K 9 Form Tax

K 9 Form Tax - Department of the treasury internal revenue service. Web you must file form 1040, u.s. Web that has elected to be treated as a u.s. Web in most cases errors will repeat as each line is tested. If exempt from form 1099 reporting, check here: Corporation, (there is no exemption for medical or legal. Repeat the test as needed. Turbotax self employed online posted june 4, 2019 3:07 pm last updated june 04, 2019 3:07 pm 0 3 5,833 reply bookmark icon. See back of form and instructions. Resident during the year and who is a resident of the u.s.

Pay delinquent tax debt online; Repeat the test as needed. Web individuals claiming tax treaty benefits: Web that has elected to be treated as a u.s. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. Resident during the year and who is a resident of the u.s. Beneficiary’s share of income, deductions, credits, etc. Web what is a k9 irs form? (updated january 9, 2023) 2. Fixing one of the errors may reduce the list by eliminating the repeats.

Web in most cases errors will repeat as each line is tested. See back of form and instructions. Beneficiary’s share of income, deductions, credits, etc. Resident during the year and who is a resident of the u.s. Web that has elected to be treated as a u.s. Repeat the test as needed. And mark your qualifying exemption reason below 1. Web individuals claiming tax treaty benefits: Web what is a k9 irs form? If exempt from form 1099 reporting, check here:

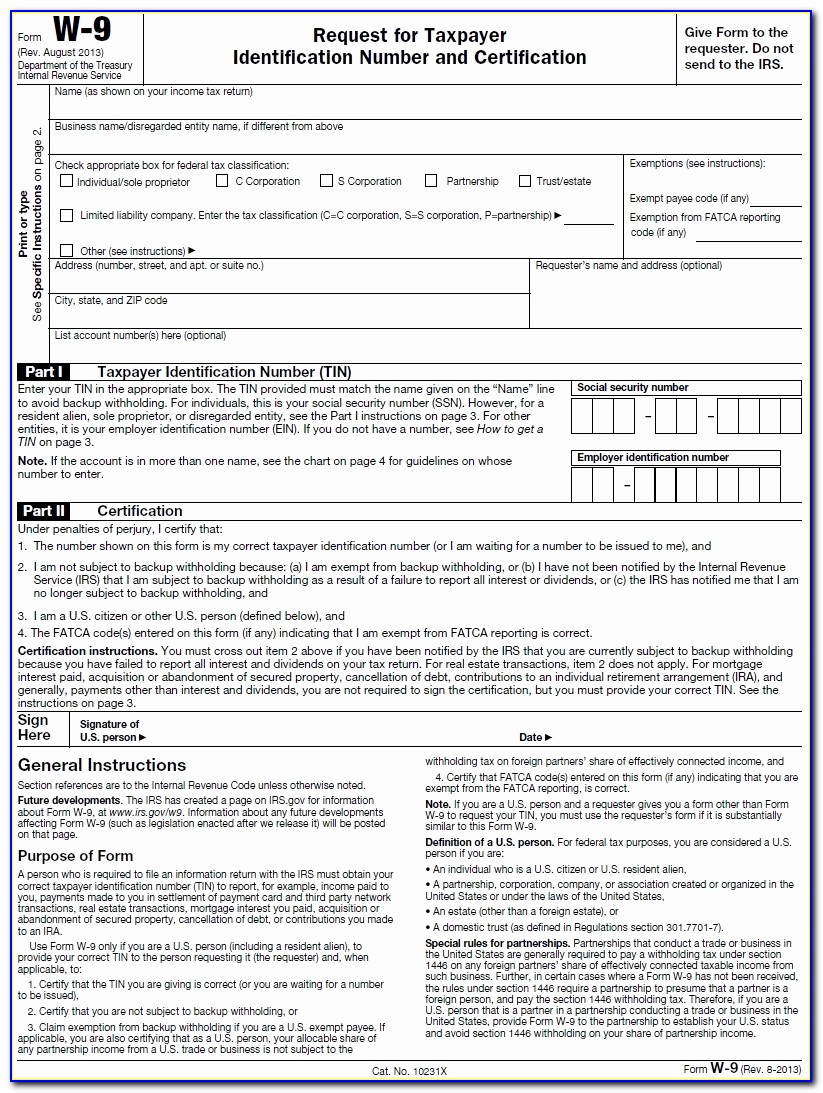

Irs Blank W 9 Form 2020 Printable Example Calendar Printable

Corporation, (there is no exemption for medical or legal. Fixing one of the errors may reduce the list by eliminating the repeats. Web that has elected to be treated as a u.s. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the.

Downloadable W9 Tax Form How To Fill Out A W9 Form Line W within Irs

Web the person named on line 1 of this form is a resident of the treaty country listed on line 9 of the form (if any) within the meaning of the income tax treaty between the united states. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have.

IRS releases drafts of the new Form 1065, Schedule K1 Tax Pro Today

Web where do i fill in for k9 forms? See back of form and instructions. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. Beneficiary’s share of income, deductions, credits, etc. Web individuals claiming tax treaty benefits:

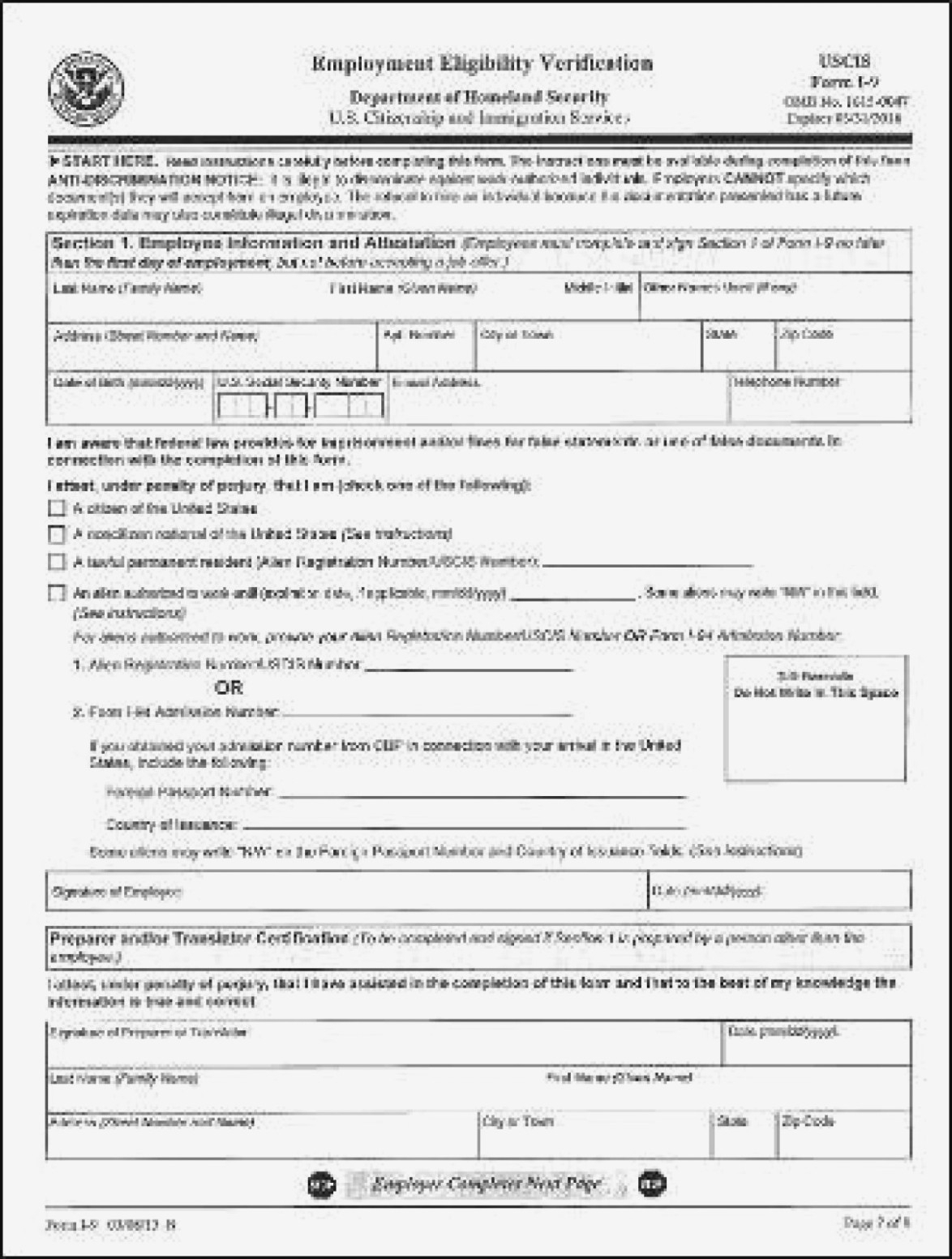

I9 Tax Form Printable Example Calendar Printable

Web in most cases errors will repeat as each line is tested. Turbotax self employed online posted june 4, 2019 3:07 pm last updated june 04, 2019 3:07 pm 0 3 5,833 reply bookmark icon. Fixing one of the errors may reduce the list by eliminating the repeats. Web the person named on line 1 of this form is a.

