How To Fill Form 8938

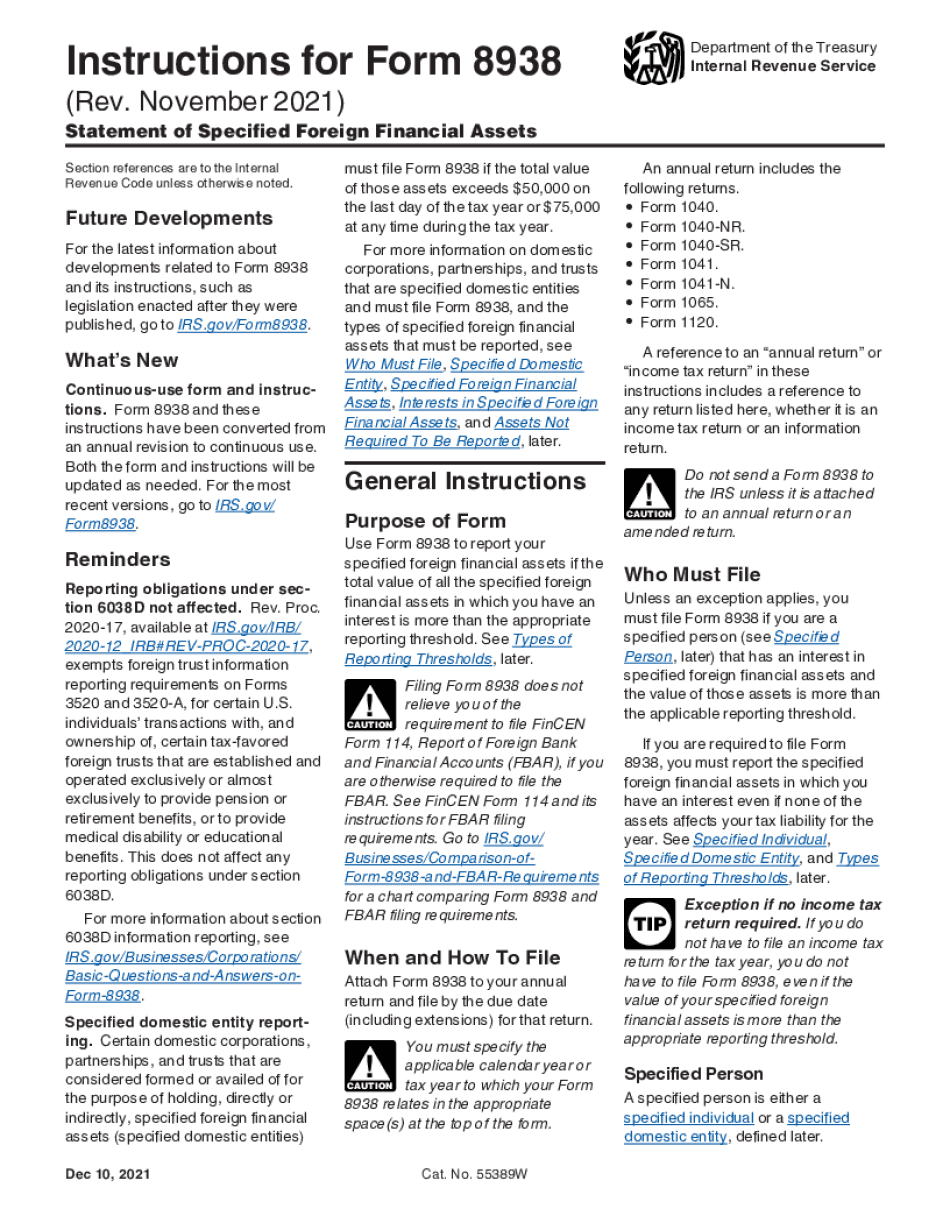

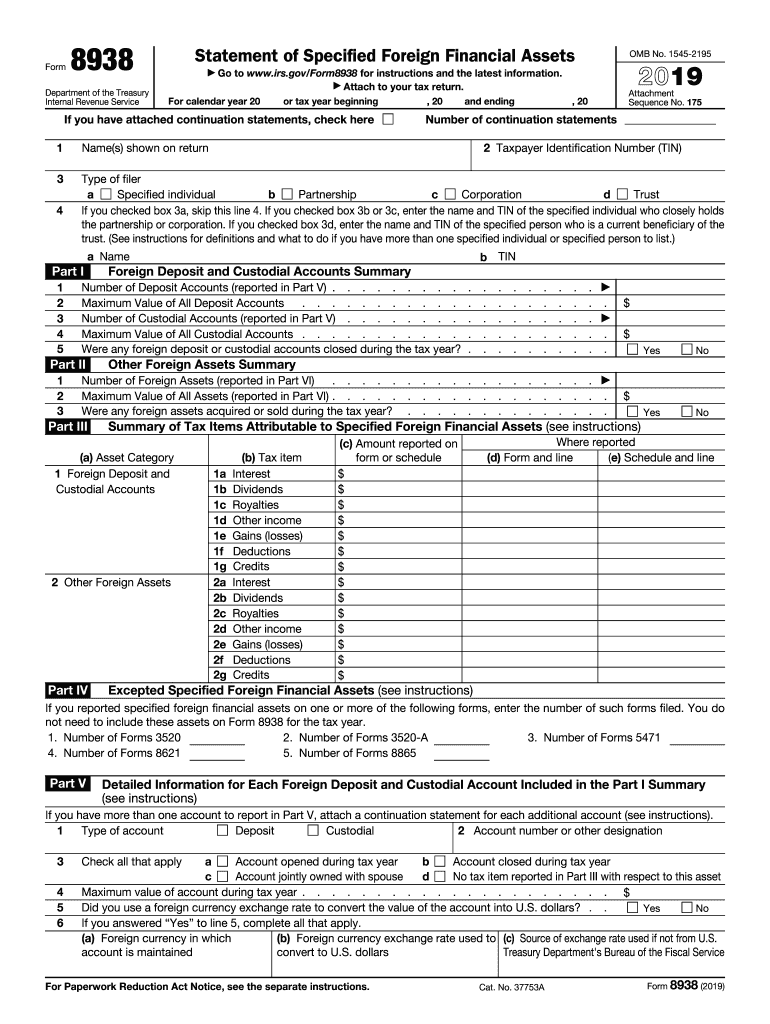

How To Fill Form 8938 - Web about form 8938, statement of specified foreign financial assets. If the irs notifies taxpayers that they are delinquent, they. Do i still need to fill form 8938 ? Taxpayers who do not have to file an income tax return for the tax year do not have to file form 8938,. Web form 8938, statement of specified foreign financial assets. Complete, edit or print tax forms instantly. Web the form 8938 must be attached to the taxpayer's annual tax return. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign. Ad get ready for tax season deadlines by completing any required tax forms today. Download the irs form 8938 from the official website of the internal revenue service.

Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Web there are several ways to submit form 4868. I searched this question on the forum, but can not find out the. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. Irs requirements and step by step instructions on how to fill it out. Taxpayers who do not have to file an income tax return for the tax year do not have to file form 8938,. To get to the 8938 section in turbotax, refer to the following instructions: From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Web to enter the information for form 8938 in the taxact program: Download the irs form 8938 from the official website of the internal revenue service.

