Kentucky State Tax Form

Kentucky State Tax Form - The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet. Web kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue. Web corporation income and limited liability entity tax; Motor vehicle rental/ride share excise tax; Web state zip code all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Web effective may 5, 2020, kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2021. Web printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Choose one of these easy methods! Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Insurance premiums tax and surcharge;

Be sure to verify that the form you are downloading is for the correct year. Keep in mind that some states will not update their tax forms for 2023 until january 2024. Individual income tax laws are found in chapter 141 of the kentucky revised statutes. Web 2021 kentucky individual income tax forms electronic filing —it’s to your advantage! Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Kentucky income tax liability is not expected this year (see instructions) ̈ 2. The kentucky income tax rate for tax year 2022 is 5%. Web corporation income and limited liability entity tax; Motor vehicle rental/ride share excise tax; The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet.

The kentucky income tax rate for tax year 2022 is 5%. Insurance premiums tax and surcharge; Web 2021 kentucky individual income tax forms electronic filing —it’s to your advantage! Motor vehicle rental/ride share excise tax; Web printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Kentucky income tax liability is not expected this year (see instructions) ̈ 2. (103 kar 18:150) to register and file online, please visit wraps.ky.gov. Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. The department of revenue annually adjust the standard deduction in accordance with krs 141.081(2)(a). Be sure to verify that the form you are downloading is for the correct year.

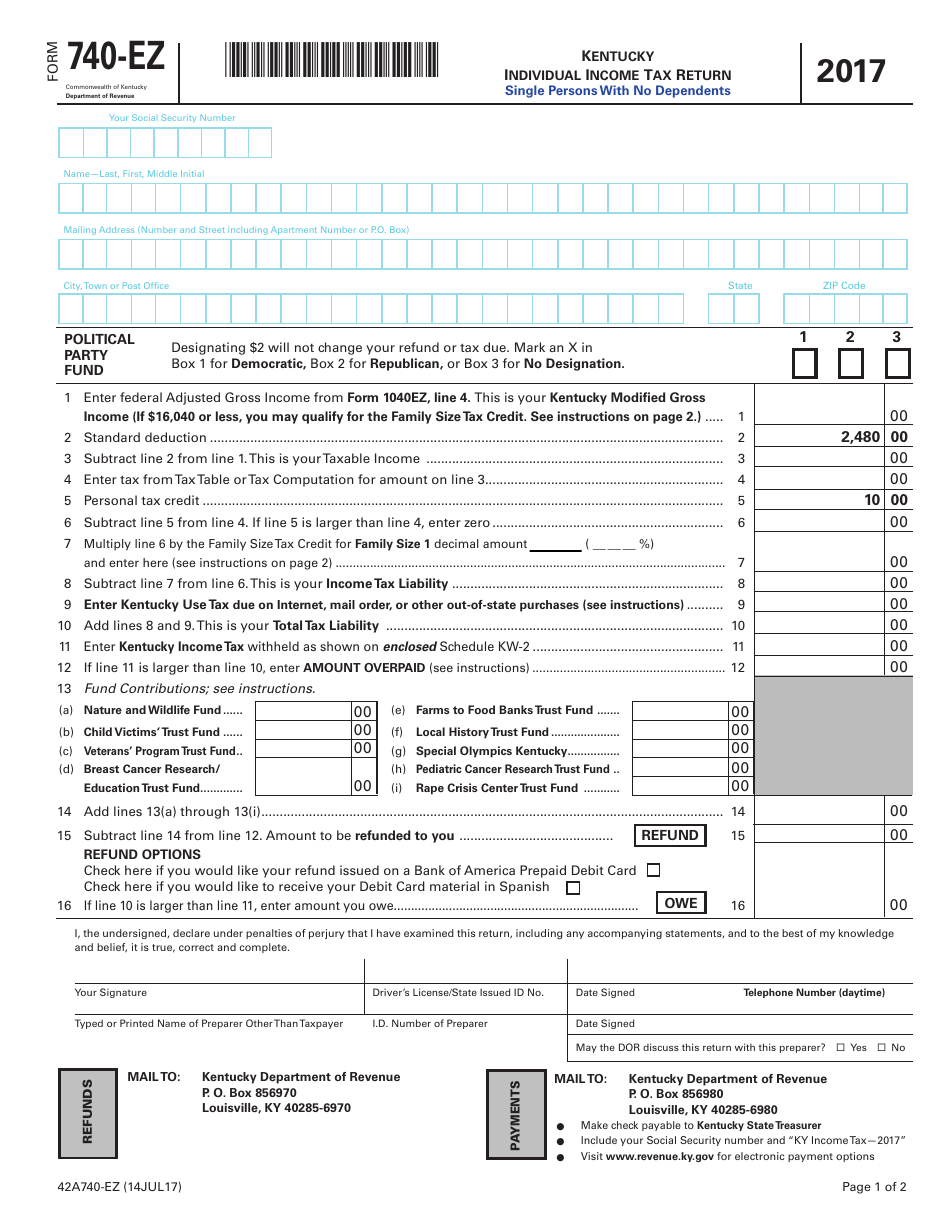

Form 740EZ Download Fillable PDF or Fill Online Kentucky Individual

Kentucky income tax liability is not expected this year (see instructions) ̈ 2. Insurance premiums tax and surcharge; Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet. (103 kar 18:150) to register and file.

