Home Heating Credit Form

Home Heating Credit Form - Web michiganders who need help with their energy bills can now apply for the home heating credit, according to the michigan department of treasury (treasury). Use get form or simply click on the template preview to open it in the editor. Type or print in blue or black ink. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web information about form 8908, energy efficient home credit, including recent updates, related forms, and instructions on how to file. Web if you have more than four (4) household members, complete home heating credit claim : Web the ea benefit amount is based upon household size, income and the type of fuel used for home heating. Visit the michigan department of treasury website at michigan.gov/treasury and enter “home. Web application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Online from the michigan department of.

Online from the michigan department of. Web the ea benefit amount is based upon household size, income and the type of fuel used for home heating. For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. Visit the michigan department of treasury website at michigan.gov/treasury and enter “home. Type or print in blue or black ink. Web application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Web the deadline for submitting this form is september 30, 2022. You may qualify for a home heating credit if all of the following apply: Web michiganders who need help with their energy bills can now apply for the home heating credit, according to the michigan department of treasury (treasury). Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information.

Web the deadline for submitting this form is september 30, 2022. Type or print in blue or black ink. Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. Web faqs how do i file for a home heating credit? Fill out the application below. Web our online form is the quickest way to get information to our crews. Web the ea benefit amount is based upon household size, income and the type of fuel used for home heating. Use get form or simply click on the template preview to open it in the editor. Ecip is designed to provide financial assistance to households in a. Issued under authority of public act 281 of 1967, as amended.