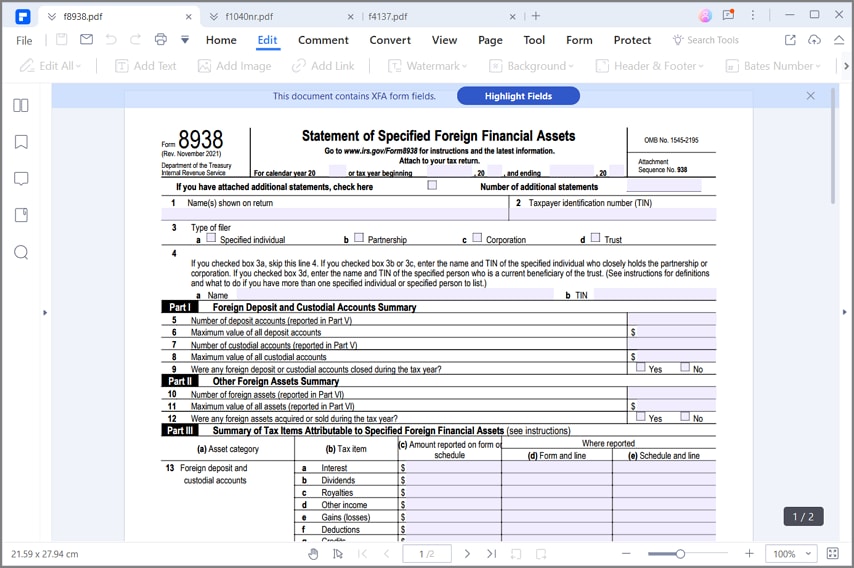

Web key takeaways form 8938 is used by certain u.s. Web filing form 8938 is only available to those using turbotax deluxe or higher. Taxpayers to report specified foreign financial assets each year on a form 8938. Irs tax form 8938 instructions involve the reporting of specified foreign financial assets to the irs in accordance with fatca. Download the irs form 8938 from the official website of the internal revenue service. Open it on pdfelement and start by writing the name and. From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. Irs requirements and step by step instructions on how to fill it out. Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file?

