Ihss Tax Exempt Form

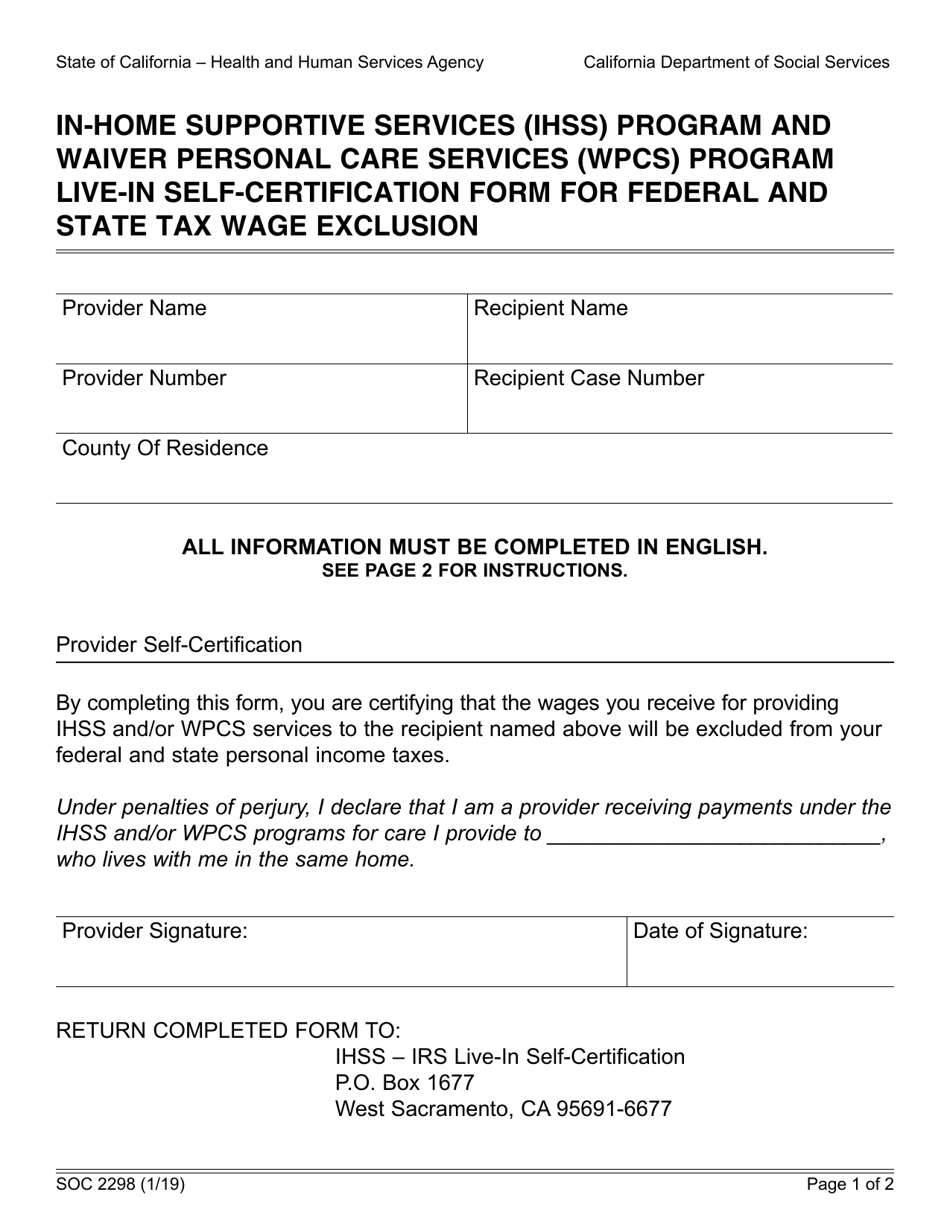

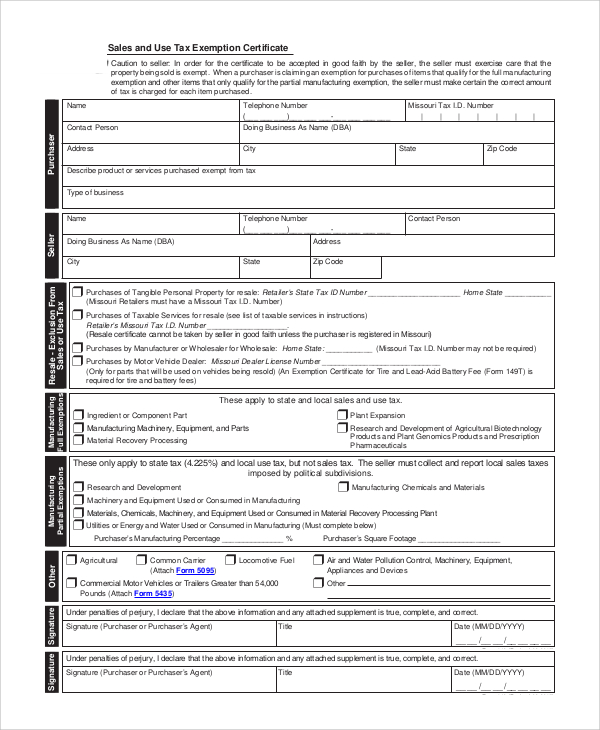

Ihss Tax Exempt Form - Web click image to zoom. Caregivers are typically employees of the individuals for whom they provide services because they work. This form is for income earned in tax year 2022, with tax returns due in april 2023. In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the property being sold is exempt. 505, tax withholding and estimated tax. As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted. These forms are unique to. The supplementary payment is equal. If you wish to claim. Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return.

Over 550,000 ihss providers currently. For more information and forms, go to the. Web california law allows an exclusion from gross income for ihss supplementary payments received by ihss providers. Web compare the state income tax withheld with your estimated total annual tax. Quarterly payroll and excise tax returns normally due on may 1. Web describe product or services purchased exempt from tax telephone number type of business. For state withholding, use the worksheets on this form. Web american indian exemption for titled and/or registered vehicles and vessels (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be exempt. Tubular upper & lower arms. The supplementary payment is equal.

Web compare the state income tax withheld with your estimated total annual tax. Web american indian exemption for titled and/or registered vehicles and vessels (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be exempt. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the property being sold is exempt. Web applying for tax exempt status. Ihss providers only receive a supplementary payment if they paid a sales tax on the ihss services they provide. You had no federal income tax liability in 2020 and you expect to have no federal income tax. Caregivers are typically employees of the individuals for whom they provide services because they work. The supplementary payment is equal. This form is for income earned in tax year 2022, with tax returns due in april 2023.