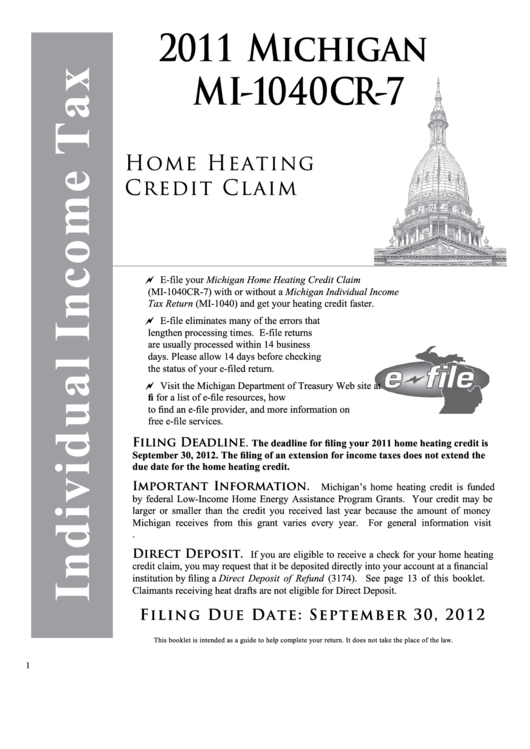

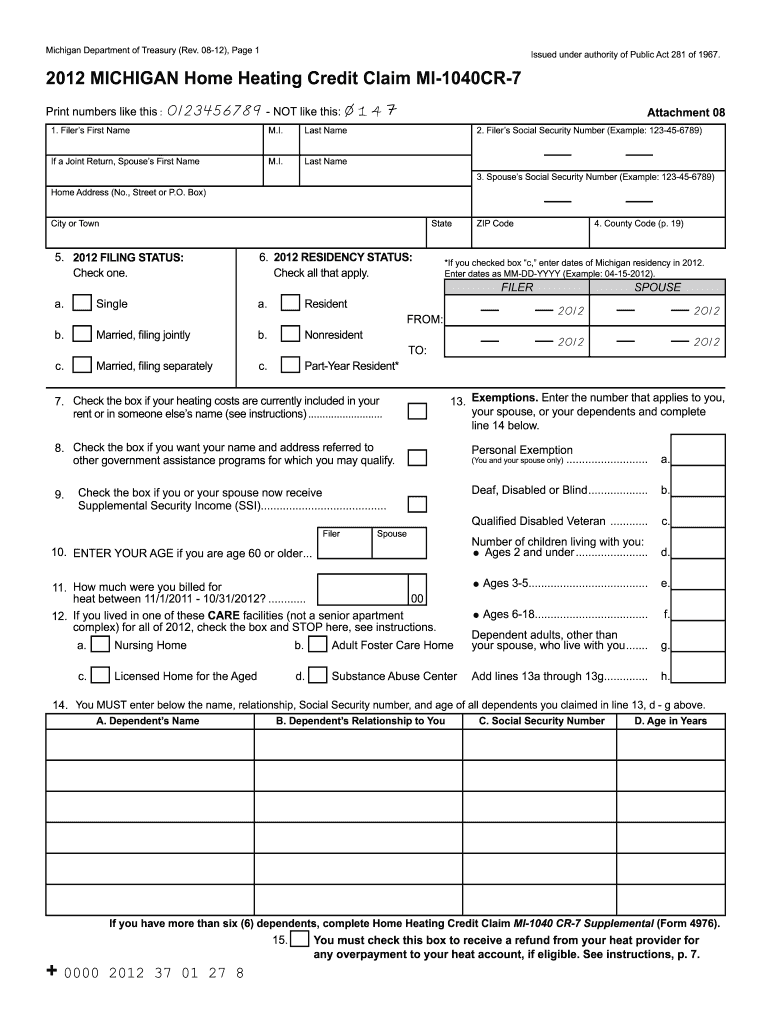

Instructions For Form Mi1040cr7 Michigan Home Heating Credit Claim

Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Use get form or simply click on the template preview to open it.

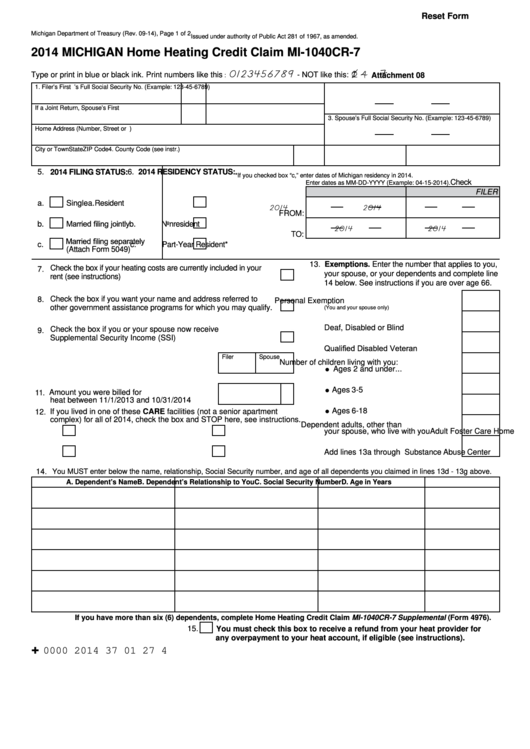

Fillable Form Mi1040cr7 Michigan Home Heating Credit Claim 2014

Web our online form is the quickest way to get information to our crews. Web the deadline for submitting this form is september 30, 2022. Issued under authority of public act 281 of 1967, as amended. Use get form or simply click on the template preview to open it in the editor. You must check this box to receive a.

Efficient Home Heating Systems Richair

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. You may qualify for a home heating credit if all of the following apply: Ecip is designed to provide financial assistance to households in a. Web faqs how do i file for a home heating credit? You must check this box to.

Michigan Home Heating Credit Calculator Fill Online, Printable

Fill out the application below. You can download or print. Form 8908 is used by. Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. Web application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for.

Home Heating Credit Form 2020 Fill and Sign Printable Template Online

Web if you have more than four (4) household members, complete home heating credit claim : Fill out the application below. 1, 2023, you may qualify for a tax credit. Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. Web download or print the 2022 michigan.

