Idaho State Withholding Form

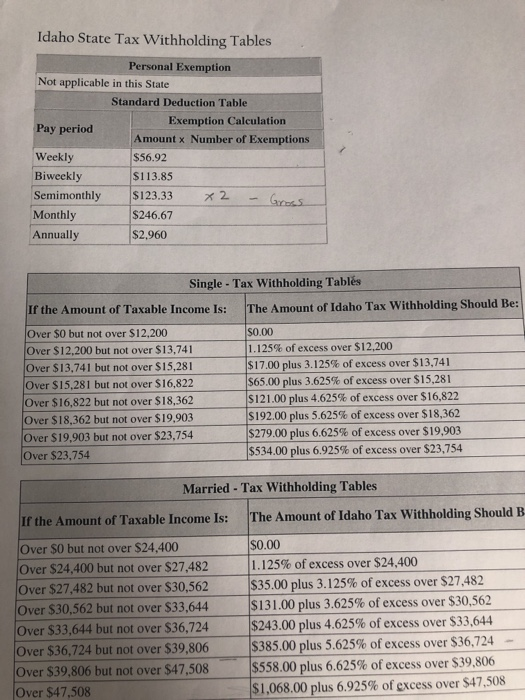

Idaho State Withholding Form - Web the amount of idaho tax withholding should be: The annual amount, per exemption allowance, has changed from $3,154 to. Web this form is to help you estimate your penalty and interest. All payments are due on or before the due date as shown in the due date table. Web symmetry software jan 11, 2019 in compliance. Employers are required by idaho law to withhold income tax from their employees’ wages. Sign the form and give it to your employer. If you’re an employee, your employer probably withholds. Web idaho income taxes electronically or with a form 910, idaho withholding payment voucher. Web ★ 4.8 satisfied 43 votes how to fill out and sign idaho 910 form online?

The amount of idaho state tax was withheld from your retirement benefit. Employers engaged in a trade or business who. Web if the entity paying the nonwage income will withhold idaho tax for you: Affidavit verifying income rtf pdf. Web the income tax withholding formula for the state of idaho has changed as follows: The annual amount, per exemption allowance, has changed from $2,960 to. Sign the form and give it to your employer. The annual amount, per exemption allowance, has changed from $3,154 to. Instructions complete this form in dark ink. Acknowledgment of service by defendant rtf pdf.

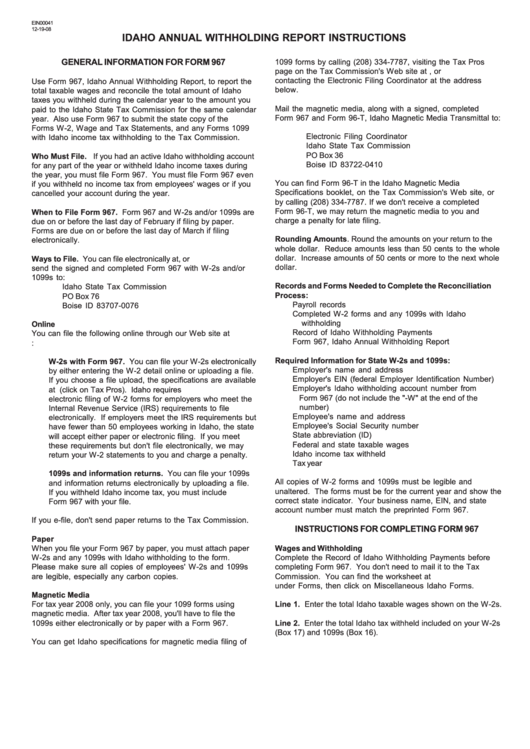

We last updated idaho form 967 in february 2023 from the idaho state tax commission. Web more about the idaho form 967 tax return. Web the income tax withholding formula for the state of idaho has changed as follows: Web july 20, 2023. Sign the form and give it to your employer. Web this form is to help you estimate your penalty and interest. Web idaho income taxes electronically or with a form 910, idaho withholding payment voucher. This form is for income earned in tax year. Web withholding tables updated for 2023. Web use this form to indicate your withholdings from your persi benefit payment state of idaho taxes.

