How Do I Submit Form 8862

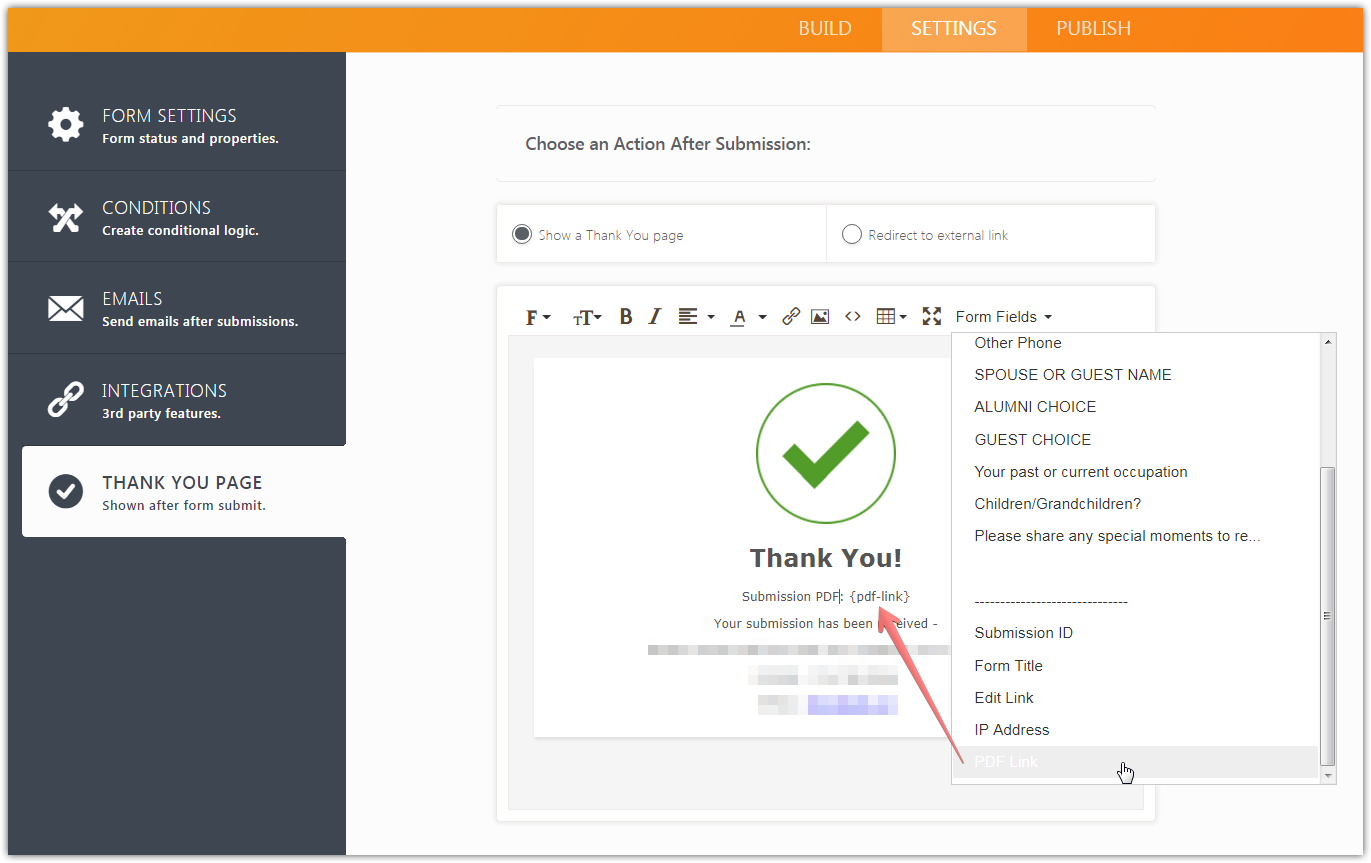

How Do I Submit Form 8862 - Web you do not need to file form 8862 in the year the credit was disallowed or reduced. Click view complete forms list. Web you may need to: For more answers to your. On smaller devices, click the menu. Ad access irs tax forms. Having a valid social security number. Put your name and social security number on the statement and attach it at. File an extension in turbotax online before the deadline to avoid a late filing penalty. Add certain credit click the green button to add information to claim a certain credit after disallowance.

Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Sign in to turbotax and select. (it is important to be in your actual return or the next steps will not. Open (continue) your return if you don't already have it open. Answer the questions accordingly, and we’ll include form 8862 with your return. After you have finished entering the information for form. By jason luthor updated may 28, 2019. Information to claim certain refundable credits. Having a valid social security number. To add form 8862 to your taxact® return:

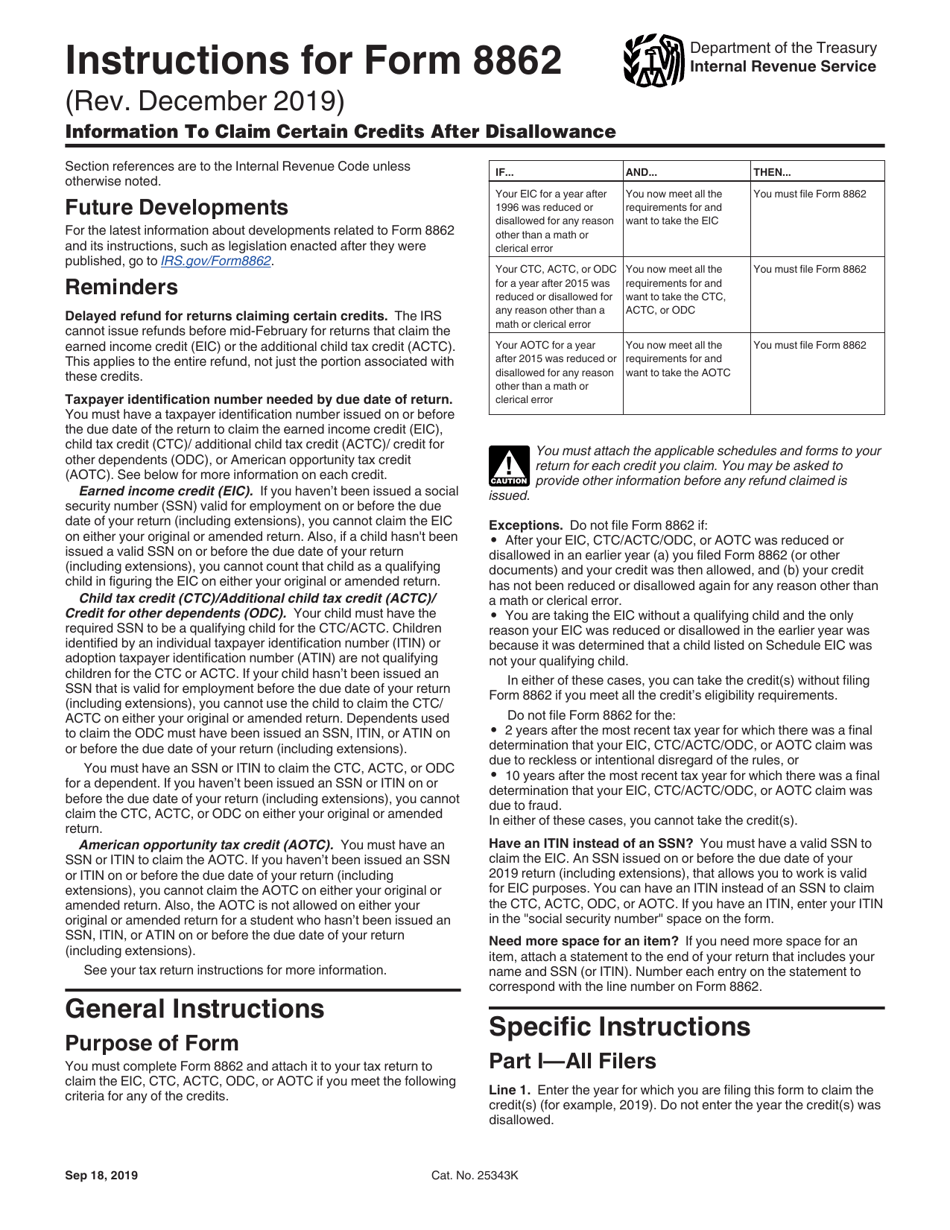

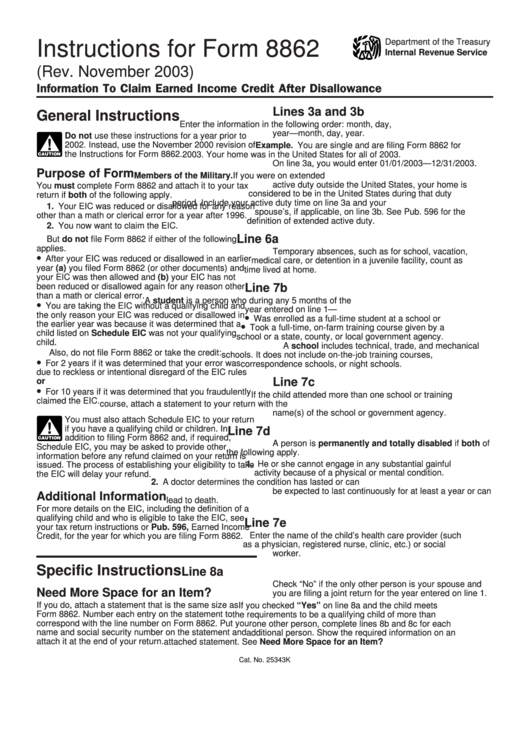

By jason luthor updated may 28, 2019. This form is for income earned in tax year 2022, with tax returns due in april. Credit for qualified retirement savings contributions. Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Web how do i submit form 8862 online. Expand the federal forms and forms and schedules folders. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Their earned income credit (eic), child tax credit (ctc)/additional child tax credit. Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Ad access irs tax forms.

How Do I File My Form 8862? StandingCloud

File an extension in turbotax online before the deadline to avoid a late filing penalty. Put your name and social security number on the statement and attach it at. Add certain credit click the green button to add information to claim a certain credit after disallowance. Sign in to efile.com sign in to efile.com 2. Web how do i file.

Irs Form 8862 Printable Master of Documents

Sign in to efile.com sign in to efile.com 2. From within your taxact return ( online or desktop) click on the federal tab. Information to claim certain refundable credits. Pay back the claims, plus interest file form 8862 when you claim the credit again we could also ban you from claiming the eitc for 2 to 10 years or. Web.

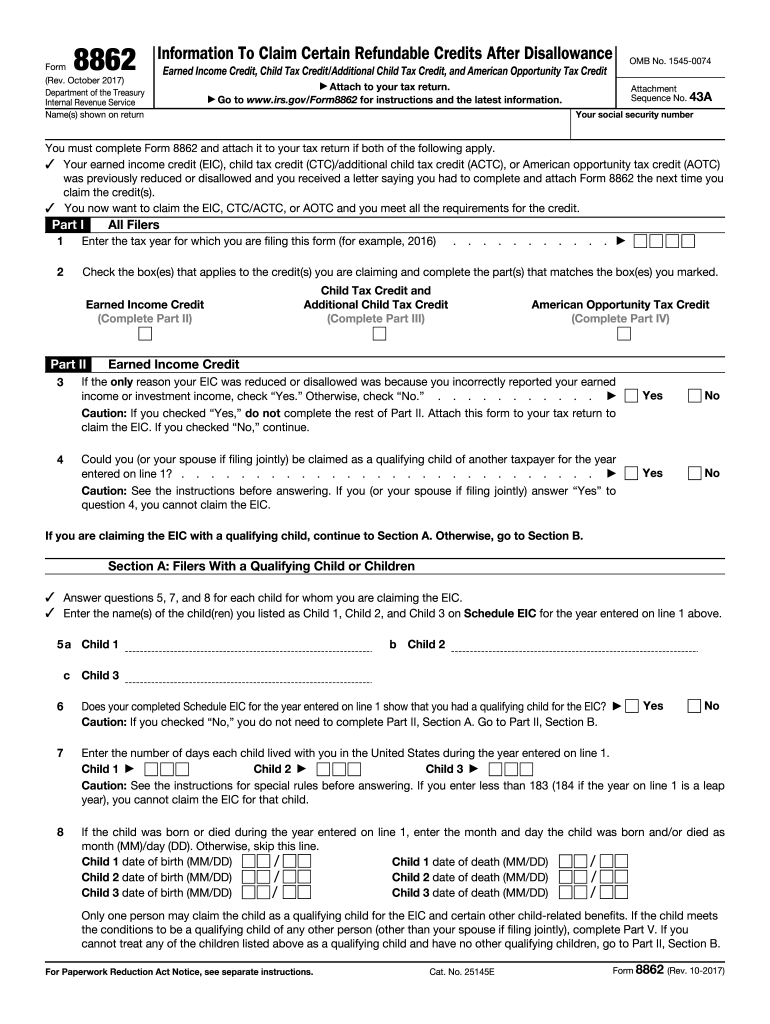

Form 8862Information to Claim Earned Credit for Disallowance

File an extension in turbotax online before the deadline to avoid a late filing penalty. Answer the questions accordingly, and we’ll include form 8862 with your return. Web search for 8862 and select the link to go to the section. Put your name and social security number on the statement and attach it at. Here's how to file form 8862.

IRS Form 8862 2017 Fill Out and Sign Printable PDF Template signNow

Web how form 8862 works. Complete, edit or print tax forms instantly. Irs form 8862 is better known as the information to claim certain credits after disallowance form. Add certain credit click the green button to add information to claim a certain credit after disallowance. Pay back the claims, plus interest file form 8862 when you claim the credit again.

Breanna Image Form Submit

Open (continue) your return if you don't already have it open. Web how form 8862 works. On smaller devices, click the menu. From within your taxact return ( online or desktop) click on the federal tab. Information to claim certain refundable credits.

I will do Submit PDF submission To 50 High Authority Document Sharing

For more answers to your. Having a valid social security number. Web search for 8862 and select the link to go to the section. Sign in to turbotax and select. Web you do not need to file form 8862 in the year the credit was disallowed or reduced.

Download Instructions for IRS Form 8862 Information to Claim Certain

Web you may need to: Web form 8862 is required to be filed with a taxpayer’s tax return if in a prior year the taxpayer’s claim for any of the following credits was reduced or disallowed for any reason other than. Answer the questions accordingly, and we’ll include form 8862 with your return. From within your taxact return ( online.

HTML Submit Form HTML Development Code Exercise

From within your taxact return ( online or desktop) click on the federal tab. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Complete, edit or print tax forms instantly. Web click the forms tab on the right side of the screen. Web you.

Form 8862 Information to Claim Earned Credit After

Irs form 8862 is better known as the information to claim certain credits after disallowance form. (it is important to be in your actual return or the next steps will not. Web how do i submit form 8862 online. Answer the questions accordingly, and we’ll include form 8862 with your return. Web form 8862 is required to be filed with.

Instructions For Form 8862 Information To Claim Earned Credit

Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. Here's how to file form 8862 in turbotax. Having a valid social security number. Click view complete forms list. File an extension in turbotax online before the deadline to avoid a late filing penalty.

Open (Continue) Your Return If You Don't Already Have It Open.

Sign in to efile.com sign in to efile.com 2. Here's how to file form 8862 in turbotax. Web for the latest information about developments related to form 8862 and its instructions, such as legislation enacted after they were published, go to irs.gov/form8862. (it is important to be in your actual return or the next steps will not.

By Jason Luthor Updated May 28, 2019.

Web we last updated federal form 8862 in december 2022 from the federal internal revenue service. Click view complete forms list. Get ready for tax season deadlines by completing any required tax forms today. Sign in to turbotax and select.

Web Search For 8862 And Select The Link To Go To The Section.

Answer the questions accordingly, and we’ll include form 8862 with your return. Web 1 best answer andreac1 level 9 you can use the steps below to help you get to where to fill out information for form 8862 to add it to your tax return. Complete, edit or print tax forms instantly. Web you may need to:

Ad Access Irs Tax Forms.

On smaller devices, click the menu. Web you do not need to file form 8862 in the year the credit was disallowed or reduced. Web if your eic was disallowed or reduced for reasons other than math or clerical errors after 1996, you may need to file form 8862 before the internal revenue. Expand the federal forms and forms and schedules folders.