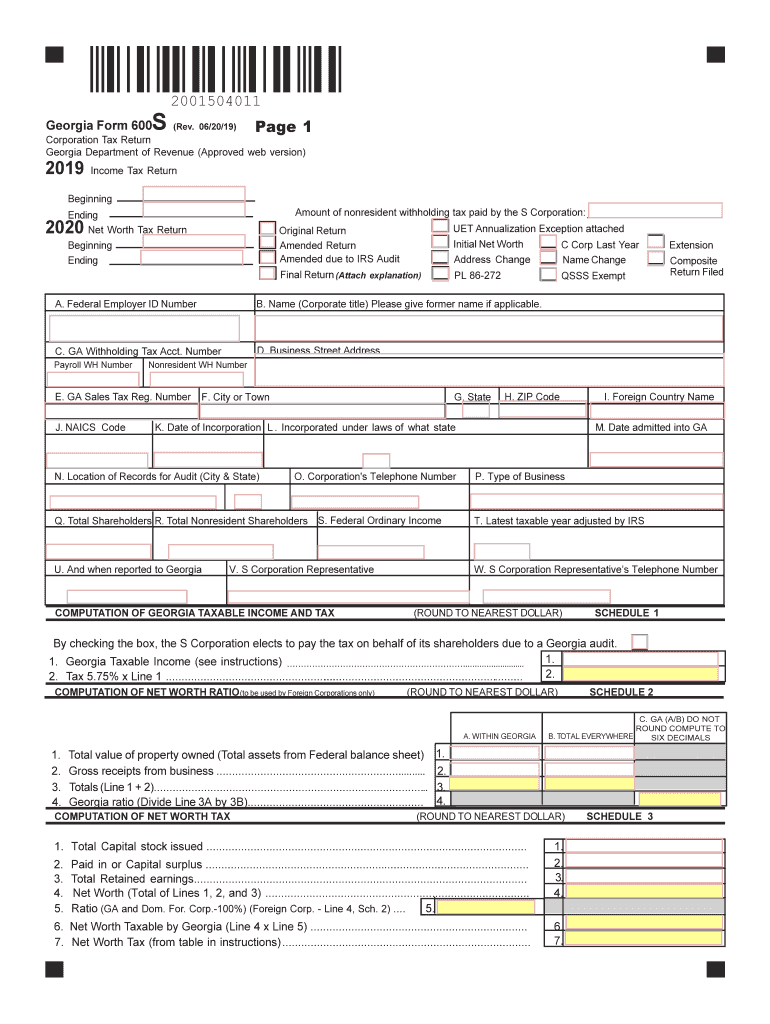

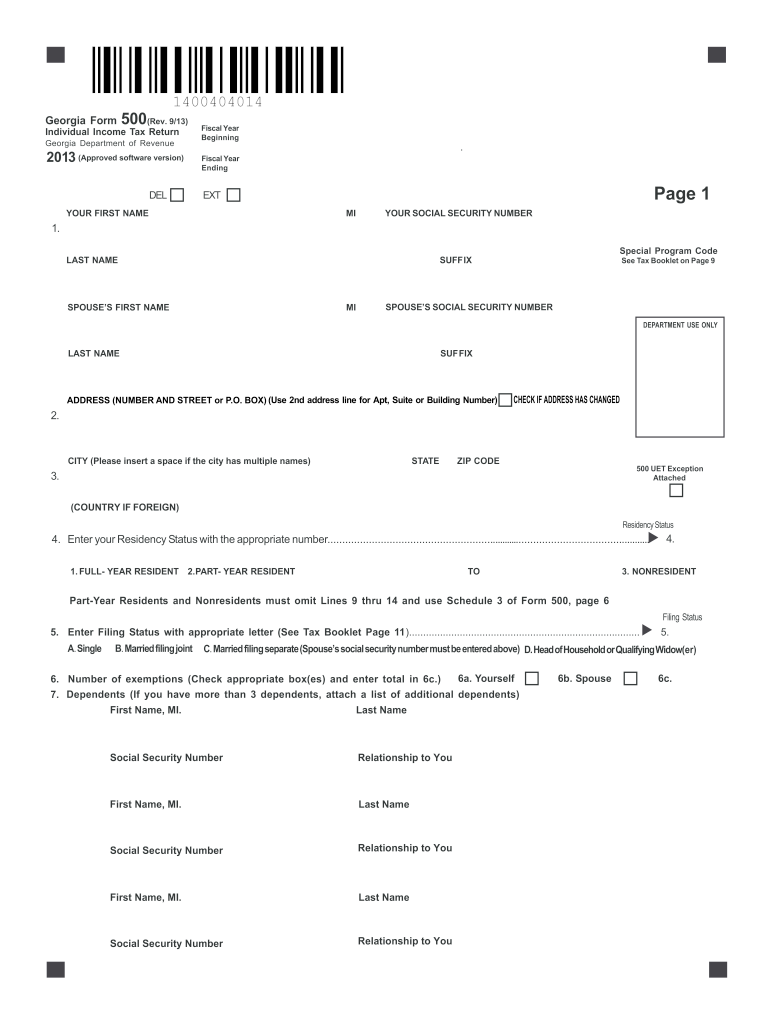

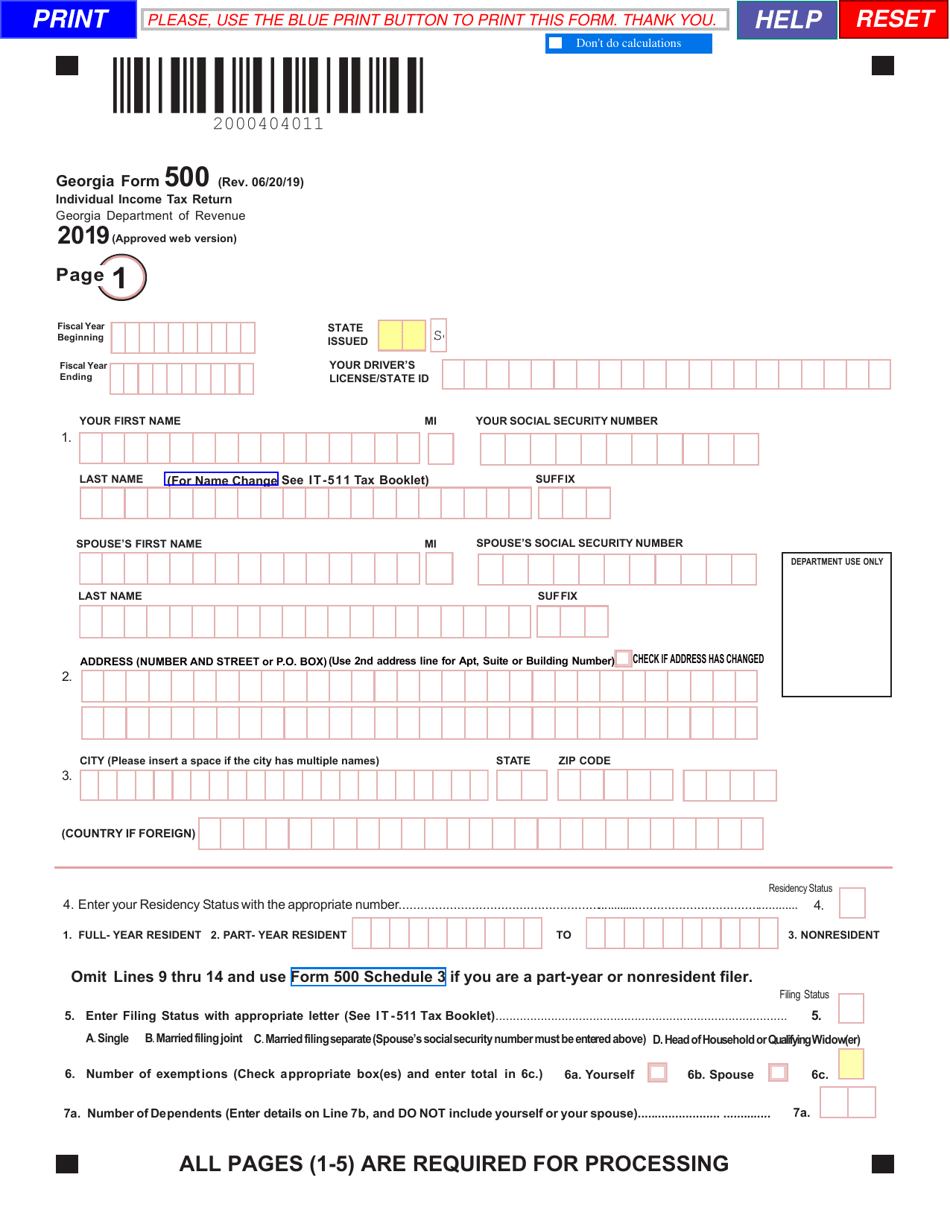

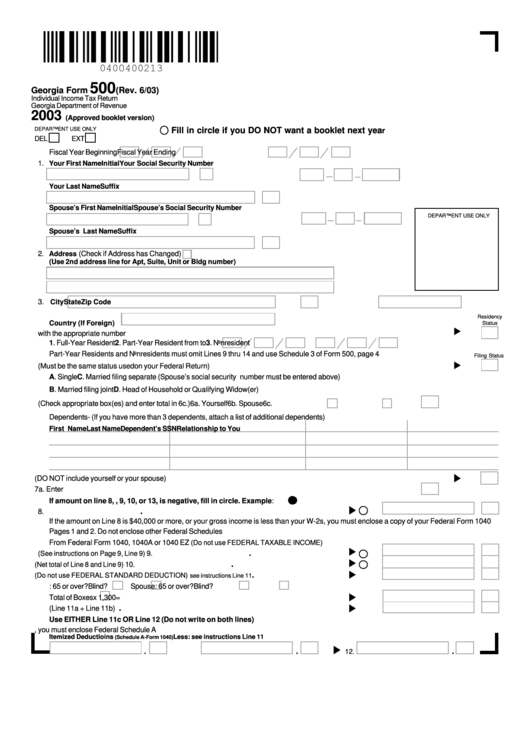

Georgia Form 500 Instructions

Georgia Form 500 Instructions - Web georgia form 500x (rev. Complete your federal return before starting your georgia return. Ad download or email ga form 500 & more fillable forms, register and subscribe now! Web we last updated georgia form 500 in january 2023 from the georgia department of revenue. We last updated the individual income tax return in january 2023, so this is the latest. Copy of georgia form 500 for the loss year. Web georgia department of revenue save form. Web up to $40 cash back free printable 500 tax forms and instructions book in pdf format for georgia state income tax returns. Ad download or email ga 500 & more fillable forms, register and subscribe now! Fill & download for free get form download the form how to edit the ga 500 instructions quickly and easily online start on editing, signing and sharing.

Enter the number from line. Web form 500 instructions include all completed schedules with your georgia return. Web form 500 requires you to list multiple forms of income, such as wages, interest, or alimony. Web georgia form 500x (rev. Enter the number from line. Your social security number gross income is less than your you must include. Fill & download for free get form download the form how to edit the ga 500 instructions quickly and easily online start on editing, signing and sharing. Complete your federal return before starting your georgia return. Try it for free now! Web up to $40 cash back free printable 500 tax forms and instructions book in pdf format for georgia state income tax returns.

Try it for free now! Exemptions are self, spouse and natural or legally adopted children. Enter the amount from form 500, line 8 or form 500ez, line 1. Enter the number from line. We last updated the individual income tax return in january 2023, so this is the latest. This form is for income earned in tax year 2022, with tax returns due in april. Print prepare and mail form 500 or 500ez to the georgia. Complete your federal return before starting your georgia return. All forms must be printed and mailed to address listed on the form. 06/20/19) amended individual income tax return georgia department of revenue use this form for the 2019 tax year only.

20182021 Form GA 500EZ Fill Online, Printable, Fillable, Blank pdfFiller

Print prepare and mail form 500 or 500ez to the georgia. Enter the number from line. Print blank form > georgia department of revenue. Ad download or email ga 500 & more fillable forms, register and subscribe now! Web form 500 instructions include all completed schedules with your georgia return.

Form 500 Instructions 2019 lwtaylorartanddesign

Fill & download for free get form download the form how to edit the ga 500 instructions quickly and easily online start on editing, signing and sharing. Print prepare and mail form 500 or 500ez to the georgia. Enter the number from line. 06/20/19) amended individual income tax return georgia department of revenue use this form for the 2019 tax.

ga form 500 Fill out & sign online DocHub

Complete your federal return before starting your georgia return. Georgia individual income tax is based. Copy of georgia form 500 for the loss year. Be sure to attach all required forms listed above and. Ad download or email ga form 500 & more fillable forms, register and subscribe now!

Form 500 Instructions 2019 lwtaylorartanddesign

Enter the number from line. Web forms in tax booklet: Ndividual income tax retu rn. Web georgia department of revenue save form. Ad download or email ga 500 & more fillable forms, register and subscribe now!

form 500 Fill out & sign online DocHub

Ndividual income tax retu rn. Copy of georgia form 500 for the loss year. Fill & download for free get form download the form how to edit the ga 500 instructions quickly and easily online start on editing, signing and sharing. Ad download or email ga 500 & more fillable forms, register and subscribe now! Be sure to attach all.

Form 500 Instructions 2019 lwtaylorartanddesign

Print prepare and mail form 500 or 500ez to the georgia. Web we last updated georgia form 500 in january 2023 from the georgia department of revenue. Complete your federal return before starting your georgia return. Complete, edit or print tax forms instantly. Upload, modify or create forms.

Form 500 Download Fillable PDF or Fill Online Individual Tax

Copy of georgia form 500 for the loss year. Enter the number from line. Complete your federal return before starting your georgia return. Web georgia form 500x (rev. Ndividual income tax retu rn.

State Tax Form 500ez bestkup

Exemptions are self, spouse and natural or legally adopted children. 06/20/19) amended individual income tax return georgia department of revenue use this form for the 2019 tax year only. Copy of georgia form 500 for the loss year. Ndividual income tax retu rn. Ad download or email ga 500 & more fillable forms, register and subscribe now!

