How Much Does It Cost To File A 1099 Form

How Much Does It Cost To File A 1099 Form - Turbotax deluxe online posted august 2, 2019 8:01 am last updated august 02, 2019 8:01 am 0 2. The balance / julie bang tax professionals set their. Ad discover a wide selection of 1099 tax forms at staples®. Web 1099online service costs as low as $0.55/return. Web if the fatca filing requirement box is checked, the payer is reporting on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Learn more about how to simplify your businesses 1099 reporting. Ad discover a wide selection of 1099 tax forms at staples®. The cost is $245.00 (10 forms at $2.90 each + 90 forms at $1.90 each + 50 forms at $0.90 each). Staples provides custom solutions to help organizations achieve their goals. Gusto supports contractor payments in 120+ countries.

Web iris is a free service that lets you: Ad discover a wide selection of 1099 tax forms at staples®. Ad electronically file 1099 forms. First 1099 + 1096 is $35 if we are also preparing your tax return; Learn more about how to simplify your businesses 1099 reporting. Staples provides custom solutions to help organizations achieve their goals. Cost $1.65 per form after the first 5. Web if the fatca filing requirement box is checked, the payer is reporting on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Web average preparation fees should you itemize? Web how much does turbo tax charge to report a 1099 misc form?

Submit up to 100 records per upload with csv templates. Official site | smart tools. Turbotax deluxe online posted august 2, 2019 8:01 am last updated august 02, 2019 8:01 am 0 2. Staples provides custom solutions to help organizations achieve their goals. Ad discover a wide selection of 1099 tax forms at staples®. Web (basis is usually the amount of cost incurred by the taxpayer when he or she acquired the property, perhaps years before the sale.) the taxpayer's basis amount is deducted by. The balance / julie bang tax professionals set their. Web if the fatca filing requirement box is checked, the payer is reporting on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code. Gusto supports contractor payments in 120+ countries. Web 1099online service costs as low as $0.55/return.

9 1099 Misc Template For Preprinted Forms Template Guru

Ad electronically file 1099 forms. Web iris is a free service that lets you: Official site | smart tools. Web how much does turbo tax charge to report a 1099 misc form? Web if the fatca filing requirement box is checked, the payer is reporting on this form 1099 to satisfy its account reporting requirement under chapter 4 of the.

Understanding the 1099 5 Straightforward Tips to File

The cost is $245.00 (10 forms at $2.90 each + 90 forms at $1.90 each + 50 forms at $0.90 each). Official site | smart tools. What the fee includes negotiate a fair price photo: Submit up to 100 records per upload with csv templates. Web (basis is usually the amount of cost incurred by the taxpayer when he or.

Download Form 1099 Misc 2018 Form Resume Examples L71x2ky3MX

Web (basis is usually the amount of cost incurred by the taxpayer when he or she acquired the property, perhaps years before the sale.) the taxpayer's basis amount is deducted by. Ad electronically file 1099 forms. Web average preparation fees should you itemize? Web 1099online service costs as low as $0.55/return. Services performed by someone who is not your employee.

1099MISC Tax Basics

Web how much does turbo tax charge to report a 1099 misc form? Ad discover a wide selection of 1099 tax forms at staples®. Turbotax deluxe online posted august 2, 2019 8:01 am last updated august 02, 2019 8:01 am 0 2. Ad process & file 1099 corrections quickly & easily online First 1099 + 1096 is $35 if we.

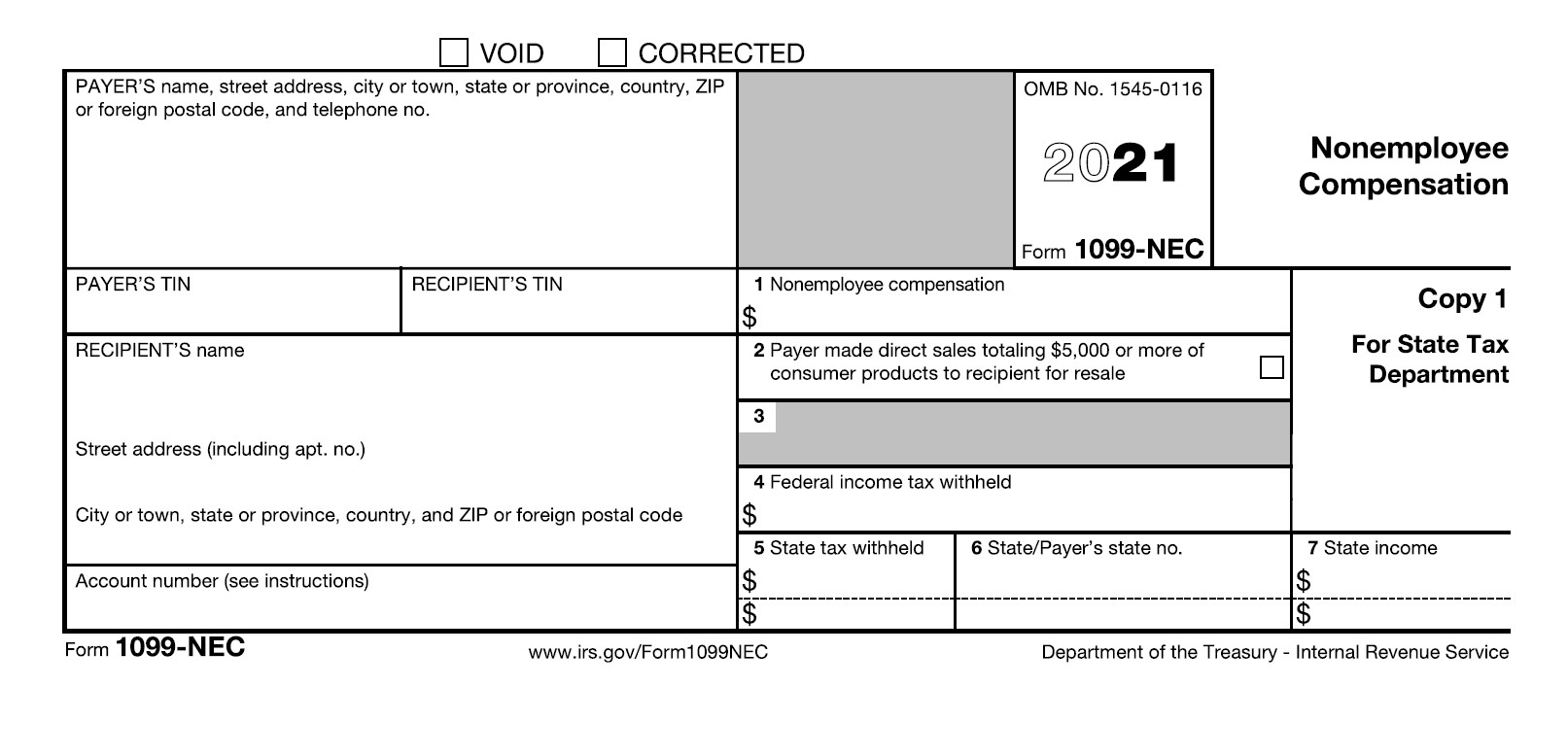

Form1099NEC

Staples provides custom solutions to help organizations achieve their goals. First 1099 + 1096 is $35 if we are also preparing your tax return; The cost is $245.00 (10 forms at $2.90 each + 90 forms at $1.90 each + 50 forms at $0.90 each). Services performed by someone who is not your employee. Submit up to 100 records per.

Process 1099MISC forms Buildium Help Center

Web iris is a free service that lets you: First 1099 + 1096 is $35 if we are also preparing your tax return; The balance / julie bang tax professionals set their. Services performed by someone who is not your employee. Ad discover a wide selection of 1099 tax forms at staples®.

File 1099 5 Important Facts To Know Before Filing Your 1099s

Ad process & file 1099 corrections quickly & easily online Turbotax deluxe online posted august 2, 2019 8:01 am last updated august 02, 2019 8:01 am 0 2. Official site | smart tools. The cost is $245.00 (10 forms at $2.90 each + 90 forms at $1.90 each + 50 forms at $0.90 each). Submit up to 100 records per.

How To File Form 1099NEC For Contractors You Employ VacationLord

Ad process & file 1099 corrections quickly & easily online Ad discover a wide selection of 1099 tax forms at staples®. Staples provides custom solutions to help organizations achieve their goals. First 1099 + 1096 is $35 if we are also preparing your tax return; Ad discover a wide selection of 1099 tax forms at staples®.

All About Forms 1099MISC and 1099K Brightwater Accounting

Web how much does turbo tax charge to report a 1099 misc form? Ad electronically file 1099 forms. Learn more about how to simplify your businesses 1099 reporting. Web iris is a free service that lets you: Staples provides custom solutions to help organizations achieve their goals.

11 Common Misconceptions About Irs Form 11 Form Information Free

Staples provides custom solutions to help organizations achieve their goals. Submit up to 100 records per upload with csv templates. Ad discover a wide selection of 1099 tax forms at staples®. Official site | smart tools. Web if the fatca filing requirement box is checked, the payer is reporting on this form 1099 to satisfy its account reporting requirement under.

Learn More About How To Simplify Your Businesses 1099 Reporting.

Submit up to 100 records per upload with csv templates. Web iris is a free service that lets you: Staples provides custom solutions to help organizations achieve their goals. Turbotax deluxe online posted august 2, 2019 8:01 am last updated august 02, 2019 8:01 am 0 2.

Web Average Preparation Fees Should You Itemize?

Ad process & file 1099 corrections quickly & easily online The cost is $245.00 (10 forms at $2.90 each + 90 forms at $1.90 each + 50 forms at $0.90 each). Web how much does turbo tax charge to report a 1099 misc form? Gusto supports contractor payments in 120+ countries.

Ad Electronically File 1099 Forms.

First 1099 + 1096 is $35 if we are also preparing your tax return; Staples provides custom solutions to help organizations achieve their goals. Ad discover a wide selection of 1099 tax forms at staples®. Official site | smart tools.

Web 1099Online Service Costs As Low As $0.55/Return.

The balance / julie bang tax professionals set their. Ad discover a wide selection of 1099 tax forms at staples®. What the fee includes negotiate a fair price photo: Web if the fatca filing requirement box is checked, the payer is reporting on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.