Instructions Form 5472

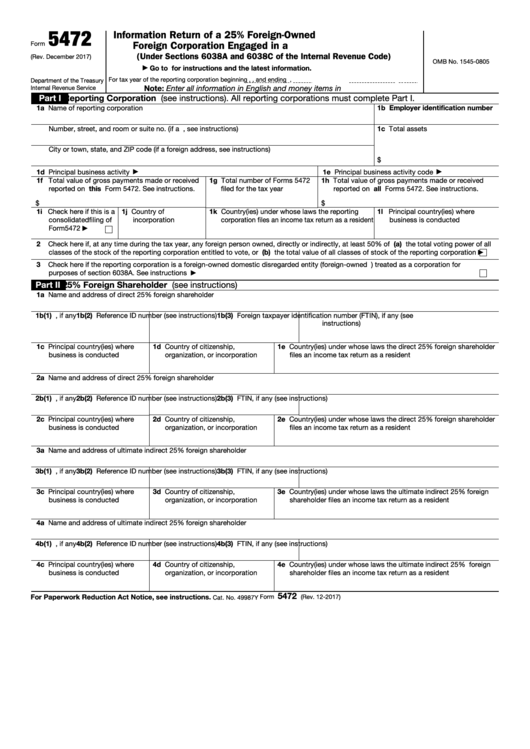

Instructions Form 5472 - Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Internal revenue service form 5472 is an informational form that discloses the transactions during the tax year of a reporting. The instructions for form 5472 provide detailed information on how to register for and use. What's new part vii, lines 41a through. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Web as explained by the internal revenue service (irs), form 5472 should be used to provide the information required under section 6038a and section 6038c when. A reporting corporation that engages. Affiliated group are reporting corporations under section. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web in summary, only reporting corporations need to file irs form 5472.

The instructions for form 5472 provide detailed information on how to register for and use. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Web form 5472 a schedule stating which members of the u.s. Affiliated group are reporting corporations under section. The internal revenue code imposes penalties for the failure to timely file international information returns on form 5471,. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Web form 5472 is here and instructions to form 5472 here. What's new part vii, lines 41a through. The top 10 questions from llc owners.

Form 5472 instructions are available from the irs. Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Web in summary, only reporting corporations need to file irs form 5472. Web form 5472 a schedule stating which members of the u.s. Web introductionwho must filehow and when to fileobtaining us employer identification numberinformation to be reportedrecord maintenance. Corporations file form 5472 to provide information required. Web as explained by the internal revenue service (irs), form 5472 should be used to provide the information required under section 6038a and section 6038c when. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. The us internal revenue service (irs) uses the form 5472 in developing. Web form 5472 is here and instructions to form 5472 here.

Form 5472 Information Return of Corporation Engaged in U.S. Trade

Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Web form 5472 a schedule stating which members of the u.s. But, the information provided can still be rather confusing. Web form 5472 explained: Affiliated group are reporting corporations under section.

Should You File a Form 5471 or Form 5472? Asena Advisors

Web form 5472 is here and instructions to form 5472 here. Web form 5472 explained: What's new part vii, lines 41a through. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Affiliated group are reporting corporations under section.

Fillable Form 5472 Information Return Of A 25 ForeignOwned U.s

The internal revenue code imposes penalties for the failure to timely file international information returns on form 5471,. The common parent must attach to form 5472 a schedule stating which members of the u.s. Form 5472 instructions are available from the irs. Web form 5472 explained: Corporations file form 5472 to provide information required.

Form 5472 What Is It and Do I Need to File It? WilkinGuttenplan

The internal revenue code imposes penalties for the failure to timely file international information returns on form 5471,. Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. The instructions for form 5472 provide detailed information on how to register for and use. What is form 5472 used.

How to File Form 5472 Extension Due July 15th 2020! YouTube

The internal revenue code imposes penalties for the failure to timely file international information returns on form 5471,. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Web purpose of the form. Web in summary, only reporting corporations need to file irs form 5472. A reporting corporation that engages.

Instructions & Quick Guides on Form 5472 Asena Advisors

Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Web form 5472 is here and instructions to form 5472 here. Web purpose of the form. The us internal revenue service (irs) uses the form 5472 in developing. But, the information provided can still be rather confusing.

form 5472 instructions 2018 Fill Online, Printable, Fillable Blank

Web information about form 5472, including recent updates, related forms, and instructions on how to file. What is form 5472 used for? Web form 5472 a schedule stating which members of the u.s. Web developments related to form 5472 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5472. The internal revenue code imposes penalties for.

What Is Effectively Connected Gross Bizfluent

A reporting corporation that engages. Web form 5472 a schedule stating which members of the u.s. Web information about form 5472, including recent updates, related forms, and instructions on how to file. Corporations file form 5472 to provide information required. Affiliated group are reporting corporations under section.

Demystifying IRS Form 5472 SF Tax Counsel

The internal revenue code imposes penalties for the failure to timely file international information returns on form 5471,. Web as explained by the internal revenue service (irs), form 5472 should be used to provide the information required under section 6038a and section 6038c when. Web form 5472 explained: The common parent must attach to form 5472 a schedule stating which.

Instrucciones del formulario 5472 del IRS Impuestos 2021

The top 10 questions from llc owners. Web form 5472 is here and instructions to form 5472 here. Affiliated group are reporting corporations under section. Web information about form 5472, including recent updates, related forms, and instructions on how to file. The instructions for form 5472 provide detailed information on how to register for and use.

Affiliated Group Are Reporting Corporations Under Section.

What's new part vii, lines 41a through. But, the information provided can still be rather confusing. Web introductionwho must filehow and when to fileobtaining us employer identification numberinformation to be reportedrecord maintenance. The internal revenue code imposes penalties for the failure to timely file international information returns on form 5471,.

The Us Internal Revenue Service (Irs) Uses The Form 5472 In Developing.

Form 5472 instructions are available from the irs. What is form 5472 used for? Web form 5472 is an information return used to fulfill federal reporting obligations under internal revenue code (irc) sections 6038a and 6038c. Web developments related to form 5472 and its instructions, such as legislation enacted after they were published, go to irs.gov/form5472.

Web Purpose Of The Form.

Web form 5472 explained: Web form 5472 is here and instructions to form 5472 here. Web in summary, only reporting corporations need to file irs form 5472. A reporting corporation that engages.

The Top 10 Questions From Llc Owners.

Web the 5472 form is an international tax form that is used by foreign persons to report an interest in, or ownership over a u.s. Affiliated group are reporting corporations under section 6038a, and which of those members are joining in the. Web as explained by the internal revenue service (irs), form 5472 should be used to provide the information required under section 6038a and section 6038c when. Web information about form 5472, including recent updates, related forms, and instructions on how to file.