It-2104 Form New York

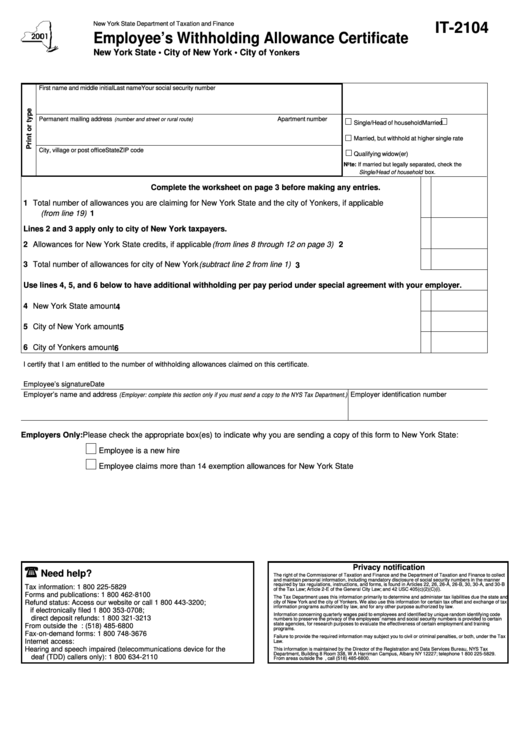

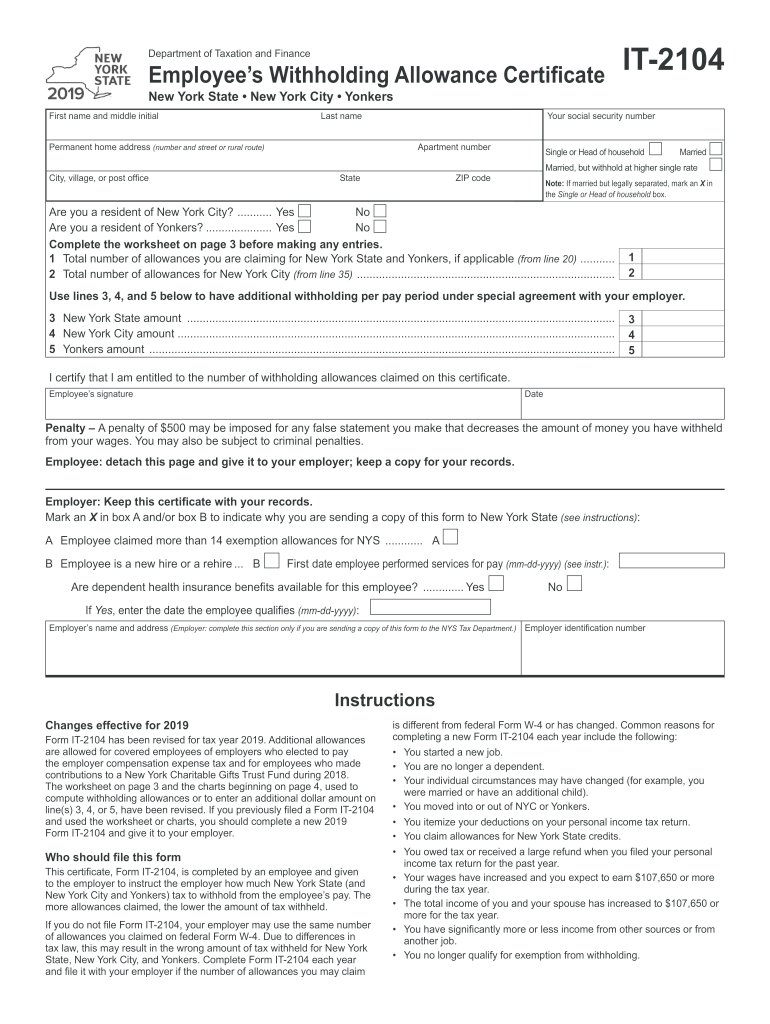

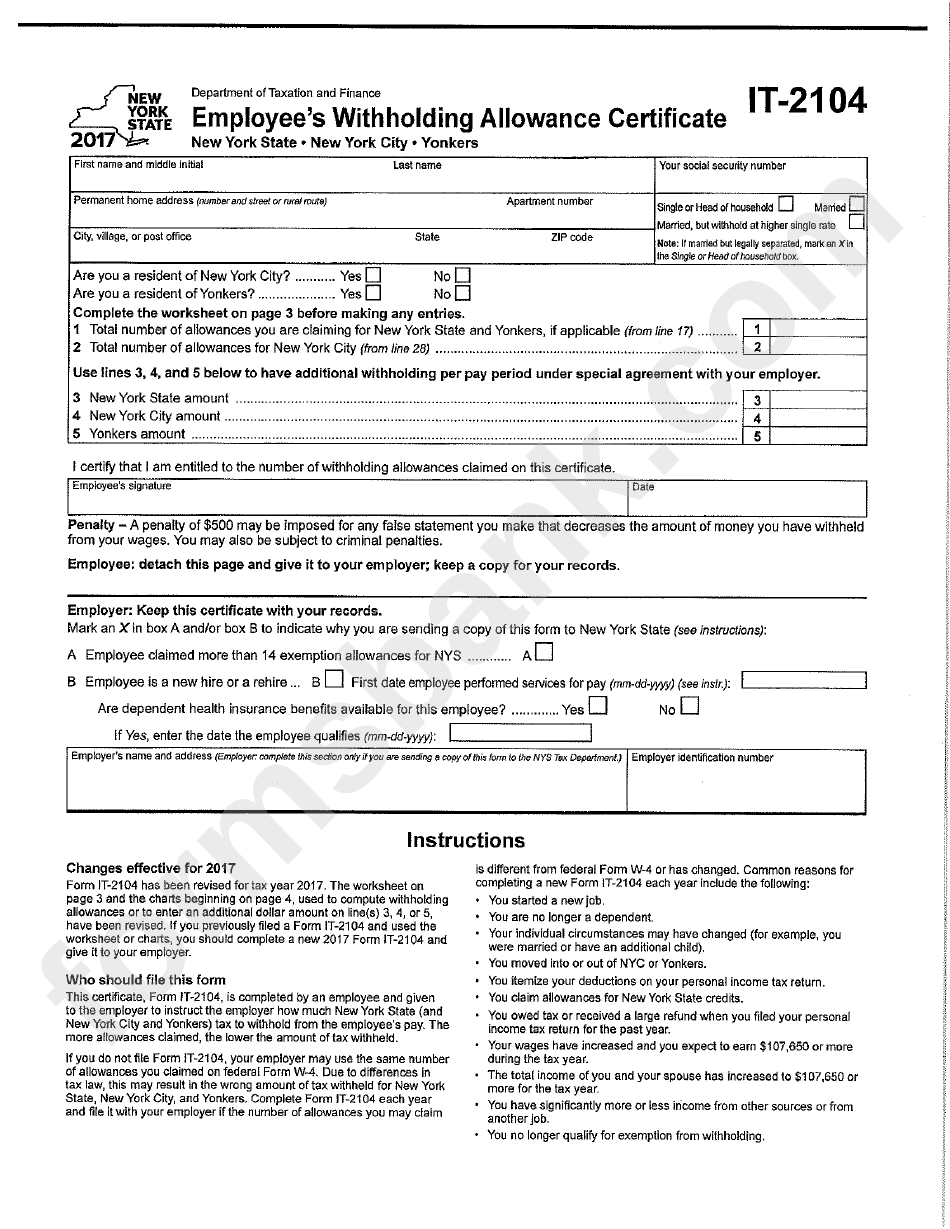

It-2104 Form New York - Web employee's withholding allowance certificate. Web state, new york city, and yonkers. Web 8 rows employee's withholding allowance certificate. The more allowances claimed, the lower the amount of tax withheld.,i\rxgrqrw¿oh)rup,7. Every employee must pay federal and state taxes, unless you’re in a state that. Web aaron wojack for the new york times. Web once a pilot whale — which can grow up to 24 feet in length and weigh up to 6,600 pounds — is out of the water, its organs can be gradually crushed under its own. Our businesses reopened really early, says polis. Web new york city and yonkers) tax to withhold from the employee’s pay. Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers.

