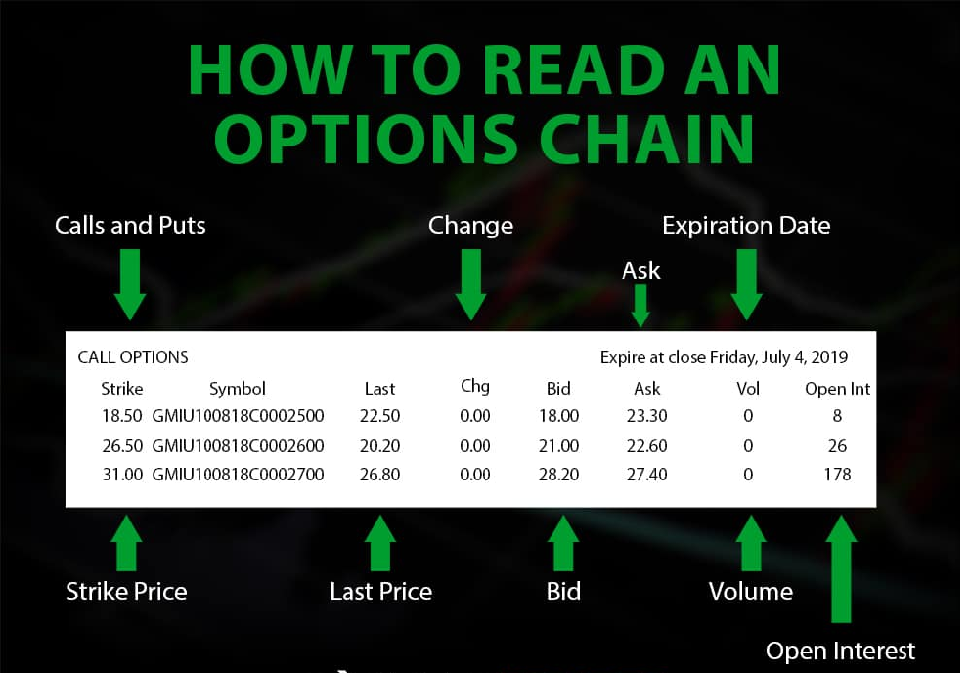

How To Read An Options Chain

How To Read An Options Chain - Web an option chain is utilized by investors to view the pricing and activity of all of the listed options for the selected underlying. It shows all listed puts, calls,. Web an options chain, also known as an options matrix, is a listing of all available options contracts for a given security. Web reading option chain data. Web the order of columns in an option chain is as follows: You first need to choose the security you want to buy options for. Strike, symbol, last, change, bid, ask, volume, and open interest. Each option contract has its own. The first column will show us the volume of contracts that are being traded. How is the option chain organized?

Web an options chain, also known as an options matrix, is a listing of all available options contracts for a given security. Web an option chain is utilized by investors to view the pricing and activity of all of the listed options for the selected underlying. How is the option chain organized? Web the order of columns in an option chain is as follows: Before you get to see an option chain, you first need to do some filtering. The volume in the options chain. The first column will show us the volume of contracts that are being traded. Web how to read an option chain. Strike, symbol, last, change, bid, ask, volume, and open interest. Web reading option chain data.

It shows all listed puts, calls,. Web the order of columns in an option chain is as follows: The volume in the options chain. Each option contract has its own. Web reading option chain data. Before you get to see an option chain, you first need to do some filtering. How is the option chain organized? Strike, symbol, last, change, bid, ask, volume, and open interest. Let us begin from left to right. You first need to choose the security you want to buy options for.

How to Read an Options Chain [Beginners Guide]

How is the option chain organized? Before you get to see an option chain, you first need to do some filtering. Let us begin from left to right. Web an option chain is utilized by investors to view the pricing and activity of all of the listed options for the selected underlying. The first column will show us the volume.

Option Chain Definition

It shows all listed puts, calls,. You first need to choose the security you want to buy options for. How is the option chain organized? Each option contract has its own. Before you get to see an option chain, you first need to do some filtering.

A Newbie's Guide to Reading an Options Chain

Strike, symbol, last, change, bid, ask, volume, and open interest. Web reading option chain data. Before you get to see an option chain, you first need to do some filtering. It shows all listed puts, calls,. Web an option chain is utilized by investors to view the pricing and activity of all of the listed options for the selected underlying.

How to Read an Options Chain The Ultimate Guide Option strategies

Web the order of columns in an option chain is as follows: Strike, symbol, last, change, bid, ask, volume, and open interest. Web an option chain is utilized by investors to view the pricing and activity of all of the listed options for the selected underlying. Before you get to see an option chain, you first need to do some.

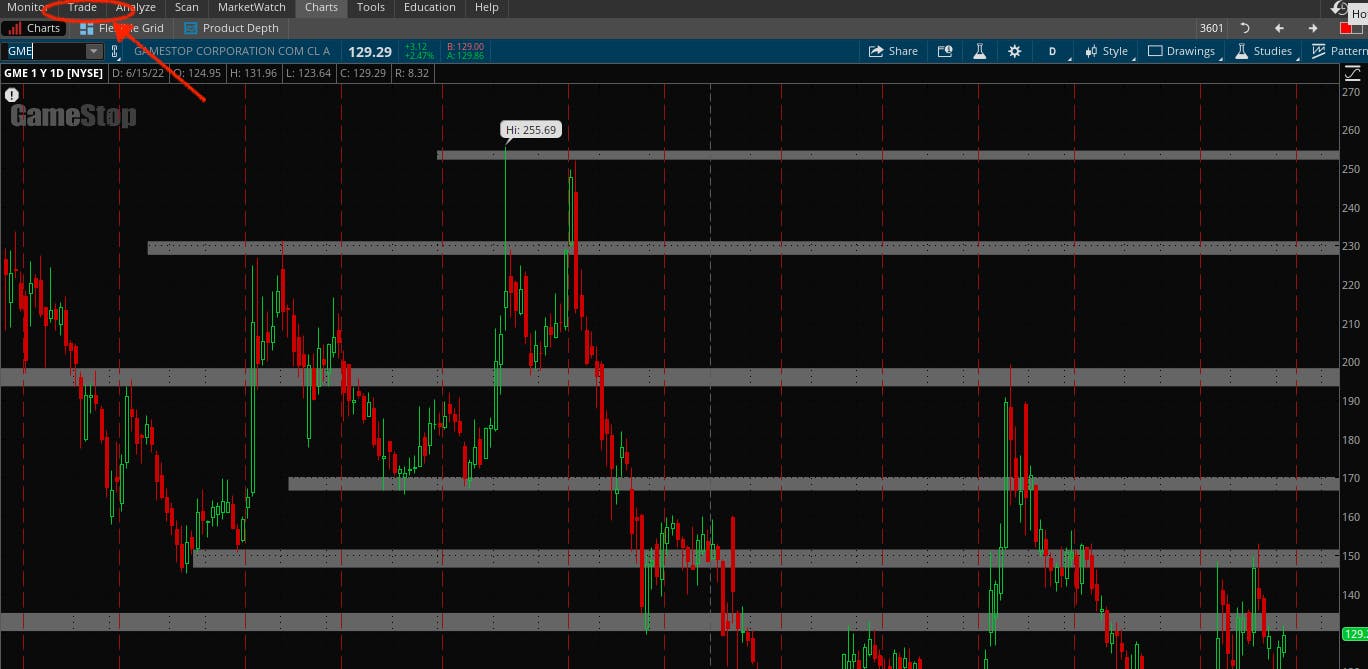

How To Read The Thinkorswim Options Chain

Web the order of columns in an option chain is as follows: You first need to choose the security you want to buy options for. Web an options chain, also known as an options matrix, is a listing of all available options contracts for a given security. Each option contract has its own. The volume in the options chain.

Option Chains Quotes Inspiration

Web an options chain, also known as an options matrix, is a listing of all available options contracts for a given security. Let us begin from left to right. It shows all listed puts, calls,. Web reading option chain data. Web an option chain is utilized by investors to view the pricing and activity of all of the listed options.

How to read options chain?

Strike, symbol, last, change, bid, ask, volume, and open interest. How is the option chain organized? You first need to choose the security you want to buy options for. It shows all listed puts, calls,. Each option contract has its own.

How To Read An Option Chain Correctly Your 101 Only Guide!

Strike, symbol, last, change, bid, ask, volume, and open interest. Let us begin from left to right. You first need to choose the security you want to buy options for. The volume in the options chain. Before you get to see an option chain, you first need to do some filtering.

How to Read an Options Chain.pdf Put Option Option (Finance)

Web an option chain is utilized by investors to view the pricing and activity of all of the listed options for the selected underlying. Let us begin from left to right. The volume in the options chain. Web an options chain, also known as an options matrix, is a listing of all available options contracts for a given security. Each.

How to Read an Options Chain The Ultimate Guide in 2020 Options

The volume in the options chain. Before you get to see an option chain, you first need to do some filtering. The first column will show us the volume of contracts that are being traded. Web how to read an option chain. Web reading option chain data.

Web Reading Option Chain Data.

Strike, symbol, last, change, bid, ask, volume, and open interest. Before you get to see an option chain, you first need to do some filtering. Web how to read an option chain. You first need to choose the security you want to buy options for.

Let Us Begin From Left To Right.

Web an option chain is utilized by investors to view the pricing and activity of all of the listed options for the selected underlying. The first column will show us the volume of contracts that are being traded. It shows all listed puts, calls,. How is the option chain organized?

Web The Order Of Columns In An Option Chain Is As Follows:

The volume in the options chain. Web an options chain, also known as an options matrix, is a listing of all available options contracts for a given security. Each option contract has its own.

![How to Read an Options Chain [Beginners Guide]](https://daytradingz.com/wp-content/uploads/2022/01/how-to-read-an-options-chain-202201.png)

:max_bytes(150000):strip_icc()/outrightoptiontradeexampleAAPL-01e05f85d910444cb5c8119c7b830dc5.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_A_Newbies_Guide_to_Reading_an_Options_Chain_2020-01-92888ba78f8a4f519e037a483501af81.jpg)