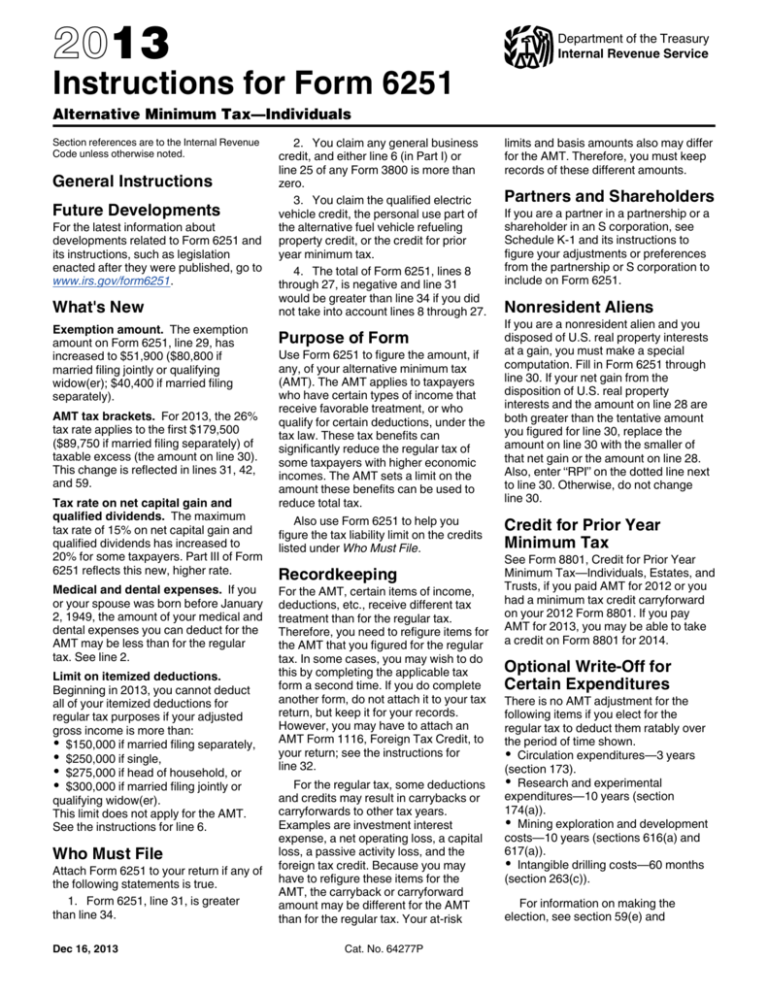

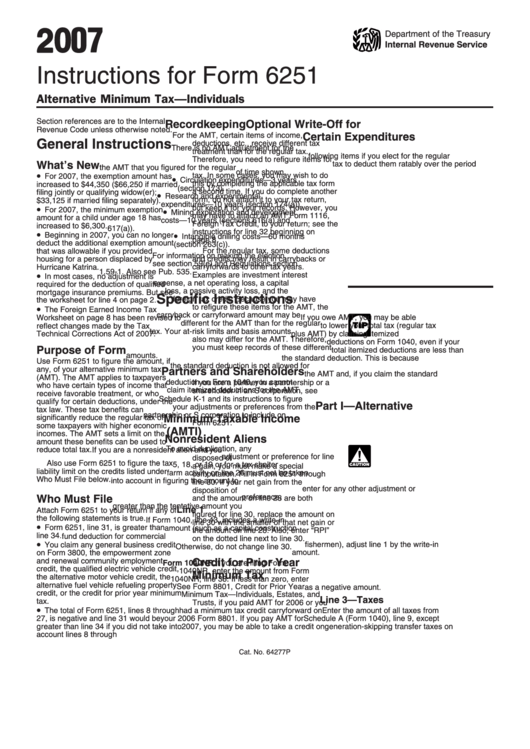

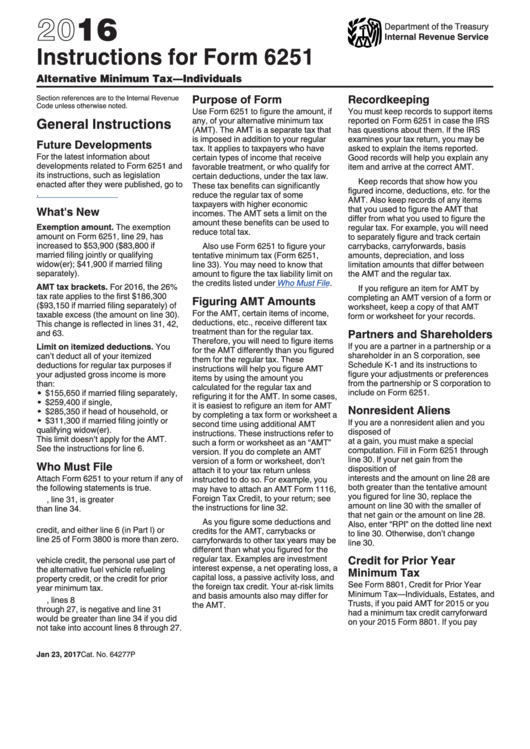

Instructions For Form 6251

Instructions For Form 6251 - The taxpayer certainty and disaster tax relief act of 2019 retroactively. Web will need to file form 6251. For 2020, the 26% tax rate applies to the first $197,900 ($98,950 if married filing separately) of taxable excess (the amount on line 6). Web about form 6251, alternative minimum tax — individuals. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The amt applies to taxpayers. Form 6251, line 7, is greater than line 10. The amt applies to taxpayers who have certain types of income that receive. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The amt is a separate tax that is imposed in addition to your regular tax.