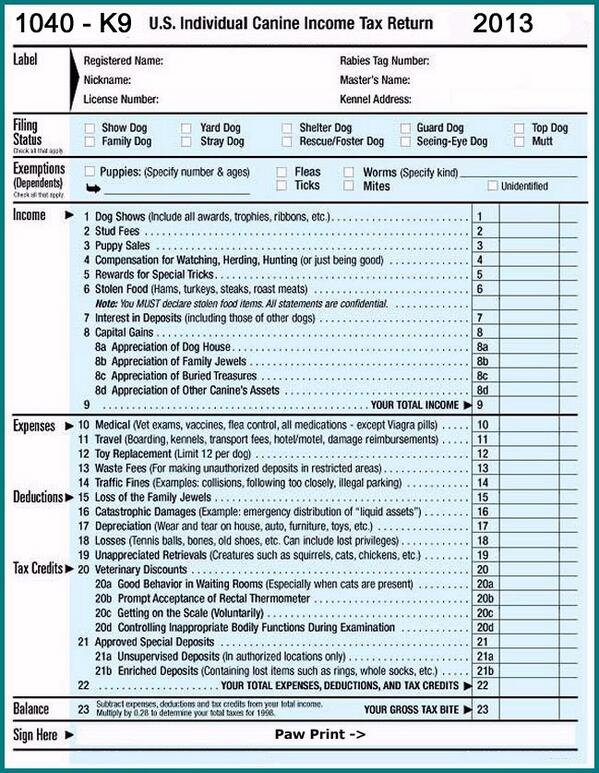

Tripawds » K9 Canine Tax Form

(updated january 9, 2023) 2. And mark your qualifying exemption reason below 1. Web you must file form 1040, u.s. Repeat the test as needed. Department of the treasury internal revenue service.

The Isaac Brock Society New Form 1040K9

Resident during the year and who is a resident of the u.s. Repeat the test as needed. Beneficiary’s share of income, deductions, credits, etc. (updated january 9, 2023) 2. See back of form and instructions.

Who Needs to Fill Out a Form W9? Bizfluent

Fixing one of the errors may reduce the list by eliminating the repeats. Web that has elected to be treated as a u.s. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. Department of the treasury internal revenue service..

Sample Example Of W9 Form Filled Out Fill Online, Printable, Fillable

Web where do i fill in for k9 forms? Corporation, (there is no exemption for medical or legal. Web that has elected to be treated as a u.s. Web you must file form 1040, u.s. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is.

Military dog handler, K9 form stronger bond for deployment > Edwards

(updated january 9, 2023) 2. Web where do i fill in for k9 forms? Fixing one of the errors may reduce the list by eliminating the repeats. Department of the treasury internal revenue service. Web that has elected to be treated as a u.s.

