How To File Form 568

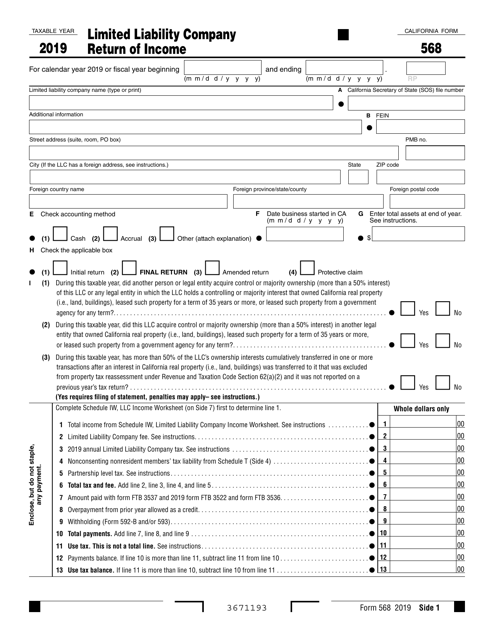

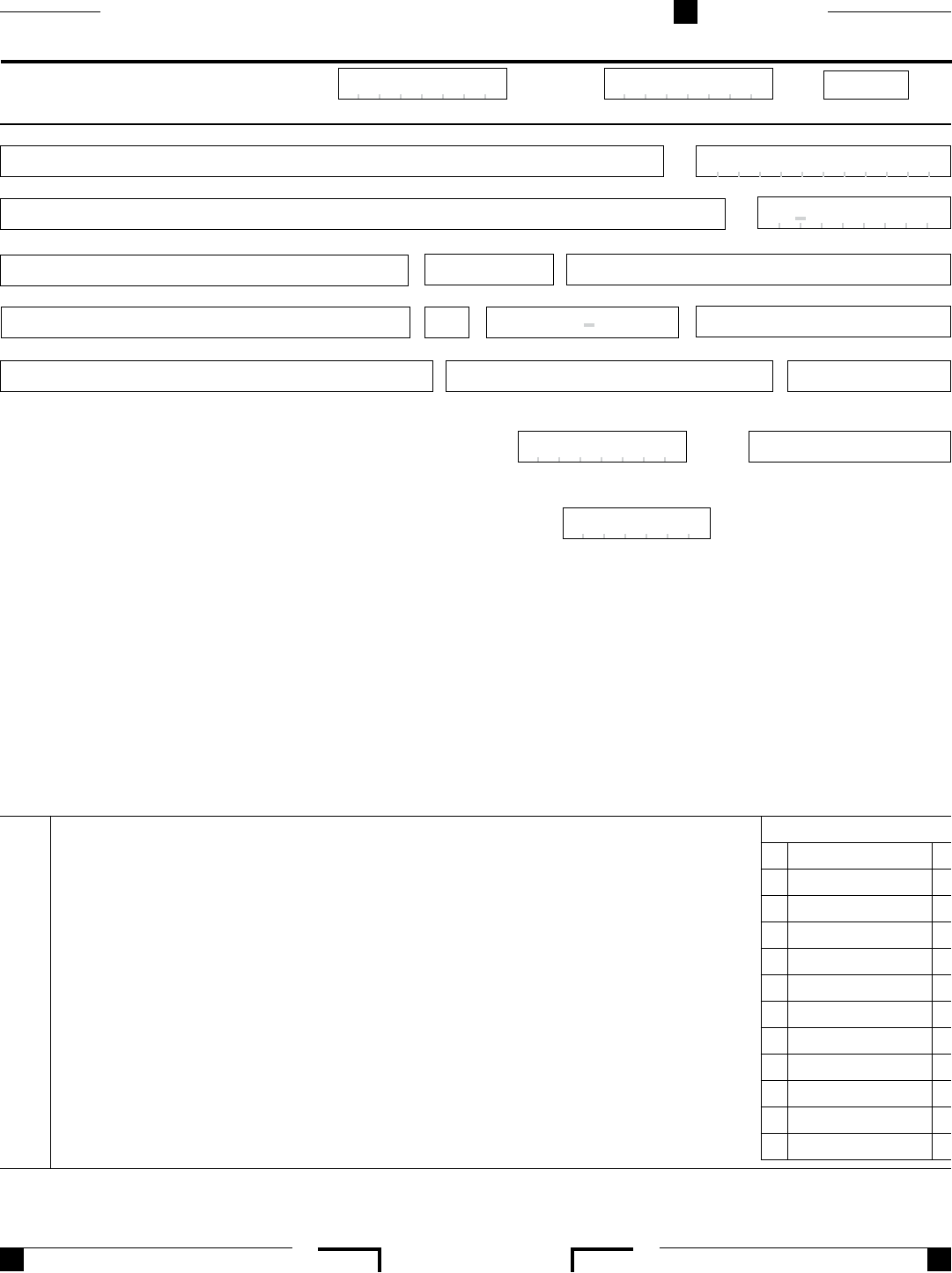

How To File Form 568 - Web there are several ways to submit form 4868. If you are married, you and your spouse are considered one owner and can. Web up to $40 cash back who needs 2022 form 568: Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Line 1—total income from schedule iw. Web llcs classified as partnerships file form 568. Web overview if your llc has one owner, you’re a single member limited liability company (smllc). Follow the interview to the business summary topic and click edit. Web an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. Form 568 must be filed by every llc that is not taxable as a corporation if any of the following.

• form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. Web up to $40 cash back who needs 2022 form 568: Web an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. Web to enter the information for form 568 in the 1040 taxact ® program: The llc must file the. Web there are several ways to submit form 4868. Web to create an llc unit, enter a state use code 3 form 568: Complete, edit or print tax forms instantly. Ad upload, modify or create forms. Web along with form 3522, you will have to file ca form 568 if your llc tax status is either as a disregarded entity or a partnership.

