Heloc After Chapter 13 Discharge

Heloc After Chapter 13 Discharge - There are two basic types of bankruptcy available to consumers — chapter 7 and chapter 13. During this time, you continue paying on your first. Web most lenders want to see the bankruptcy seasoned for at least two years from the date of discharge or four years from the dismissal date. Find out how much you could save now! Check out top home equity loan options within minutes. Web if your first position mortgage balance exceeds the value of your home and the heloc or second mortgage is not supported by any equity in the home, you can file a chapter 13 and reclassify the second. How a home equity line of credit (heloc) is treated in bankruptcy depends on what type of bankruptcy. In such situations, the debtor may ask the court to grant a hardship discharge. 11 u.s.c. Explore all your options now! Web bad credit series:

This post will focus on chapter 7 bankruptcy as this option can, in many cases, allow individuals to obtain. Borrow from yourself through a home equity line of credit. Find out how much you could save now! Home equity loan after bankruptcy — home.loans home loans blog get the latest info on mortgages, home equity, and refinancing at the home loans blog. Which debts get paid, and how. A heloc is a secured debt unless the property that secured the loan is sold. Unlike chapter 7, chapter 13 bankruptcy allows for almost all personal property to be kept, with debts being repaid over a three to five year period. With chapter 13 bankruptcy, you create a payment plan that lasts three to five years. If you filed for chapter 13 bankruptcy or were recently discharged, you might wonder whether you qualify for a. You can qualify for a refinance as little as a day after the discharge or dismissal date of your.

How a home equity line of credit (heloc) is treated in bankruptcy depends on what type of bankruptcy. If you filed for chapter 13 bankruptcy or were recently discharged, you might wonder whether you qualify for a. Web bad credit series: Check out top home equity loan options within minutes. Web the chapter 13 hardship discharge after confirmation of a plan, circumstances may arise that prevent the debtor from completing the plan. In such situations, the debtor may ask the court to grant a hardship discharge. 11 u.s.c. Unlike chapter 7, chapter 13 bankruptcy allows for almost all personal property to be kept, with debts being repaid over a three to five year period. In some cases, you may even be eligible for a home loan one day after discharge… However, if you have nonexempt equity, you'll have to pay an equivalent amount toward your general. Borrow from yourself through a home equity line of credit.

The Chapter 13 Discharge Chapter 13 Bankruptcy Attorney

Web you can actually use chapter 13 bankruptcy to get rid of a heloc. Explore all your options now! Find out how much you could save now! In some cases, you may even be eligible for a home loan one day after discharge… Compare and save with lendingtree.

What Happens After a Chapter 13 Discharge? Husker Law

Web heloc/2nd mortgages require a much longer seasoning period from a bk discharge (as well as more strict requirements in practically all categories) than a 1st mortgage due to them being in. Home equity loan after bankruptcy — home.loans home loans blog get the latest info on mortgages, home equity, and refinancing at the home loans blog. Web things may.

Home Equity Loan or 401k Loan? Both Have Risks Level Financial Advisors

Don't overpay on your loan. If you filed for chapter 13 bankruptcy or were recently discharged, you might wonder whether you qualify for a. Web most lenders want to see the bankruptcy seasoned for at least two years from the date of discharge or four years from the dismissal date. Unlike chapter 7, chapter 13 bankruptcy allows for almost all.

The Chapter 13 Discharge Chapter 13 Bankruptcy Attorney

Web things may be slightly different in chapter 13 bankruptcy, but being allowed to get a home equity loan in the process is still highly unlikely. Borrow from yourself through a home equity line of credit. During this time, you continue paying on your first. With chapter 13 bankruptcy, you create a payment plan that lasts three to five years..

HELOC Chapter 2 on Vimeo

This post will focus on chapter 7 bankruptcy as this option can, in many cases, allow individuals to obtain. Web things may be slightly different in chapter 13 bankruptcy, but being allowed to get a home equity loan in the process is still highly unlikely. Web if the heloc loan was not shown on the plan as a long term.

Can I Buy a House in Chapter 13

In such situations, the debtor may ask the court to grant a hardship discharge. 11 u.s.c. Web heloc under chapter 13 bankruptcy. During this time, you continue paying on your first. Web during chapter 13 bankruptcy, you are working with creditors and the bankruptcy court to create a repayment plan, rather than having your debts discharged. There are two basic.

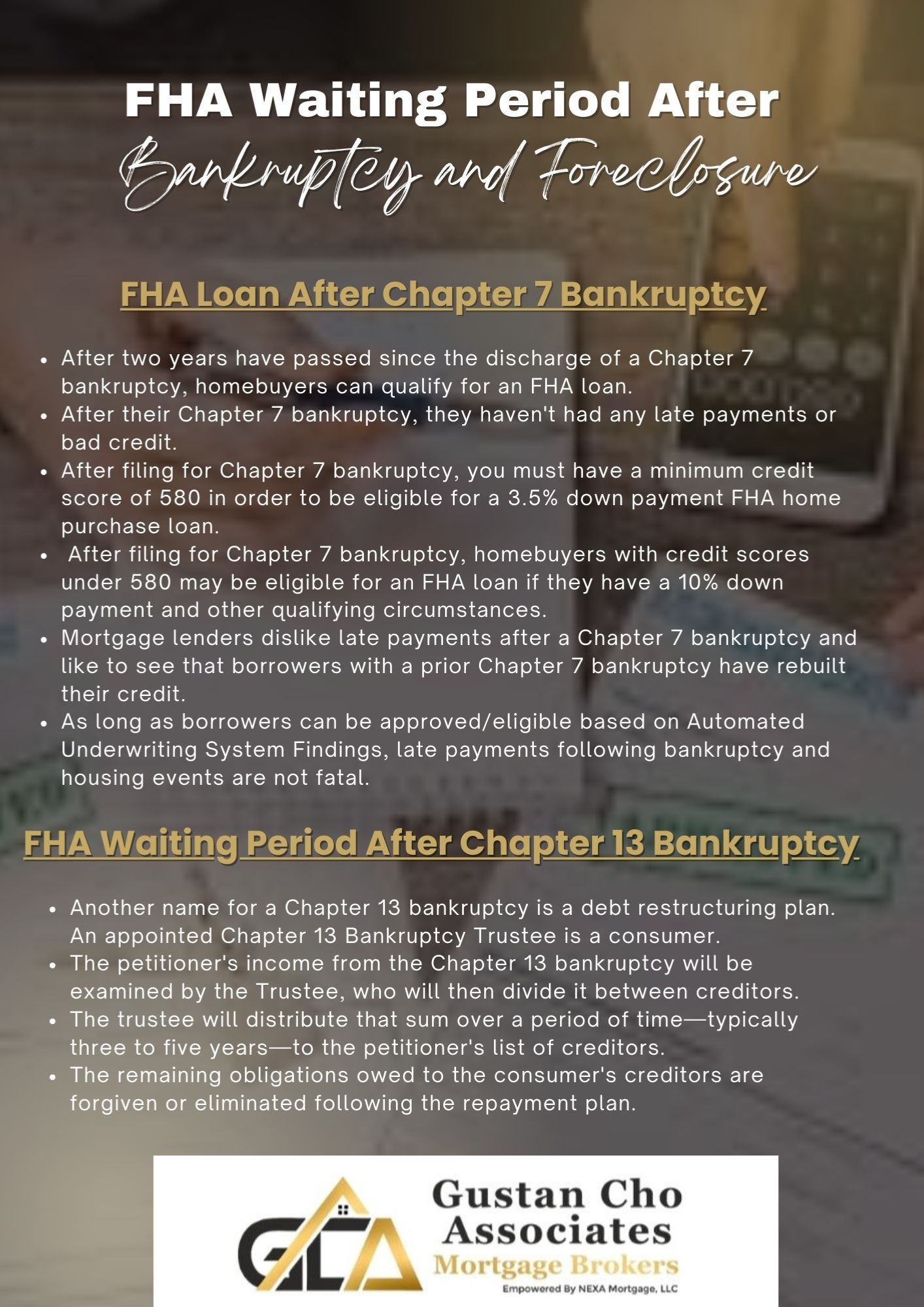

43+ Fha Waiting Period After Chapter 13 Discharge KylaTomilola

Web you can actually use chapter 13 bankruptcy to get rid of a heloc. Explore all your options now! This means that you have the means to repay your. With chapter 13 bankruptcy, you create a payment plan that lasts three to five years. Web in many cases, after 18 months of regular chapter 13 payments, debtors can typically refinance.

Chapter 13 Bankruptcy Discharge Sasser Law Firm

In some cases, you may even be eligible for a home loan one day after discharge… You can qualify for a refinance as little as a day after the discharge or dismissal date of your. Compare and save with lendingtree. Unlike chapter 7, chapter 13 bankruptcy allows for almost all personal property to be kept, with debts being repaid over.

What Is a Chapter 13 Hardship Discharge? Oaktree Law

With chapter 13 bankruptcy, you create a payment plan that lasts three to five years. You can get court approval for a repayment plan over three to five years, after which. Explore all your options now! Find out how much you could save now! Chapter 13 bankruptcy may not have the same impact on your.

Will Chapter 7 Bankruptcy Get Rid of a HELOC?

A heloc is a secured debt unless the property that secured the loan is sold. Web if the heloc loan was not shown on the plan as a long term debt and if the charge off occurred after the bankruptcy petition was filed, then the debt was discharged when your chapter 13 discharge. However, if you have nonexempt equity, you'll.

A Heloc Is A Secured Debt Unless The Property That Secured The Loan Is Sold.

In such situations, the debtor may ask the court to grant a hardship discharge. 11 u.s.c. Explore all your options now! In some cases, you may even be eligible for a home loan one day after discharge… Find out how much you could save now!

Web In Many Cases, After 18 Months Of Regular Chapter 13 Payments, Debtors Can Typically Refinance Out Of A Chapter 13, Especially If You Have Any Equity In A Home.

You can qualify for a refinance as little as a day after the discharge or dismissal date of your. This post will focus on chapter 7 bankruptcy as this option can, in many cases, allow individuals to obtain. Compare and save with lendingtree. Web in chapter 13 bankruptcy, you can keep assets like a house or a car as long as you have a reliable income.

Ad Get More From Your Home Equity Line Of Credit.

If you filed for chapter 13 bankruptcy or were recently discharged, you might wonder whether you qualify for a. Web during chapter 13 bankruptcy, you are working with creditors and the bankruptcy court to create a repayment plan, rather than having your debts discharged. Web heloc under chapter 13 bankruptcy. Explore all your options now!

Web Heloc/2Nd Mortgages Require A Much Longer Seasoning Period From A Bk Discharge (As Well As More Strict Requirements In Practically All Categories) Than A 1St Mortgage Due To Them Being In.

Unlike chapter 7, chapter 13 bankruptcy allows for almost all personal property to be kept, with debts being repaid over a three to five year period. Borrow from yourself through a home equity line of credit. Web if the heloc loan was not shown on the plan as a long term debt and if the charge off occurred after the bankruptcy petition was filed, then the debt was discharged when your chapter 13 discharge. With chapter 13 bankruptcy, you create a payment plan that lasts three to five years.