G 45 Form

G 45 Form - They must be filed throughout the year at. You can also download it, export it or print it out. The frequency you file depends on the amount. Regardless of your work's format and earnings. If you pay less than $2,000 in ge taxes during the year you file form g. 2019) state of hawaii — department of taxation do not write in this area 10 general excise/use tax return place an x in this box. Edit your form g 45 fillable online. Use this form to request a text message and/or email when uscis accepts your form. How do i file the tax returns? An agency that is registered with the u.s.

They must be filed throughout the year at. Use get form or simply click on the template preview to open it in the editor. An agency that is registered with the u.s. If you pay less than $2,000 in ge taxes during the year you file form g. 2018) state of hawaii — department of taxation do not write in this area 10 general excise/usetax return = fill in this oval. Web quick steps to complete and design g 45 form hawaii online: How do i file the tax returns? What is the purpose of this form? 2019) state of hawaii — department of taxation do not write in this area 10 general excise/use tax return place an x in this box. Edit your form g 45 fillable online.

An agency that is registered with the u.s. 2021) state of hawaii — department of taxation general excise/use tax schedule of exemptions and deductions if you are claiming. Web 138 subscribers 3.2k views 2 years ago in this walkthrough video, i show you how to file a g45 general excise tax return online with revenue and 1 deduction for. You can also download it, export it or print it out. 2018) state of hawaii — department of taxation do not write in this area 10 general excise/usetax return = fill in this oval. Web send g45 fillable form via email, link, or fax. Citizenship and immigration services’ (uscis). Use get form or simply click on the template preview to open it in the editor. If you pay less than $2,000 in ge taxes during the year you file form g. Start completing the fillable fields and.

Hawaii Form G 45 Fill Online, Printable, Fillable, Blank pdfFiller

They must be filed throughout the year at. Citizenship and immigration services’ (uscis). An agency that is registered with the u.s. Web quick steps to complete and design g 45 form hawaii online: Citizenship and immigration services accepts your.

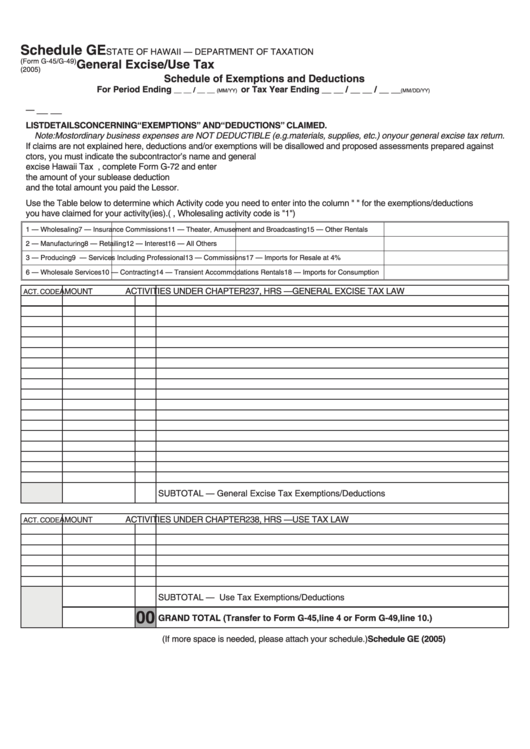

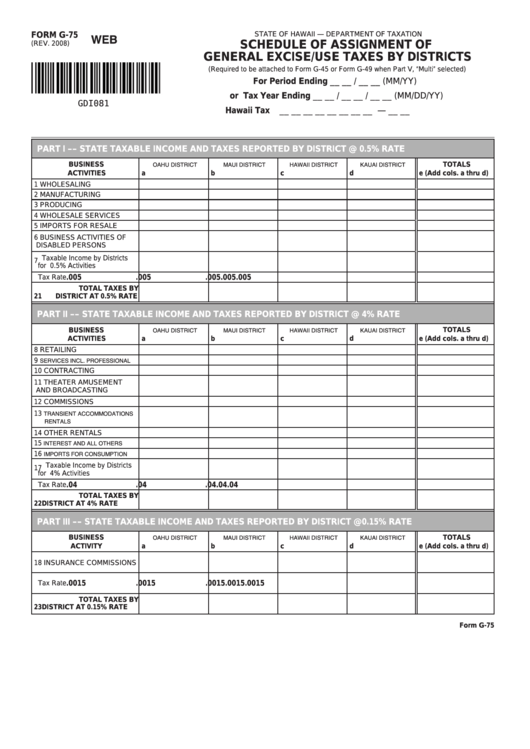

Form G45/g49 Schedule Ge General Excise/use Tax printable pdf

You can also download it, export it or print it out. They must be filed throughout the year at. Type text, add images, blackout confidential. Edit your form g 45 fillable online. 2019) state of hawaii — department of taxation do not write in this area 10 general excise/use tax return place an x in this box.

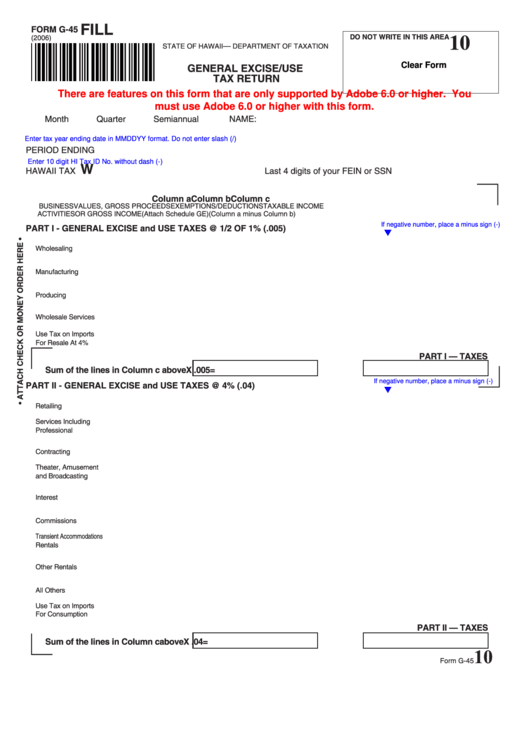

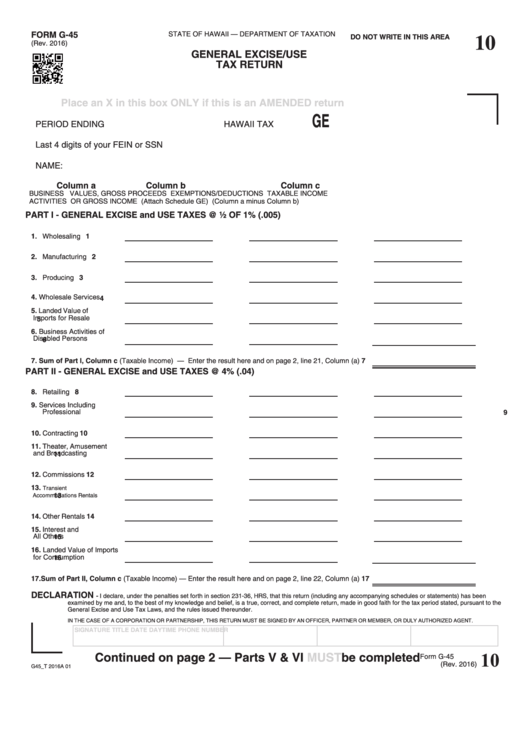

Fillable Form G45 Fill General Excise And Use Tax Return printable

Web quick steps to complete and design g 45 form hawaii online: 2021) state of hawaii — department of taxation general excise/use tax schedule of exemptions and deductions if you are claiming. Citizenship and immigration services’ (uscis). Edit your form g 45 fillable online. Type text, add images, blackout confidential.