Form 8938 Edit, Fill, Sign Online Handypdf

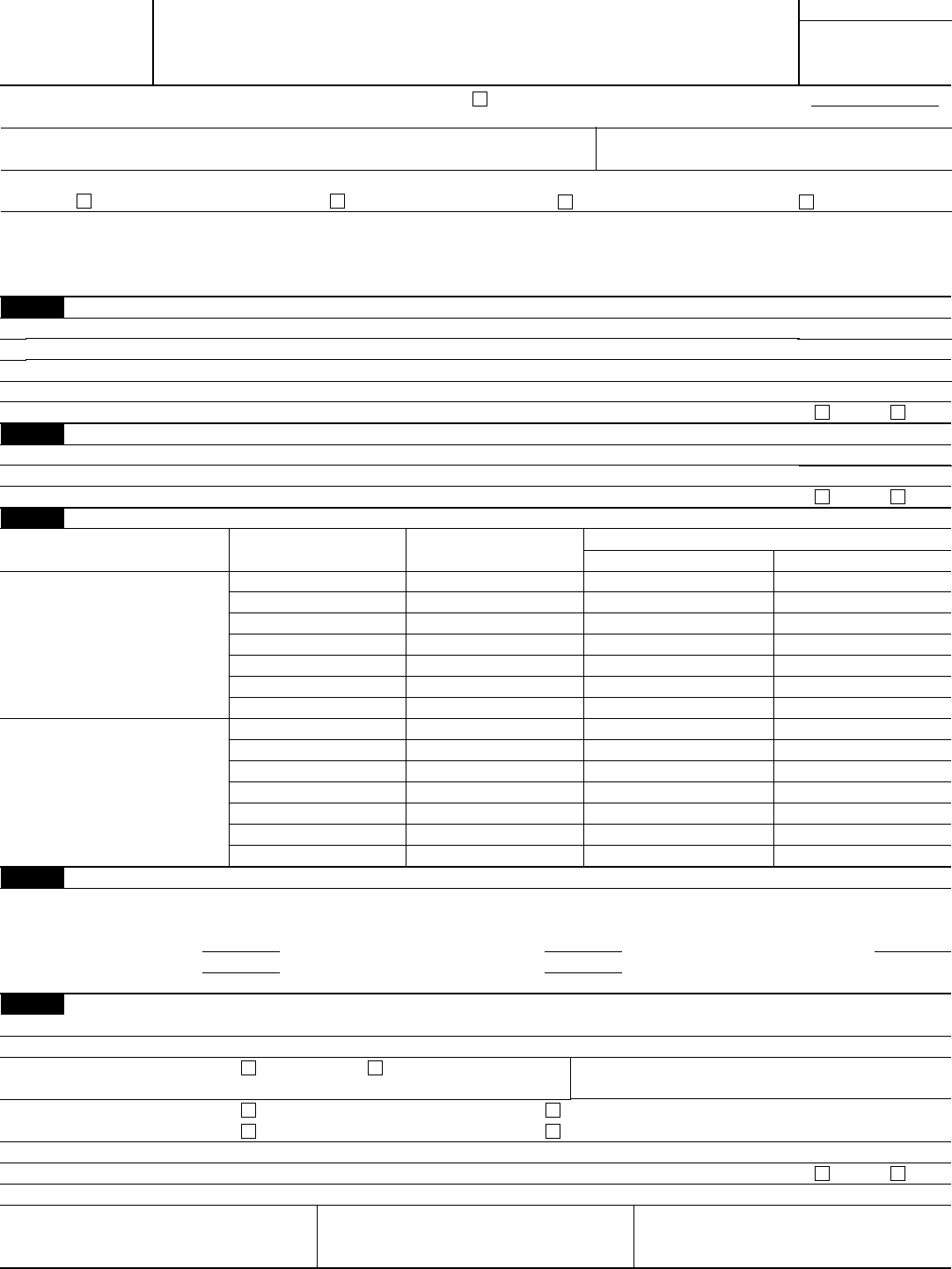

Web check this box if this is an original, amended, or supplemental form 8938 for attachment to a previously filed return. Complete, edit or print tax forms instantly. Web form 8938 instructions (how to report): Irs tax form 8938 instructions involve the reporting of specified foreign financial assets to the irs in accordance with fatca. Part i foreign deposit and.

How to Add Continuation Pages with Form 8938 in H&R Block (Reporting

Web attach form 8938 to your annual return and file by the due date (including extensions) for that return. Download the irs form 8938 from the official website of the internal revenue service. Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Irs tax form 8938 instructions involve the reporting of specified foreign financial assets.

1098 Form 2021 IRS Forms Zrivo

Web form 8938 instructions (how to report): Fincen form 114, report of foreign bank and financial accounts (fbar) who must file? Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Irs tax form 8938 instructions involve the reporting of specified foreign financial assets to the irs in accordance with fatca..

USCs and LPRs residing outside the U.S. and IRS Form 8938 « Tax

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Complete, edit or print tax forms instantly. Web key takeaways form 8938 is used by certain u.s. Web each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service.