Upload, modify or create forms. Web new york city and yonkers) tax to withhold from the employee’s pay. Web state, new york city, and yonkers. The more allowances claimed, the lower the amount of tax withheld.,i\rxgrqrw¿oh)rup,7. Our businesses reopened really early, says polis. The more allowances claimed, the lower the amount of tax withheld. A penalty of $500 may be imposed for furnishing false information that. Web july 24, 2023. When matt haney entered the california legislature, he discovered he was part of a tiny minority: Web gross income and new york additions to income is more than your new york standard deduction.

A penalty of $500 may be imposed for furnishing false information that. Try it for free now! When matt haney entered the california legislature, he discovered he was part of a tiny minority: Web 8 rows employee's withholding allowance certificate. Mckinley jr., a senior editor on the live team, has held a range of jobs at the new york times, starting on metro with the police beat and then city. Start with the worksheet one of the aspects of. Web state, new york city, and yonkers. Web new york city and yonkers) tax to withhold from the employee’s pay. The more allowances claimed, the lower the amount of tax withheld.,i\rxgrqrw¿oh)rup,7. Web employee's withholding allowance certificate.

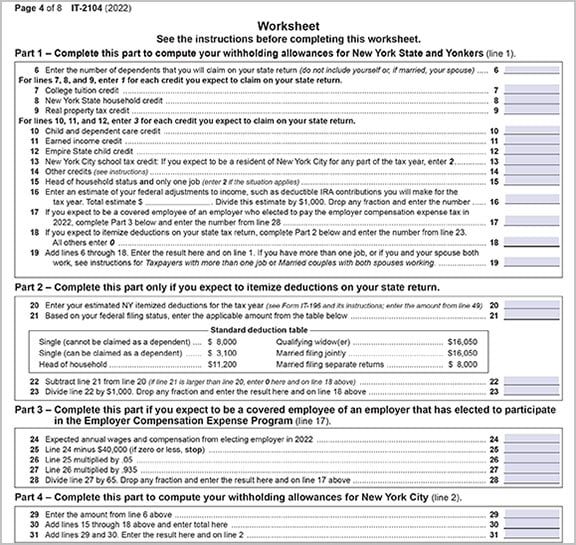

IT2104 StepbyStep Guide Baron Payroll

Web 8 rows employee's withholding allowance certificate. Web new york city and yonkers) tax to withhold from the employee’s pay. Web once a pilot whale — which can grow up to 24 feet in length and weigh up to 6,600 pounds — is out of the water, its organs can be gradually crushed under its own. Web gross income and.

Form It2104 Employee'S Withholding Allowance Certificate printable

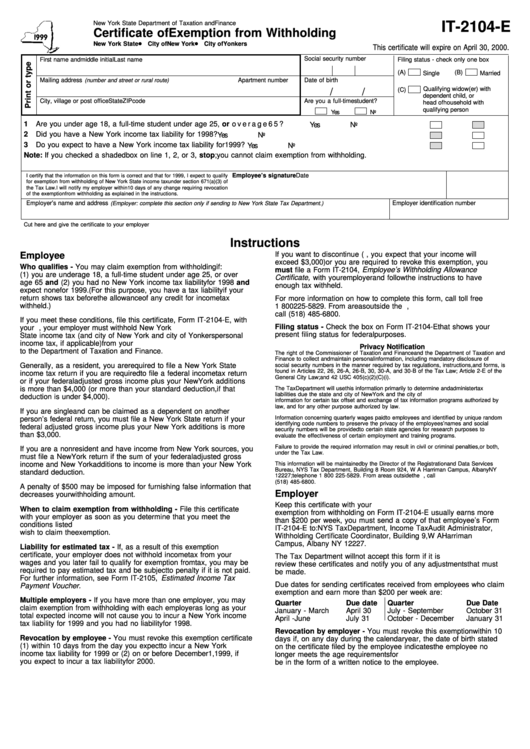

Web new york city and yonkers) tax to withhold from the employee’s pay. Certificate of exemption from withholding. Web state, new york city, and yonkers. Web gross income and new york additions to income is more than your new york standard deduction. Start with the worksheet one of the aspects of.