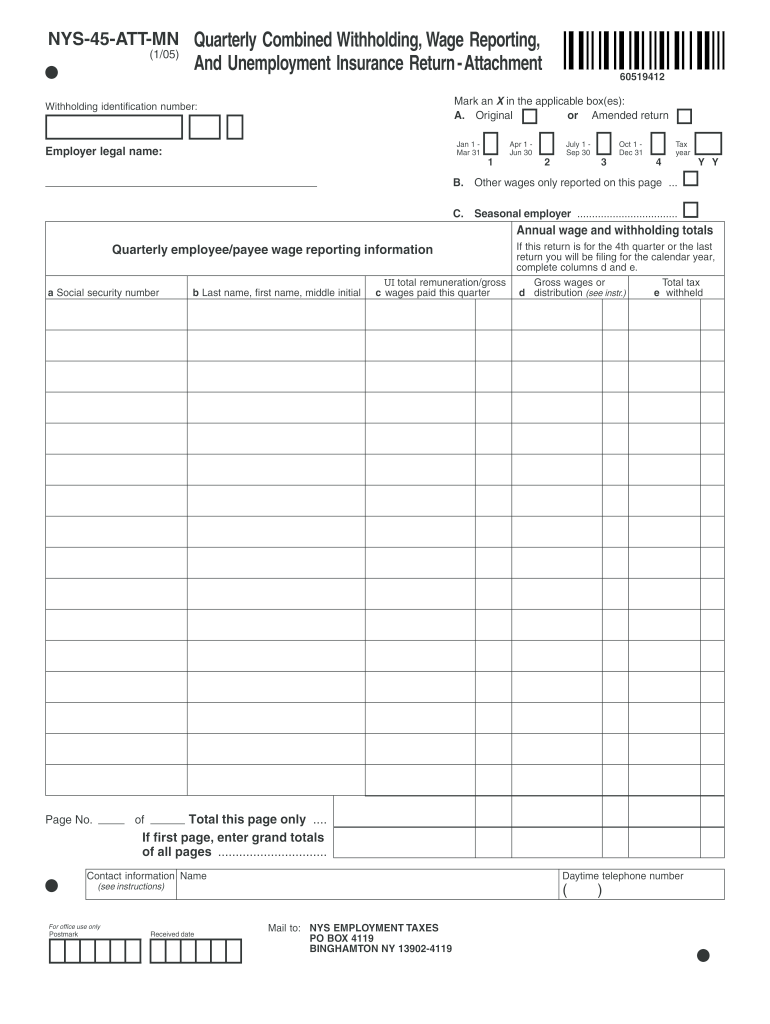

Nys 45 Att Form 2020 Fill Online, Printable, Fillable, Blank pdfFiller

2018) state of hawaii — department of taxation do not write in this area 10 general excise/usetax return = fill in this oval. Edit your form g 45 fillable online. 2021) state of hawaii — department of taxation general excise/use tax schedule of exemptions and deductions if you are claiming. They must be filed throughout the year at. 2019) state.

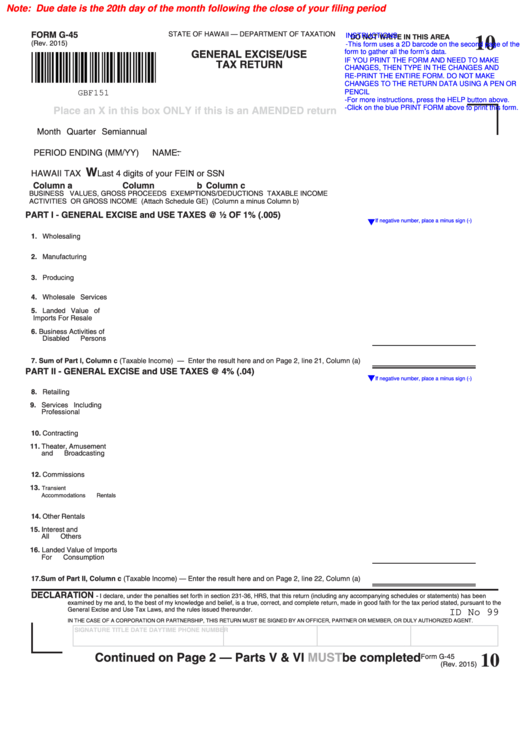

Fillable Form G45 General Excise/use Tax Return 2015, Form G75

The frequency you file depends on the amount. If you pay less than $2,000 in ge taxes during the year you file form g. What is the purpose of this form? An agency that is registered with the u.s. Citizenship and immigration services’ (uscis).

