How Do I Get Form 5695

How Do I Get Form 5695 - Ad access irs tax forms. Web to enter form 5695 information in taxact: Web january 11, 2022 12:09 pm. Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. The residential clean energy credit, and the energy efficient home. For tax years 2006 through 2017 it was also used to calculate the nonbusiness. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,. You’ll need four forms to file for the credit, which can be. Yes, you can carry any unused residential solar energy credits forward to 2022. In the search bar, type 5695.

Get ready for tax season deadlines by completing any required tax forms today. To add or remove this. Yes, you can carry any unused residential solar energy credits forward to 2022. Web to enter form 5695 information in taxact: Web up to $40 cash back сomplete the missouri tax form 5695 for free get started! To claim the credit, you must file irs form 5695 as part. & more fillable forms, try for free now! Also use form 5695 to take any residential energy. In the search bar, type 5695. Keywords relevant to mo form 5695 missouri.

Use previous versions of form 5695. Rate free missouri form 5695. Web to enter form 5695 information in taxact: To enter qualified fuel cell property costs: In the search bar, type 5695. For tax years 2006 through 2017 it was also used to calculate the nonbusiness. & more fillable forms, register and subscribe now! The residential energy credits are: Ad register and subscribe now to work on your irs form 5695 & more fillable forms. Web up to $40 cash back сomplete the missouri tax form 5695 for free get started!