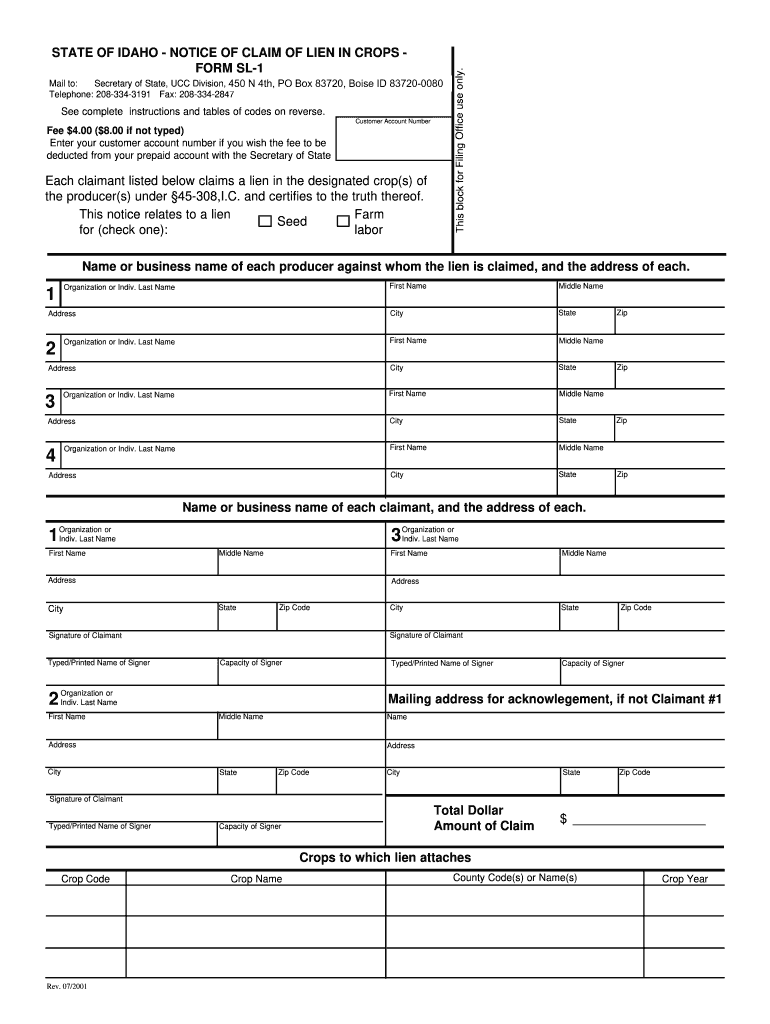

Mechanics Lien Pdf Fill Out and Sign Printable PDF Template signNow

If you’re an employee, your employer probably withholds. Over $0 but not over $12,400. If you make an error, cross out the. Web ★ 4.8 satisfied 43 votes how to fill out and sign idaho 910 form online? Sign the form and give it to your employer.

