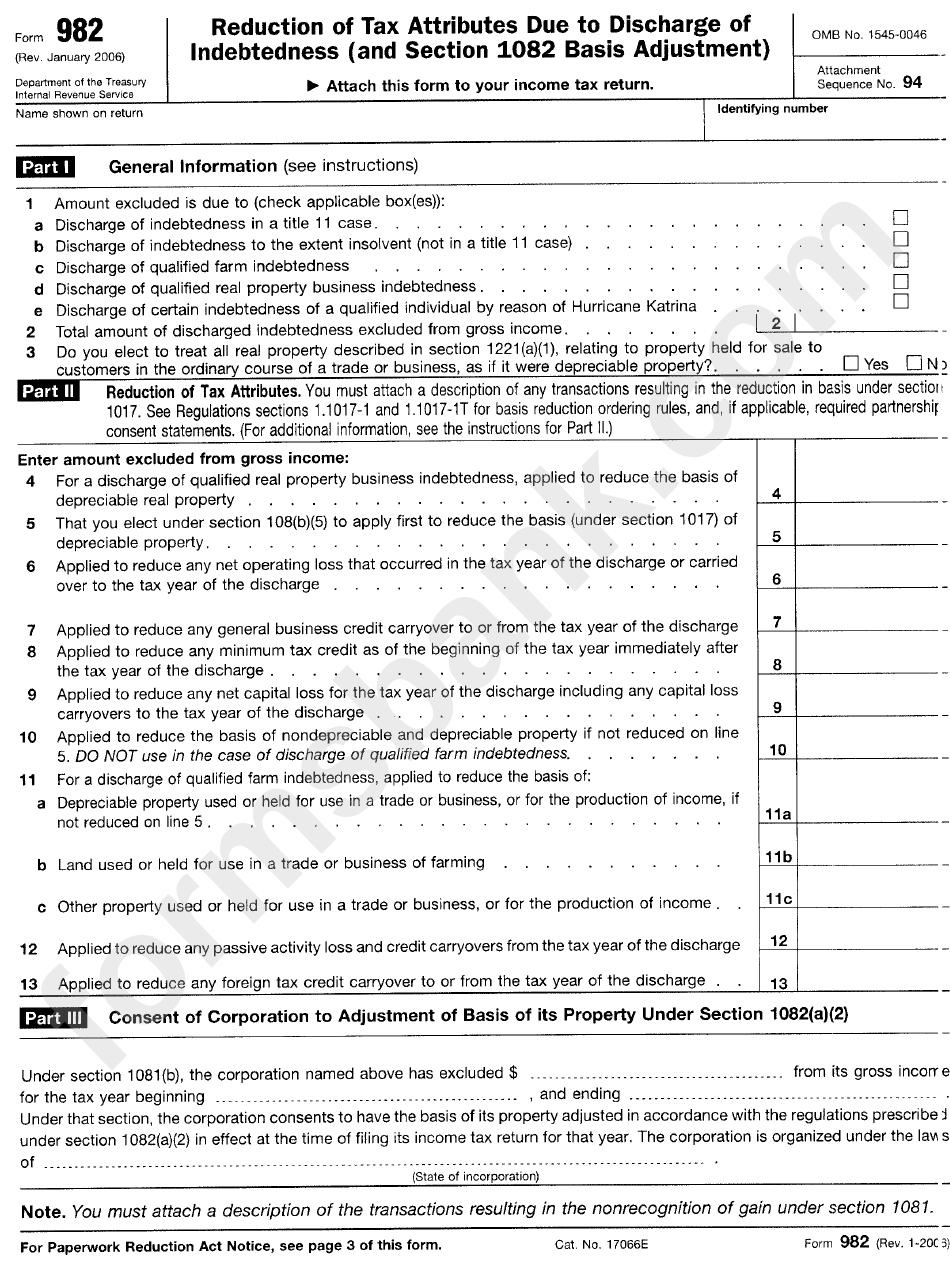

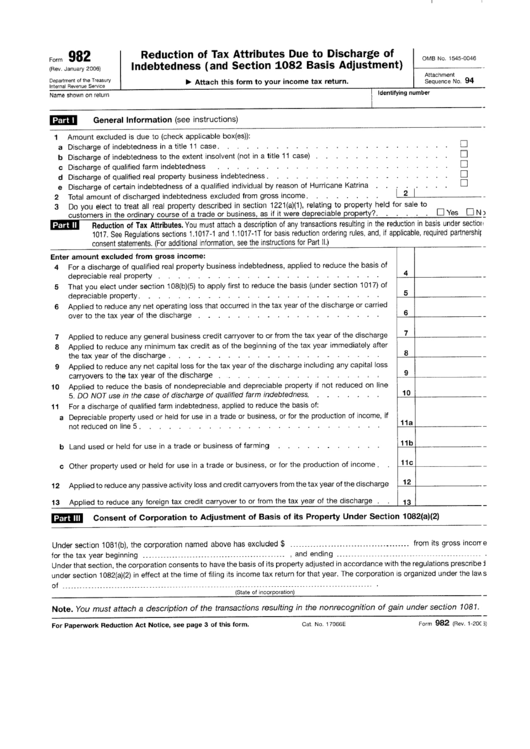

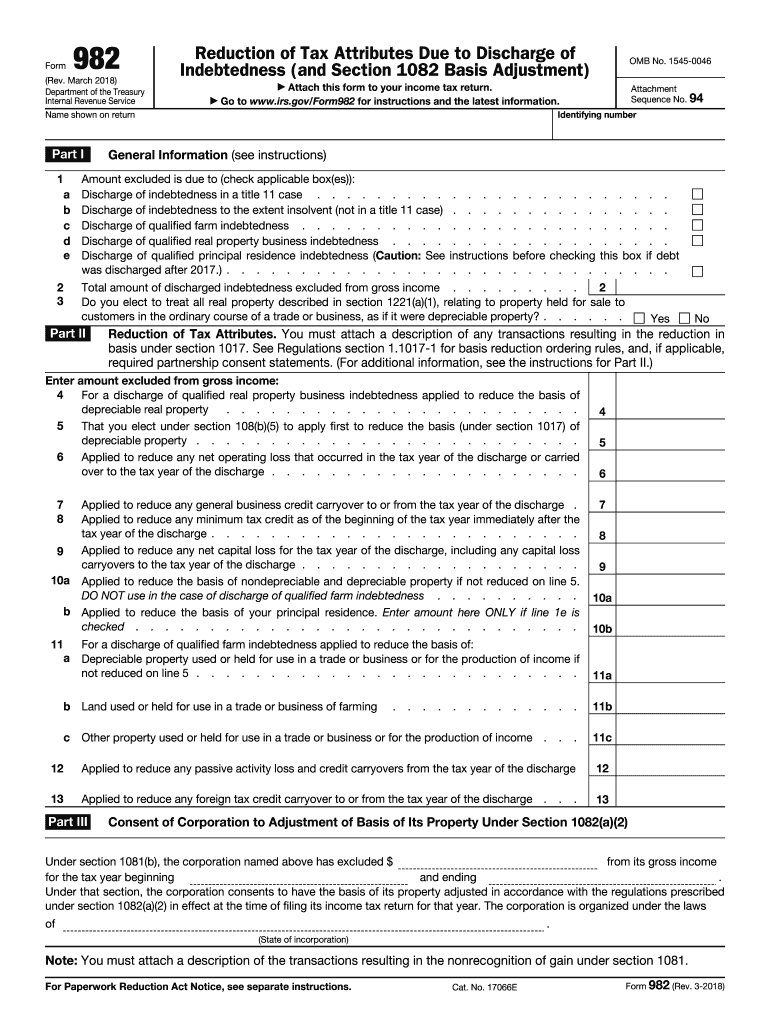

Irs Form 982 Explained

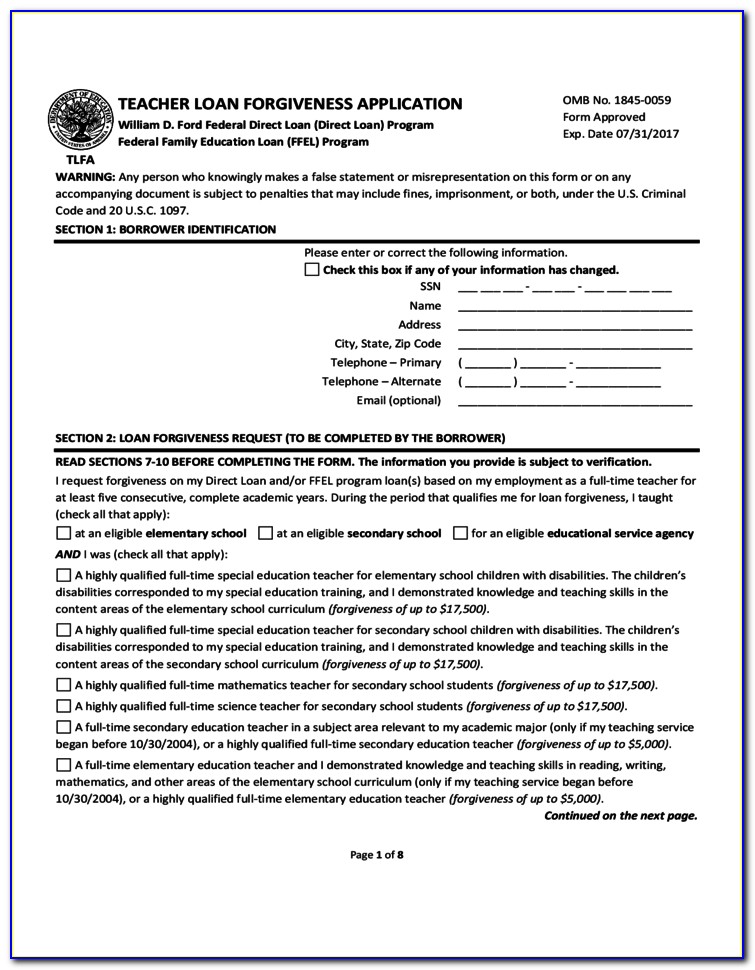

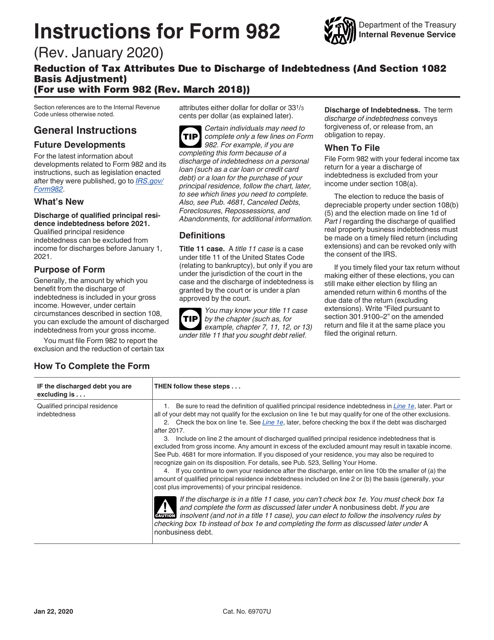

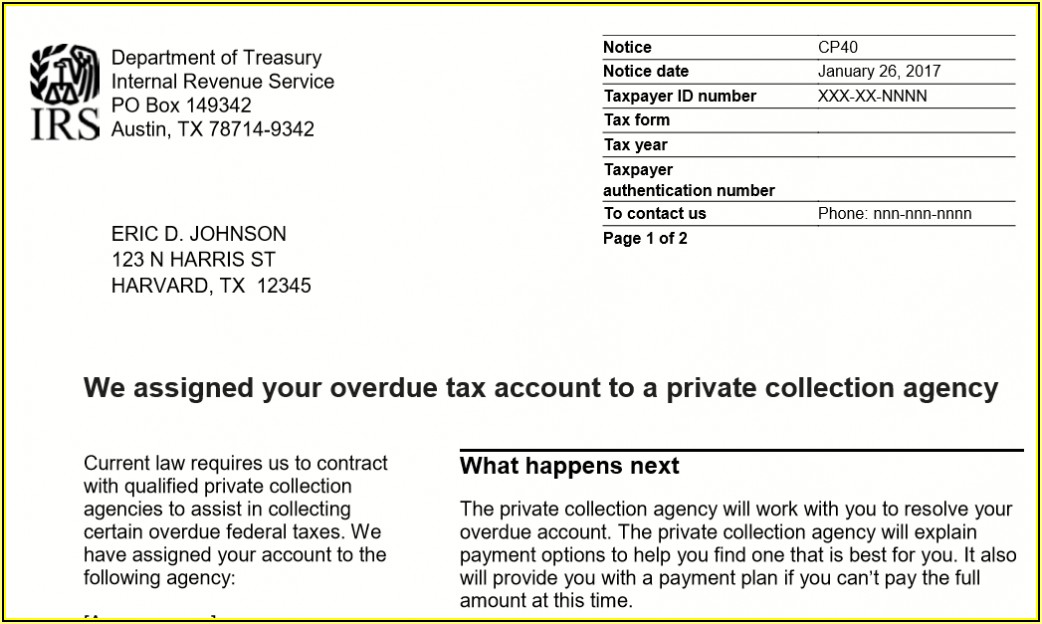

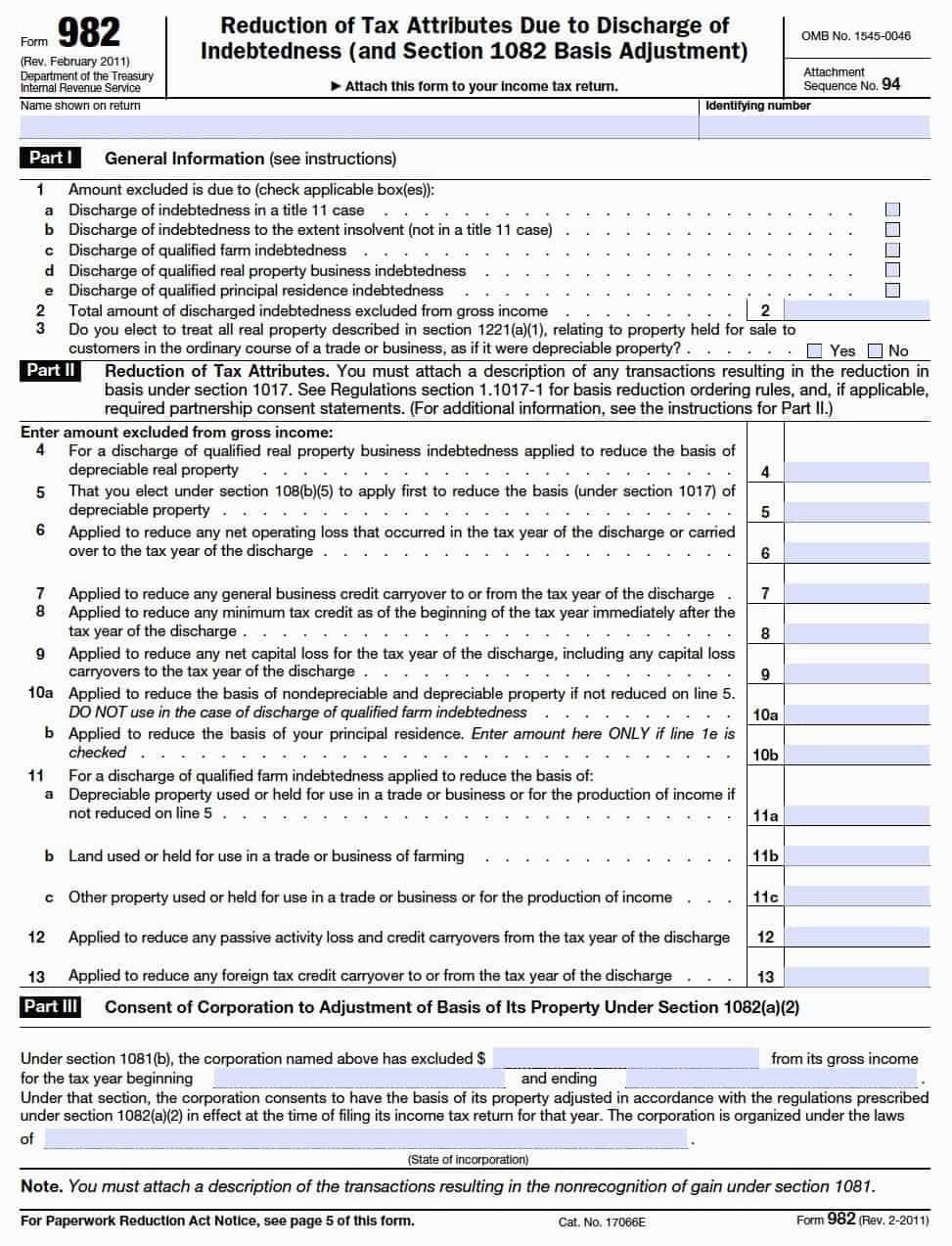

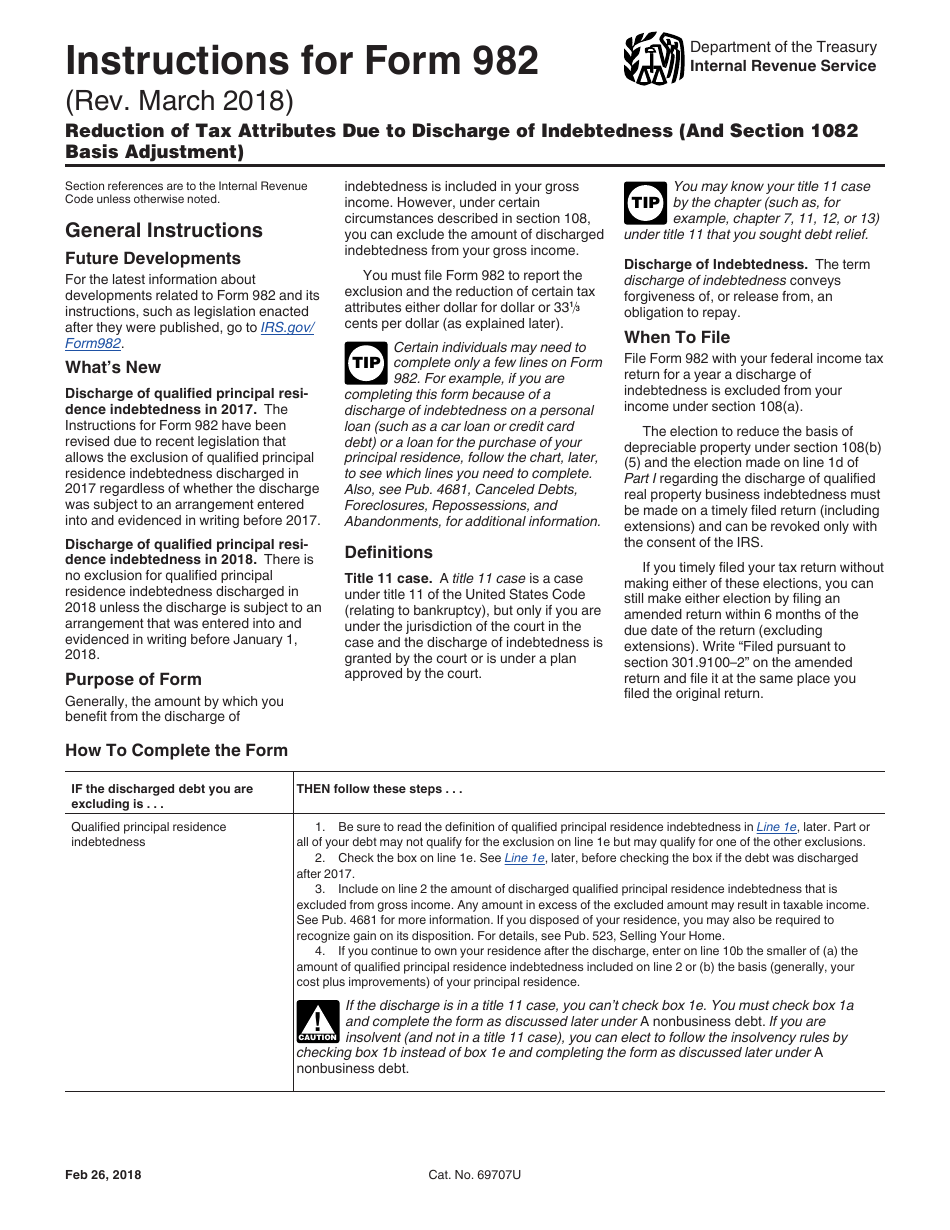

Irs Form 982 Explained - Attach form 982 to your federal income tax return for 2022 and check the. Web form 982 federal — reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) download this form print this form it appears you. Form 982 is used to determine, under certain. March 2018) department of the