It 2104 Fill Out and Sign Printable PDF Template signNow

Web once a pilot whale — which can grow up to 24 feet in length and weigh up to 6,600 pounds — is out of the water, its organs can be gradually crushed under its own. Web employee's withholding allowance certificate. Web new york city and yonkers) tax to withhold from the employee’s pay. When matt haney entered the california.

Fillable Form It2104E Certificate Of Exemption From Withholding

The former tropical storm don, which briefly strengthened over the weekend to become the first hurricane in the atlantic this year, had degraded to. When matt haney entered the california legislature, he discovered he was part of a tiny minority: Web july 24, 2023. Web new york city and yonkers) tax to withhold from the employee’s pay. Web state, new.

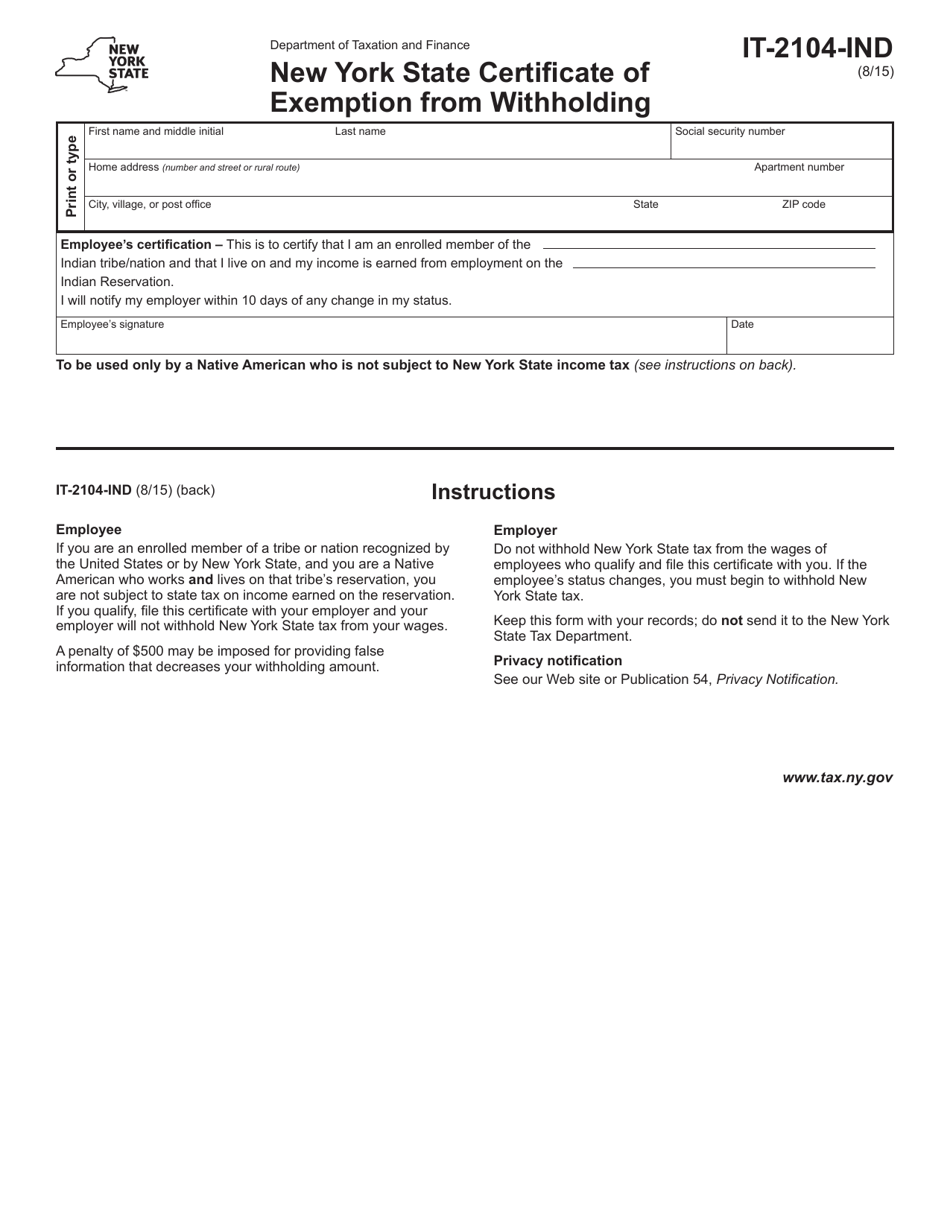

Form IT2104IND Download Fillable PDF or Fill Online New York State

Certificate of exemption from withholding. When matt haney entered the california legislature, he discovered he was part of a tiny minority: Every employee must pay federal and state taxes, unless you’re in a state that. Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. The more allowances.