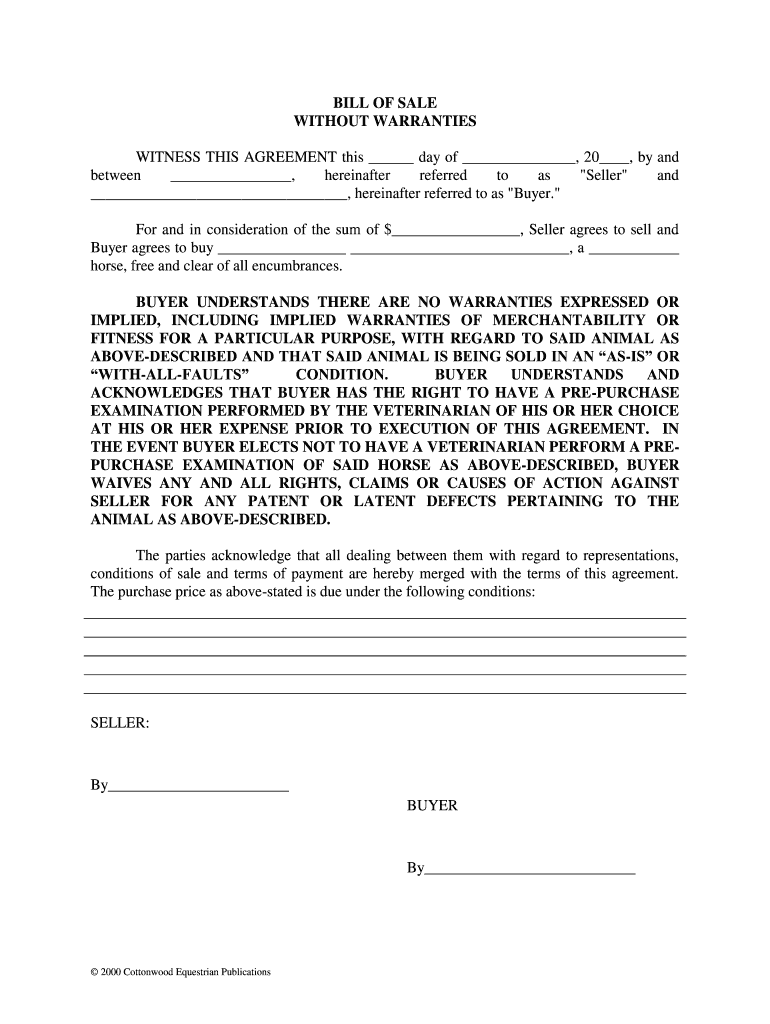

Amount Due In Accordance With The Laws Of The State Of Idaho Fill Out

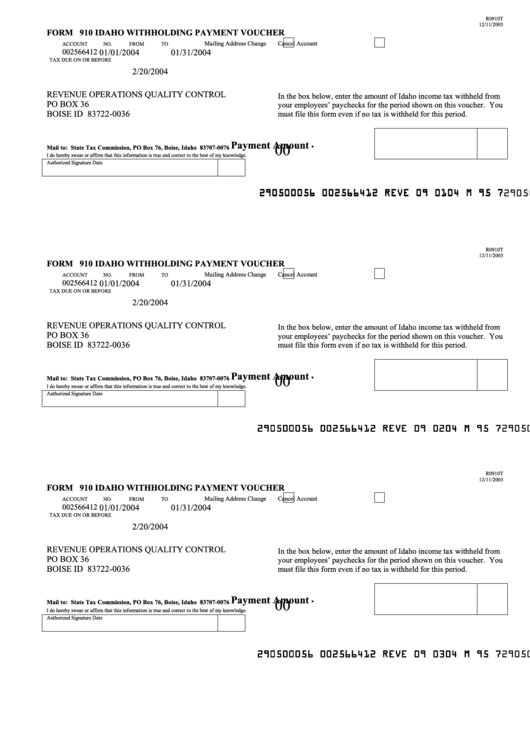

Web idaho income taxes electronically or with a form 910, idaho withholding payment voucher. Web july 20, 2023. We’ve updated the income tax withholding tables for 2023 due to a law change that. All payments are due on or before the due date as shown in the due date table. If you make an error, cross out the.

Form 910 Idaho Withholding Payment Voucher 2004 printable pdf download

Web this form is to help you estimate your penalty and interest. Employers are required by idaho law to withhold income tax from their employees’ wages. Web ★ 4.8 satisfied 43 votes how to fill out and sign idaho 910 form online? All payments are due on or before the due date as shown in the due date table. Web.