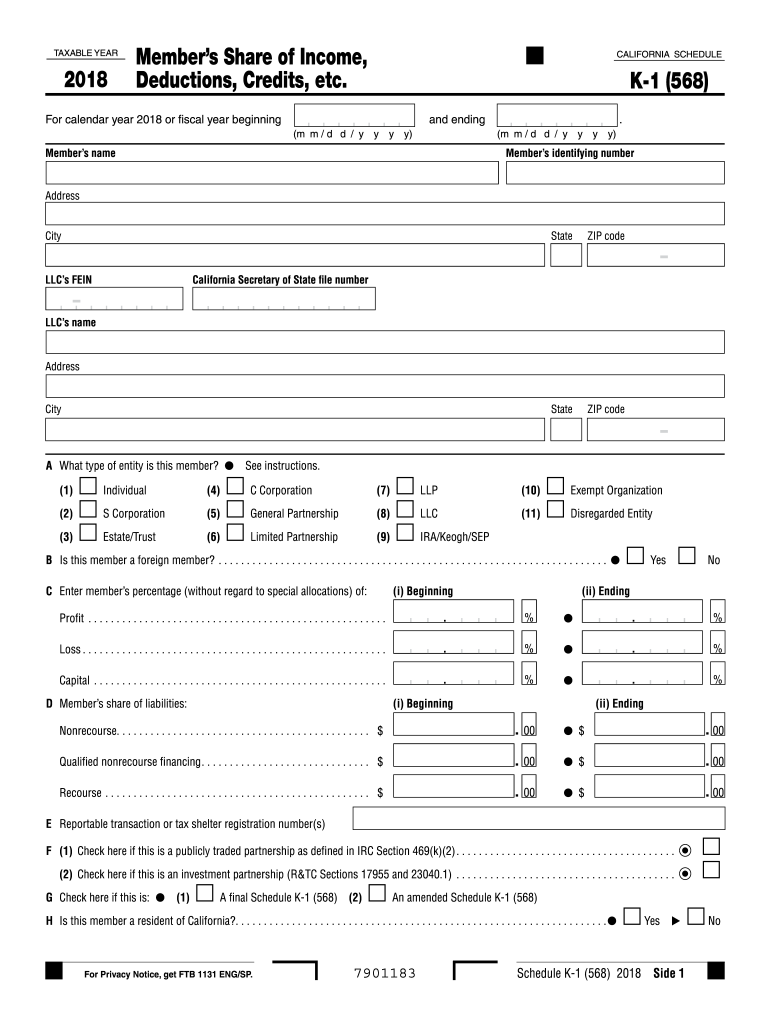

(m m / d d / y y y y) (m m / d d / y y y y) rp. Web along with form 3522, you will have to file ca form 568 if your llc tax status is either as a disregarded entity or a partnership. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Form 568 must be filed by every llc that is not taxable as a corporation if any of the following. Line 1—total income from schedule iw. If you are married, you and your spouse are considered one owner and can. Web an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. Business entities that are partnerships, llcs, or corporations in the state of california are required to file form 568. Web california form 568 can be generated from a federal schedule c, schedule e, or schedule f. Web overview if your llc has one owner, you’re a single member limited liability company (smllc).