treasury internal revenue service. We last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Complete, edit or print tax forms instantly. Web check box 1e on form 982. Web what is form 982? Reduction of tax attributes due to discharge of indebtedness (and section 1082. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331⁄ 3 cents per dollar (as explained below).

Reduction of tax attributes due to discharge of indebtedness (and section 1082. Web the election is made by completing form 982 in accordance with its instructions. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Qualified real property business indebtedness is indebtedness: Web check box 1e on form 982. Web form 982 federal — reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) download this form print this form it appears you. This is because you received a benefit from. Attach form 982 to your federal income tax return for 2022 and check the. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). What is a discharge of qualified real property business indebtedness?

Attach form 982 to your federal income tax return for 2022 and check the. That is assumed or incurred in. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web more about the federal form 982 corporate income tax ty 2022. Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Web the election is made by completing form 982 in accordance with its instructions. What is a discharge of qualified real property business indebtedness? Web form 982 is used to find the discharged indebtedness amount that can be excluded from gross income. Complete, edit or print tax forms instantly. March 2018) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis.

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

That is assumed or incurred in. Web more about the federal form 982 corporate income tax ty 2022. Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports the amount of cancelled debt to excluded from taxable income. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar.

Irs Debt Form 982 Form Resume Examples 86O7r9A5BR

March 2018) department of the treasury internal revenue service. That is assumed or incurred in. Complete, edit or print tax forms instantly. Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Web the election is made by completing form 982 in accordance with.

Form 982 Reduction Of Tax Attributes Due To Discharge Of Indebtedness

Complete, edit or print tax forms instantly. That is assumed or incurred in. Reduction of tax attributes due to discharge of indebtedness (and section 1082. Taxpayers who are not personally liable for. This is because you received a benefit from.

Form 982 Fill Out and Sign Printable PDF Template signNow

Web form 982 federal — reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) download this form print this form it appears you. Complete, edit or print tax forms instantly. Qualified real property business indebtedness is indebtedness: We last updated the reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Web.

Irs Debt Form 982 Form Resume Examples MeVRkgq2Do

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web more about the federal form 982 corporate income tax ty 2022. See publication 4012, income tab, capital loss on foreclosure, on how to complete form 982. Web the election is.