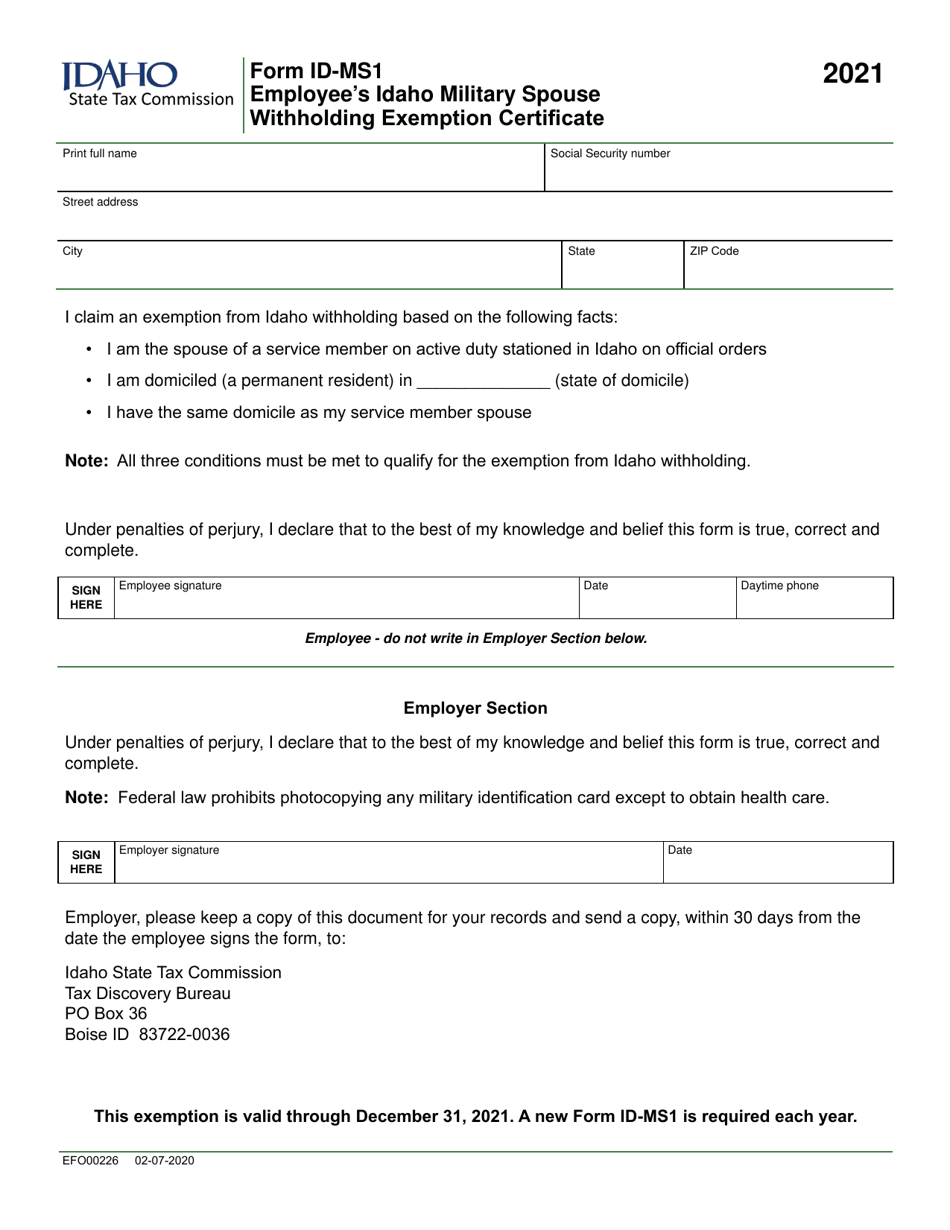

Form IDMS1 (EFO00226) Download Fillable PDF or Fill Online Employee's

The annual amount, per exemption allowance, has changed from $3,154 to. Web if the entity paying the nonwage income will withhold idaho tax for you: Over $12,400 but not over $13,968. Affidavit of service with orders rtf pdf. Web use this form to indicate your withholdings from your persi benefit payment state of idaho taxes.

Instructions For Form 967 Idaho Annual Withholding Report printable

Sign the form and give it to your employer. Affidavit verifying income rtf pdf. Web ★ 4.8 satisfied 43 votes how to fill out and sign idaho 910 form online? The annual amount, per exemption allowance, has changed from $3,154 to. Snohomish county tax preparer pleads guilty to assisting in the.

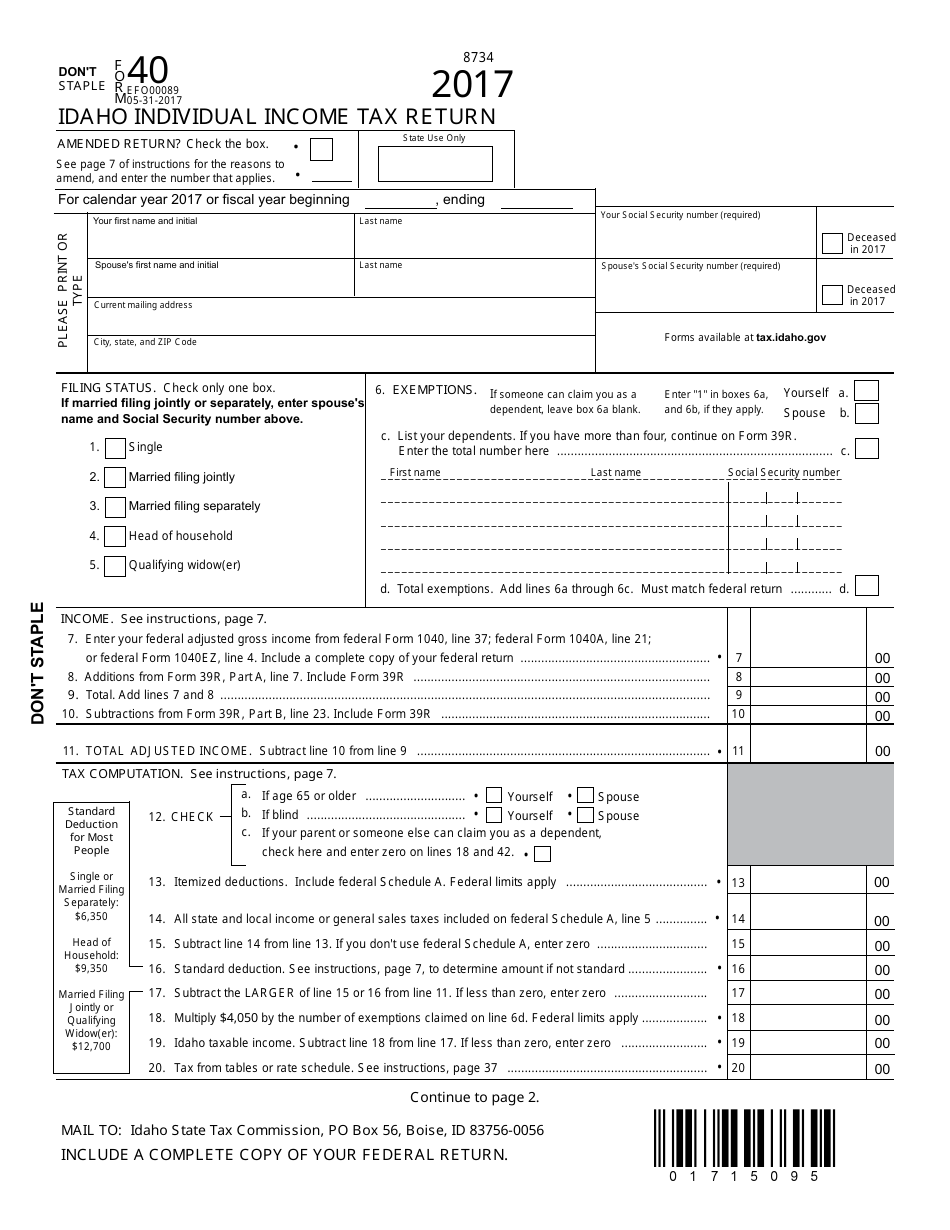

Form 40 Download Fillable PDF or Fill Online Idaho Individual

Sign the form and give it to your employer. Affidavit verifying income rtf pdf. We last updated idaho form 967 in february 2023 from the idaho state tax commission. This form is for income earned in tax year. Web more about the idaho form 967 tax return.