Fill FORM G45 GE GENERAL EXCISEUSE TAX RETURN Place (Hawaii)

Citizenship and immigration services accepts your. Type text, add images, blackout confidential. 2019) state of hawaii — department of taxation do not write in this area 10 general excise/use tax return place an x in this box. Citizenship and immigration services’ (uscis). 2018) state of hawaii — department of taxation do not write in this area 10 general excise/usetax return.

Fillable Form G75 Schedule Of Assignment Of General Excise/use Taxes

An agency that is registered with the u.s. Citizenship and immigration services accepts your. Use this form to request a text message and/or email when uscis accepts your form. Citizenship and immigration services’ (uscis). If you pay less than $2,000 in ge taxes during the year you file form g.

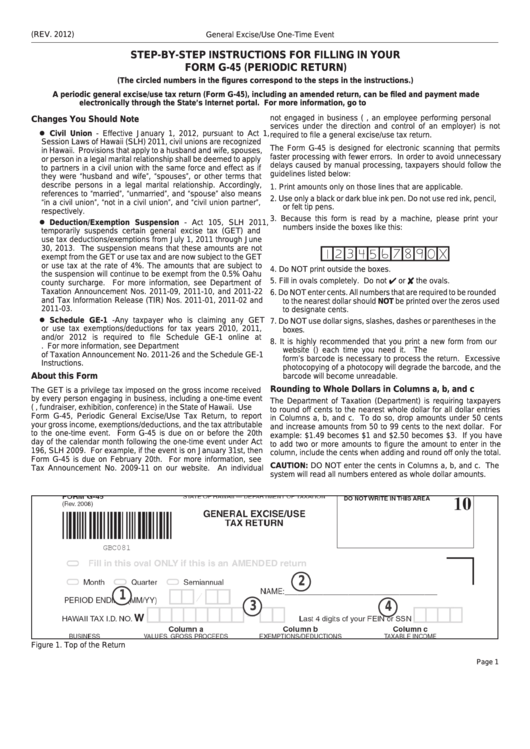

StepByStep Instructions For Filling In Your Form G45 (Periodic

Web send g45 fillable form via email, link, or fax. An agency that is registered with the u.s. What is the purpose of this form? Citizenship and immigration services accepts your. Type text, add images, blackout confidential.

Form 45b Fill Online, Printable, Fillable, Blank pdfFiller

An agency that is registered with the u.s. Regardless of your work's format and earnings. Citizenship and immigration services’ (uscis). If you pay less than $2,000 in ge taxes during the year you file form g. They must be filed throughout the year at.

Form G45 Periodic General Excise/use Tax Return printable pdf download

How do i file the tax returns? Use this form to request a text message and/or email when uscis accepts your form. You can also download it, export it or print it out. The frequency you file depends on the amount. Regardless of your work's format and earnings.

2019) State Of Hawaii — Department Of Taxation Do Not Write In This Area 10 General Excise/Use Tax Return Place An X In This Box.

They must be filed throughout the year at. The frequency you file depends on the amount. Edit your form g 45 fillable online. Use this form to request a text message and/or email when uscis accepts your form.

Type Text, Add Images, Blackout Confidential.

Web send g45 fillable form via email, link, or fax. An agency that is registered with the u.s. You can also download it, export it or print it out. 2021) state of hawaii — department of taxation general excise/use tax schedule of exemptions and deductions if you are claiming.

2018) State Of Hawaii — Department Of Taxation Do Not Write In This Area 10 General Excise/Usetax Return = Fill In This Oval.

Citizenship and immigration services accepts your. Regardless of your work's format and earnings. Start completing the fillable fields and. How do i file the tax returns?

Web 138 Subscribers 3.2K Views 2 Years Ago In This Walkthrough Video, I Show You How To File A G45 General Excise Tax Return Online With Revenue And 1 Deduction For.

Use get form or simply click on the template preview to open it in the editor. If you pay less than $2,000 in ge taxes during the year you file form g. What is the purpose of this form? Citizenship and immigration services’ (uscis).