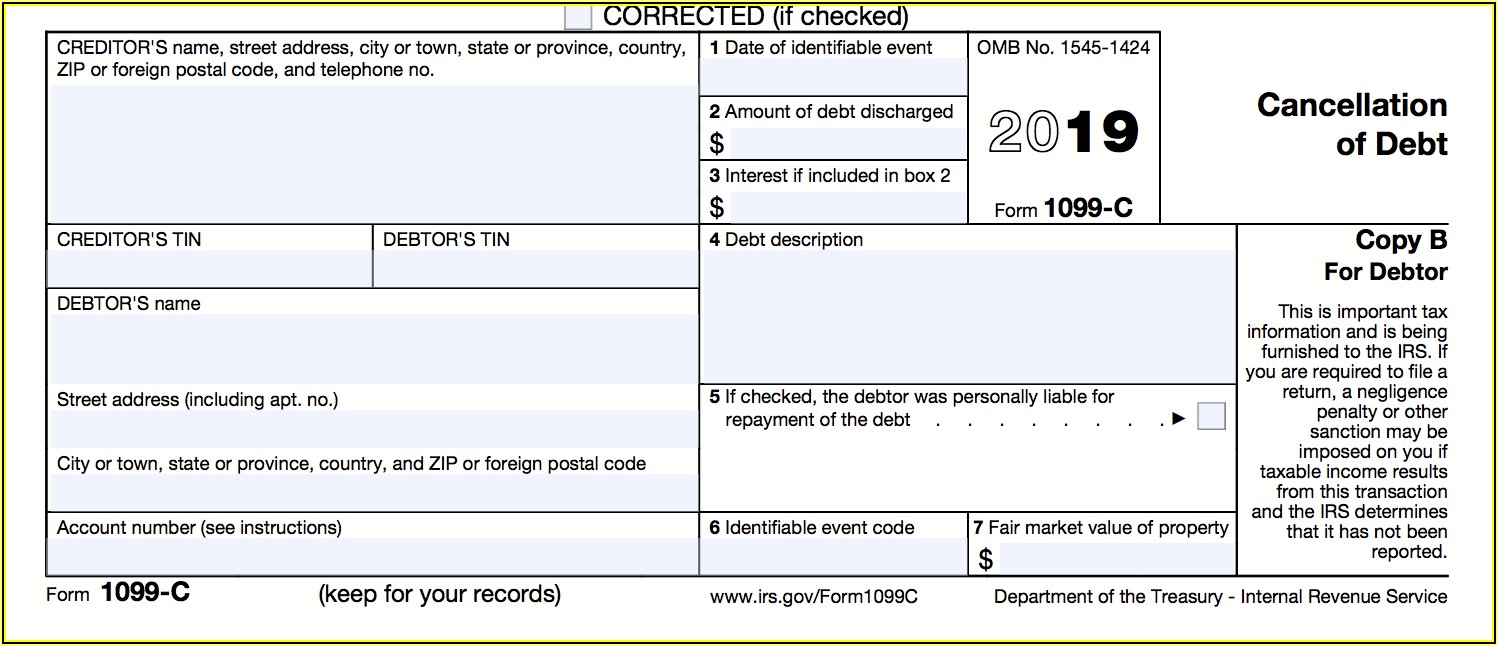

Tax form 982 Insolvency Worksheet Along with 1099 form Utah

Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Complete, edit or print tax forms instantly. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331⁄ 3 cents per dollar.

Download Instructions for IRS Form 982 Reduction of Tax Attributes Due

Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). This is because you received a benefit from. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331⁄ 3 cents per.

Irs Of Debt Form Form Resume Examples ojYqD0M9zl

Complete, edit or print tax forms instantly. Reduction of tax attributes due to discharge of indebtedness (and section 1082. March 2018) department of the treasury internal revenue service. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web form 982.

Form 982 Instructions Reasons Why 9 Is Grad Amended Return —

Reduction of tax attributes due to discharge of indebtedness (and section 1082. Web check box 1e on form 982. Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Form 982 is used to determine, under certain. Attach form 982 to your federal income.

Download Instructions for IRS Form 982 Reduction of Tax Attributes Due

Web what is form 982? Reduction of tax attributes due to discharge of indebtedness (and section 1082. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331⁄ 3 cents per dollar (as explained below). Web form 982 (reduction of tax attributes due to discharge of indebtedness) reports.

Qualified Real Property Business Indebtedness Is Indebtedness:

Taxpayers who are not personally liable for. Web the election is made by completing form 982 in accordance with its instructions. March 2018) department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis. Generally, the amount by which you benefit from the discharge of indebtedness is included in your gross income.

March 2018) Department Of The Treasury Internal Revenue Service.

Web to claim a canceled debt amount should be excluded from gross income, the taxpayer needs to complete irs form 982 and attach the completed form to their return. Web more about the federal form 982 corporate income tax ty 2022. Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). This is because you received a benefit from.

See Publication 4012, Income Tab, Capital Loss On Foreclosure, On How To Complete Form 982.

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331⁄ 3 cents per dollar (as explained below). Tax rules, the dollar value of canceled debt is included in gross inc. Reduction of tax attributes due to discharge of indebtedness (and section 1082. That is assumed or incurred in.

We Last Updated The Reduction Of Tax Attributes Due To Discharge Of Indebtedness (And Section 1082 Basis.

Web you must file form 982 to report the exclusion and the reduction of certain tax attributes either dollar for dollar or 331/3 cents per dollar (as explained later). Web in order to claim this, taxpayers must file irs form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment). Web what is form 982? Attach form 982 to your federal income tax return for 2022 and check the.