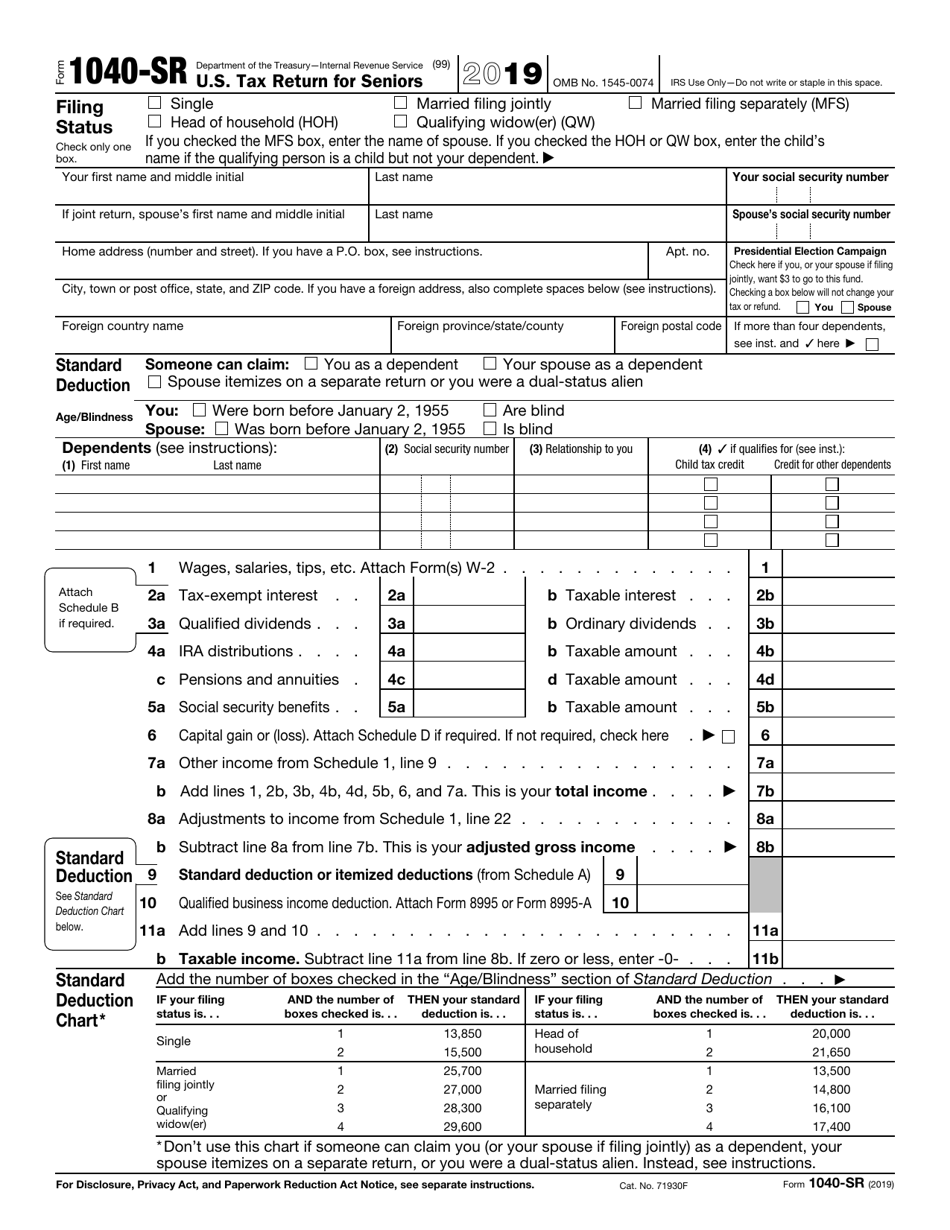

IRS Form 1040SR 2019 Fill Out, Sign Online and Download Fillable

If you wish to claim. This form is for income earned in tax year 2022, with tax returns due in april 2023. As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted. Web applying for tax exempt status. For state withholding, use the worksheets on this form.

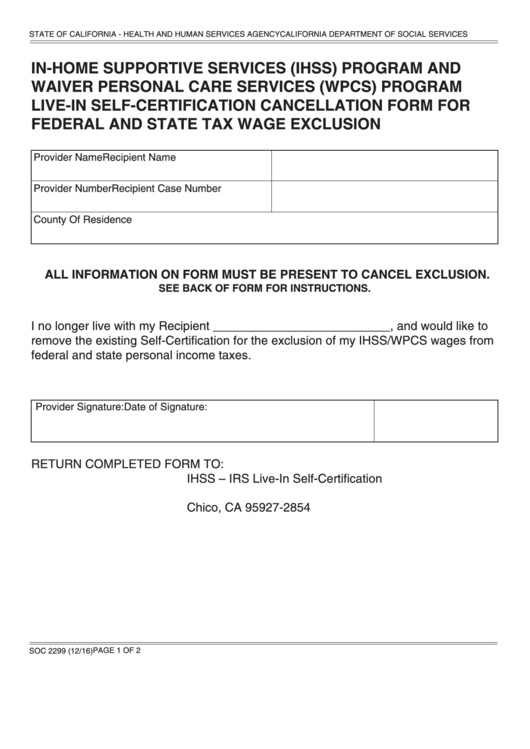

Soc 2298 20202022 Fill and Sign Printable Template Online US Legal

Quarterly payroll and excise tax returns normally due on may 1. Visit irs’s certain medicaid waiver payments may be excludable from. To check in turbotax online: To claim exemption from withholding, certify that you meet both of the conditions above by writing “exempt” on. These forms are unique to.

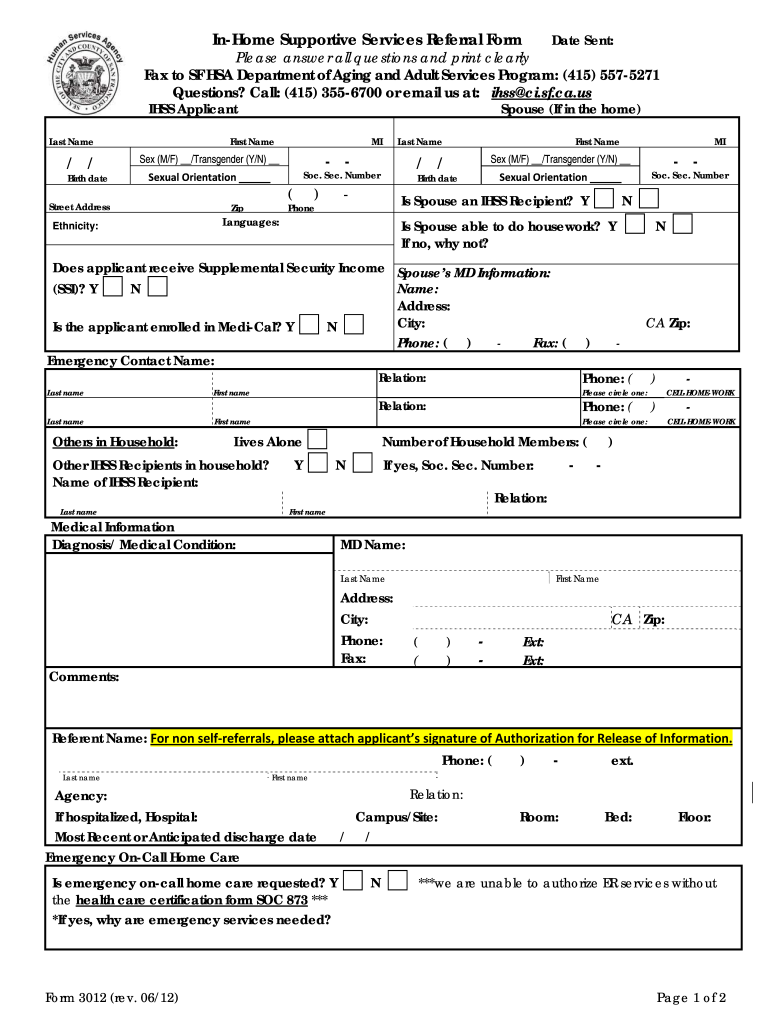

Gm Service Manual Dvd In Home Supportive Services Direct Deposit Form

Web compare the state income tax withheld with your estimated total annual tax. Web describe product or services purchased exempt from tax telephone number type of business. Visit irs’s certain medicaid waiver payments may be excludable from. Web when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and.

In Home Supportive Services Ihss Program Provider Enrollment Form

Some states require government travelers to submit a form for this exemption. 505, tax withholding and estimated tax. Tubular upper & lower arms. These forms are unique to. To check in turbotax online:

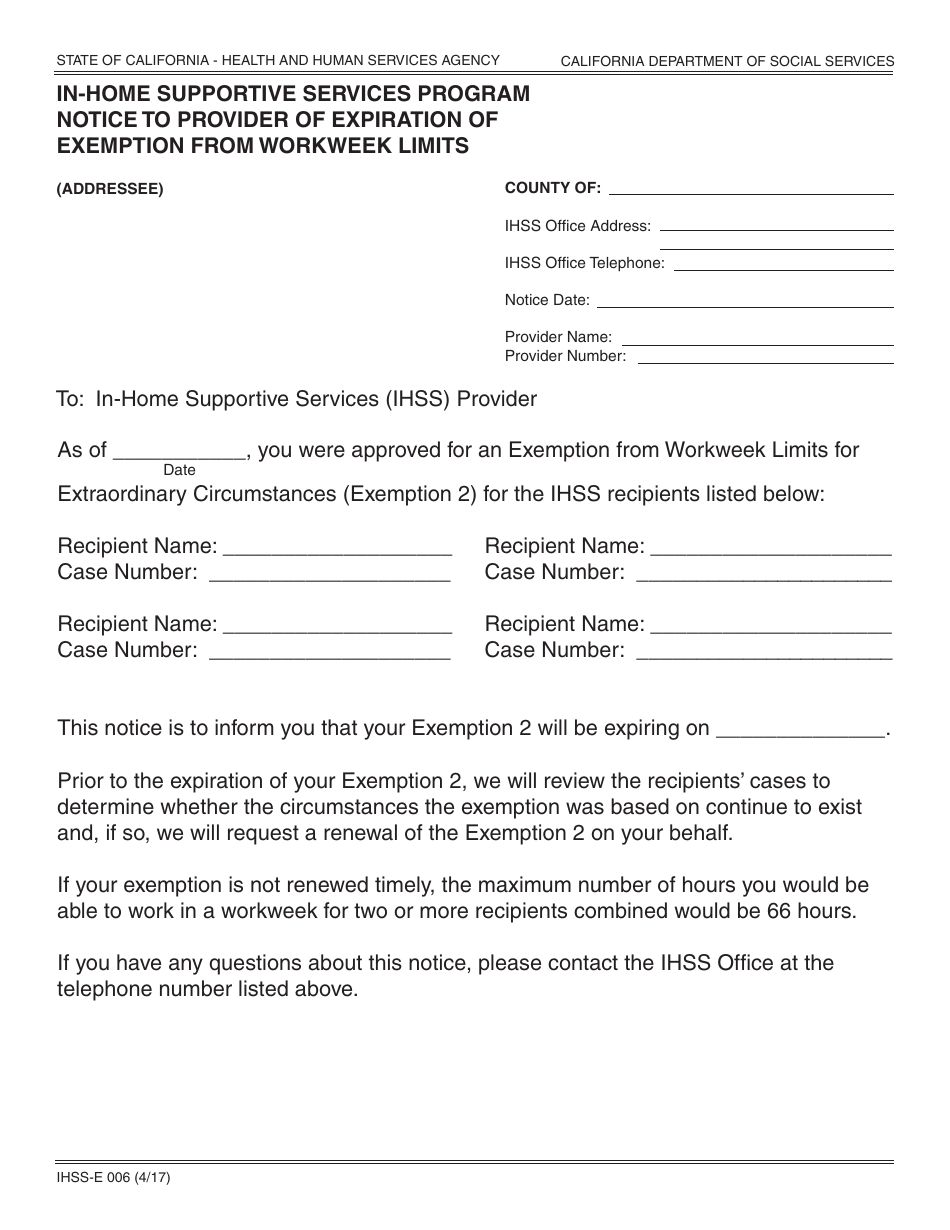

Form Ihsse006 Download Fillable Pdf Or Fill Online Inhome Supportive

This form is for income earned in tax year 2022, with tax returns due in april 2023. Some states require government travelers to submit a form for this exemption. In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the property being sold is exempt. You may claim exemption from.

What Is Ihss Certification

Web click image to zoom. Ihss providers only receive a supplementary payment if they paid a sales tax on the ihss services they provide. This form is for income earned in tax year 2022, with tax returns due in april 2023. Web applying for tax exempt status. Some states require government travelers to submit a form for this exemption.

Military Tax Exempt form Easy Full List Of Property Tax Exemptions by State

As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted. To check in turbotax online: Web if you think you may qualify for an exemption 2, the provider, or the recipients on behalf of the provider, may submit the request for exemption for workweek limits for extraordinary circumstances (exemption 2) form (soc 2305) to the.

FREE 10+ Sample Tax Exemption Forms in PDF

Select the form you received and follow the instructions to enter your payment in turbotax. Web american indian exemption for titled and/or registered vehicles and vessels (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be exempt. Some states.

The IRS has developed a new Form W4, Employee's Withholding

Web american indian exemption for titled and/or registered vehicles and vessels (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be exempt. Web if you think you may qualify for an exemption 2, the provider, or the recipients on.

Ihss Application Form Fill Online, Printable, Fillable, Blank pdfFiller

Web american indian exemption for titled and/or registered vehicles and vessels (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be exempt. Over 550,000 ihss providers currently. Web applying for tax exempt status. Web click image to zoom. This.

Web If You Think You May Qualify For An Exemption 2, The Provider, Or The Recipients On Behalf Of The Provider, May Submit The Request For Exemption For Workweek Limits For Extraordinary Circumstances (Exemption 2) Form (Soc 2305) To The County Ihss Office.the County.

As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted. You may claim exemption from withholding for 2021 if you meet both of the following conditions: For state withholding, use the worksheets on this form. Web click image to zoom.

Some States Require Government Travelers To Submit A Form For This Exemption.

In order for the certificate to be accepted in good faith by the seller, the seller must exercise care that the property being sold is exempt. Web american indian exemption for titled and/or registered vehicles and vessels (idaho sales and use tax administrative rules 091 and 107) the seller must see proof that the buyer is an enrolled member of an indian tribe for the sale to be exempt. Web you claim exemption, you will have no income tax withheld from your paycheck and may owe taxes and penalties when you file your 2023 tax return. Web describe product or services purchased exempt from tax telephone number type of business.

If You Wish To Claim.

Web compare the state income tax withheld with your estimated total annual tax. These forms are unique to. Over 550,000 ihss providers currently. Web applying for tax exempt status.

Select The Form You Received And Follow The Instructions To Enter Your Payment In Turbotax.

You had no federal income tax liability in 2020 and you expect to have no federal income tax. Caregivers are typically employees of the individuals for whom they provide services because they work. Tubular upper & lower arms. To claim exemption from withholding, certify that you meet both of the conditions above by writing “exempt” on.