2013 Form 568 Limited Liability Company Return Of Edit, Fill

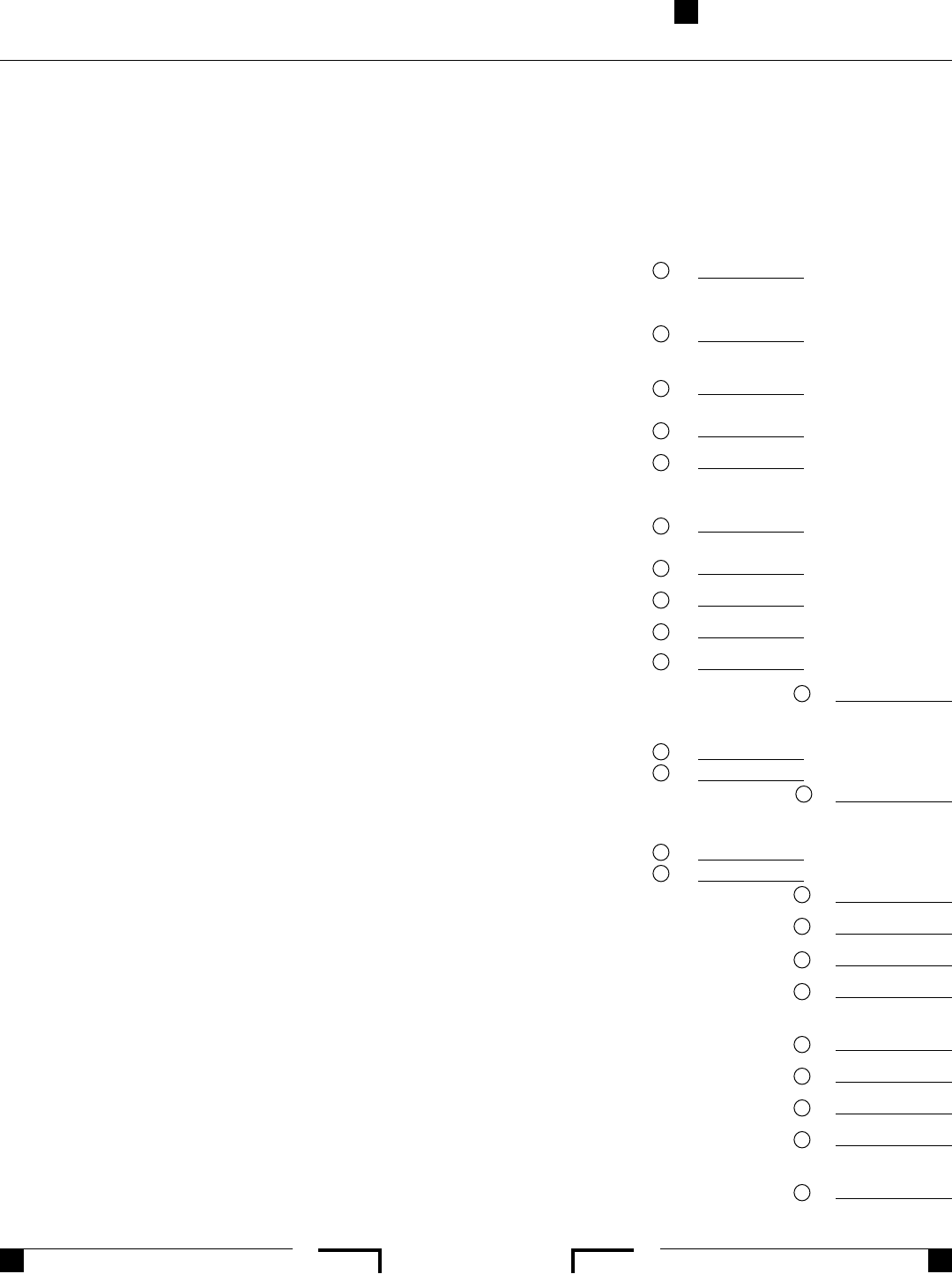

Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Follow the interview to the business summary topic and click edit. Web if you have an llc, here’s how to fill in the california form 568: Web to create an llc unit, enter.