Edit, sign and save irs instruction 6251 form. Information about form 6251 and its separate instructions is at. For 2020, the 26% tax rate applies to the first $197,900 ($98,950 if married filing separately) of taxable excess (the amount on line 6). Web name(s) shown on form 1040 or form 1040nr your social security number part i alternative minimum taxable income (see instructions for how to complete each line.). You claim any general business credit, and either line 6. The amt applies to taxpayers. Form 6251, line 7, is greater than line 10. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web attach form 6251 to your return if any of the following statements are true.

Web will need to file form 6251. Web you may need to file form 6251 if you have specific amt items. Web 2020 ia 6251 instructions, page 1. You claim any general business credit, and either line 6. Department of the treasury internal revenue service (99) alternative minimum tax—individuals. If you need to report any of the following items on your tax return, you must file form 6251, alternative minimum. Who must file ia 6251? Form 6251, line 7, is greater than line 10. The amt applies to taxpayers who have certain types of income that receive. The amt applies to taxpayers.

Form 6251Alternative Minimum Tax

Department of the treasury internal revenue service (99) alternative minimum tax—individuals. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). For 2020, the 26% tax rate applies to the first $197,900 ($98,950 if married filing separately) of taxable excess (the amount on line 6). The amt is a separate tax that is imposed in.

Instructions for Form 6251

You can get the irs form 6251 from the department of treasury or download it online. Web name(s) shown on form 1040 or form 1040nr your social security number part i alternative minimum taxable income (see instructions for how to complete each line.). The amt applies to taxpayers. Use form 6251 to figure the amount, if any, of your alternative.

Instructions For Form 6251 Alternative Minimum Tax Individuals

Web 2020 ia 6251 instructions, page 1. Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Web attach form 6251 to your return if any of the following statements are true. You can get the irs form 6251 from the department of treasury or download it online. The amt applies to.

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

Web use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). For 2020, the 26% tax rate applies to the first $197,900 ($98,950 if married filing separately) of taxable excess (the amount on line 6). Form 6251, line 7, is greater than line 10. Web will need to file form 6251. You claim any general.

Instructions For Form 6251 2016 printable pdf download

You claim any general business credit, and either line 6. Web you may need to file form 6251 if you have specific amt items. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The amt applies to taxpayers. Information about form 6251 and its separate instructions is at.

Federal Form 6251 Form 6251 Instructions Fill Out And Sign Printable

The taxpayer certainty and disaster tax relief act of 2019 retroactively. For 2020, the 26% tax rate applies to the first $197,900 ($98,950 if married filing separately) of taxable excess (the amount on line 6). Information about form 6251 and its separate instructions is at. In order for wealthy individuals to. Web attach form 6251 to your return if any.

Instructions For Form 6251 Alternative Minimum Tax Individuals

You can get the irs form 6251 from the department of treasury or download it online. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). You claim any general business credit, and either line 6. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web irs form 6251,.

Instructions For Form 6251 Alternative Minimum TaxIndividuals 2004

In order for wealthy individuals to. You can get the irs form 6251 from the department of treasury or download it online. Web you may need to file form 6251 if you have specific amt items. Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Web will need to file form.

Instructions For Form 6251 2008 printable pdf download

Web attach form 6251 to your return if any of the following statements are true. Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. The amt is a separate tax that is imposed in addition to your regular tax. You claim any general business credit, and either line 6. You can.

form 6251 instructions 2020 2021 Fill Online, Printable, Fillable

The amt applies to taxpayers. For 2020, the 26% tax rate applies to the first $197,900 ($98,950 if married filing separately) of taxable excess (the amount on line 6). Form 6251, line 7, is greater than line 10. Get ready for tax season deadlines by completing any required tax forms today. Web 2020 ia 6251 instructions, page 1.

Who Must File Ia 6251?

Get ready for tax season deadlines by completing any required tax forms today. In order for wealthy individuals to. You can get the irs form 6251 from the department of treasury or download it online. Web name(s) shown on form 1040 or form 1040nr your social security number part i alternative minimum taxable income (see instructions for how to complete each line.).

For 2020, The 26% Tax Rate Applies To The First $197,900 ($98,950 If Married Filing Separately) Of Taxable Excess (The Amount On Line 6).

The amt applies to taxpayers. Web irs form 6251, titled alternative minimum tax—individuals, determines how much alternative minimum tax (amt) you could owe. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). The taxpayer certainty and disaster tax relief act of 2019 retroactively.

Information About Form 6251 And Its Separate Instructions Is At.

Web 2020 ia 6251 instructions, page 1. Web you may need to file form 6251 if you have specific amt items. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Web will need to file form 6251.

The Amt Applies To Taxpayers Who Have Certain Types Of Income That Receive.

Department of the treasury internal revenue service (99) alternative minimum tax—individuals. The amt is a separate tax that is imposed in addition to your regular tax. Use form 6251 to figure the amount, if any, of your alternative minimum tax (amt). Edit, sign and save irs instruction 6251 form.