Form 5695 2022 2023 IRS Forms TaxUni

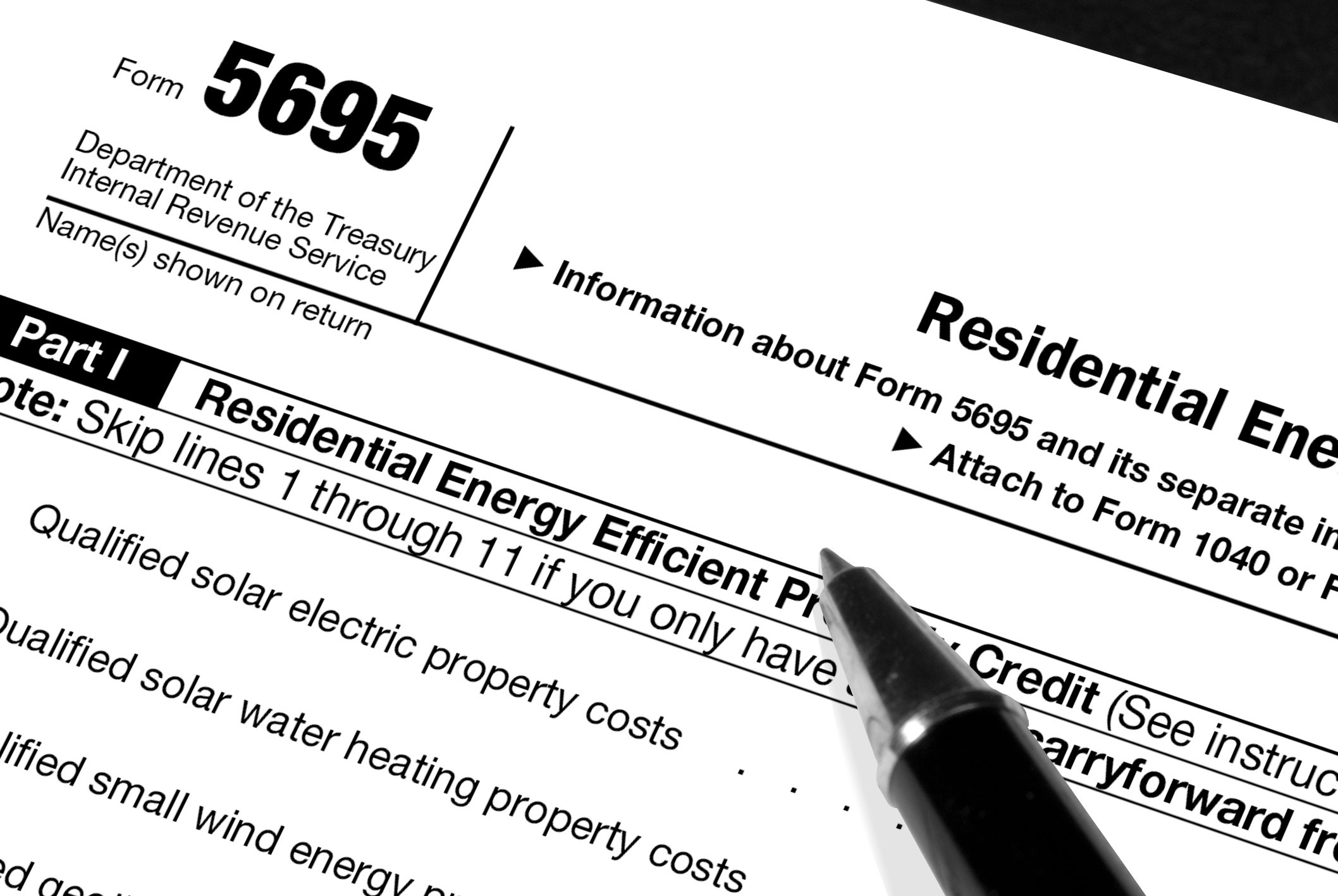

Web how to file irs form 5695 to claim your renewable energy credits. The residential energy credits are: Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. For tax years 2006 through 2017 it was also used to calculate the nonbusiness. In the search bar, type 5695.

2016 Form 5695 Fill Online, Printable, Fillable, Blank pdfFiller

You'll also need to save copies of the receipts for these. To add or remove this. Rate free missouri form 5695. You’ll need four forms to file for the credit, which can be. To enter qualified fuel cell property costs:

Instructions for filling out IRS Form 5695 Everlight Solar

Form 5695 claiming residential energy credits with form 5695 jo willetts, ea director, tax resources. Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. In the search bar, type 5695. Web the residential energy credits are: Also use form 5695 to take any residential energy.

How to File IRS Form 5695 To Claim Your Renewable Energy Credits

Also use form 5695 to take any residential energy. Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. Web january 11, 2022 12:09 pm. The residential energy credits are: Web the residential energy credits are:

Filing For The Solar Tax Credit Wells Solar

The residential clean energy credit, and the energy efficient home. Web january 11, 2022 12:09 pm. Web to enter the amount for form 5695, line 22a: Get ready for tax season deadlines by completing any required tax forms today. Web to enter form 5695 information in taxact:

Image tagged in scumbag,old fashioned Imgflip

Web to enter the amount for form 5695, line 22a: & more fillable forms, register and subscribe now! Web for the latest information about developments related to form 5695 and its instructions, such as legislation enacted after they were published, go to. Get ready for tax season deadlines by completing any required tax forms today. The energy efficient home improvement.

Replacement windows government rebate » Window Replacement

The residential energy credits are: In the search bar, type 5695. Form 5695 claiming residential energy credits with form 5695 jo willetts, ea director, tax resources. Yes, you can carry any unused residential solar energy credits forward to 2022. Get ready for tax season deadlines by completing any required tax forms today.