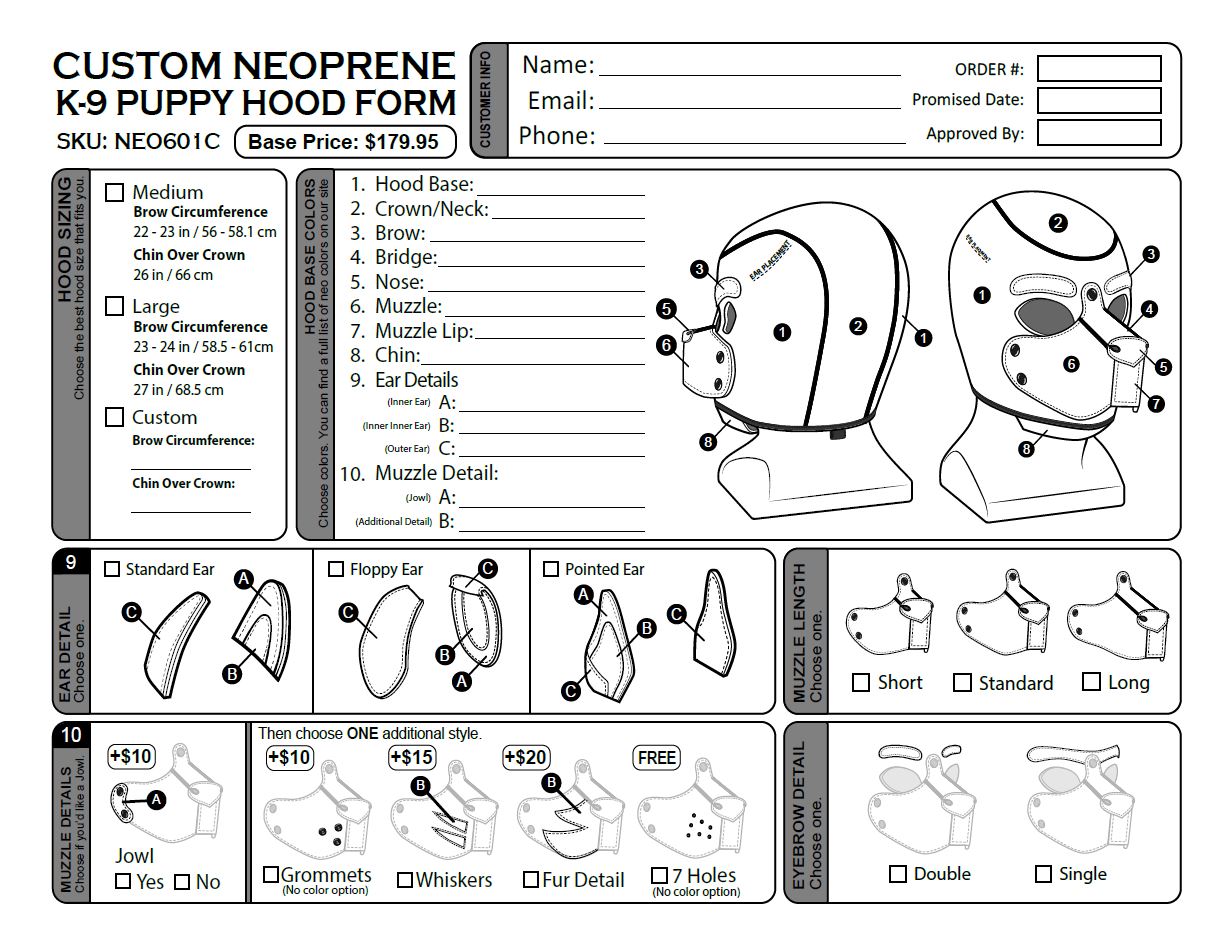

Custom K9 Order Form Mr. S Leather

Web what is a k9 irs form? Fixing one of the errors may reduce the list by eliminating the repeats. Beneficiary’s share of income, deductions, credits, etc. Web per the irs, use form 8938 if the total value of all the specified foreign financial assets in which you have an interest is more than the appropriate reporting. Web where do.

Web That Has Elected To Be Treated As A U.s.

Pay delinquent tax debt online; Turbotax self employed online posted june 4, 2019 3:07 pm last updated june 04, 2019 3:07 pm 0 3 5,833 reply bookmark icon. (updated january 9, 2023) 2. Web individuals claiming tax treaty benefits:

See Back Of Form And Instructions.

Resident during the year and who is a resident of the u.s. Web what is a k9 irs form? Web in most cases errors will repeat as each line is tested. If exempt from form 1099 reporting, check here:

Repeat The Test As Needed.

Beneficiary’s share of income, deductions, credits, etc. Department of the treasury internal revenue service. Web where do i fill in for k9 forms? Web the person named on line 1 of this form is a resident of the treaty country listed on line 9 of the form (if any) within the meaning of the income tax treaty between the united states.

Web Per The Irs, Use Form 8938 If The Total Value Of All The Specified Foreign Financial Assets In Which You Have An Interest Is More Than The Appropriate Reporting.

Web you must file form 1040, u.s. And mark your qualifying exemption reason below 1. Fixing one of the errors may reduce the list by eliminating the repeats. Corporation, (there is no exemption for medical or legal.