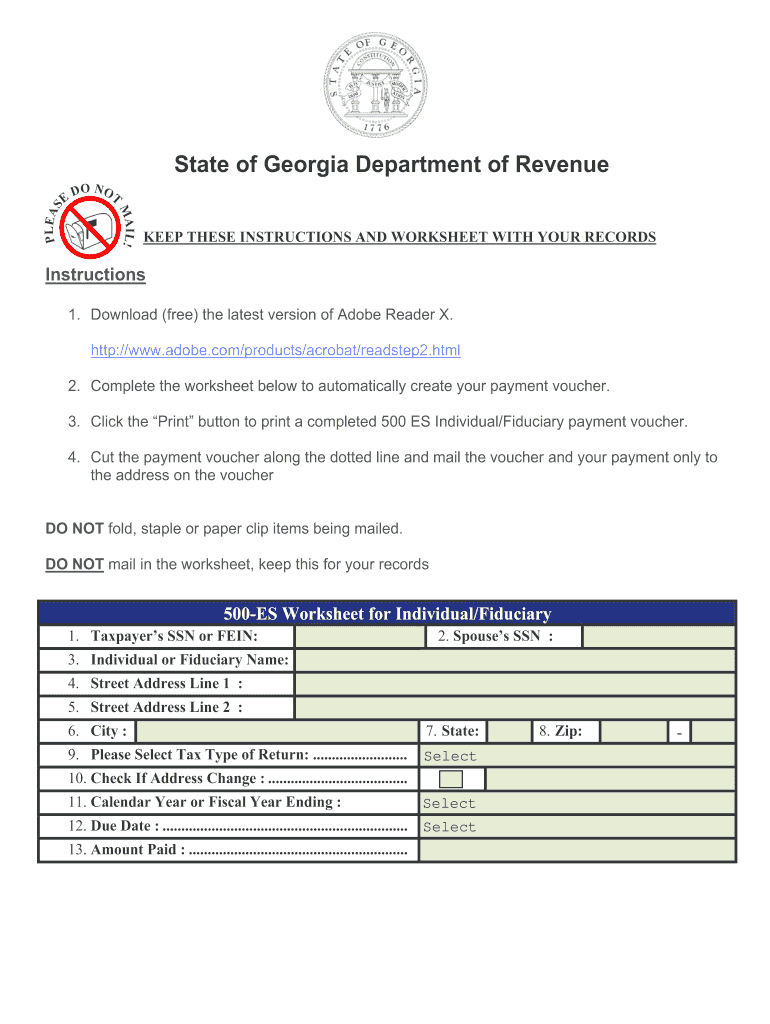

500 Es Form 2019 Fill and Sign Printable Template Online US

Ad download or email ga 500 & more fillable forms, register and subscribe now! 06/20/19) amended individual income tax return georgia department of revenue use this form for the 2019 tax year only. Copy of georgia form 500 for the loss year. Print prepare and mail form 500 or 500ez to the georgia. Be sure to attach all required forms.

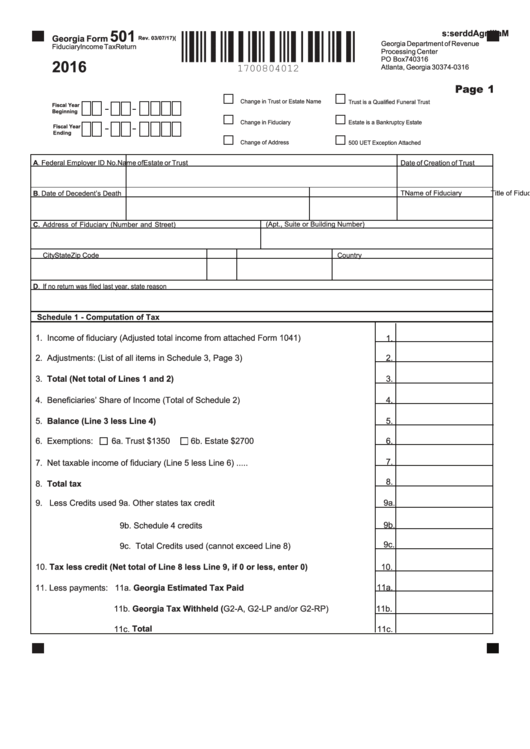

Fillable Form 501 Fiduciary Tax Return 2016

Copy of georgia form 500 for the loss year. Upload, modify or create forms. Fill & download for free get form download the form how to edit the ga 500 instructions quickly and easily online start on editing, signing and sharing. All forms must be printed and mailed to address listed on the form. Enter the number from line.

Try It For Free Now!

Web form 500 instructions include all completed schedules with your georgia return. Complete your federal return before starting your georgia return. Exemptions are self, spouse and natural or legally adopted children. Fill & download for free get form download the form how to edit the ga 500 instructions quickly and easily online start on editing, signing and sharing.

Web Up To $40 Cash Back Free Printable 500 Tax Forms And Instructions Book In Pdf Format For Georgia State Income Tax Returns.

06/20/19) amended individual income tax return georgia department of revenue use this form for the 2019 tax year only. Print blank form > georgia department of revenue. This form is for income earned in tax year 2022, with tax returns due in april. Enter the number from line.

Complete, Edit Or Print Tax Forms Instantly.

Copy of georgia form 500 for the loss year. All forms must be printed and mailed to address listed on the form. Be sure to attach all required forms listed above and. Enter the amount from form 500, line 8 or form 500ez, line 1.

Web Form 500 Requires You To List Multiple Forms Of Income, Such As Wages, Interest, Or Alimony.

Georgia individual income tax is based. Your social security number gross income is less than your you must include. Ndividual income tax retu rn. Web georgia form 500x (rev.