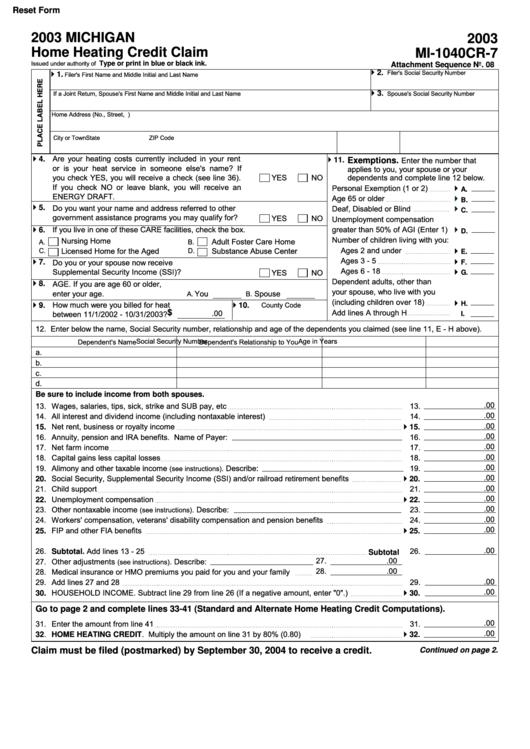

Fillable Form Mi1040cr7 Home Heating Credit Claim 2003 printable

Visit the michigan department of treasury website at michigan.gov/treasury and enter “home. Web download or print the 2022 michigan (home heating credit claim) (2022) and other income tax forms from the michigan department of treasury. Online from the michigan department of. Web if you have more than four (4) household members, complete home heating credit claim : Web our online.

1999 Form MI MI1040CR7 Fill Online, Printable, Fillable, Blank

Visit the michigan department of treasury website at michigan.gov/treasury and enter “home. Web home heating credit claim: Web information about form 8908, energy efficient home credit, including recent updates, related forms, and instructions on how to file. Form 8908 is used by. Web our online form is the quickest way to get information to our crews.

Maintain your comfort throughout 2020 by following through on these New

Web home heating credit claim: Web application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Issued under authority of public act 281 of 1967, as amended. Web the deadline for submitting this form is september 30, 2022. Visit the michigan department of treasury website at michigan.gov/treasury.

288,000 Michigan Residents to Receive Additional Home Heating Credit

Ecip is designed to provide financial assistance to households in a. For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. Use get form or simply click on the template preview to open it in the editor. Type or print in blue or black ink. Web home heating credit claim:

Fillable Online Printable 2020 Michigan Form 4976 (Home Heating Credit

You must check this box to receive a. Web information about form 8908, energy efficient home credit, including recent updates, related forms, and instructions on how to file. For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. Type or print in blue or black ink. Web the ea benefit amount is based upon household.

Web Download Or Print The 2022 Michigan (Home Heating Credit Claim) (2022) And Other Income Tax Forms From The Michigan Department Of Treasury.

Web application for financial help to heat or cool your home low income home energy assistance program (liheap) how to apply for liheap 1. Web home heating credit claim: You must check this box to receive a. Online from the michigan department of.

Web The Ea Benefit Amount Is Based Upon Household Size, Income And The Type Of Fuel Used For Home Heating.

Fill out the application below. You can download or print. Ecip is designed to provide financial assistance to households in a. Form 8908 is used by.

Web Michiganders Who Need Help With Their Energy Bills Can Now Apply For The Home Heating Credit, According To The Michigan Department Of Treasury (Treasury).

Issued under authority of public act 281 of 1967, as amended. Web the deadline for submitting this form is september 30, 2022. Home heating credit claim instruction book: You may qualify for a home heating credit if all of the following apply:

Web Information About Form 8908, Energy Efficient Home Credit, Including Recent Updates, Related Forms, And Instructions On How To File.

Visit the michigan department of treasury website at michigan.gov/treasury and enter “home. Web form 5695 2021 residential energy credits department of the treasury internal revenue service go to www.irs.gov/form5695 for instructions and the latest information. For example, if you purchased fuel that was taxed at $0.195 per gallon and fuel. 1, 2023, you may qualify for a tax credit.