The Counting Thread v2 (Page 298) EVGA Forums

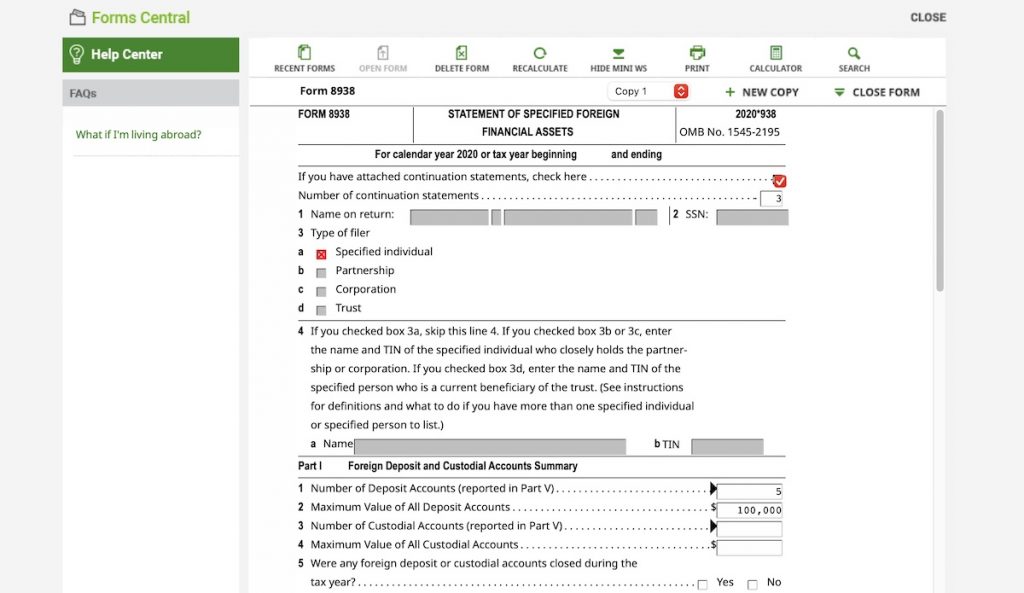

Part i foreign deposit and custodial accounts (see. Person must complete form 8938 and attach it to their form 1040 if. Complete, edit or print tax forms instantly. Web about form 8938, statement of specified foreign financial assets. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have.

How to fill fbar form Fill online, Printable, Fillable Blank

Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting threshold. Web each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form. Do i still need.

What is FATCA? (Foreign Account Tax Compliance Act)

Web to enter the information for form 8938 in the taxact program: Return to data entry and enter a valid address on either screen frgn or co38. Download the irs form 8938 from the official website of the internal revenue service. I searched this question on the forum, but can not find out the. To get to the 8938 section.

Form 8938 Statement of Specified Foreign Financial Assets 2018 DocHub

To get to the 8938 section in turbotax, refer to the following instructions: Use form 8938 to report your specified foreign financial assets if the total value of all the specified foreign. Person must complete form 8938 and attach it to their form 1040 if. Taxpayers who do not have to file an income tax return for the tax year.

What Is IRS Form 8938? (2023)

Web form 8938 instructions (how to report): Web each year, the us government requires us taxpayers who own foreign assets, investments and accounts to disclose this information on internal revenue service form. Ad get ready for tax season deadlines by completing any required tax forms today. Web per the irs, use form 8938 if the total value of all the.

Do YOU need to file Form 8938? “Statement of Specified Foreign

Web key takeaways form 8938 is used by certain u.s. Web the form 8938 must be attached to the taxpayer's annual tax return. The form 8938 instructions are complex. Web filing form 8938 is only available to those using turbotax deluxe or higher. Taxpayers to report specified foreign financial assets each year on a form 8938.

Web Form 8938, Statement Of Specified Foreign Financial Assets.

From within your taxact return ( online or desktop), click federal (on smaller devices, click in the top left corner. The standard penalty is a fine of $10,000 per year. Do i still need to fill form 8938 ? Web key takeaways form 8938 is used by certain u.s.

Web To Enter The Information For Form 8938 In The Taxact Program:

Web check this box if this is an original, amended, or supplemental form 8938 for attachment to a previously filed return. Web there are several ways to submit form 4868. Taxpayers to report specified foreign financial assets each year on a form 8938. Complete, edit or print tax forms instantly.

Web Each Year, The Us Government Requires Us Taxpayers Who Own Foreign Assets, Investments And Accounts To Disclose This Information On Internal Revenue Service Form.

You must specify the applicable calendar year or tax year to which your. Web for tax years beginning after december 31, 2015, certain domestic corporations, partnerships, and trusts that are formed or availed of for the purpose of holding, directly. If the irs notifies taxpayers that they are delinquent, they. Download the irs form 8938 from the official website of the internal revenue service.

Ad Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Web filing form 8938 is only available to those using turbotax deluxe or higher. Person must complete form 8938 and attach it to their form 1040 if. Irs requirements and step by step instructions on how to fill it out. Return to data entry and enter a valid address on either screen frgn or co38.

:max_bytes(150000):strip_icc()/TaxForm8938-31bd8f0fd53f4dc8a8dea33f06fdf460.png)