Heavy Use Tax Form 2290 Instructions

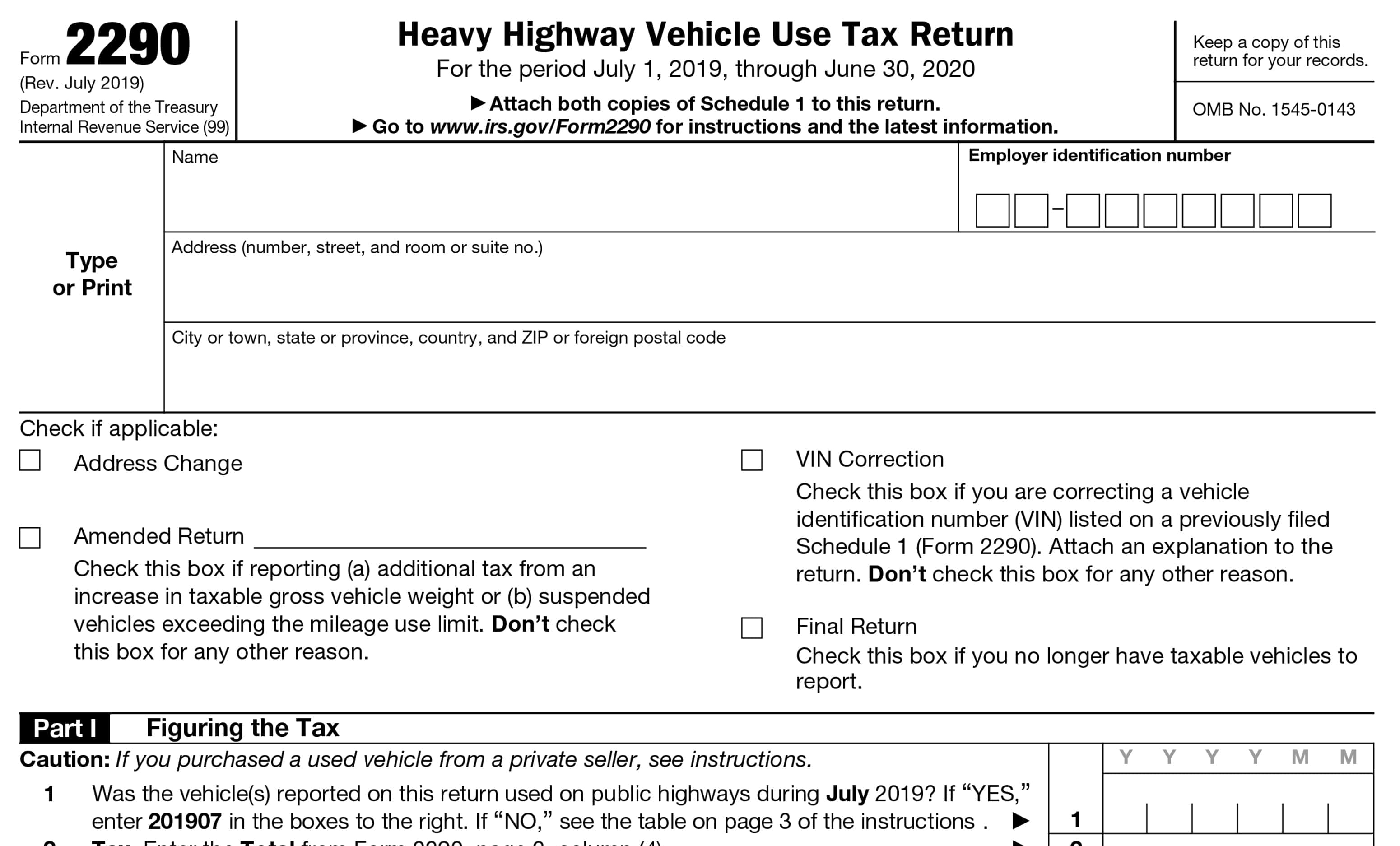

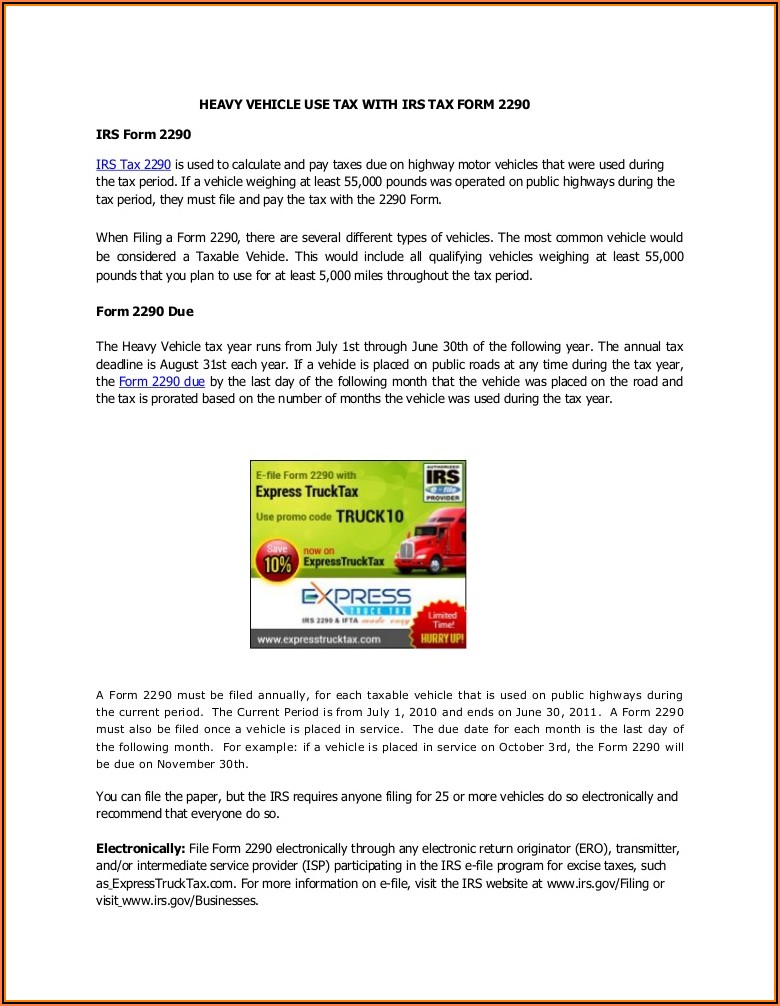

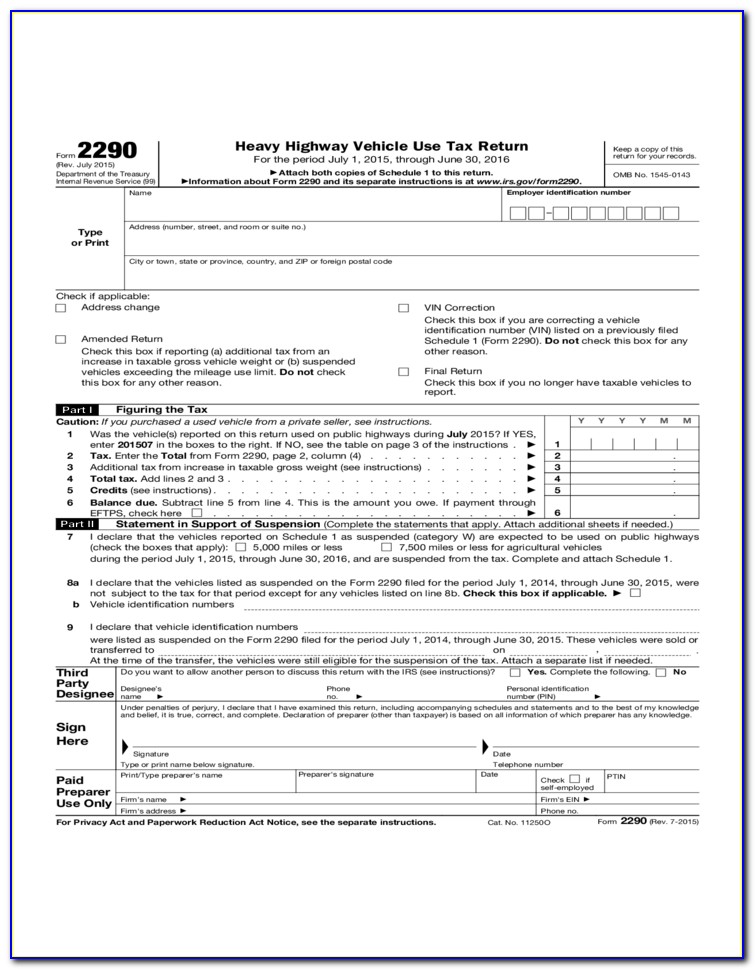

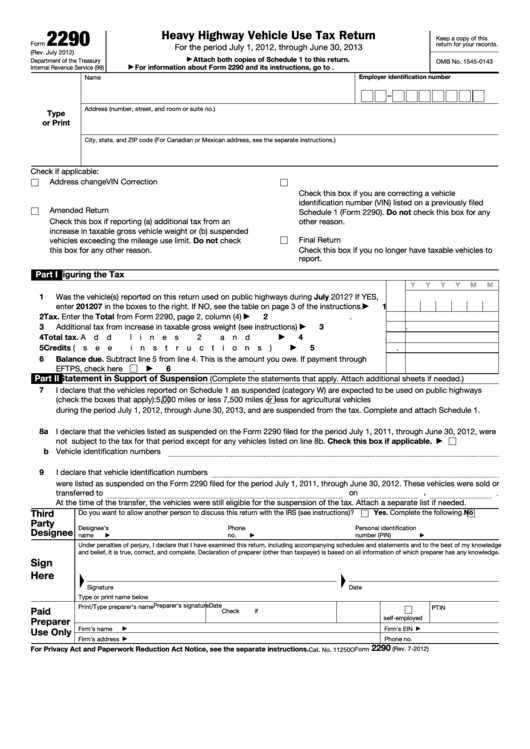

Heavy Use Tax Form 2290 Instructions - This revision if you need to file a return for a tax period that began on or before june 30, 2023. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period and the. Taxable gross weight of each. Gather your information employer identification number. Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. When is the form 2290 due date? The form is used to report the taxable use of heavy vehicles duri. Irs form 2290 instructions can be found on the irs website. The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date.

Vehicle identification number of each vehicle. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file form 2290, heavy highway vehicle use tax return. You cannot use your social security number don't have an ein? When is the form 2290 due date? And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or more. This revision if you need to file a return for a tax period that began on or before june 30, 2023. 2022 the 2290 form is used to report the annual heavy vehicle use tax. Irs form 2290 instructions can be found on the irs website. The form is used to report the taxable use of heavy vehicles duri. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more.

Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Gather your information employer identification number. You cannot use your social security number don't have an ein? Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period and the. Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. And it does apply to highway vehicles used on public roads. To obtain a prior revision of form 2290 and its separate instructions, visit. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut with the irs every tax year. This revision if you need to file a return for a tax period that began on or before june 30, 2023.

IRS Form 2290 Instructions How to Fill HVUT 2290 Form

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. It does not apply to vehicles used strictly for off road purposes. Vehicle identification number of each vehicle. When is the.

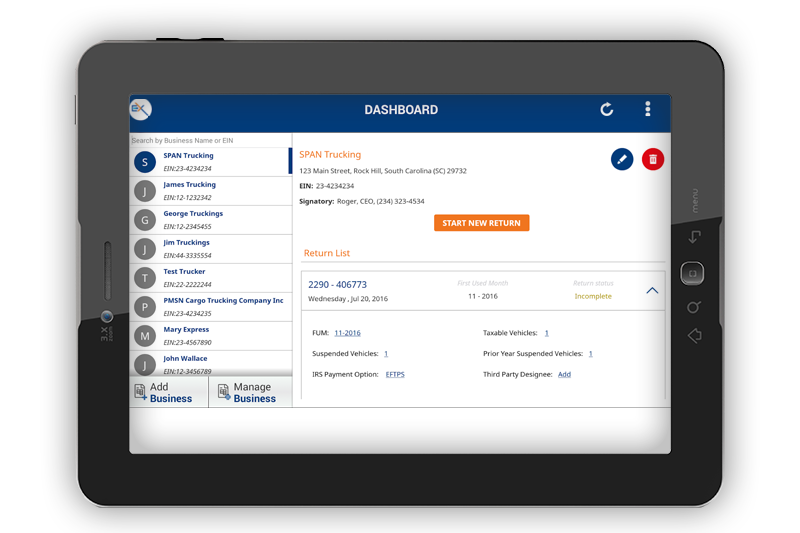

Efile HVUT (Heavy Vehicle Use Tax) Form 2290 for 20222023

Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut with the irs every tax year. And it does apply to highway vehicles used on public roads. Vehicle identification number.

Heavy Vehicle Use Tax Form 2290 Schedule 1 Form Resume Examples

The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date. 2022 the online 2290 form is used for the filing of heavy vehicle use tax (hvut) returns. You cannot use your social security number don't have an ein? Form 2290 is used to.

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross.

Heavy Highway Use Tax Form 2290 Due Date Form Resume Examples

Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file form 2290, heavy highway vehicle use tax return. Web information about form 2290, heavy highway vehicle.

2290 Heavy Highway Tax Form 2017 Universal Network

When is the form 2290 due date? Web 12/6/2022 new updates printable version: Taxable gross weight of each. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Heavy Vehicle Use Tax Form 2290 Schedule 1 Form Resume Examples

Irs form 2290 instructions can be found on the irs website. The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross.

When to Fill Out a Heavy Use Tax Form 2290 by taxform2290 s Issuu

2022 the 2290 form is used to report the annual heavy vehicle use tax. Web 12/6/2022 new updates printable version: Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut.

2290 heavy use tax 3451892290 heavy use tax 2020

Web 12/6/2022 new updates printable version: Vehicle identification number of each vehicle. And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or more. Irs form 2290 instructions can be found on the irs website. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Heavy Vehicle Use Tax and Form 2290 DrivePFS

Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file form 2290, heavy highway vehicle use tax return. Form 2290 is used to figure and pay.

Web Anyone Who Has Registered Or Is Required To Register A Heavy Highway Motor Vehicle With A Taxable Gross Weight Of 55,000 Pounds Or More In Their Name At The Time Of First Use On The Public Highways During The Reporting Period Must File Form 2290, Heavy Highway Vehicle Use Tax Return.

And it does apply to highway vehicles used on public roads. Vehicle identification number of each vehicle. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut with the irs every tax year. When is the form 2290 due date?

Web 12/6/2022 New Updates Printable Version:

Taxable gross weight of each. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

Web This July 2023 Revision Is For The Tax Period Beginning On July 1, 2023, And Ending On June 30, 2024.

Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date. Gather your information employer identification number. You cannot use your social security number don't have an ein?

This Revision If You Need To File A Return For A Tax Period That Began On Or Before June 30, 2023.

2022 the 2290 form is used to report the annual heavy vehicle use tax. 2022 the online 2290 form is used for the filing of heavy vehicle use tax (hvut) returns. Irs form 2290 instructions can be found on the irs website. To obtain a prior revision of form 2290 and its separate instructions, visit.