Inheritance Beneficiary Form

Inheritance Beneficiary Form - The owner must designate the beneficiary under procedures established by the plan. Web this form, along with a copy of every schedule a, is used to report values to the irs. See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts. Web application form for trust, estate, and organization beneficiaries. Simply customize the form, add a background image, and send responses to your other accounts — like google drive, dropbox, box, or salesforce. One schedule a is provided to each beneficiary receiving property from an estate. Some retirement plans require specific beneficiaries under the terms of the plan (such as a spouse or child). Web a beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an ira after they die. Of course, you should consult your tax advisor Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent omb no.

One schedule a is provided to each beneficiary receiving property from an estate. If you’re the beneficiary or trust, it’s important to understand what to do. Check box if this is a supplemental filing Statement for more details on whether any tax or penalty applies to your distribution. If any of the above conditions apply, that individual must file a gift tax return (form 709) even if a gift tax is not payable. Web application form for trust, estate, and organization beneficiaries. Required documents attach the following required documents based on your relationship to the decedent: Simply customize the form, add a background image, and send responses to your other accounts — like google drive, dropbox, box, or salesforce. Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent omb no. Web a beneficiary form does not have to be complicated.

Statement for more details on whether any tax or penalty applies to your distribution. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service One schedule a is provided to each beneficiary receiving property from an estate. If any of the above conditions apply, that individual must file a gift tax return (form 709) even if a gift tax is not payable. The owner must designate the beneficiary under procedures established by the plan. Simply customize the form, add a background image, and send responses to your other accounts — like google drive, dropbox, box, or salesforce. Check box if this is a supplemental filing Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent omb no. Use a free inequality beneficiary form on your website to distribute the estate of a deceased person to their beneficiaries. Web a beneficiary form does not have to be complicated.

Inherited IRA rules that nonspouse beneficiaries need to know WTOP News

Web a beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an ira after they die. The owner must designate the beneficiary under procedures established by the plan. Check box if this is a supplemental filing The simplicity of the form. Some retirement plans require specific beneficiaries under the.

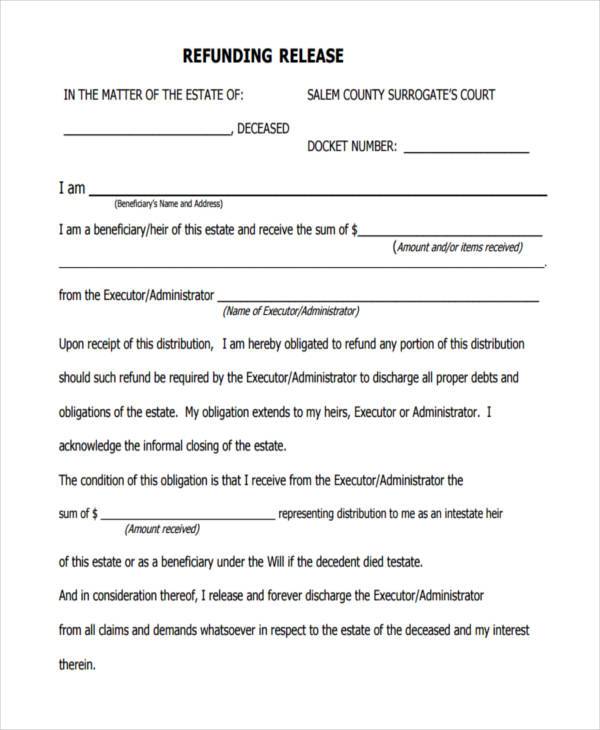

FREE 7+ Sample Beneficiary Release Forms in PDF MS Word

The simplicity of the form. Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263 (1/23) use this form to request normal or premature distributions from either your traditional or roth ira. One schedule a is provided to each beneficiary receiving property from an estate. If you’re the beneficiary or trust, it’s important to understand what to do..

