How Are Qualified Charitable Distributions Reported On Form 1099-R

How Are Qualified Charitable Distributions Reported On Form 1099-R - Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. In early 2023, the ira owner. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. Scroll down to the other. They are aggregated with other taxable distributions and reported on lines. A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. To report a qcd on your form 1040 tax return,. When an amount is entered in this box, the. For inherited iras or inherited roth iras, the qcd will be reported.

When an amount is entered in this box, the. It won’t distinguish between qcds and other. Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. Indicate the return includes a qcd. To report a qcd on your form 1040 tax return,. In early 2023, the ira owner. Scroll down to the other. Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. For inherited iras or inherited roth iras, the qcd will be reported. A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season.

They are aggregated with other taxable distributions and reported on lines. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Indicate the return includes a qcd. Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. Generally, do not report payments subject to withholding of social security and medicare taxes on this form. In early 2023, the ira owner. When an amount is entered in this box, the. It won’t distinguish between qcds and other. Scroll down to the other. To report a qcd on your form 1040 tax return,.

IRS Form 1099R Box 7 Distribution Codes — Ascensus

Indicate the return includes a qcd. Scroll down to the other. Web qualified charitable distributions (qcd): For inherited iras or inherited roth iras, the qcd will be reported. To report a qcd on your form 1040 tax return,.

Make Qualified Charitable Distributions Keystone Financial Partners

Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. In early 2023, the ira owner. Generally, do not report payments subject to withholding of social security and medicare taxes on this form. To report a qcd on your form 1040 tax return,. Web if you gave part or all of your required minimum distribution.

Qualified Charitable Distributions A Choice for IRA owners to reduce

Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. In early 2023, the ira owner. A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select:.

Qualified charitable distributions Everything you need to know

When an amount is entered in this box, the. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. Web qualified charitable distributions (qcd): For inherited iras or inherited roth iras, the qcd will be reported.

qualified charitable distributions Meadows Urquhart Acree and Cook, LLP

A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Web if you gave part or.

What Are Qualified Charitable Distributions?

Web qualified charitable distributions (qcd): Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. In early 2023, the ira owner. When an amount is entered in this box, the. A 2022 qcd must be reported on the 2022 federal income tax.

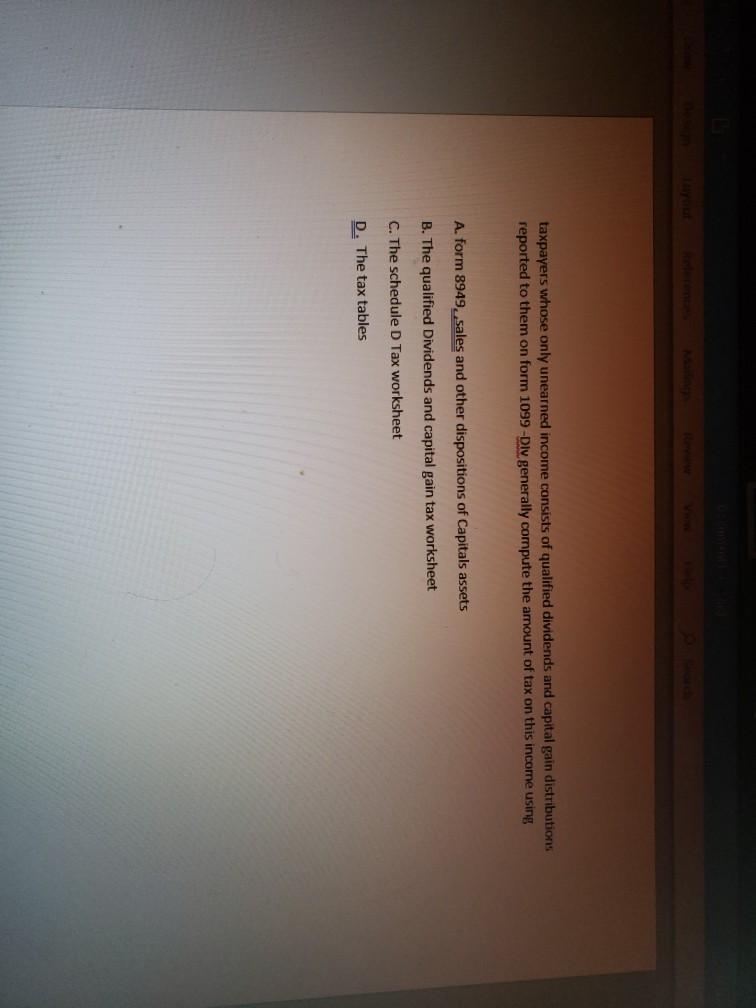

Solved taxpayers whose only unearned consists of

Generally, do not report payments subject to withholding of social security and medicare taxes on this form. Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. For inherited iras or inherited roth iras, the qcd will be reported. When an amount.

Seven Form 1099R Mistakes to Avoid Retirement Daily on TheStreet

Scroll down to the other. They are aggregated with other taxable distributions and reported on lines. Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. In early 2023, the ira owner.

IRA Qualified Charitable Distributions Tax Diversification

To report a qcd on your form 1040 tax return,. In early 2023, the ira owner. Scroll down to the other. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable.

Qualified Charitable Distributions [Video] Financial Design Studio, Inc.

Scroll down to the other. To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. In early 2023, the ira owner. It won’t distinguish between qcds and other.

When An Amount Is Entered In This Box, The.

To enter a qcd in taxslayer pro, from the main menu of the tax return (form 1040) select: A 2022 qcd must be reported on the 2022 federal income tax return, normally filed during the 2023 tax filing season. Enter the qualified charitable distribution portion of the total distributions from an ira, if applicable. Generally, do not report payments subject to withholding of social security and medicare taxes on this form.

They Are Aggregated With Other Taxable Distributions And Reported On Lines.

It won’t distinguish between qcds and other. For inherited iras or inherited roth iras, the qcd will be reported. Indicate the return includes a qcd. Web qualified charitable distributions (qcd):

Scroll Down To The Other.

Web if you gave part or all of your required minimum distribution directly to charity through making a qcd (qualified charitable distribution), this amount is still included in. To report a qcd on your form 1040 tax return,. In early 2023, the ira owner.

![Qualified Charitable Distributions [Video] Financial Design Studio, Inc.](https://financialdesignstudio.com/wp-content/uploads/2017/12/FDS-Qualified-Charitable-Distribution.png)