Nys Withholding Tax Forms 2022

Over $0 but not over $12,400. Affidavit of service with orders rtf pdf. Instructions complete this form in dark ink. Acknowledgment of service by defendant rtf pdf. We last updated idaho form 967 in february 2023 from the idaho state tax commission.

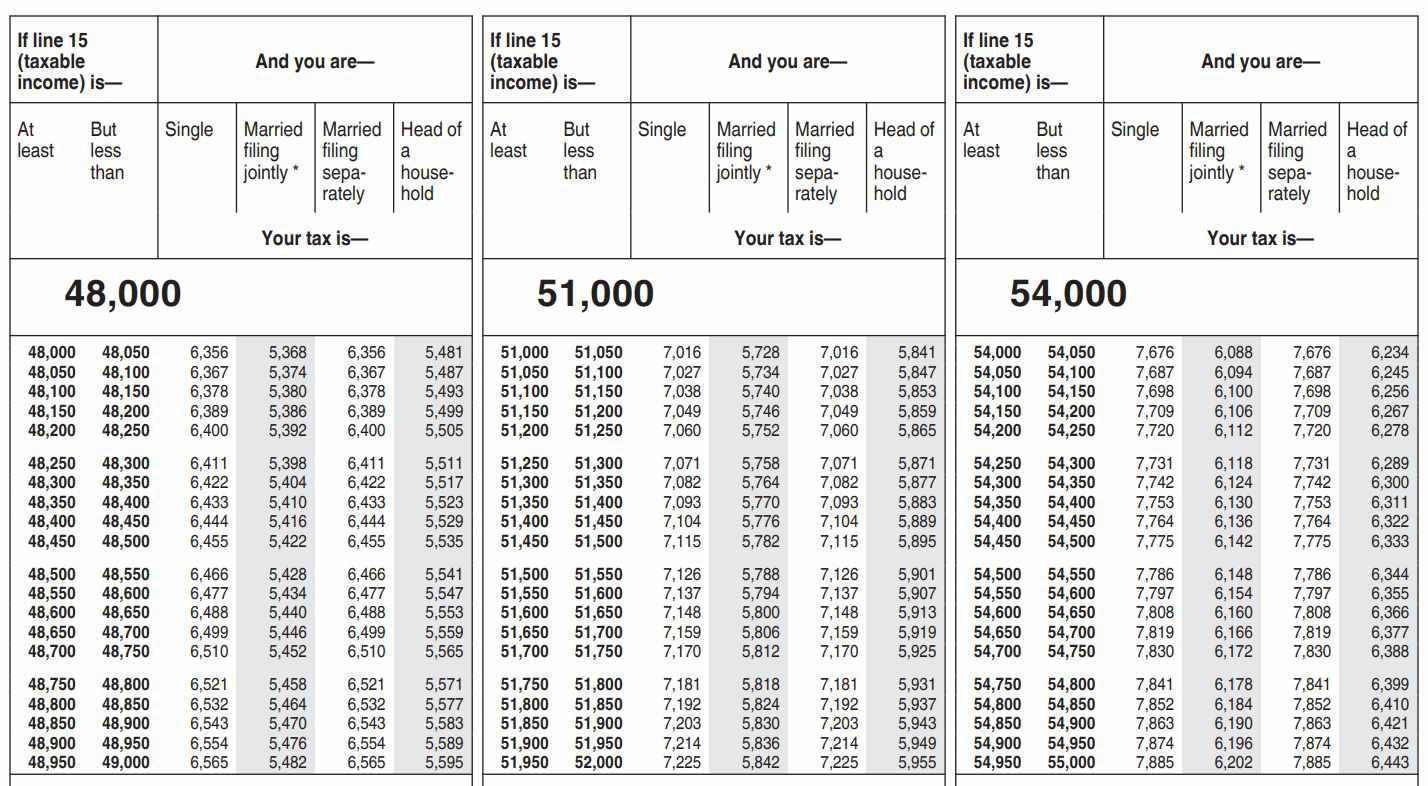

please answer the gross pay, state withholdings,

Employers engaged in a trade or business who. We’ve updated the income tax withholding tables for 2023 due to a law change that. Web if the entity paying the nonwage income will withhold idaho tax for you: If you’re an employee, your employer probably withholds. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement.

What Is The Annual Withholding Allowance For 2022 Gettrip24

Acknowledgment of service by defendant rtf pdf. Instructions complete this form in dark ink. Over $12,400 but not over $13,968. All payments are due on or before the due date as shown in the due date table. Web if the entity paying the nonwage income will withhold idaho tax for you:

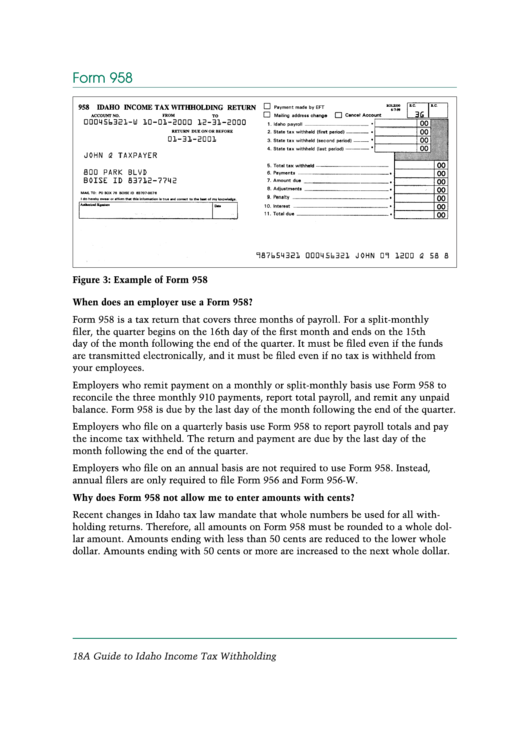

Form 958 Idaho Tax Withholding Return printable pdf download

Please make sure to choose the correct tax type before entering your information. Employers engaged in a trade or business who. We’ve updated the income tax withholding tables for 2023 due to a law change that. Web use this form to indicate your withholdings from your persi benefit payment state of idaho taxes. Affidavit verifying income rtf pdf.

This Form Is For Income Earned In Tax Year.

Over $12,400 but not over $13,968. Employers engaged in a trade or business who. Snohomish county tax preparer pleads guilty to assisting in the. Web the income tax withholding formula for the state of idaho has changed as follows:

Sign The Form And Give It To Your Employer.

Affidavit of service with orders rtf pdf. Web the income tax withholding formula for the state of idaho has changed as follows: Web idaho income taxes electronically or with a form 910, idaho withholding payment voucher. Acknowledgment of service by defendant rtf pdf.

Web Use This Form To Indicate Your Withholdings From Your Persi Benefit Payment State Of Idaho Taxes.

Web july 20, 2023. If you’re an employee, your employer probably withholds. All payments are due on or before the due date as shown in the due date table. Web ★ 4.8 satisfied 43 votes how to fill out and sign idaho 910 form online?

Web More About The Idaho Form 967 Tax Return.

We’ve updated the income tax withholding tables for 2023 due to a law change that. The amount of idaho state tax was withheld from your retirement benefit. Web eligible homeowners can now apply online for property tax deferral. Web the amount of idaho tax withholding should be: