Instructions For Form 4684

Instructions For Form 4684 - Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were. Web future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to. You must use a separate form 4684 (through line 12) for each casualty or theft event involving personal use. Web up to $40 cash back use a separate form 4684 for each casualty or theft. Web how to complete irs form 4684 who is eligible to claim a casualty loss deduction frequently asked questions let’s start with a walk through on how to complete. Tax relief for homeowners with corrosive drywall: Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. Web the way to fill out the i 684 form on the internet: Web use form 4684 to report gains and losses from casualties and thefts. Attach form 4684 to your tax return.

Web use form 4684 to report gains and losses from casualties and thefts. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Web form 4684 is for a casualty loss. Web 2020 instructions for form 4684 casualties and thefts (rev. February 2020) department of the treasury internal revenue service section references are to the internal revenue code. Web up to $40 cash back use a separate form 4684 for each casualty or theft. You must use a separate form 4684 (through line 12) for each casualty or theft event involving personal use. Losses you can deduct you can deduct losses of property from fire,. Attach form 4684 to your tax. Web instructions for form ar4684)rup $5 ,qvw 3j 5 3djh ri.

Web instructions for form ar4684)rup $5 ,qvw 3j 5 3djh ri. Tax relief for homeowners with corrosive drywall: Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were. Web how to complete irs form 4684 who is eligible to claim a casualty loss deduction frequently asked questions let’s start with a walk through on how to complete. Attach form 4684 to your tax. February 2020) department of the treasury internal revenue service section references are to the internal revenue code. Web the way to fill out the i 684 form on the internet: Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web form 4684 is for a casualty loss. Web instructions for form 4684 casualties and thefts department of the treasury internal revenue service section references are to the internal revenue code unless otherwise.

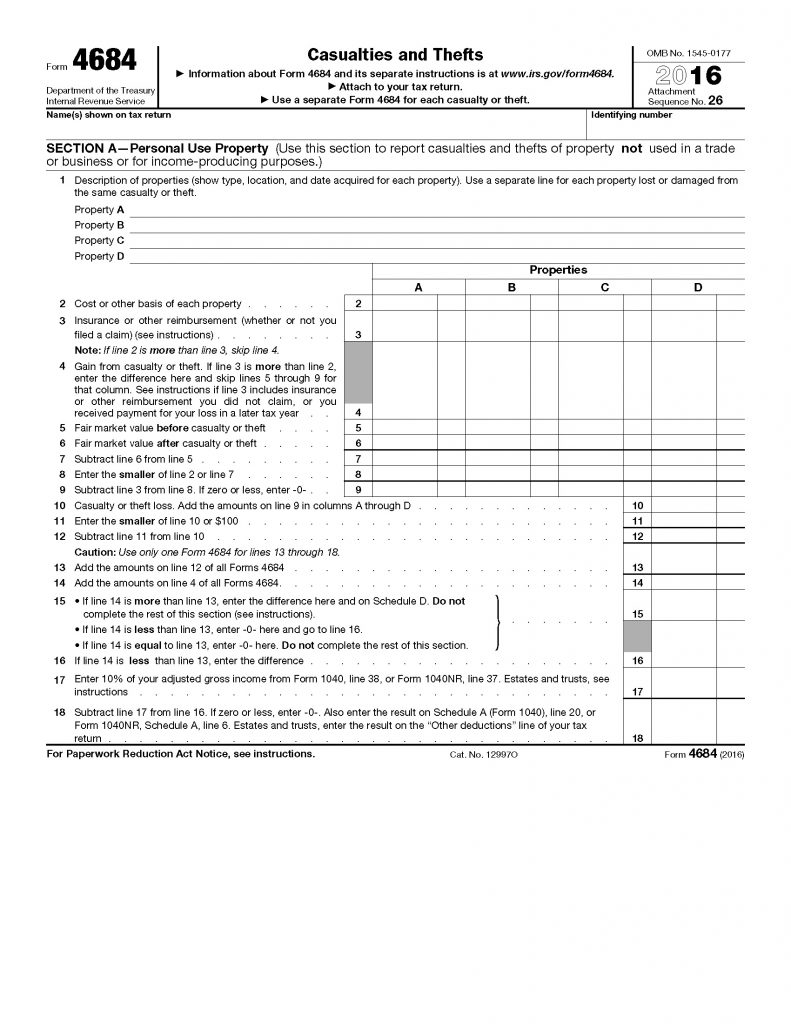

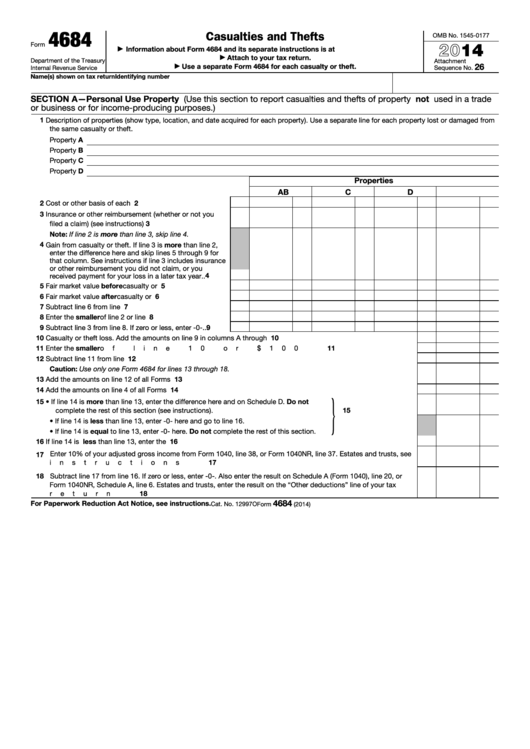

Form 4684 Casualties and Thefts (2015) Free Download

February 2020) department of the treasury internal revenue service section references are to the internal revenue code. Web up to $40 cash back use a separate form 4684 for each casualty or theft. Web 2020 instructions for form 4684 casualties and thefts (rev. Web use form 4684 to report gains and losses from casualties and thefts. February 2021) department of.

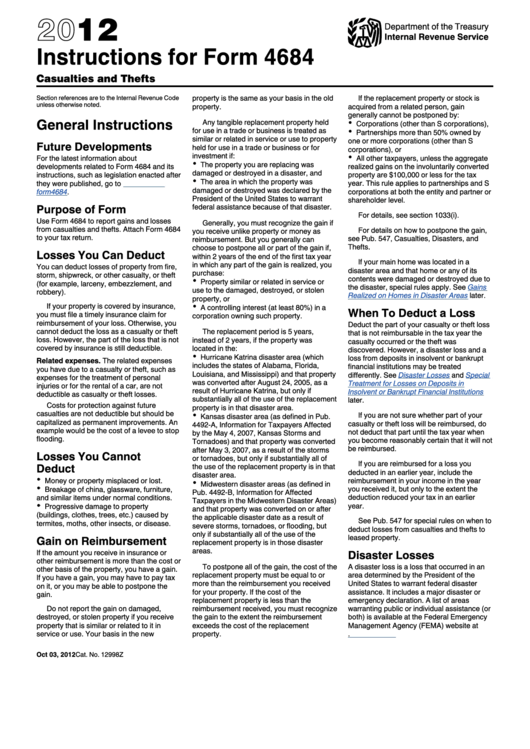

Instructions For Form 4684 Casualties And Thefts 2012 printable pdf

Web instructions for form ar4684)rup $5 ,qvw 3j 5 3djh ri. Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or losses. Web use a separate form 4684 for each casualty or theft. Web 2020 instructions for form 4684 casualties and thefts (rev..

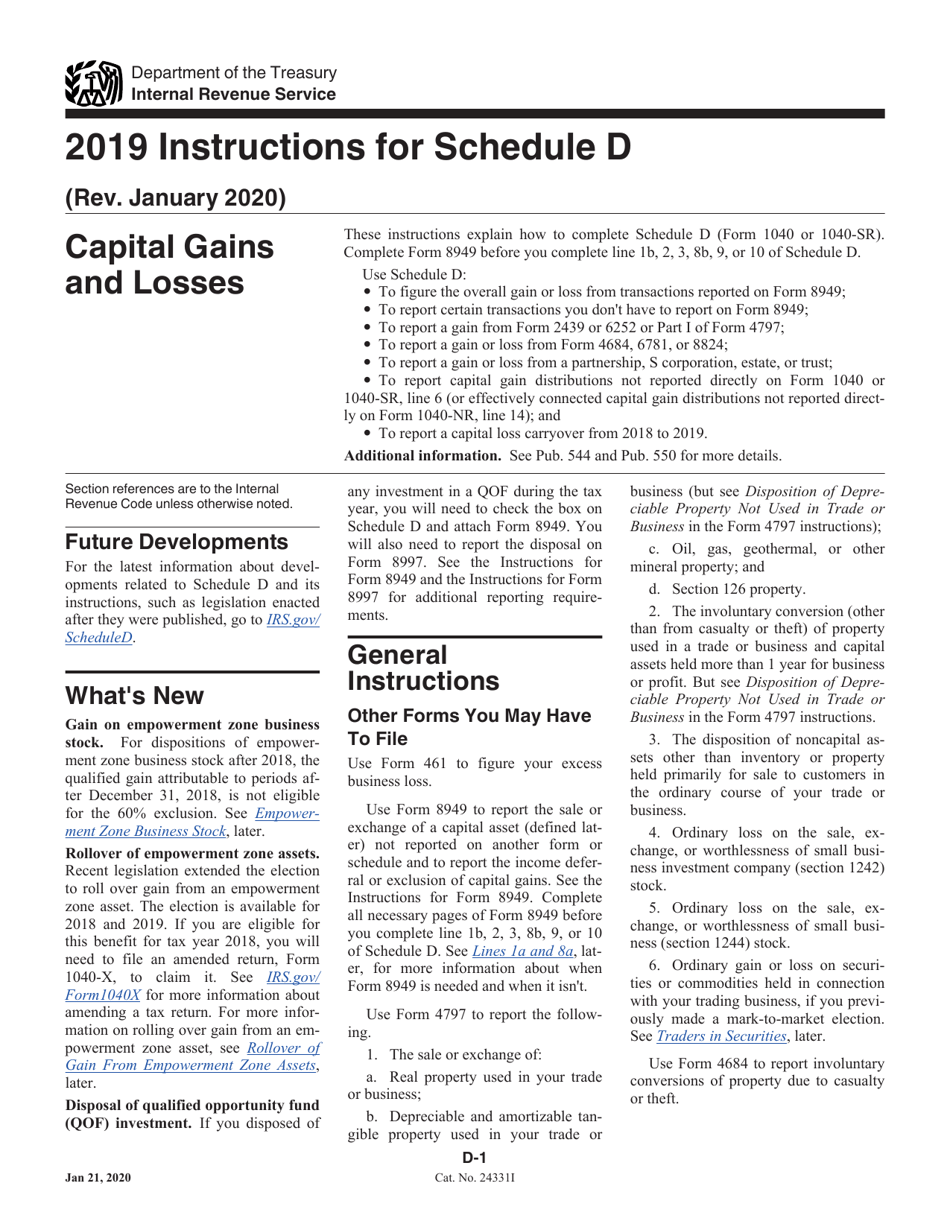

Download Instructions for IRS Form 1040, 1040SR Schedule D Capital

Web instructions for form 4684 casualties and thefts (rev. Web the way to fill out the i 684 form on the internet: Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. Web instructions for form ar4684)rup $5 ,qvw 3j 5 3djh ri. Web form 4684 is for.

Publication 225, Farmer's Tax Guide; Chapter 20 Sample Return

Web form 4684 is for a casualty loss. Sign online button or tick the preview image of the blank. Web use form 4684 to report gains and losses from casualties and thefts. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web form 4684 is a form provided by the.

Form 4684 Casualties and Thefts (2015) Free Download

Tax relief for homeowners with corrosive drywall: Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were. You must use a separate form 4684 (through line 12) for each casualty or theft event involving personal use. Web up to $40 cash back use a separate.

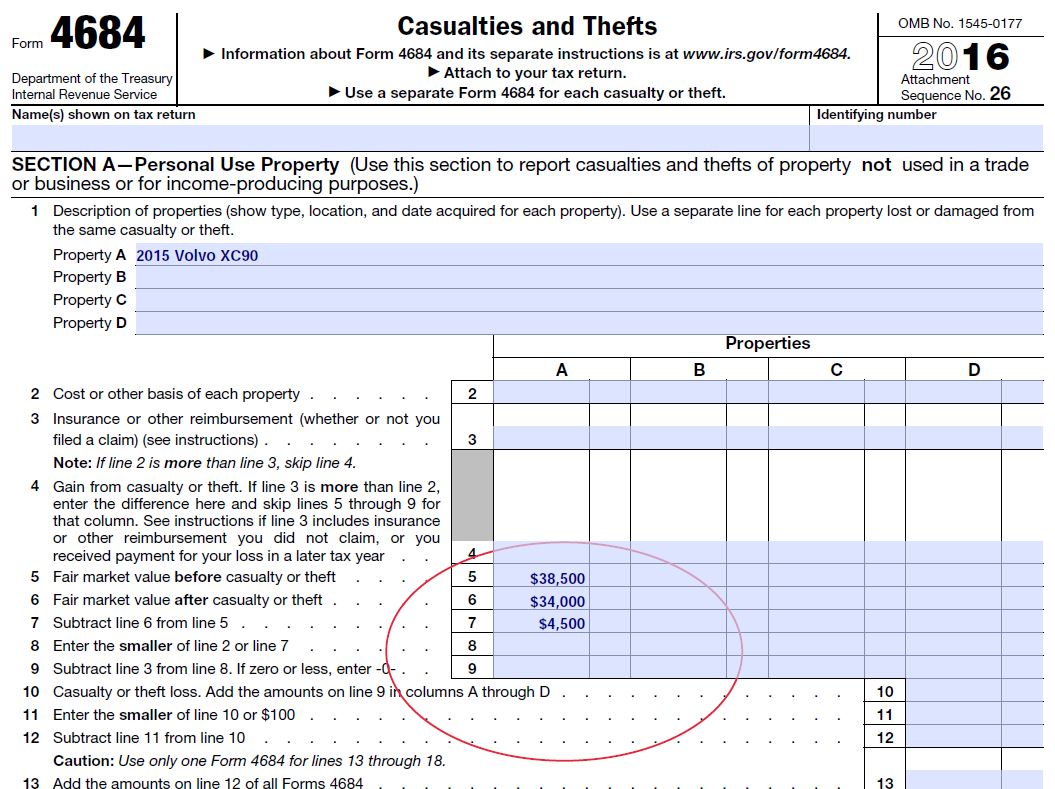

Diminished Value and Taxes, IRS form 4684 Diminished Value of

You must use a separate form 4684 (through line 12) for each casualty or theft event involving personal use. Web up to $40 cash back use a separate form 4684 for each casualty or theft. Web form 4684 is for a casualty loss. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how.

Fillable Form 4684 Casualties And Thefts 2014 printable pdf download

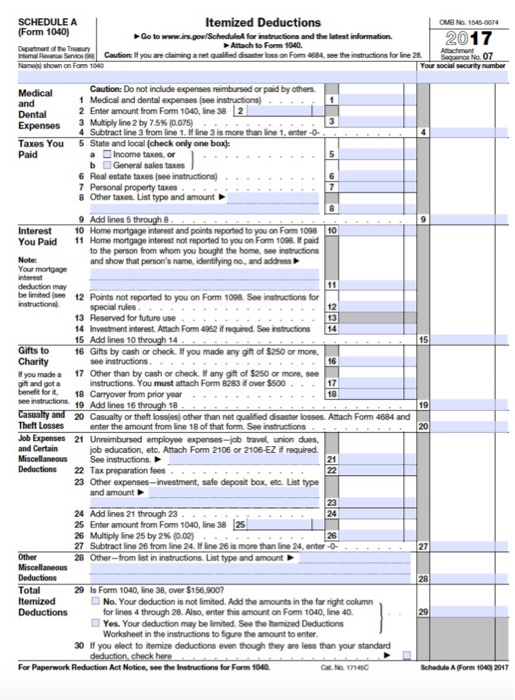

Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or losses. Tax relief for homeowners with.

Publication 225, Farmer's Tax Guide; Chapter 20 Sample Return

Web the way to fill out the i 684 form on the internet: Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or losses. Losses you can deduct you can deduct losses of property from fire,. Web form 4684 is for a casualty.

Based on Exhibi 69 (Schedule A; Itemized

Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts. We last updated the casualties and thefts in january 2023, so this is the latest version of form 4684, fully updated for tax. Attach form 4684 to your tax. If reporting a qualified disaster loss, see the instructions.

Diminished Value and Taxes, IRS form 4684 Diminished Value of

This year, the casualty losses you can deduct are mainly limited to those caused by federally declared disasters. Web the way to fill out the i 684 form on the internet: Web future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to. Web use a.

We Last Updated The Casualties And Thefts In January 2023, So This Is The Latest Version Of Form 4684, Fully Updated For Tax.

Web the taxact program uses form 4684 to figure the amount of your loss, and transfers the information to schedule a (form 1040) itemized deductions, line 15. Tax relief for homeowners with corrosive drywall: February 2021) department of the treasury internal revenue service section references are to the internal revenue. To begin the document, utilize the fill camp;

Web 2020 Instructions For Form 4684 Casualties And Thefts (Rev.

Attach form 4684 to your tax. Web how to complete irs form 4684 who is eligible to claim a casualty loss deduction frequently asked questions let’s start with a walk through on how to complete. Web form 4684 is a form provided by the internal revenue service (irs) that taxpayers who itemize deductions can use with the purpose of reporting gains or losses. Web general instructions future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were.

Web The Way To Fill Out The I 684 Form On The Internet:

Web form 4684 is for a casualty loss. Web information about form 4684, casualties and thefts, including recent updates, related forms and instructions on how to file. Web future developments for the latest information about developments related to form 4684 and its instructions, such as legislation enacted after they were published, go to. Web a casualty loss is claimed as an itemized deduction on schedule a of form 1040 and form 4684, casualties and thefts.

Web Instructions For Form 4684 Casualties And Thefts (Rev.

February 2020) department of the treasury internal revenue service section references are to the internal revenue code. Web instructions for form ar4684)rup $5 ,qvw 3j 5 3djh ri. If reporting a qualified disaster loss, see the instructions for special rules that apply. This year, the casualty losses you can deduct are mainly limited to those caused by federally declared disasters.