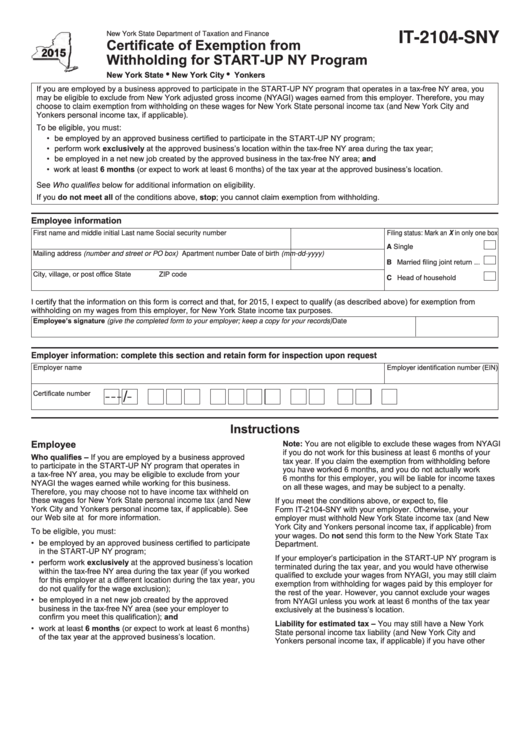

Form It2104Sny Certificate Of Exemption From Withholding For Start

Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Web 8 rows employee's withholding allowance certificate. Web once a pilot whale — which can grow up to 24 feet in length and weigh up to 6,600 pounds — is out of the water, its organs can be.

Form It2104 Employee'S Withholding Allowance Certificate 2017

Web aaron wojack for the new york times. When matt haney entered the california legislature, he discovered he was part of a tiny minority: Web 8 rows employee's withholding allowance certificate. Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. The more allowances claimed, the lower the.