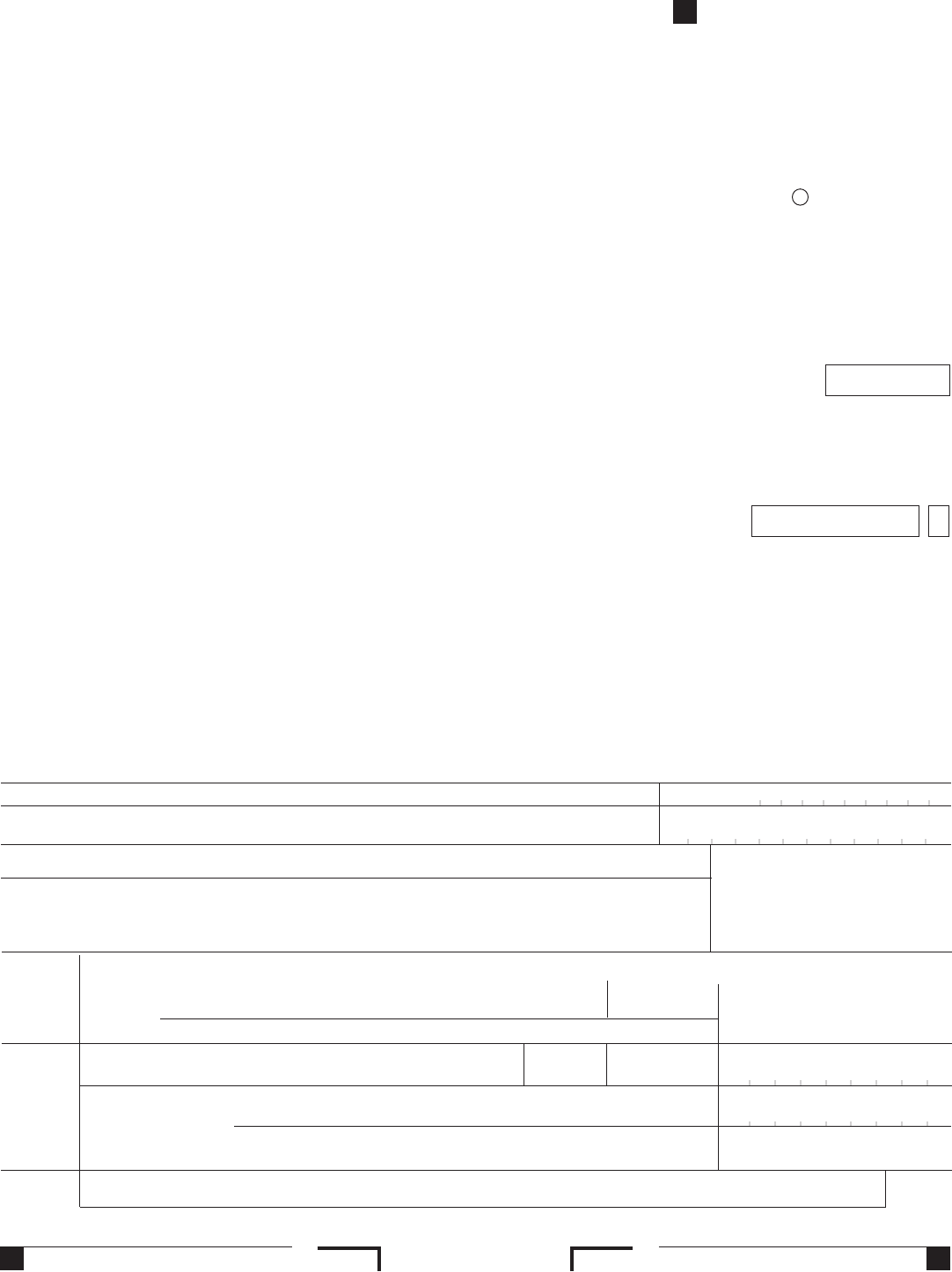

California Schedule K 1 568 Form Fill Out and Sign Printable PDF

For calendar year 2020 or fiscal year beginning and ending. Web the questions about form 568 appear during california interview. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web overview if your llc has one owner, you’re a single member limited liability company (smllc). Try it for free now!

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Line 1—total income from schedule iw. Web llcs classified as partnerships file form 568. Web to create an llc unit, enter a state use code 3 form 568: Go to the state tax tab. Follow the interview to the business summary topic and click edit.

Form 568 2019 Fill Out, Sign Online and Download Fillable PDF

Ca and unique secretary of state (sos) account number in the state use code statement dialog in federal screen c,. If you are married, you and your spouse are considered one owner and can. Web llcs classified as partnerships file form 568. Go to the state tax tab. • form 568, limited liability company return of income • form 565,.

2012 Form 568 Limited Liability Company Return Of Edit, Fill

For calendar year 2020 or fiscal year beginning and ending. Ad upload, modify or create forms. Line 1—total income from schedule iw. Web adding a limited liability return (form 568) to add limited liability, form 568 to the california return, choose file > client properties > california tab and mark the form 568. Web an llc fee an llc return.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Click the file menu, and select go to state/city. Web california form 568 can be generated from a federal schedule c, schedule e, or schedule f. Web there are several ways to submit form 4868. Complete, edit or print tax forms instantly. Web along with form 3522, you will have to file ca form 568 if your llc tax status.

ADEM Form 568 Download Printable PDF or Fill Online Application for

Web california where do i enter ca form 568 llc information in an individual return? From within your taxact return ( online or desktop), click state to expand, then click california (or ca ). Web to create an llc unit, enter a state use code 3 form 568: Click the file menu, and select go to state/city. Web to enter.

Fillable California Form 568 Limited Liability Company Return Of

