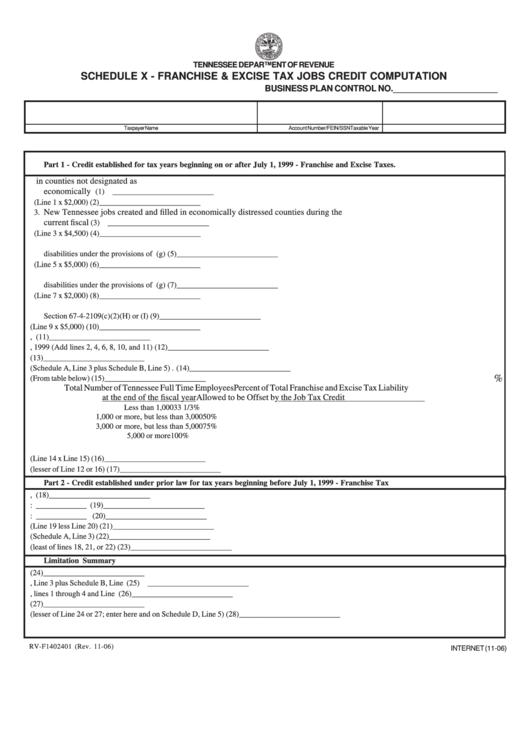

Fillable Form RvF1402401 Schedule X Franchise & Excise Tax Jobs

Web income tax due for partnerships tennessee forms and schedules form inc 250—individual income tax return form inc 251—application for extension of time to file individual. Web when filing the franchise and excise tax return on tntap, a taxpayer should check “yes” when asked “have you filed for an extension?” taxpayers who qualify for an. Web franchise tax (25¢ per.

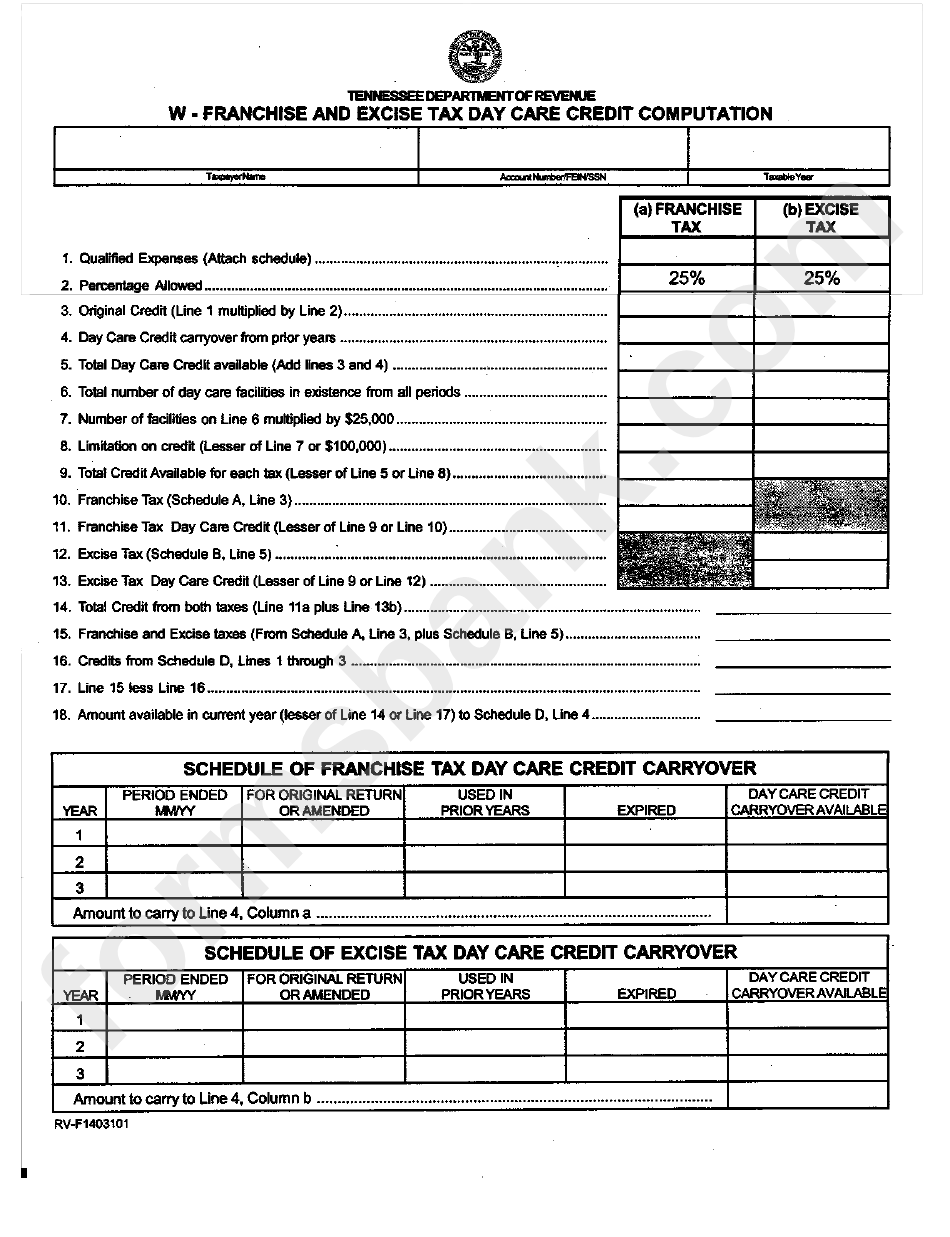

WFranchise And Excise Tax Day Care Credit Computation Form printable

Web the franchise tax rate is 0.25% times the greater of a business’s net worth or real and tangible property. Web the franchise tax is based on the greater of: Please use the link below. Tennessee taxes | form fae 170 | taxact support. Web income tax due for partnerships tennessee forms and schedules form inc 250—individual income tax return.

tn franchise and excise tax mailing address Blimp Microblog Custom

Net worth (assets less liabilities) or; Web in general, the franchise tax is based on the greater of tennessee apportioned. Tennessee taxes | form fae 170 | taxact support. Web income tax due for partnerships tennessee forms and schedules form inc 250—individual income tax return form inc 251—application for extension of time to file individual. Web the taxpayer’s initial franchise.

Fillable Form Fae 183 Franchise And Excise Tax Annual Exemption

Web when filing the franchise and excise tax return on tntap, a taxpayer should check “yes” when asked “have you filed for an extension?” taxpayers who qualify for an. 1) net worth or the book value of real property or 2) tangible personal property owned or used in tennessee. Web the following entity types may be required to file the.

Who Must Make Estimated Tax Payments:

Web 2 | page contents chapter 1: Web the franchise tax rate is 0.25% times the greater of a business’s net worth or real and tangible property. The minimum tax is $100. Ad register and subscribe now to work on your excise tax declaration & more fillable forms.

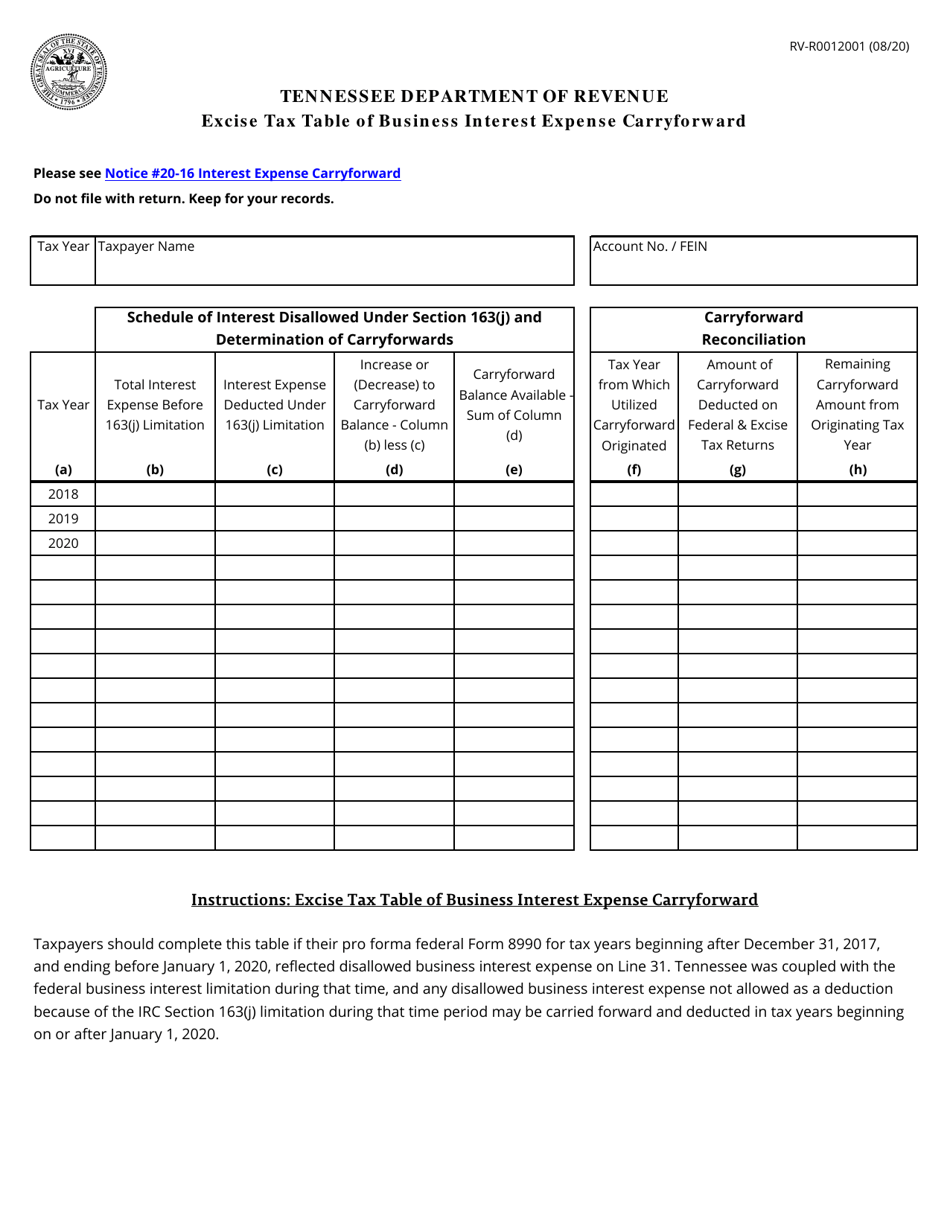

Web Any Depreciation Under The Provisions Of Irc Section 168 Not Permitted For Excise Tax Purposes Due To Tennessee Permanently Decoupling From Federal Bonus Depreciation.

Web the taxpayer’s initial franchise and excise tax exemption application, and all subsequent exemption renewal applications, should be submitted on or before the 15th. Complete, edit or print tax forms instantly. Tennessee taxes | form fae 170 | taxact support. Web income tax due for partnerships tennessee forms and schedules form inc 250—individual income tax return form inc 251—application for extension of time to file individual.

The Book Value (Cost Less Accumulated.

Web when filing the franchise and excise tax return on tntap, a taxpayer should check “yes” when asked “have you filed for an extension?” taxpayers who qualify for an. Web franchise tax (25¢ per $100.00 or major fraction thereof on the greater of lines 1 or 2; Web 3 | page overview.45 Get ready for tax season deadlines by completing any required tax forms today.

1) Net Worth Or The Book Value Of Real Property Or 2) Tangible Personal Property Owned Or Used In Tennessee.

Web in general, the franchise tax is based on the greater of tennessee apportioned. Taxpayers with a franchise, excise tax liability of $5,000 or more in the prior tax year who expect a franchise, excise tax. Net worth (assets less liabilities) or; Web the franchise tax is based on the greater of: