Ftb 3522 Form

Ftb 3522 Form - Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. Engaged parties names, addresses and numbers etc. Web find the ca ftb 3522 you require. An llc should use this voucher if any of the following apply: The llc has articles of organization accepted by the california secretary of state (sos). All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Does my california llc need to file form 3536 (estimated fee for llcs) in the 1st year? When a new llc is formed in california, it has four months from the date of its formation to pay this fee. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Open it with online editor and start adjusting.

All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Web does my california llc need to file form 3522 (limited liability company tax voucher) in the 1st year? What's the goal of assembly bill 85 for business owners? Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. Enjoy smart fillable fields and interactivity. The llc has articles of organization accepted by the california secretary of state (sos). Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. Web find the ca ftb 3522 you require. Customize the blanks with smart fillable fields. This form must be filed in order to report the gain or loss from the sale or other disposition.

Web form ftb 3522 is a form that is used to report the sale or other disposition of california real property. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. What's the goal of assembly bill 85 for business owners? All llcs in the state are required to pay this annual tax to stay compliant and in good standing. This form must be filed in order to report the gain or loss from the sale or other disposition. Customize the blanks with smart fillable fields. When a new llc is formed in california, it has four months from the date of its formation to pay this fee. Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form.

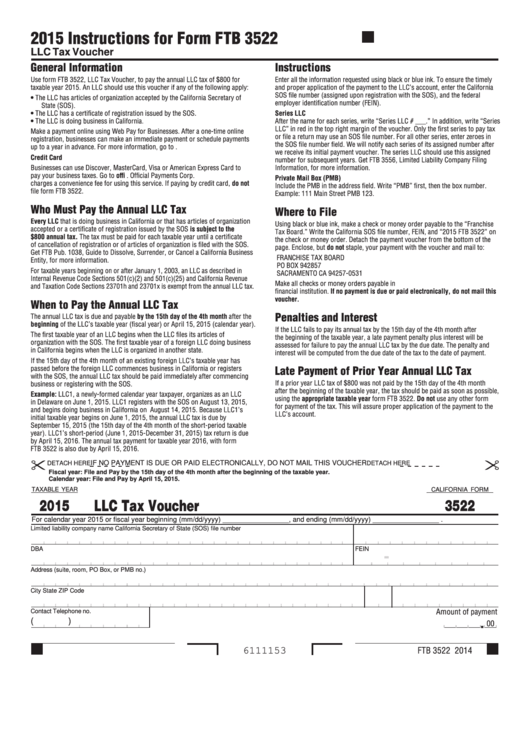

2015 Form Ftb 3522 Llc Tax Voucher Tax Walls

An llc should use this voucher if any of the following apply: Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to fill out and sign 2023 ftb 3522 online? The llc has articles of organization accepted by the california secretary of state.

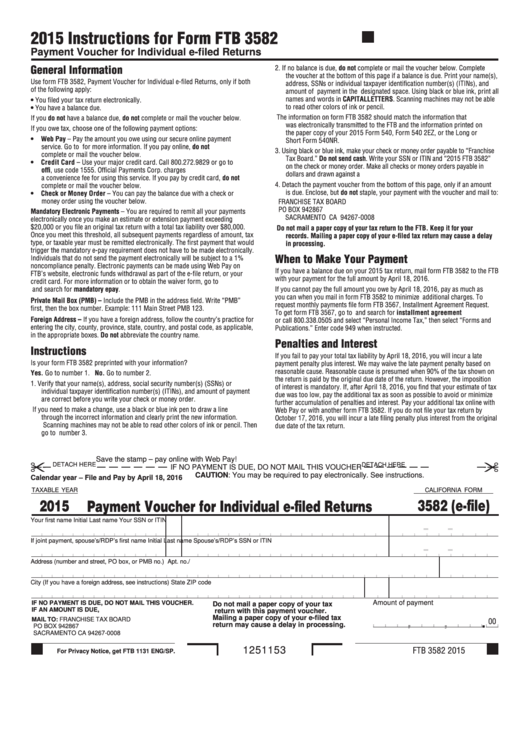

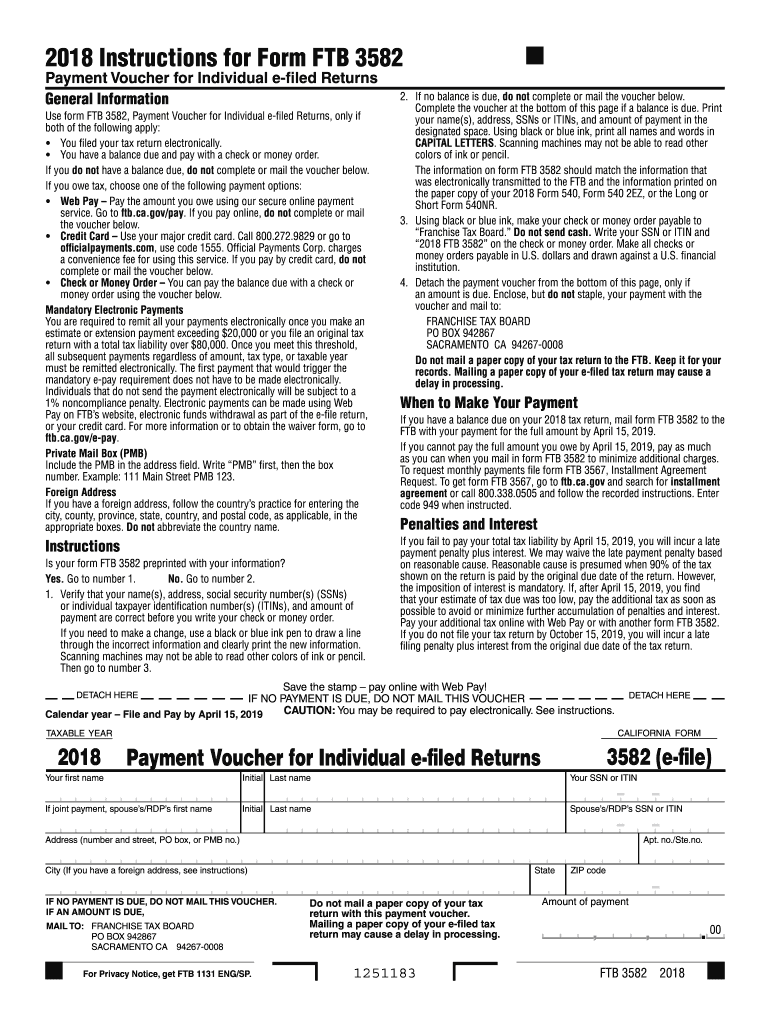

Fillable Form 3582 California Payment Voucher For Individual EFiled

When a new llc is formed in california, it has four months from the date of its formation to pay this fee. The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form. Engaged parties names, addresses and numbers etc. Follow the simple instructions below: Web form 3522 is a form used by llcs.

Form Ftb 3522 ≡ Fill Out Printable PDF Forms Online

Does my california llc need to file form 3536 (estimated fee for llcs) in the 1st year? All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. Open.

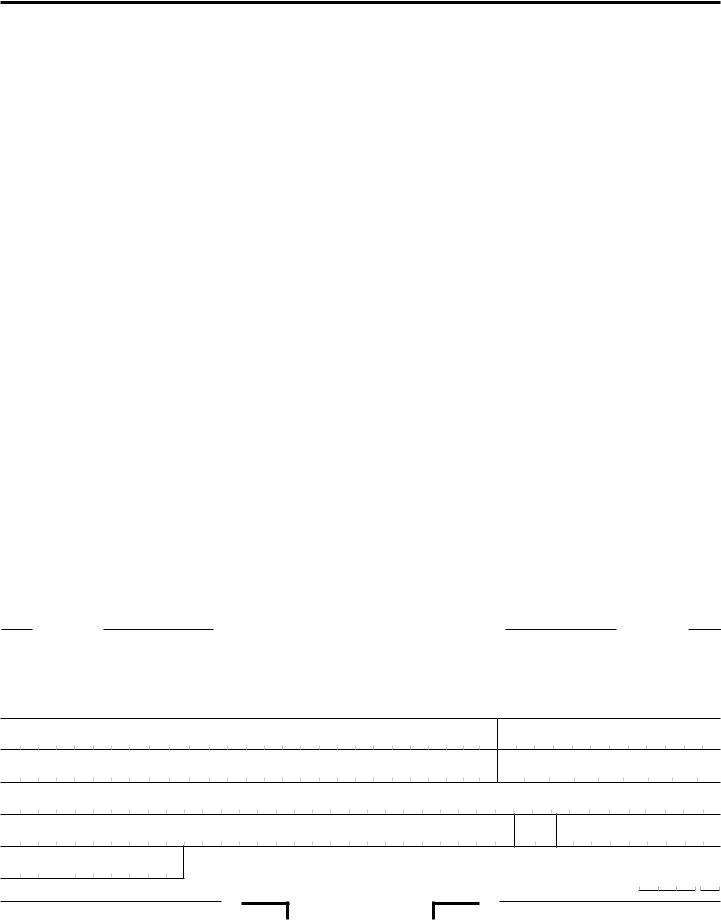

2017 Instructions For Form Ftb 3522 Llc Tax Voucher printable pdf

What's the goal of assembly bill 85 for business owners? Web form 3522 is a form used by llcs in california to pay a businesss annual tax of $800. Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to fill out and sign.

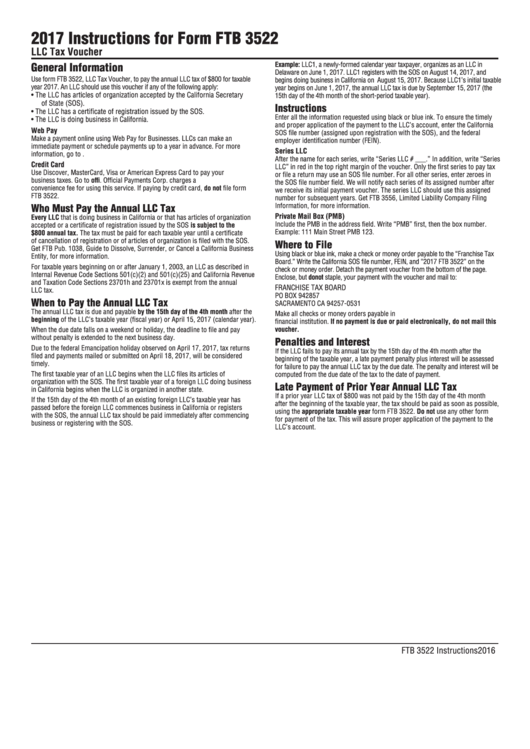

공장등록증명(신청)서(자가공장, 임대공장) 샘플, 양식 다운로드

The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form. Fill out the empty fields; Web does my california llc need to file form 3522 (limited liability company tax voucher) in the 1st year? All llcs in the state are required to pay this annual tax to stay compliant and in good standing..

Form 3582 Fill Out and Sign Printable PDF Template signNow

Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to fill out and sign 2023 ftb 3522 online? The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form. Get your online template and fill it in.

California Tax Form 3522 (Draft) Instructions For Form Ftb 3522 Llc

Engaged parties names, addresses and numbers etc. Fill out the empty fields; Web ftb 3522 form 2023 rating ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ ★ 4.8 satisfied 34 votes how to fill out and sign 2023 ftb 3522 online? Use estimated fee for llcs (ftb 3536) file limited liability company return of.

Nj form 500 instructions Australian tutorials Working Examples

Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Does my california llc need to file form 3536 (estimated fee for llcs) in the 1st year? Web use.

California Form 3522 Llc Tax Voucher 2015 printable pdf download

The llc has articles of organization accepted by the california secretary of state (sos). Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. What is the estimated fee for california llcs? All llcs in the state are required to pay this annual tax to stay compliant and in good standing..

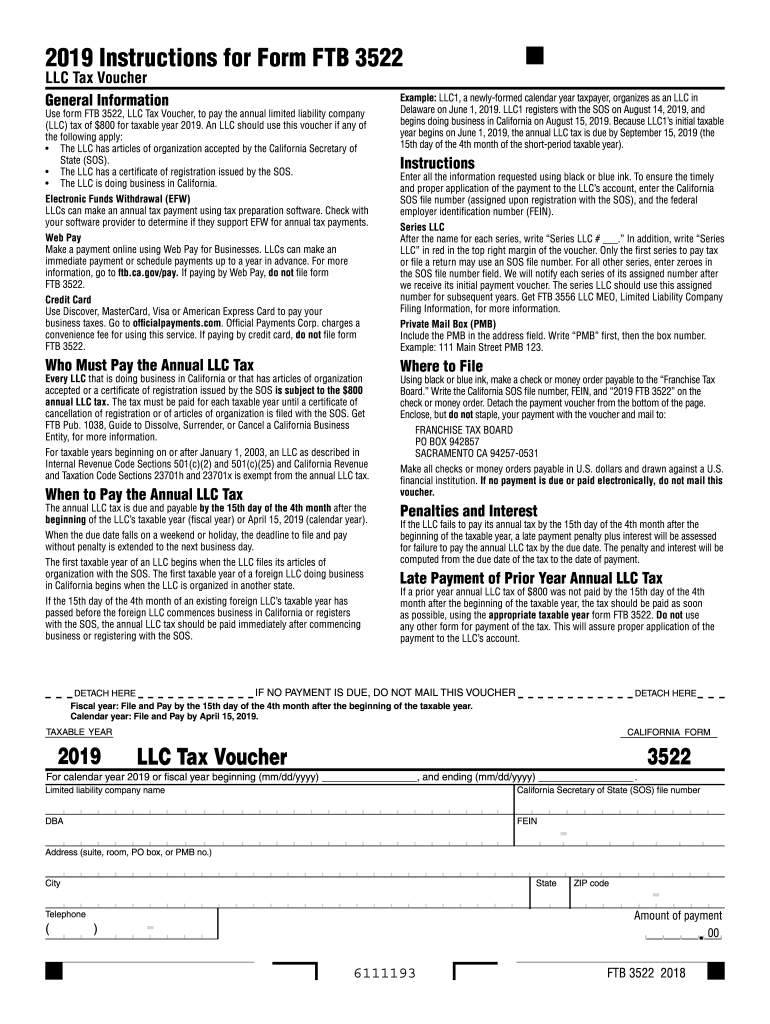

2019 Form CA FTB 3522 Fill Online, Printable, Fillable, Blank pdfFiller

Enjoy smart fillable fields and interactivity. Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. Web find the ca ftb 3522 you require. Include the date and place your electronic signature. When a new llc is formed in california, it has four months from the.

Enjoy Smart Fillable Fields And Interactivity.

An llc should use this voucher if any of the following apply: All llcs in the state are required to pay this annual tax to stay compliant and in good standing. Use estimated fee for llcs (ftb 3536) file limited liability company return of income (form 568) by the original return due date. Customize the blanks with smart fillable fields.

All Llcs In The State Are Required To Pay This Annual Tax To Stay Compliant And In Good Standing.

Web form 3522 is a form used by llcs in california to pay a business's annual tax of $800. Web does my california llc need to file form 3522 (limited liability company tax voucher) in the 1st year? Web use form ftb 3522, llc tax voucher, to pay the annual limited liability company (llc) tax of $800 for taxable year 2022. The date of acquisition, adjusted basis, holding period, and sale price must be reported on this form.

Web Find The Ca Ftb 3522 You Require.

Open it with online editor and start adjusting. Get your online template and fill it in using progressive features. Web form ftb 3522 is a form that is used to report the sale or other disposition of california real property. When a new llc is formed in california, it has four months from the date of its formation to pay this fee.

Follow The Simple Instructions Below:

Fill out the empty fields; Web use limited liability company tax voucher (ftb 3522) estimate and pay the llc fee by the 15th day of the 6th month after the beginning of the current tax year. Include the date and place your electronic signature. All llcs in the state are required to pay this annual tax to stay compliant and in good standing.