Web to enter the information for form 568 in the 1040 taxact ® program: Web there are several ways to submit form 4868. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Form 568 must be filed by every llc that is not taxable as.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Ca and unique secretary of state (sos) account number in the state use code statement dialog in federal screen c,. Web to create an llc unit, enter a state use code 3 form 568: Web adding a limited liability return (form 568) to add limited liability, form 568 to the california return, choose file > client properties > california tab.

CA Form 568 Due Dates 2023 State And Local Taxes Zrivo

Thus, you will need to file both if you are running a. Go to the state tax tab. Web to complete california form 568 for a partnership, from the main menu of the california return, select: Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited.

If You Are Married, You And Your Spouse Are Considered One Owner And Can.

Ca and unique secretary of state (sos) account number in the state use code statement dialog in federal screen c,. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. The llc must file the. Web adding a limited liability return (form 568) to add limited liability, form 568 to the california return, choose file > client properties > california tab and mark the form 568.

Thus, You Will Need To File Both If You Are Running A.

Web up to $40 cash back who needs 2022 form 568: (m m / d d / y y y y) (m m / d d / y y y y) rp. Web california where do i enter ca form 568 llc information in an individual return? For calendar year 2020 or fiscal year beginning and ending.

Web Llcs Classified As Partnerships File Form 568.

Web an llc fee an llc return filing requirement (form 568) generally, a disregarded smllc must file a form 568 by the same deadline applicable to the owner's tax return. Web to create an llc unit, enter a state use code 3 form 568: Web to complete california form 568 for a partnership, from the main menu of the california return, select: • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california.

Web If You Have An Llc, Here’s How To Fill In The California Form 568:

From within your taxact return ( online or desktop), click state to expand, then click california (or ca ). Go to the state tax tab. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.