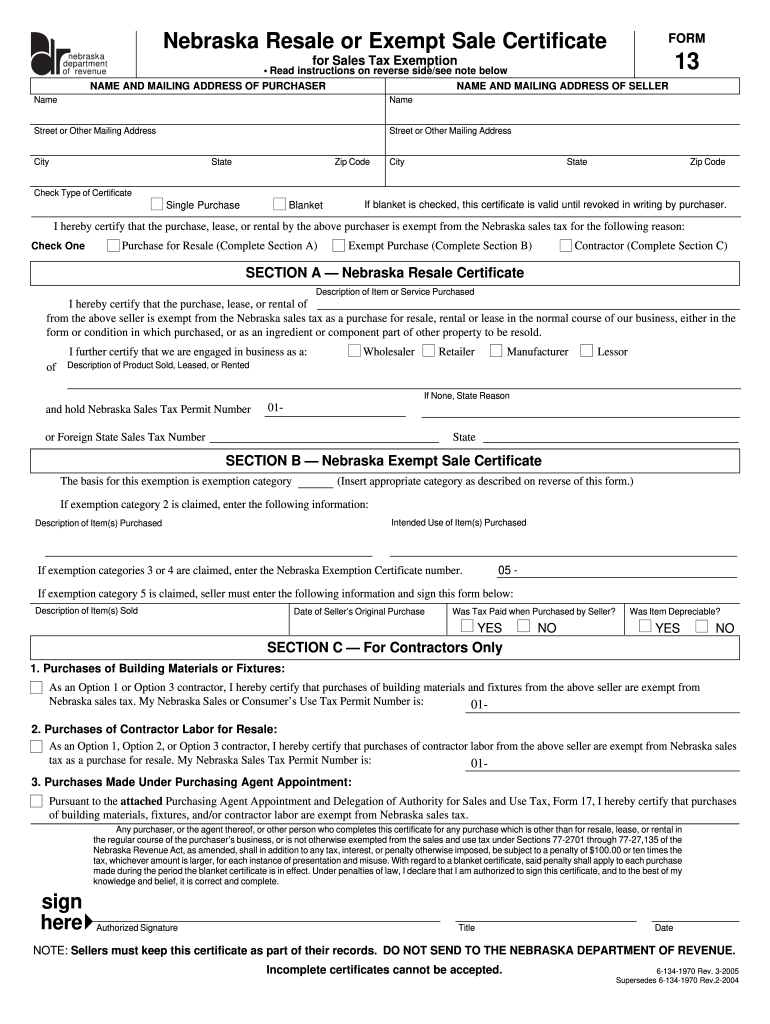

Form 13 Fill Out and Sign Printable PDF Template (2022)

Web form 5695 (residential energy credits) is used to calculate tax credits for energy efficient improvements and alternative energy equipment. Ad register and subscribe now to work on your irs form 5695 & more fillable forms. Rate free missouri form 5695. You'll also need to save copies of the receipts for these. Web how to file irs form 5695 to.

Form 5695 Instructions Information On Form 5695 —

Rate free missouri form 5695. Web use form 5695 to figure and take your residential energy credits. You'll also need to save copies of the receipts for these. Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. To enter qualified fuel cell property costs:

Steps To Complete Form 5695 Lovetoknow —

Yes, you can carry any unused residential solar energy credits forward to 2022. Web the residential energy credits are: Web for the latest information about developments related to form 5695 and its instructions, such as legislation enacted after they were published, go to. Ad access irs tax forms. You’ll need four forms to file for the credit, which can be.

You'll Also Need To Save Copies Of The Receipts For These.

Ad access irs tax forms. Keywords relevant to mo form 5695 missouri. Web for the latest information about developments related to form 5695 and its instructions, such as legislation enacted after they were published, go to. 1, 2023, the credit equals 30% of certain qualified expenses,.

The Residential Clean Energy Credit, And The Energy Efficient Home.

Web in order to complete form 5695, you'll need to know exactly how much you spent on the qualified home improvements. To add or remove this. Use previous versions of form 5695. To claim the credit, you must file irs form 5695 as part.

Rate Free Missouri Form 5695.

In the topic box, highlight 5695, residential energy credit, then click go. The energy efficient home improvement credit. In the search bar, type 5695. Web january 11, 2022 12:09 pm.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web form 5695 is used to calculate the nonrefundable credit for residential energy efficient property. Get ready for tax season deadlines by completing any required tax forms today. Form 5695 claiming residential energy credits with form 5695 jo willetts, ea director, tax resources. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner of your screen,.