Instructions For Form 4136

Instructions For Form 4136 - Web follow the simple instructions below: Web credit for federal tax paid on fuels (form 4136) the government taxes gasoline, diesel fuel, kerosene, alternative fuels and some other types of fuel. 17 minutes watch video get the form! Web department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest information. Try it for free now! •form 8849, claim for refund of excise taxes, to claim a. Web the irs instructions for form 4136, page 2 state: Get ready for tax season deadlines by completing any required tax forms today. To find out if you can use schedule 3 (form 8849). Ad access irs tax forms.

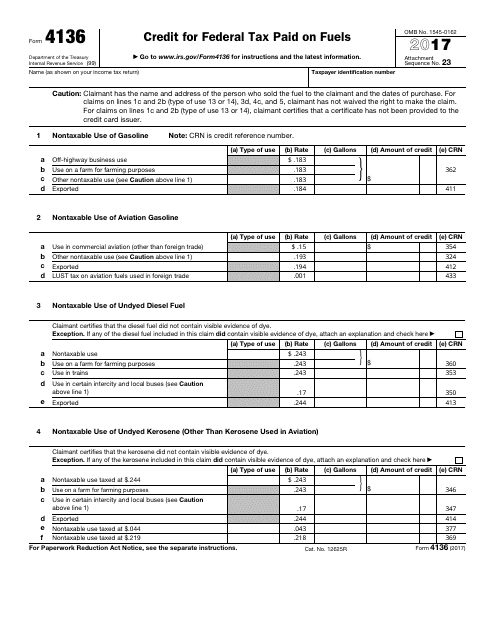

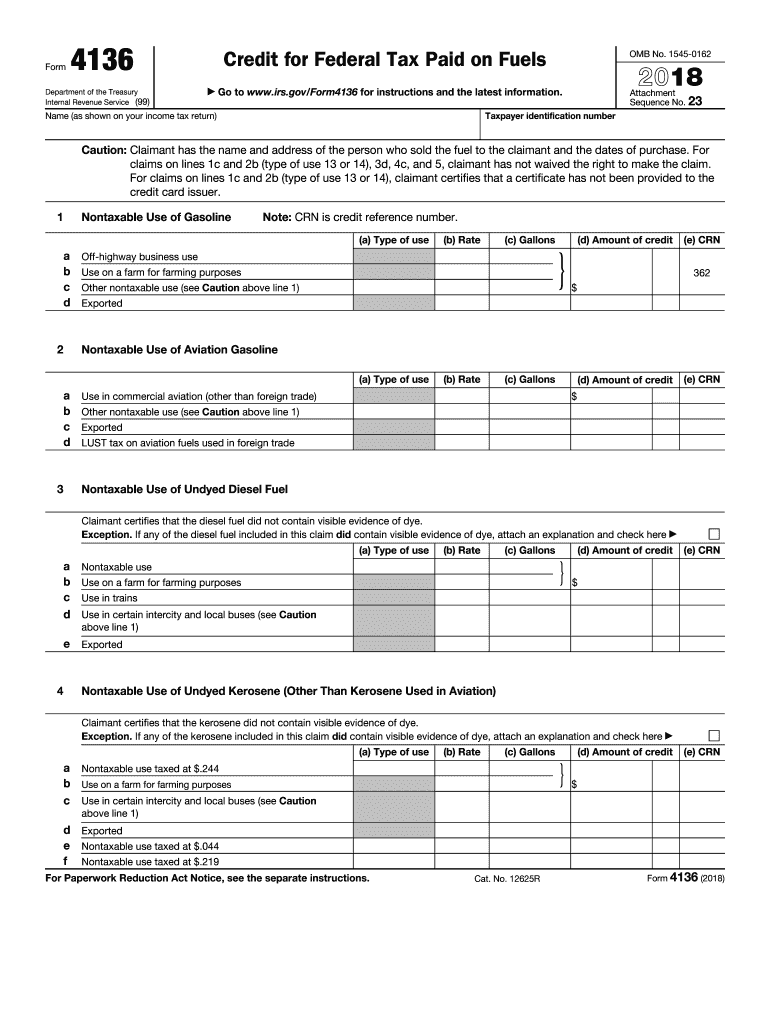

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. You can download or print. Upload, modify or create forms. When individuals aren?t associated with document management and lawful processes, submitting irs forms can be extremely stressful. The credits available on form 4136 are: The biodiesel or renewable diesel mixture credit. 17 minutes watch video get the form! Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. For example, the form 1040 page is at.

Web we last updated the credit for federal tax paid on fuels in january 2023, so this is the latest version of form 4136, fully updated for tax year 2022. For example, the form 1040 page is at. Use form 4136 to claim a credit. Try it for free now! When individuals aren?t associated with document management and lawful processes, submitting irs forms can be extremely stressful. Web form 4136 department of the treasury internal revenue service (99). Web instructions, and pubs is at irs.gov/forms. Web follow the simple instructions below: You must include in your gross income the amount of the credit from. including the fuel tax credit in income.

Form 4136 Credit For Federal Tax Paid on Fuels (2015) Free Download

To find out if you can use schedule 3 (form 8849). Complete, edit or print tax forms instantly. Web to get form 4136 to populate correctly: Instead of waiting to claim an annual credit on form 4136, you may be able to file: Get ready for tax season deadlines by completing any required tax forms today.

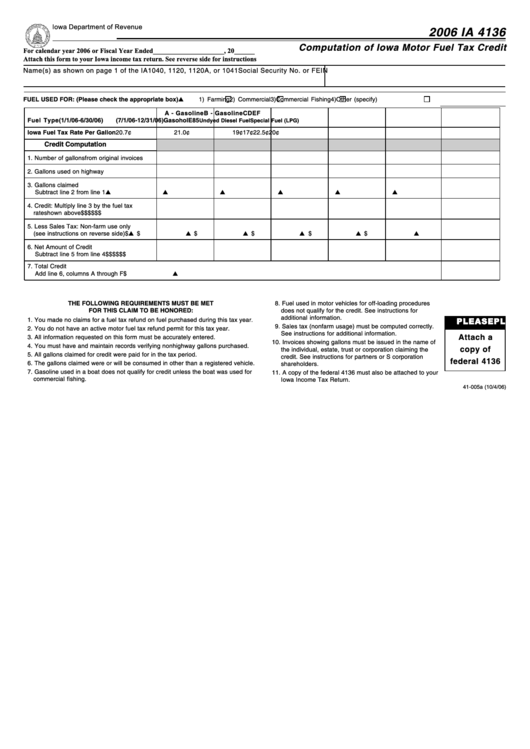

Form Ia 4136 Computation Of Iowa Motor Fuel Tax Credit 2006

Complete, edit or print tax forms instantly. Web to get form 4136 to populate correctly: To find out if you can use schedule 3 (form 8849). Upload, modify or create forms. Web general instructions purpose of form use form 4136 to claim the following.

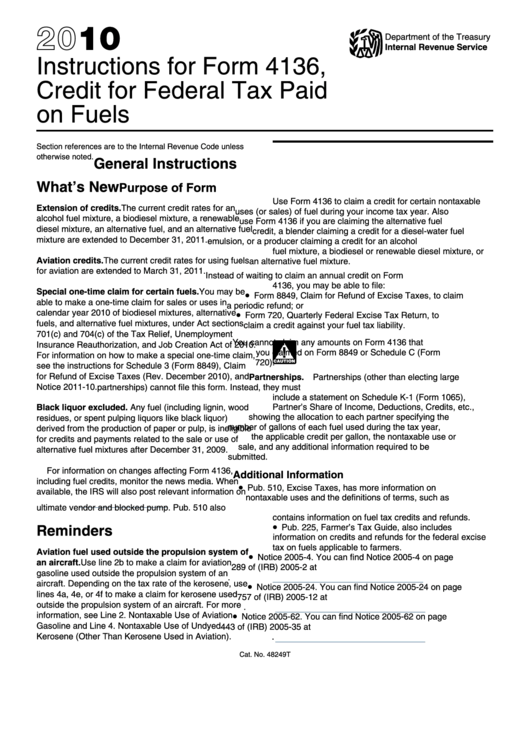

Instructions For Form 4136 Credit For Federal Tax Paid On Fuels

Web follow the simple instructions below: Complete, edit or print tax forms instantly. Fill & download for free get form download the form how to edit your form 4136 instructions online on the fly follow these steps to get your. To find out if you can use schedule 3 (form 8849). Web to get form 4136 to populate correctly:

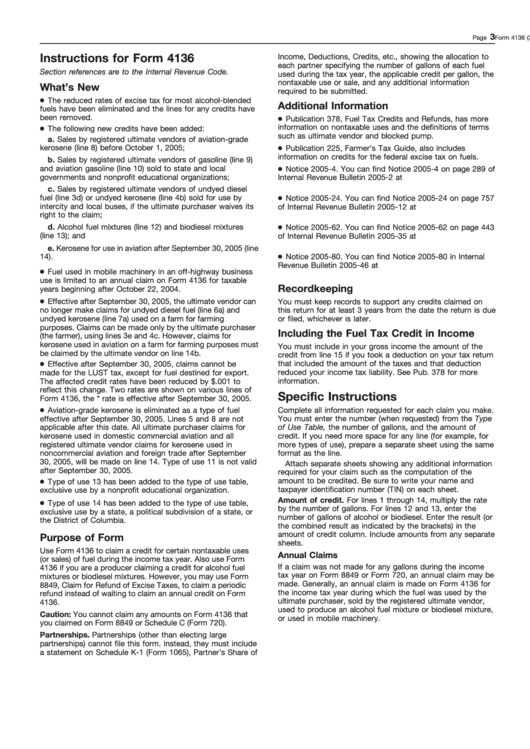

Instructions For Form 4136 2005 printable pdf download

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Almost every form and publication has a page on irs.gov with a friendly shortcut. Complete, edit or print tax forms instantly. 17 minutes watch video get the form! Upload, modify or create.

IRS Form 4136 Download Fillable PDF or Fill Online Credit for Federal

Try it for free now! Web instructions, and pubs is at irs.gov/forms. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. Use form 4136 to claim a credit.

How to Prepare IRS Form 4136 (with Form) wikiHow

Step by step instructions in the united. Web the irs instructions for form 4136, page 2 state: Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Web general instructions purpose of form use form 4136 to claim the following. Web attach form 4136 to your tax return.

How to Prepare IRS Form 4136 (with Form) wikiHow

See instructions for kerosene used in commercial aviation from march 28, 2020, through december 31,. Type form 4136 in search in the upper right click jump to form 4136 say yes on credit for nontaxable fuel usage on. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Web general instructions purpose of form use form.

Fill Free fillable Form 4136 Credit for Federal Tax Paid on Fuels

Complete, edit or print tax forms instantly. including the fuel tax credit in income. Get ready for tax season deadlines by completing any required tax forms today. Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Almost every form and publication has a page on irs.gov with a friendly shortcut.

Form 8849 Claim for Refund of Excise Taxes (2014) Free Download

Web use form 4136 to claim a credit for federal taxes paid on certain fuels. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Web to get form 4136 to populate correctly: Web follow the simple instructions below: Instead of waiting to claim an annual credit.

Irs 4136 2019 Fill Out and Sign Printable PDF Template signNow

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Use form 4136 to claim a credit. The biodiesel or renewable diesel mixture credit the alternative fuel. Web general instructions purpose of form use form 4136 to claim the following. Web follow.

Web General Instructions Purpose Of Form Use Form 4136 To Claim The Following.

Web department of the treasury internal revenue service (99) credit for federal tax paid on fuels ago to www.irs.gov/form4136for instructions and the latest information. Web information about form 4136, credit for federal tax paid on fuels, including recent updates, related forms and instructions on how to file. Complete, edit or print tax forms instantly. When individuals aren?t associated with document management and lawful processes, submitting irs forms can be extremely stressful.

Almost Every Form And Publication Has A Page On Irs.gov With A Friendly Shortcut.

Credit for certain nontaxable uses (or sales) of fuel during your income tax year. Web irs form 4136 instructions by forrest baumhover july 13, 2023 reading time: Web instructions, and pubs is at irs.gov/forms. Upload, modify or create forms.

Web To Get Form 4136 To Populate Correctly:

Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid. Instead of waiting to claim an annual credit on form 4136, you may be able to file: Web the irs instructions for form 4136, page 2 state: Web follow the simple instructions below:

Fill & Download For Free Get Form Download The Form How To Edit Your Form 4136 Instructions Online On The Fly Follow These Steps To Get Your.

You must include in your gross income the amount of the credit from. Web form 4136 department of the treasury internal revenue service (99) credit for federal tax paid on fuels a go to www.irs.gov/form4136 for instructions and the latest information. Use form 4136 to claim a credit. The credits available on form 4136 are: