I Forgot To File A Tax Form

I Forgot To File A Tax Form - An individual having salary income should collect. To validate and successfully submit. If you forgot to file your tax return, the internal. The first step of filing itr is to collect all the documents related to the process. Web some people haven't filed a 2021 tax return because they're still waiting on their 2020 tax return to be processed. Free federal filing, state only $17.99. Web if you haven’t filed your federal income tax return for this year or for previous years, you should file your return as soon as possible regardless of your reason for not. You can claim hra while filing your income tax return (itr)[7]. Web as this irs tip sheet says, you can call the irs, who will then contact your employer or other financial entity to get the information you need. Web even if you forgot to file your income tax return for previous years in the u.s., you can and should file them now.

There is no way to estimate the. Premium 2021 tax software for late tax returns. To validate and successfully submit. If you forgot to file your tax return, the internal. On the irs website, we can download the q1. Web time limitations time is of the essence in refiling your amended form. Web as this irs tip sheet says, you can call the irs, who will then contact your employer or other financial entity to get the information you need. Typically, if your income is. While taxpayers can use software to. Online prior year tax prep makes it easy.

Web as this irs tip sheet says, you can call the irs, who will then contact your employer or other financial entity to get the information you need. You will need to contact your past employers to obtain any payroll. Typically, if your income is. But there's no need to wait. You have only two years to file the amended tax form to reclaim cash if you didn't file the original form on. Ensure you present the right. Web time limitations time is of the essence in refiling your amended form. You can claim hra while filing your income tax return (itr)[7]. To validate and successfully submit. That's why the q1of 941 form is not generating within your company file.

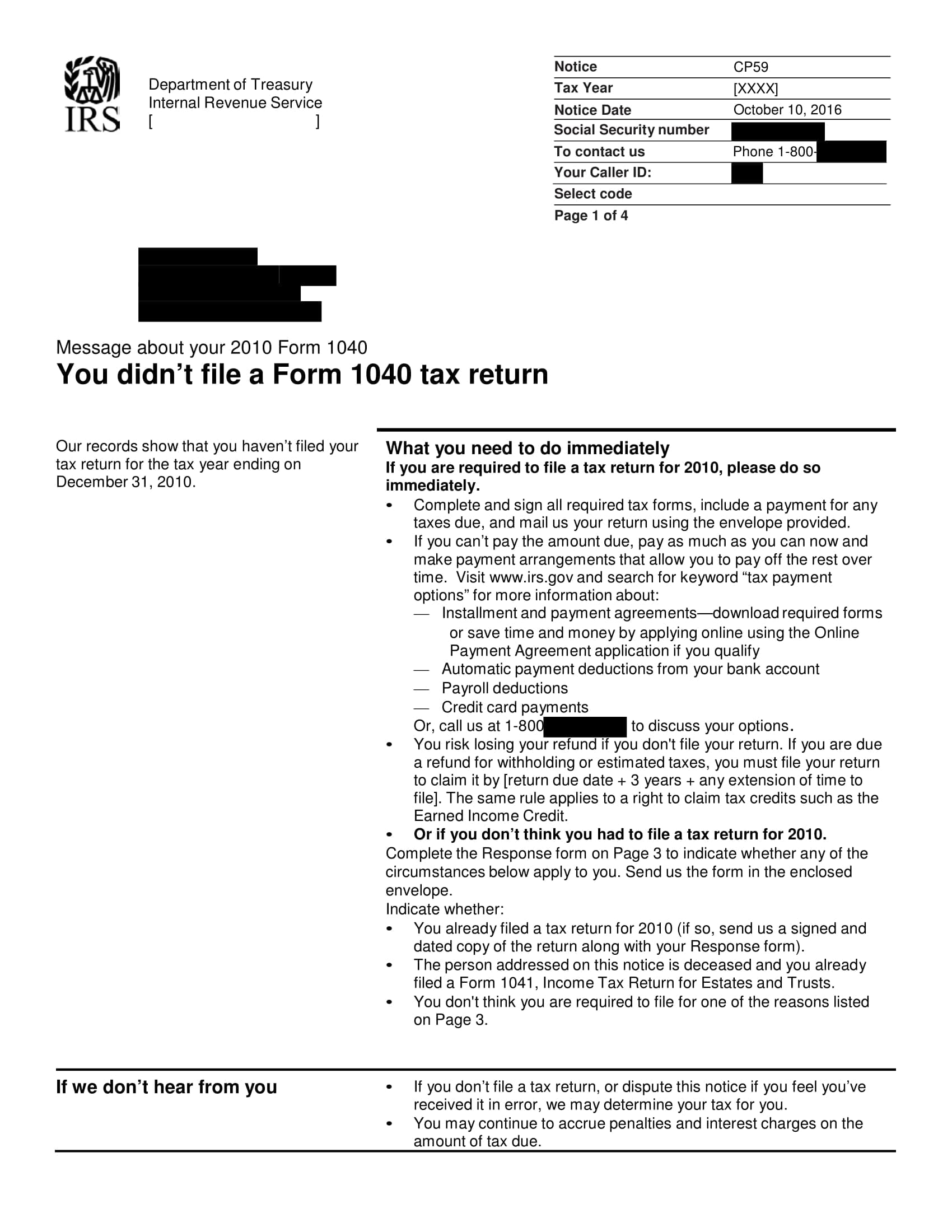

I to file my tax return. Did I commit tax evasion

Premium 2021 tax software for late tax returns. While taxpayers can use software to. Web some people haven't filed a 2021 tax return because they're still waiting on their 2020 tax return to be processed. The first step of filing itr is to collect all the documents related to the process. To validate and successfully submit.

To Verify Your Tax Return (ITR) File Condonation of

Tax forms image by chad mcdermott from fotolia.com. Free federal filing, state only $17.99. But there's no need to wait. Web as this irs tip sheet says, you can call the irs, who will then contact your employer or other financial entity to get the information you need. Web time limitations time is of the essence in refiling your amended.

Paper calculations 20 of Americans are making this tax filing mistake

If you forgot to file your tax return, the internal. Web anyone who didn't file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest. There is no way to estimate the. Web documents needed to file itr; To validate and successfully submit.

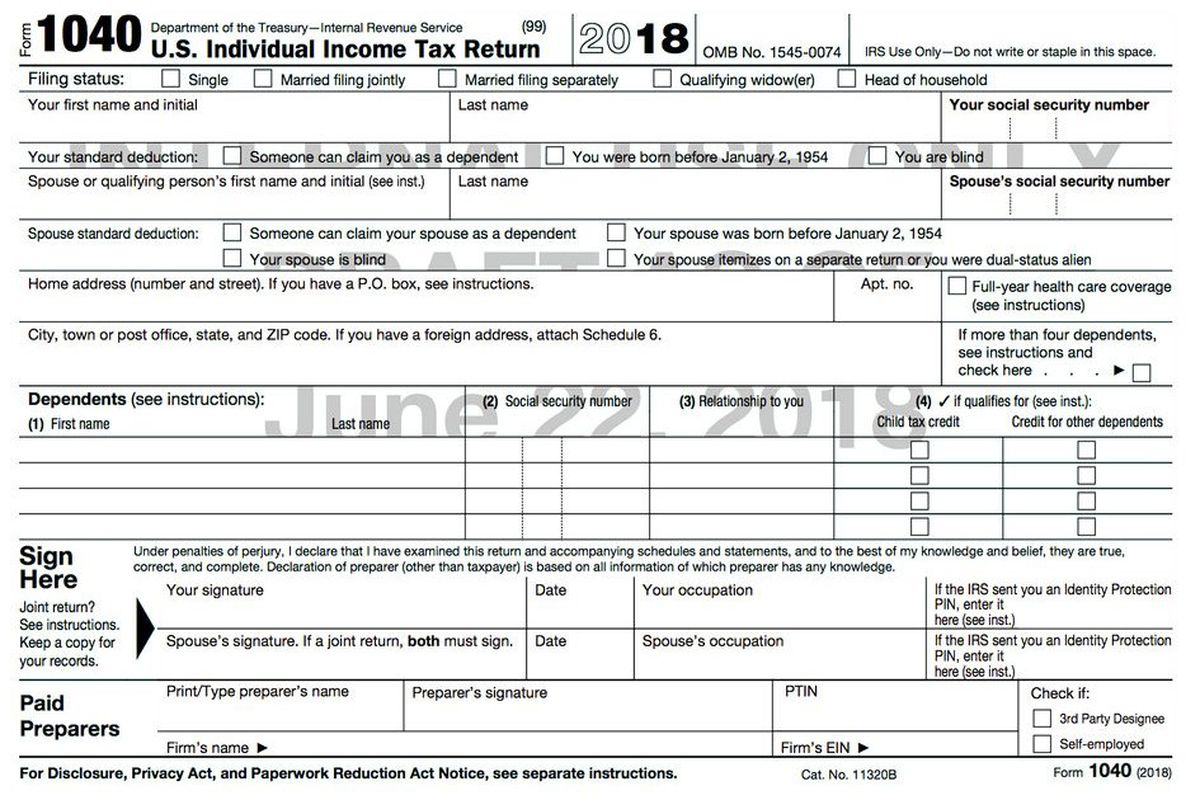

The IRS Shrinks The 1040 Tax Form But The Workload Stays 1040 Form

Web the gift tax return is a separate tax return. You can claim hra while filing your income tax return (itr)[7]. Web documents needed to file itr; The first step of filing itr is to collect all the documents related to the process. While taxpayers can use software to.

Tax efiling password? Recover in new method YouTube

Ad file late 2021 federal taxes 100% free. Online prior year tax prep makes it easy. There is no way to estimate the. Web if you haven’t filed your federal income tax return for this year or for previous years, you should file your return as soon as possible regardless of your reason for not. A 1099 form is an.

E File Tax Form 7004 Universal Network

Web if you haven’t filed your federal income tax return for this year or for previous years, you should file your return as soon as possible regardless of your reason for not. Tax forms image by chad mcdermott from fotolia.com. The first step of filing itr is to collect all the documents related to the process. Web if you've overlooked.

Tax Q&A What to do if you a tax payment

Individual income tax return, to correct their tax return. But there's no need to wait. Premium 2021 tax software for late tax returns. You can claim hra while filing your income tax return (itr)[7]. Ad file late 2021 federal taxes 100% free.

To File Your NJ Taxes? Here's What You Should Do Now

Web anyone who didn't file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest. Web filing a late tax return might save you tax penalties. If you forgot to file your tax return, the internal. Web in fact, you won’t need to file a tax.

How to File Tax Form 1120 for Your Small Business (2023)

You will need to contact your past employers to obtain any payroll. Web filing a late tax return might save you tax penalties. Ad file late 2021 federal taxes 100% free. Web if you've overlooked submitting rent receipts to your employer, fret not. Online prior year tax prep makes it easy.

What If You To File Taxes Last Year

Web if you haven’t filed your federal income tax return for this year or for previous years, you should file your return as soon as possible regardless of your reason for not. Tax forms image by chad mcdermott from fotolia.com. You have only two years to file the amended tax form to reclaim cash if you didn't file the original.

You Can Claim Hra While Filing Your Income Tax Return (Itr)[7].

On the irs website, we can download the q1. Tax forms image by chad mcdermott from fotolia.com. Premium 2021 tax software for late tax returns. If you forgot to file your tax return, the internal.

To Validate And Successfully Submit.

Ad file late 2021 federal taxes 100% free. Web anyone who didn't file and owes tax should file a return as soon as they can and pay as much as they can to reduce penalties and interest. You will need to contact your past employers to obtain any payroll. Web some people haven't filed a 2021 tax return because they're still waiting on their 2020 tax return to be processed.

You Have Only Two Years To File The Amended Tax Form To Reclaim Cash If You Didn't File The Original Form On.

That's why the q1of 941 form is not generating within your company file. Web documents needed to file itr; But there's no need to wait. The first step of filing itr is to collect all the documents related to the process.

Ensure You Present The Right.

Web the gift tax return is a separate tax return. Web what happens when someone forgets to file a 1099 on their tax return? Free federal filing, state only $17.99. Web time limitations time is of the essence in refiling your amended form.