How To Form A Multi Member Llc

How To Form A Multi Member Llc - Depending on the state in which you are filing, your articles might also be referred to as: Web here is a list of the various forms you will need to file: Web limited liability company (llc) a limited liability company (llc) is a business structure allowed by state statute. The agreement should be created when forming the company as an understanding of how the organization will run. Thus, an llc with multiple owners can either accept its default classification as a partnership, or file form 8832 to elect to be classified as an association taxable as a corporation. To form as an llc, you must file your company's articles of organization with your state's secretary of state office. Because llcs are regulated at the state level, you’ll first file articles of organization of your mmllc with your secretary of state. All taxpayers must file this form. Be prepared to make some decisions ahead of time and share some info when you register: Web divorce updated july 8, 2020:

Thus, an llc with multiple owners can either accept its default classification as a partnership, or file form 8832 to elect to be classified as an association taxable as a corporation. Depending on the state in which you are filing, your articles might also be referred to as: Web here is a list of the various forms you will need to file: Just as everyone in the us needs a social security number (ssn), all businesses. Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Because llcs are regulated at the state level, you’ll first file articles of organization of your mmllc with your secretary of state. Get your unique identification number. Your business name will shape your logo and branding, impact your marketing, and make or. Partners report their individual share of profit or loss on their personal tax return. Web divorce updated july 8, 2020:

Web here is a list of the various forms you will need to file: Be prepared to make some decisions ahead of time and share some info when you register: Certificate of organization certificate of formation All taxpayers must file this form. Thus, an llc with multiple owners can either accept its default classification as a partnership, or file form 8832 to elect to be classified as an association taxable as a corporation. Web limited liability company (llc) a limited liability company (llc) is a business structure allowed by state statute. The agreement should be created when forming the company as an understanding of how the organization will run. Depending on the state in which you are filing, your articles might also be referred to as: That means if someone sues your business, in most cases, only the business’s assets are at stake. To form as an llc, you must file your company's articles of organization with your state's secretary of state office.

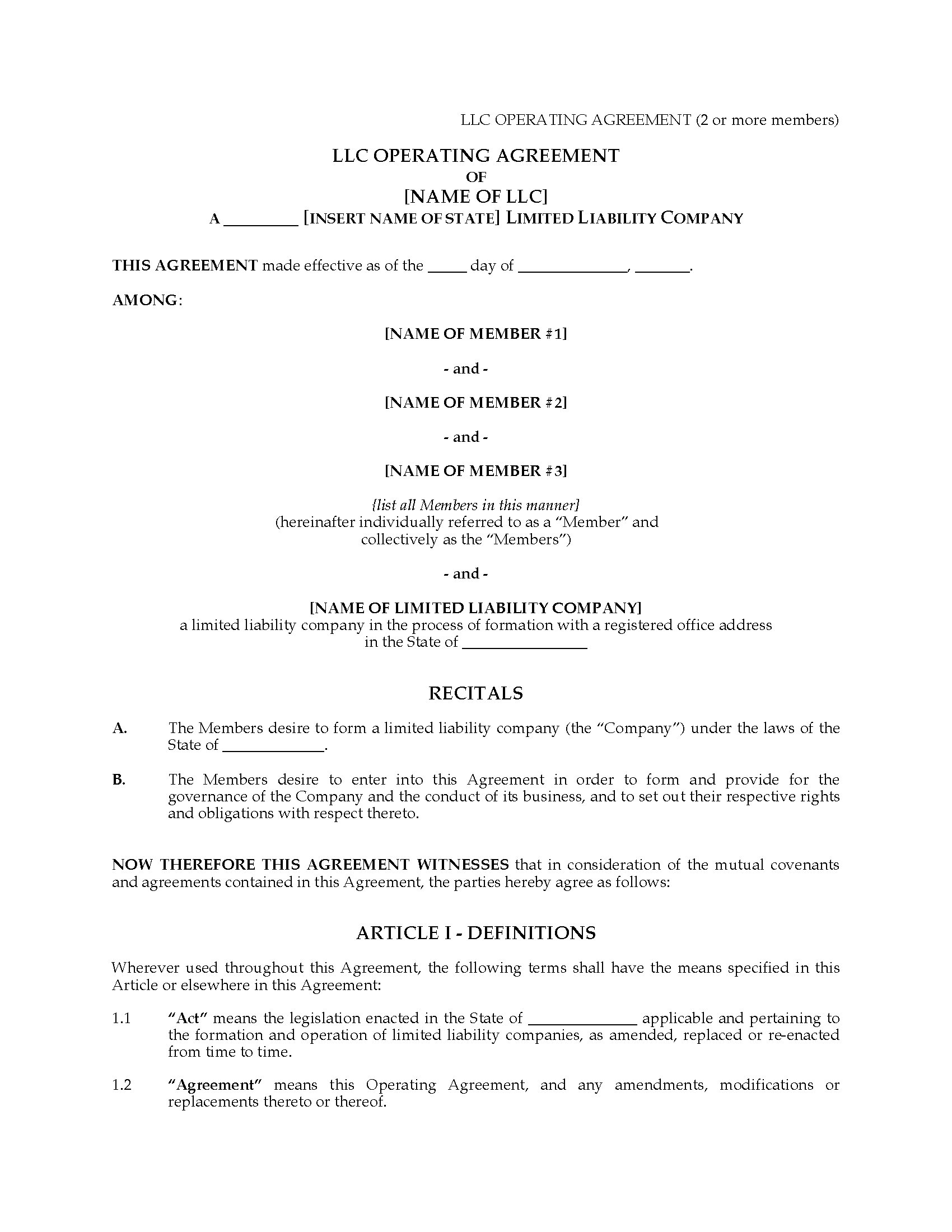

USA LLC Operating Agreement for Multimember Company Legal Forms and

Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Certificate of organization certificate of formation Just as everyone in the us needs a social security number (ssn), all businesses. Your business name will shape your logo and branding, impact your marketing, and make or. Get your unique identification.

Board Member Bio Template Resume Examples

Get your unique identification number. Web divorce updated july 8, 2020: Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. To form as an llc, you must file your company's articles of organization with your state's secretary of state office. Your business name will shape your logo and.

Properly Completing IRS Form W9 for Your IRA/LLC or Checkbook Control

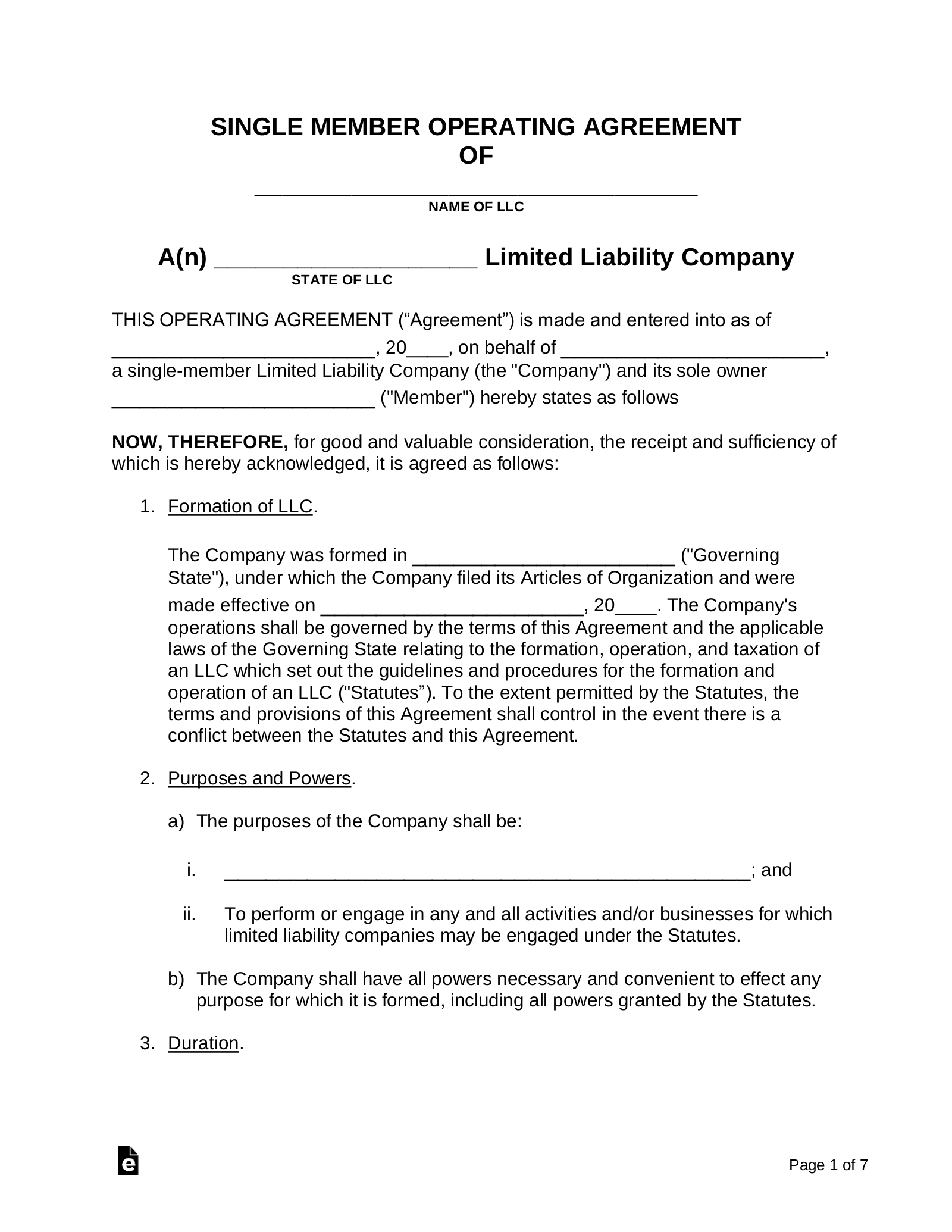

Be prepared to make some decisions ahead of time and share some info when you register: The agreement should be created when forming the company as an understanding of how the organization will run. Web limited liability company (llc) a limited liability company (llc) is a business structure allowed by state statute. Certificate of organization certificate of formation To form.

Corporation Operating Agreement Template Collection

Your business name will shape your logo and branding, impact your marketing, and make or. Each state may use different regulations, you should check with your state if you are interested in starting a limited liability company. Get your unique identification number. Owners of an llc are called members. To form as an llc, you must file your company's articles.

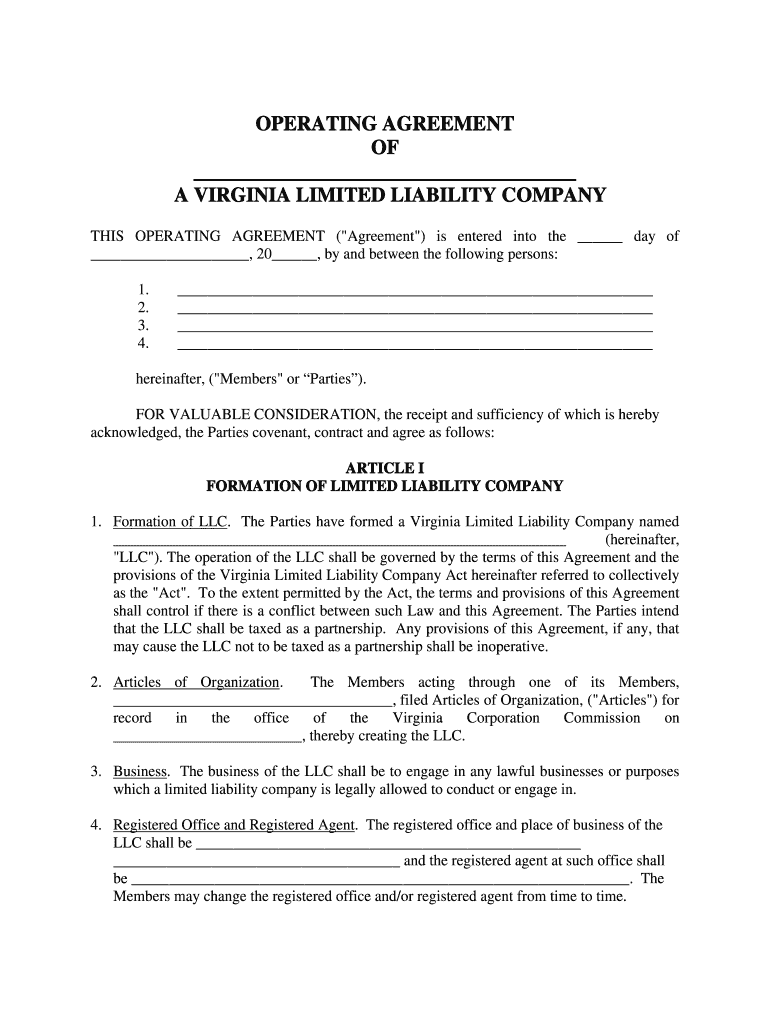

Llc Operating Agreement Virginia Fill Out and Sign Printable PDF

Certificate of organization certificate of formation Depending on the state in which you are filing, your articles might also be referred to as: Be prepared to make some decisions ahead of time and share some info when you register: Your business name will shape your logo and branding, impact your marketing, and make or. Web here is a list of.