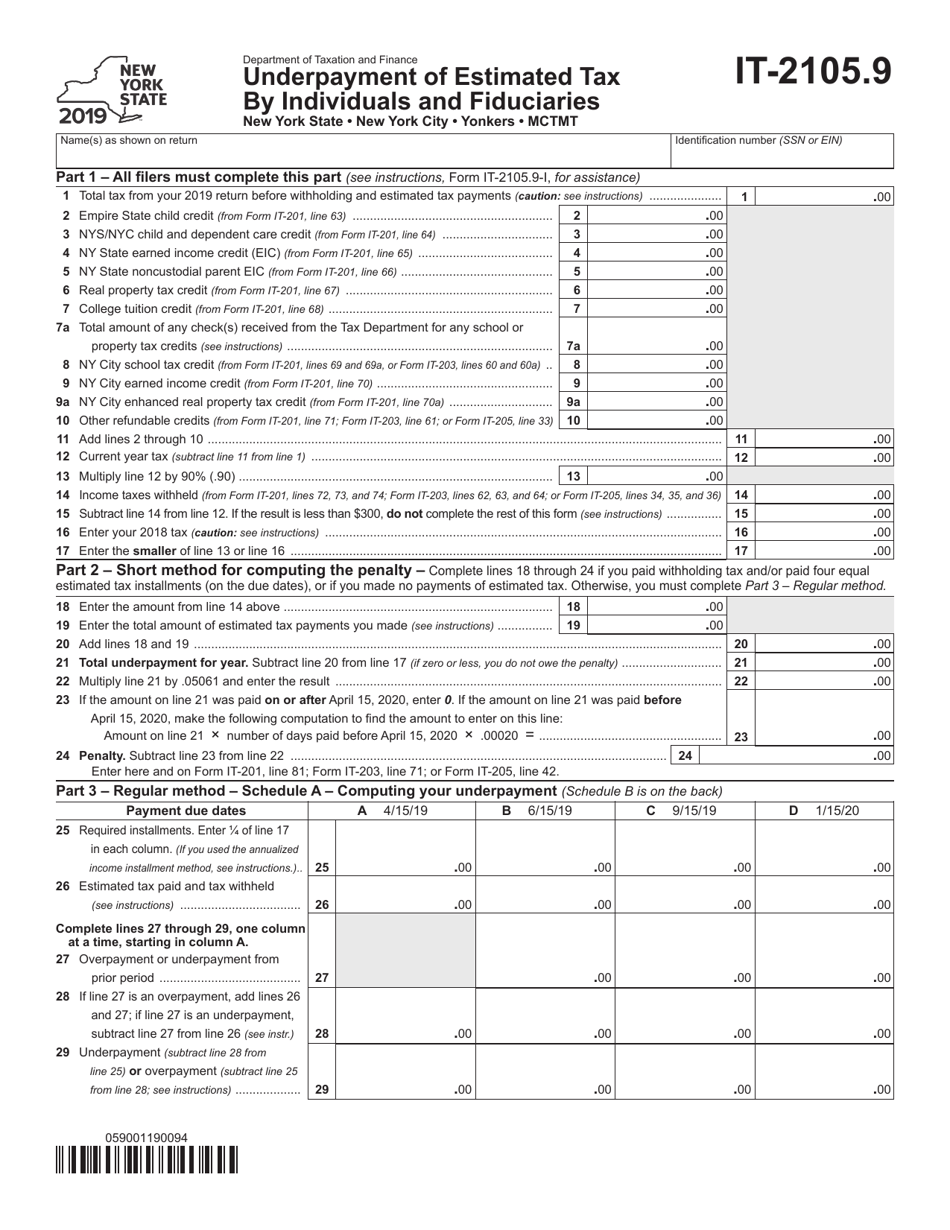

Form IT2105.9 Download Fillable PDF or Fill Online Underpayment of

Web new york city and yonkers) tax to withhold from the employee’s pay. A penalty of $500 may be imposed for furnishing false information that. Every employee must pay federal and state taxes, unless you’re in a state that. Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and.

W 9 Form 2017 Printable Printable Word Searches

Our businesses reopened really early, says polis. Web july 24, 2023. Web gross income and new york additions to income is more than your new york standard deduction. A penalty of $500 may be imposed for furnishing false information that. Employers are often unsure if they must have employees.

2022 Form NY DTF IT2104SNY Fill Online, Printable, Fillable, Blank

Upload, modify or create forms. Mckinley jr., a senior editor on the live team, has held a range of jobs at the new york times, starting on metro with the police beat and then city. Web tax law, this may result in the wrong amount of tax withheld for new york state, new york city, and yonkers. Web new york.

Web Tax Law, This May Result In The Wrong Amount Of Tax Withheld For New York State, New York City, And Yonkers.

Web employee's withholding allowance certificate. Web july 24, 2023. Web new york city and yonkers) tax to withhold from the employee’s pay. Web 8 rows employee's withholding allowance certificate.

Certificate Of Exemption From Withholding.

Web new york city and yonkers) tax to withhold from the employee’s pay. Employers are often unsure if they must have employees. Our businesses reopened really early, says polis. When matt haney entered the california legislature, he discovered he was part of a tiny minority:

Web Once A Pilot Whale — Which Can Grow Up To 24 Feet In Length And Weigh Up To 6,600 Pounds — Is Out Of The Water, Its Organs Can Be Gradually Crushed Under Its Own.

Complete, edit or print tax forms instantly. Web aaron wojack for the new york times. Try it for free now! The former tropical storm don, which briefly strengthened over the weekend to become the first hurricane in the atlantic this year, had degraded to.

The More Allowances Claimed, The Lower The Amount Of Tax Withheld.

Start with the worksheet one of the aspects of. The more allowances claimed, the lower the amount of tax withheld.,i\rxgrqrw¿oh)rup,7. Upload, modify or create forms. A penalty of $500 may be imposed for furnishing false information that.