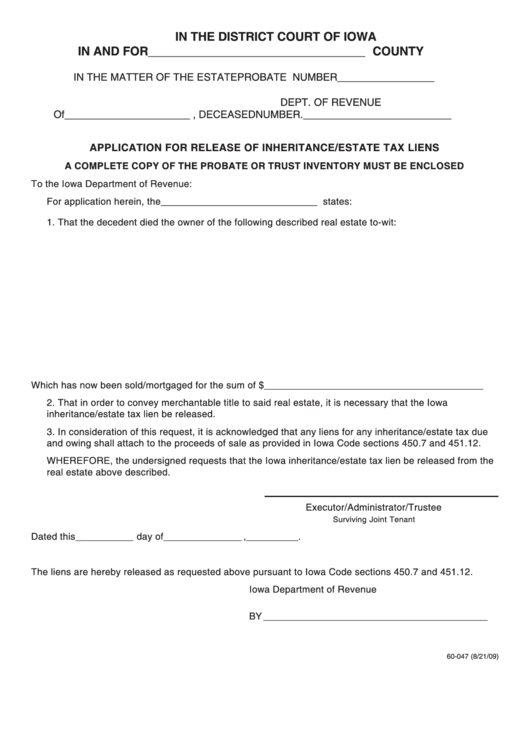

Form 60047 Application For Release Of Inheritance/estate Tax Liens

Statement for more details on whether any tax or penalty applies to your distribution. If you’re the beneficiary or trust, it’s important to understand what to do. Simply customize the form, add a background image, and send responses to your other accounts — like google drive, dropbox, box, or salesforce. Web a beneficiary is generally any person or entity the.

Modeling Contract Model Agreement Template (Form with Sample)

Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent omb no. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts. Required documents attach the following required.

Affidavit of Disclaimer of Interest by Heir of Tanadgusix Corporation

Web a beneficiary form does not have to be complicated. Required documents attach the following required documents based on your relationship to the decedent: Please refer to the disclosure. If you’re the beneficiary or trust, it’s important to understand what to do. One schedule a is provided to each beneficiary receiving property from an estate.

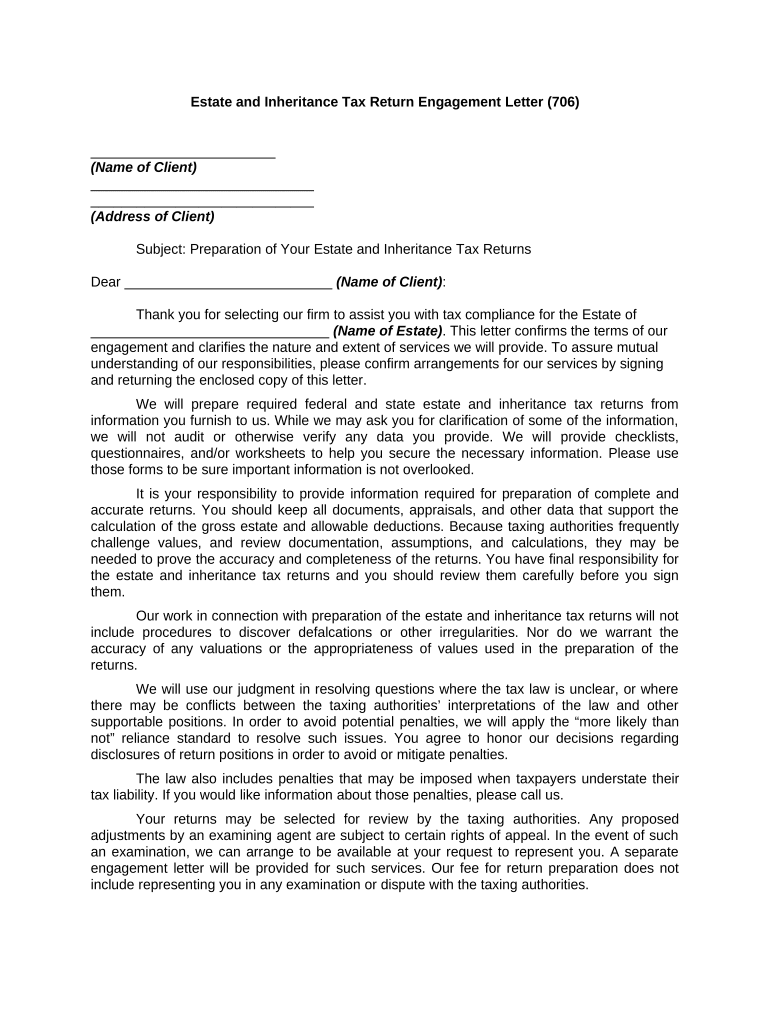

Inheritance Letter from Lawyer PDF Form Fill Out and Sign Printable

Some retirement plans require specific beneficiaries under the terms of the plan (such as a spouse or child). The owner must designate the beneficiary under procedures established by the plan. Use a free inequality beneficiary form on your website to distribute the estate of a deceased person to their beneficiaries. One schedule a is provided to each beneficiary receiving property.

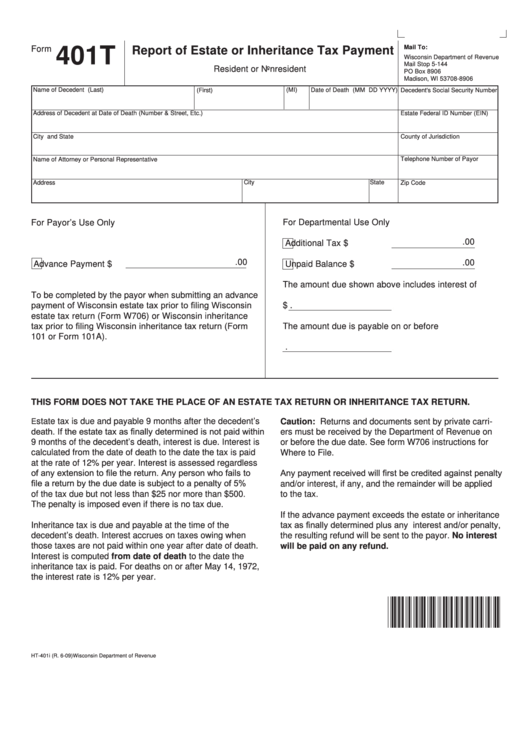

Form 401t Report Of Estate Or Inheritance Tax Payment Resident Or

One schedule a is provided to each beneficiary receiving property from an estate. Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263 (1/23) use this form to request normal or premature distributions from either your traditional or roth ira. If any of the above conditions apply, that individual must file a gift tax return (form 709) even.

Money Inheritance Document PDF Form Fill Out and Sign Printable PDF

Use a free inequality beneficiary form on your website to distribute the estate of a deceased person to their beneficiaries. Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent omb no. If you’re the beneficiary or trust, it’s important to understand what to do. If any of the above conditions.

Beneficiary/Inheritance Email Scam Removal and recovery steps (updated)

Statement for more details on whether any tax or penalty applies to your distribution. See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts. Web a beneficiary is generally any person or entity the account owner chooses to receive the benefits of a retirement account or an ira after they die. Simply.

How to Determine Inheritance if the Intended Beneficiary Is Deceased

Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263 (1/23) use this form to request normal or premature distributions from either your traditional or roth ira. Simply customize the form, add a background image, and send responses to your other accounts — like google drive, dropbox, box, or salesforce. If you’re the beneficiary or trust, it’s important.

Web This Form, Along With A Copy Of Every Schedule A, Is Used To Report Values To The Irs.

Web a beneficiary form does not have to be complicated. Web 8971 form (january 2016)department of the treasury internal revenue service information regarding beneficiaries acquiring property from a decedent omb no. Use a free inequality beneficiary form on your website to distribute the estate of a deceased person to their beneficiaries. Required documents attach the following required documents based on your relationship to the decedent:

Web A Beneficiary Is Generally Any Person Or Entity The Account Owner Chooses To Receive The Benefits Of A Retirement Account Or An Ira After They Die.

One schedule a is provided to each beneficiary receiving property from an estate. The owner must designate the beneficiary under procedures established by the plan. If you’re the beneficiary or trust, it’s important to understand what to do. About form 8971, information regarding beneficiaries acquiring property from a decedent | internal revenue service

Please Refer To The Disclosure.

Some retirement plans require specific beneficiaries under the terms of the plan (such as a spouse or child). Web ira beneficiary inheritance request form page 1 of 10 tfdmm f41263 (1/23) use this form to request normal or premature distributions from either your traditional or roth ira. Of course, you should consult your tax advisor See the instructions for form 709 and publication 559, survivors, executors, and administrators for additional information on gifts.

Web Application Form For Trust, Estate, And Organization Beneficiaries.

Statement for more details on whether any tax or penalty applies to your distribution. The simplicity of the form. Check box if this is a supplemental filing If any of the above conditions apply, that individual must file a gift tax return (form 709) even if a gift tax is not payable.