What is a MultiMember LLC? The Pros and Cons Gusto

Partners report their individual share of profit or loss on their personal tax return. Owners of an llc are called members. Thus, an llc with multiple owners can either accept its default classification as a partnership, or file form 8832 to elect to be classified as an association taxable as a corporation. Web pursuant to the entity classification rules, a.

Best Templates Free Multiple MemberManaged LLC Operating Agreement

Partners report their individual share of profit or loss on their personal tax return. That means if someone sues your business, in most cases, only the business’s assets are at stake. To form as an llc, you must file your company's articles of organization with your state's secretary of state office. Just as everyone in the us needs a social.

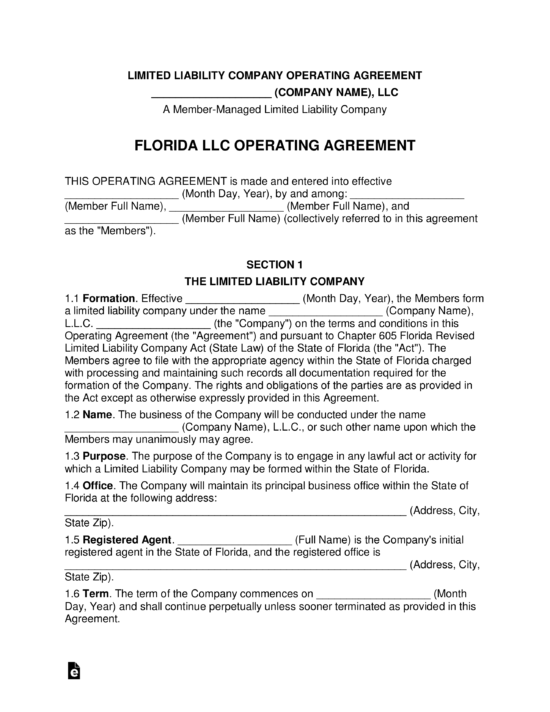

Florida MultiMember LLC Operating Agreement Form eForms

That means if someone sues your business, in most cases, only the business’s assets are at stake. Thus, an llc with multiple owners can either accept its default classification as a partnership, or file form 8832 to elect to be classified as an association taxable as a corporation. Just as everyone in the us needs a social security number (ssn),.

Single Member LLC vs. MultiMember LLC Pros & Cons

Be prepared to make some decisions ahead of time and share some info when you register: Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. Depending on the state in which you are filing, your articles might also be referred to as: Thus, an llc with multiple owners.

California LLC Operating Agreement Template PDF Word

To form as an llc, you must file your company's articles of organization with your state's secretary of state office. Certificate of organization certificate of formation That means if someone sues your business, in most cases, only the business’s assets are at stake. Your business name will shape your logo and branding, impact your marketing, and make or. Thus, an.

Web Limited Liability Company (Llc) A Limited Liability Company (Llc) Is A Business Structure Allowed By State Statute.

Your business name will shape your logo and branding, impact your marketing, and make or. Partners report their individual share of profit or loss on their personal tax return. Each state may use different regulations, you should check with your state if you are interested in starting a limited liability company. Get your unique identification number.

Certificate Of Organization Certificate Of Formation

Owners of an llc are called members. Depending on the state in which you are filing, your articles might also be referred to as: Web divorce updated july 8, 2020: The agreement should be created when forming the company as an understanding of how the organization will run.

Be Prepared To Make Some Decisions Ahead Of Time And Share Some Info When You Register:

Because llcs are regulated at the state level, you’ll first file articles of organization of your mmllc with your secretary of state. Web pursuant to the entity classification rules, a domestic entity that has more than one member will default to a partnership. All taxpayers must file this form. Web here is a list of the various forms you will need to file:

Just As Everyone In The Us Needs A Social Security Number (Ssn), All Businesses.

To form as an llc, you must file your company's articles of organization with your state's secretary of state office. That means if someone sues your business, in most cases, only the business’s assets are at stake. Thus, an llc with multiple owners can either accept its default classification as a partnership, or file form 8832 to elect to be classified as an association taxable as a corporation.