In Its First Taxable Year Platform Inc Generated

In Its First Taxable Year Platform Inc Generated - In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, inc. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. To calculate platform's taxable income for its second year, we begin with. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, inc.

Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, inc. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. This results in a taxable income of $230,000. To calculate platform's taxable income for its second year, we begin with.

Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, inc. This results in a taxable income of $230,000. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity.

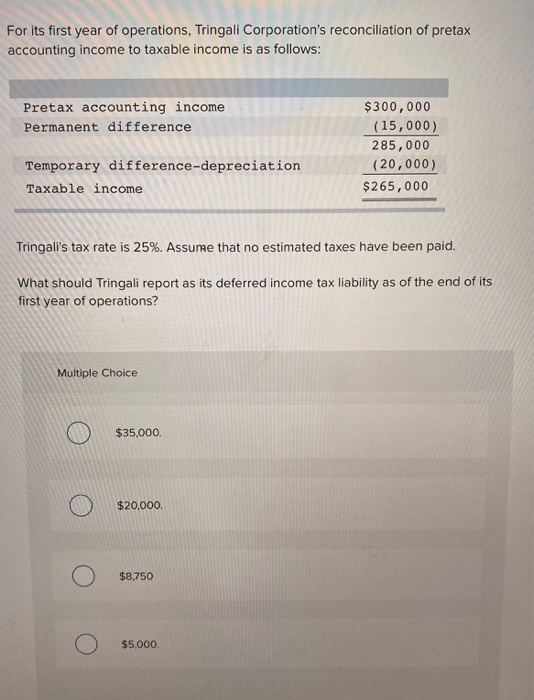

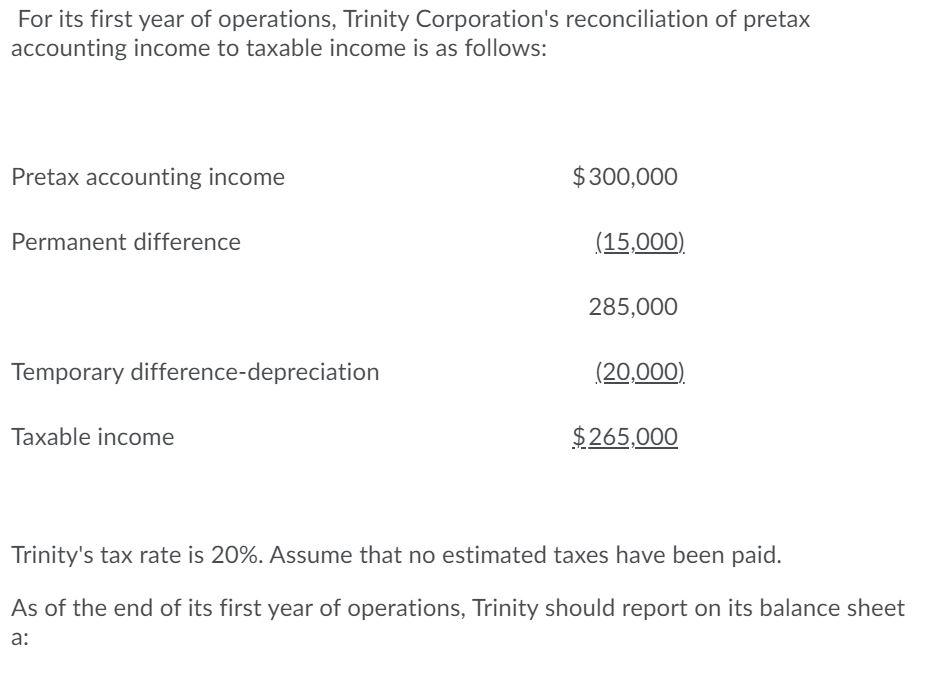

Solved For its first year of operations, Tringali

Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and.

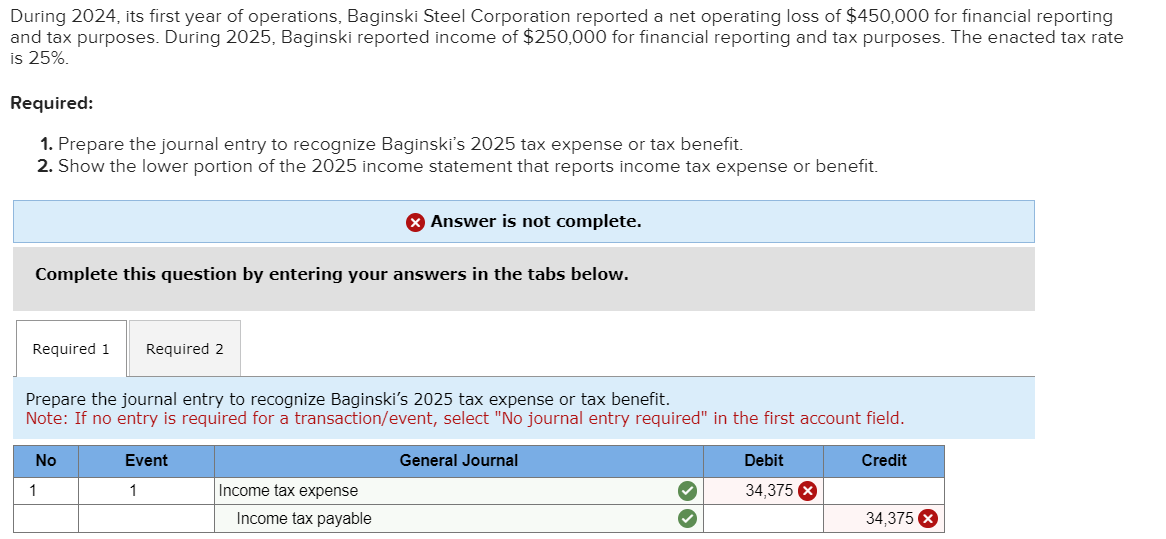

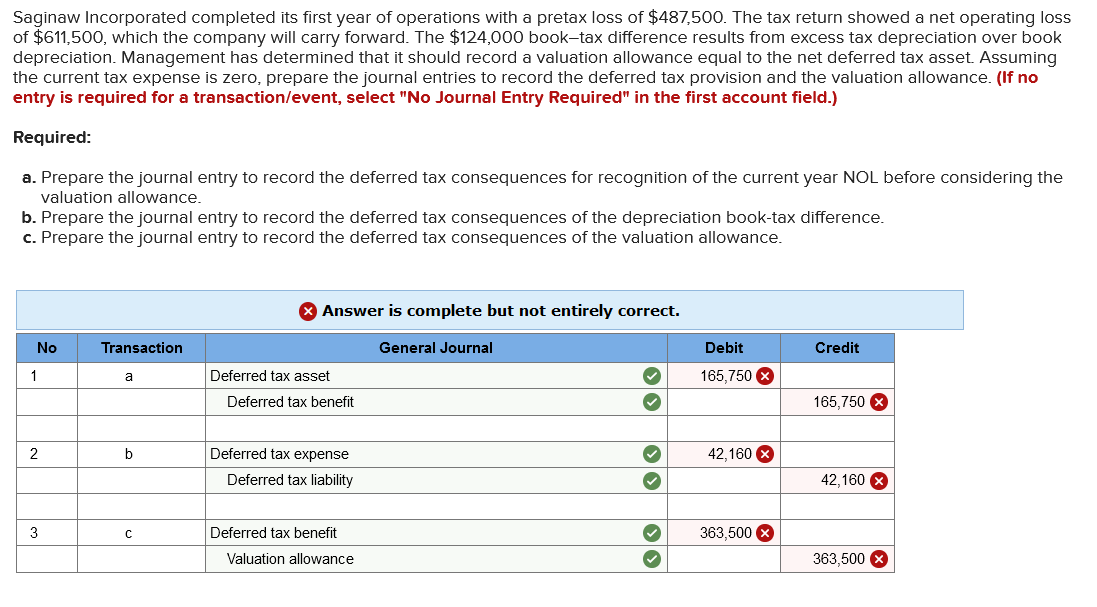

Solved During 2024 , its first year of operations, Baginski

In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation.

SOLVED For its first year of operations, Tringali Corporation's

In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation.

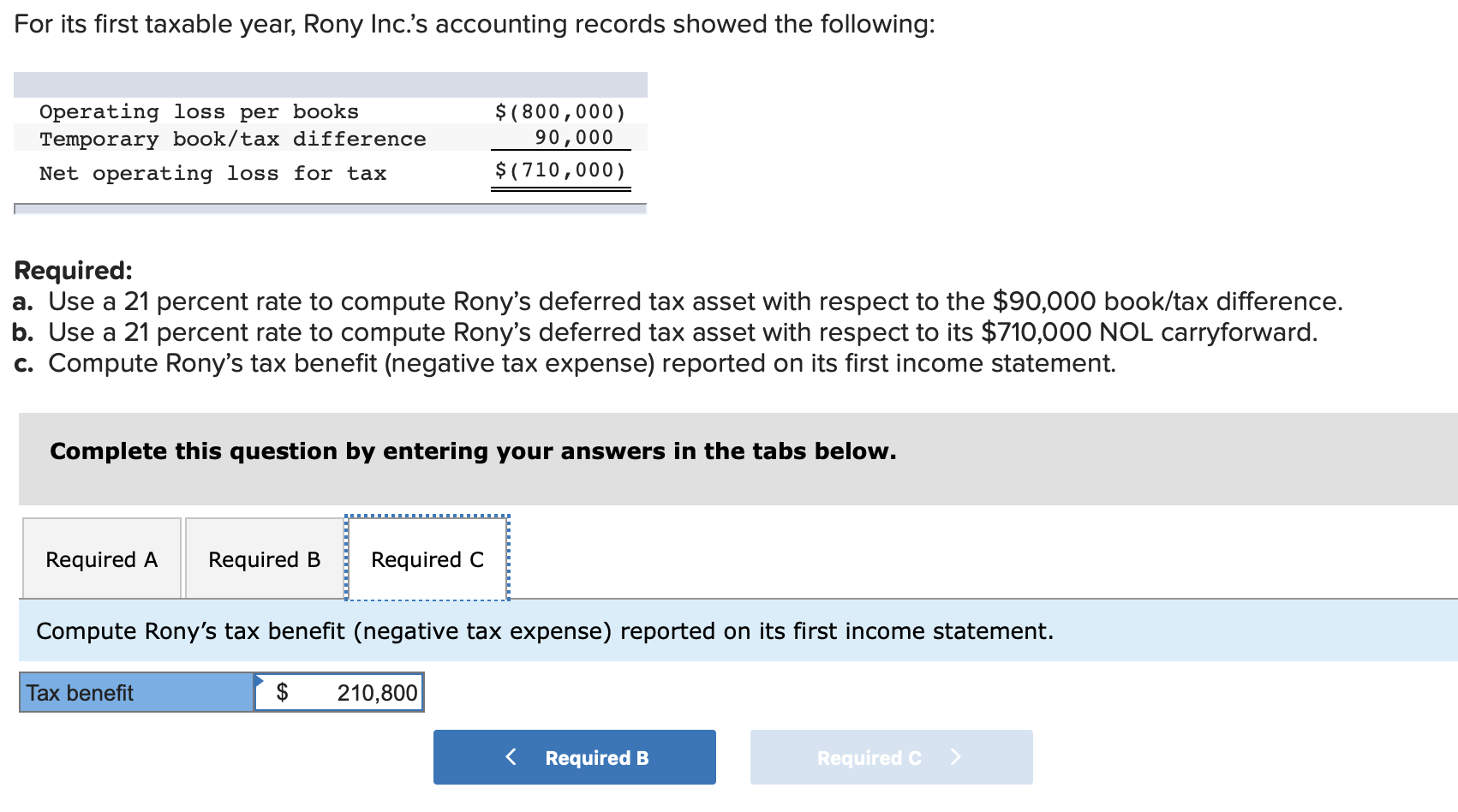

Solved For its first taxable year, Rony Inc.'s accounting

To calculate platform's taxable income for its second year, we begin with. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc..

Solved For its first year of operations, Trinity

Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. This results in.

Solved TimesRoman Publishing Company reports the following

Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. This results in a taxable income of $230,000. In its first taxable.

Solved Saginaw Incorporated completed its first year of

In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a.

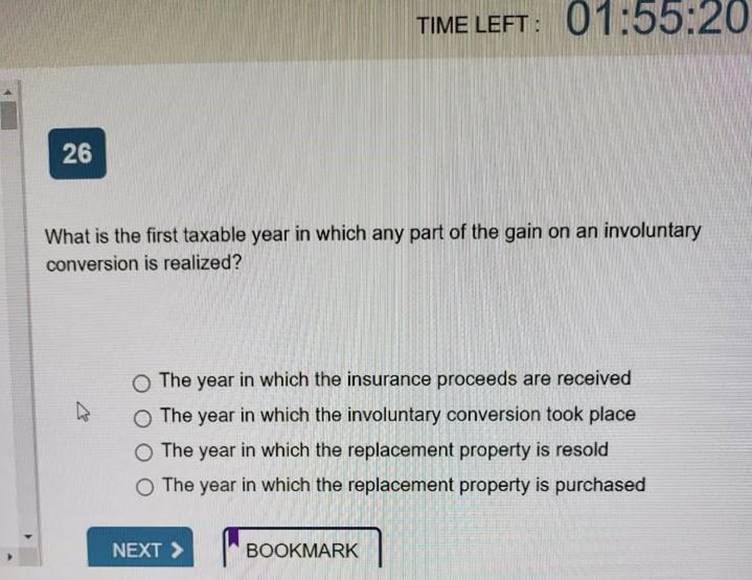

(Get Answer) TIME LEFT 015520 26 What is the first taxable year in

In its first taxable year, platform, inc. Generated a $200,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, incorporated generated a $100,000 net operating loss and.

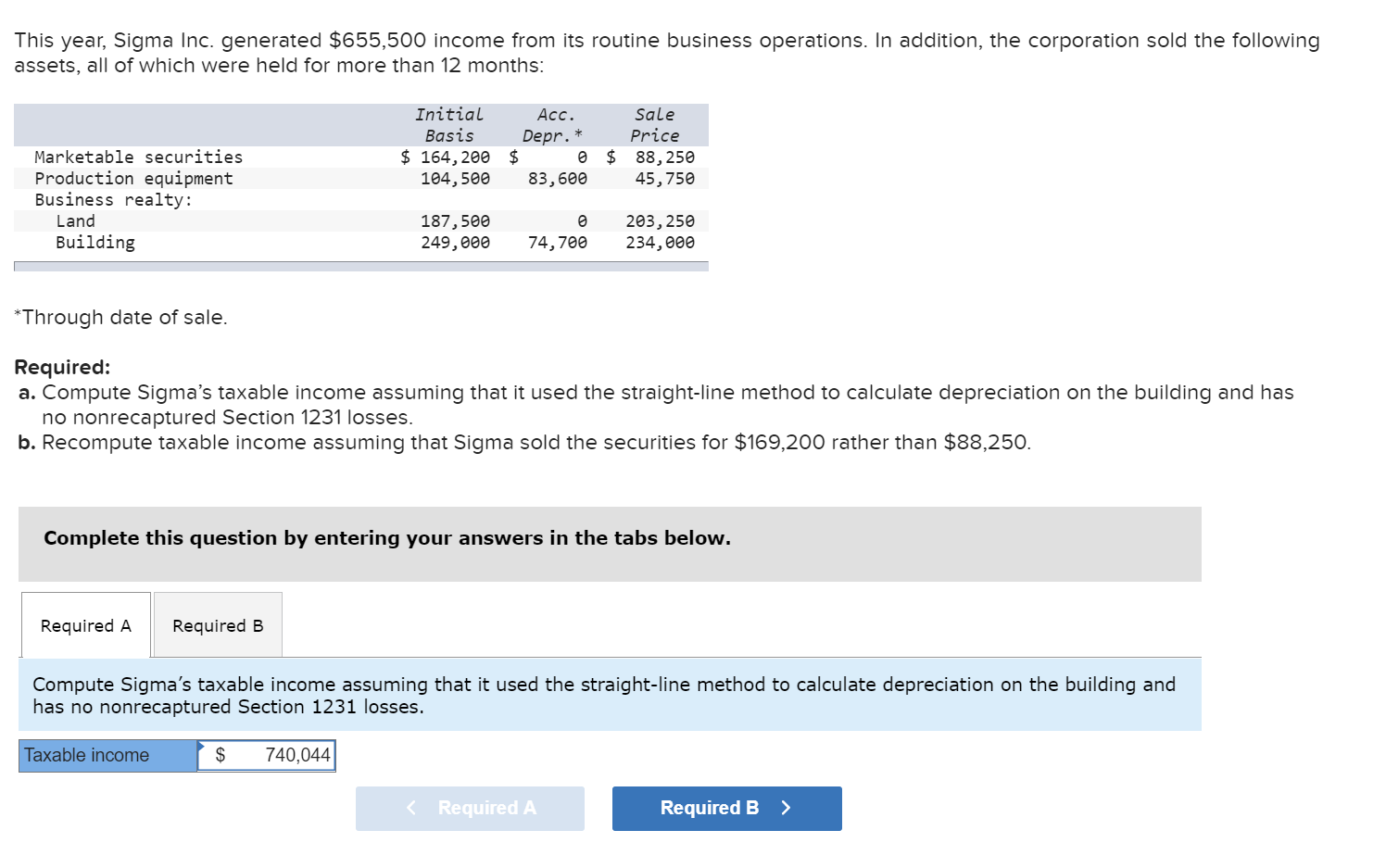

Solved This year, Sigma Inc. generated 655,500 from

In its first taxable year, platform, inc. In its first taxable year, platform, inc. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. To calculate platform's taxable income for its second year, we begin with. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity.

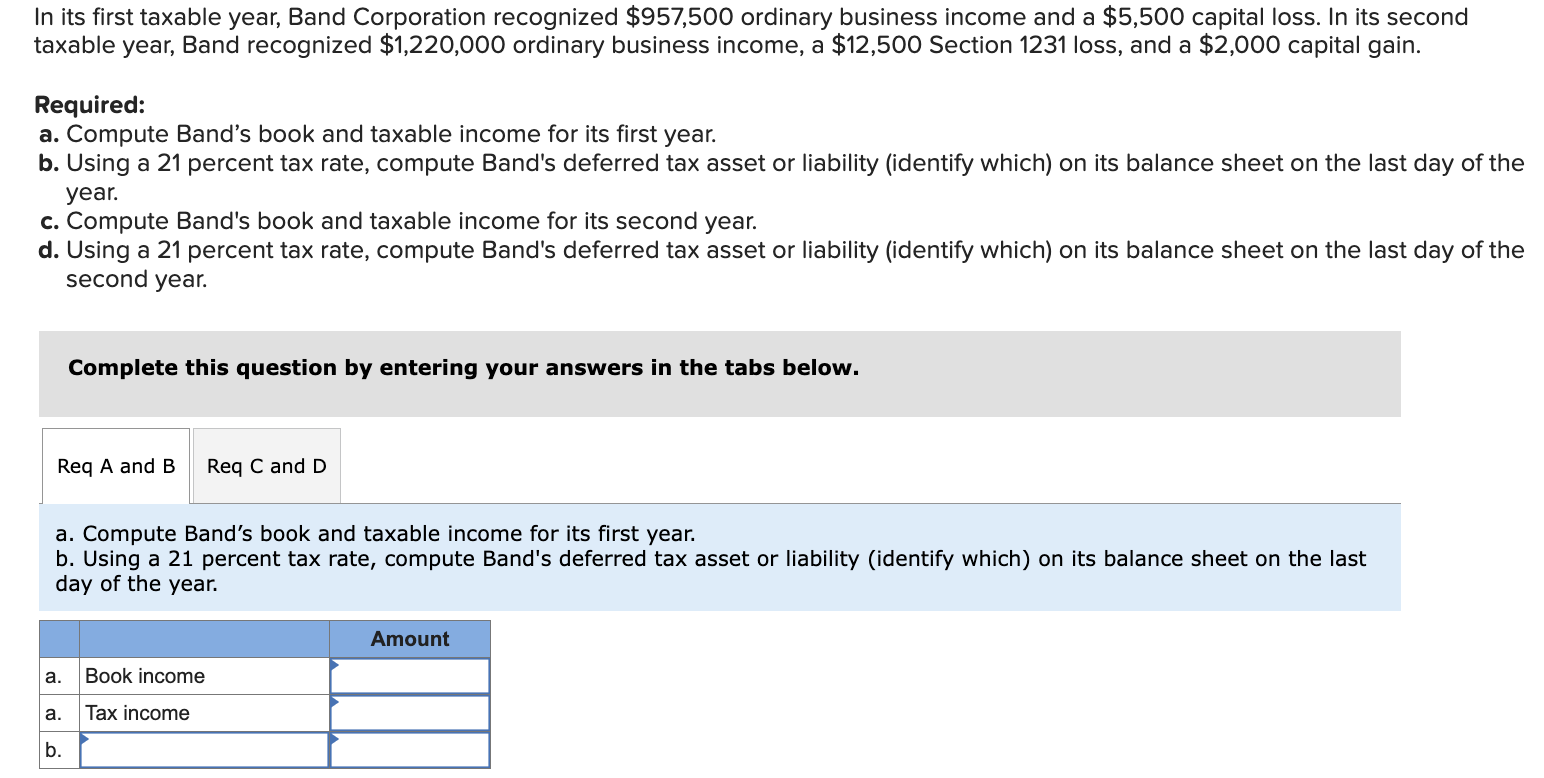

Solved In its first taxable year, Band Corporation

This results in a taxable income of $230,000. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its.

Generated A $100,000 Net Operating Loss And Made A $10,000 Cash Donation To A Local Charity.

In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. To calculate platform's taxable income for its second year, we begin with. Generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. This results in a taxable income of $230,000.

Generated A $200,000 Net Operating Loss And Made A $10,000 Cash Donation To A Local Charity.

In its first taxable year, platform, incorporated generated a $100,000 net operating loss and made a $10,000 cash donation to a local charity. In its first taxable year, platform, inc. In its second year, platform generated $350,000 operating income and made a $20,000 donation to the same charity. In its first taxable year, platform, inc.

In Its Second Year, Platform Generated $350,000 Operating Income And Made A $20,000 Donation To The Same Charity.

In its first taxable year, platform, inc.