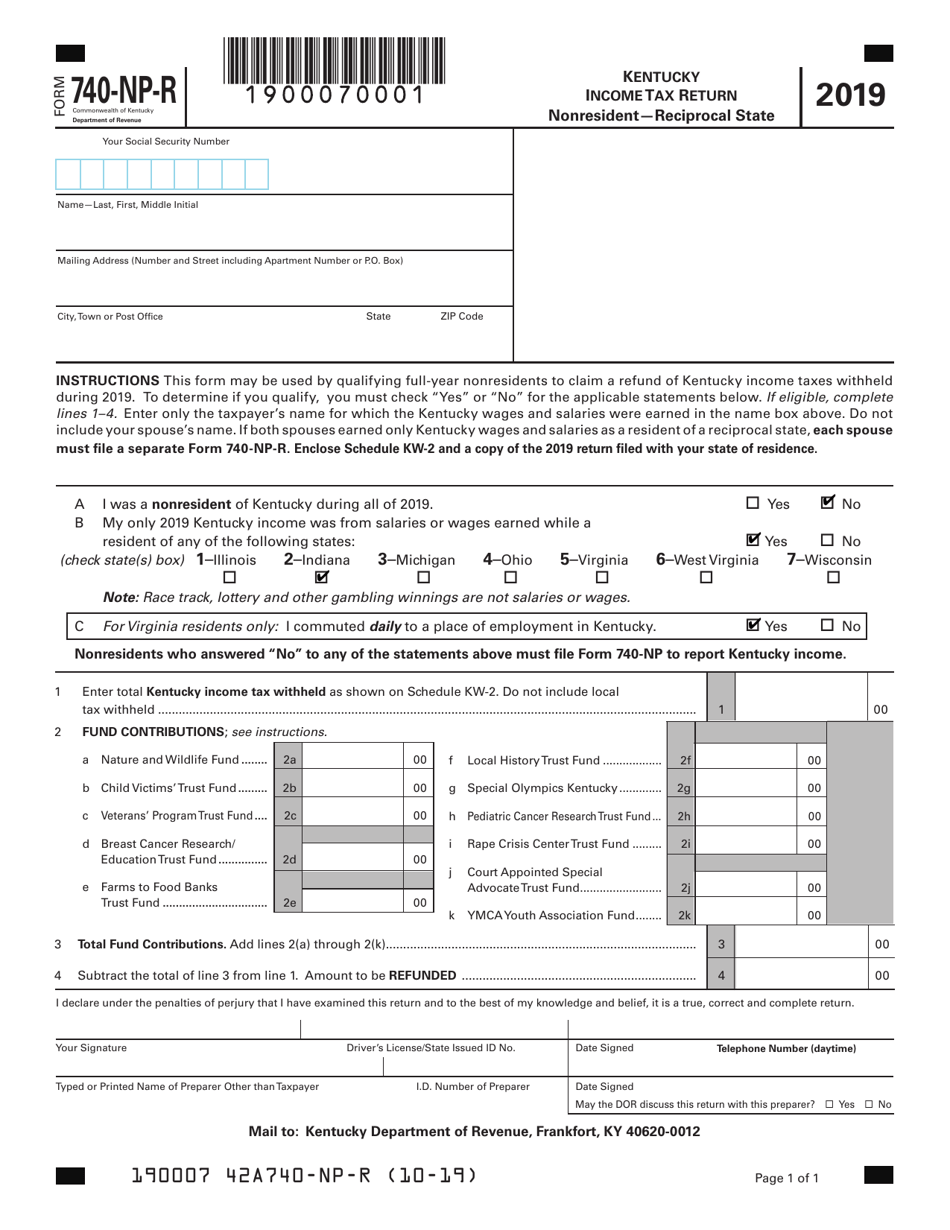

Form 740NPR Download Fillable PDF or Fill Online Kentucky Tax

Web 2021 kentucky individual income tax forms electronic filing —it’s to your advantage! Individual income tax laws are found in chapter 141 of the kentucky revised statutes. Motor vehicle rental/ride share excise tax; (103 kar 18:150) to register and file online, please visit wraps.ky.gov. Keep in mind that some states will not update their tax forms for 2023 until january.

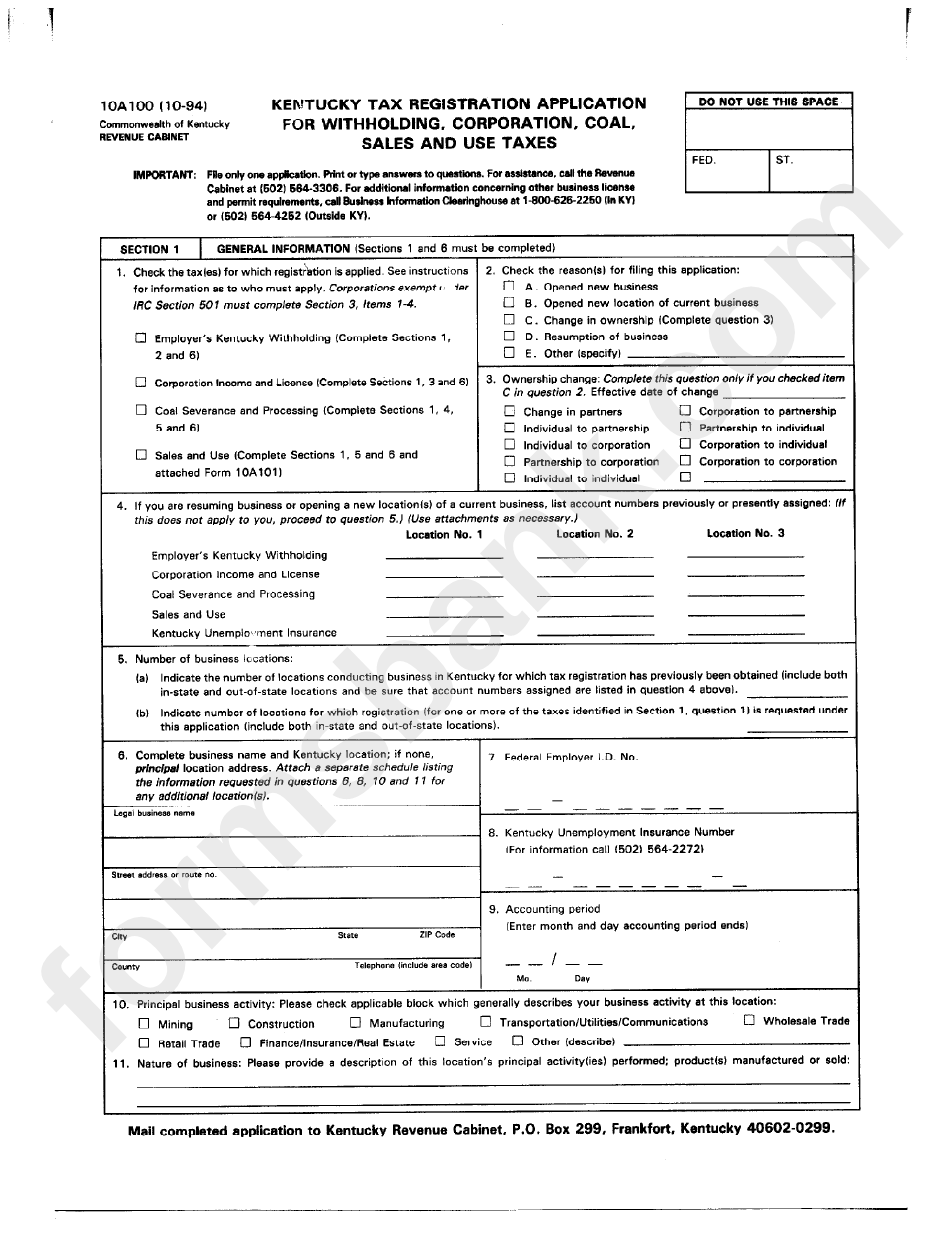

Form 10a100 Kentucky Tax Registration Application For Withholding

Motor vehicle rental/ride share excise tax; Web effective may 5, 2020, kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2021. The current tax year is 2022, and most states will release updated tax forms between january and april.

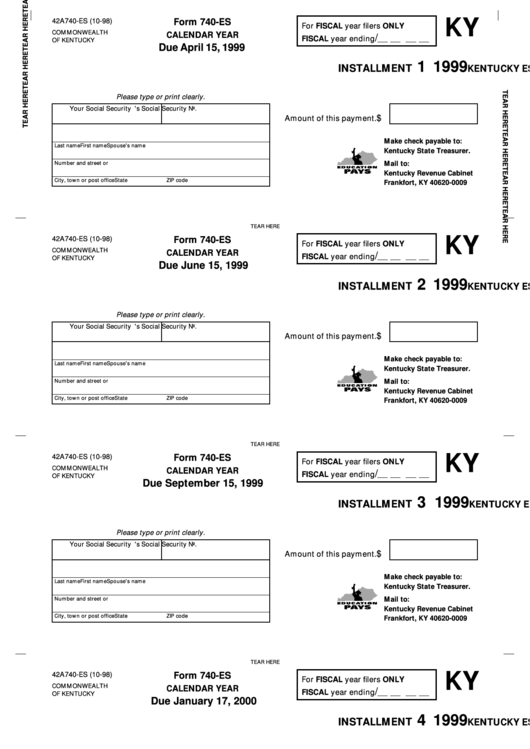

Fillable Form 740Es Kentucky Estimated Tax Voucher 1999 printable

Web 2021 kentucky individual income tax forms electronic filing —it’s to your advantage! Web corporation income and limited liability entity tax; The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet. Individual income tax laws are found in chapter 141 of the kentucky revised statutes. Keep in.

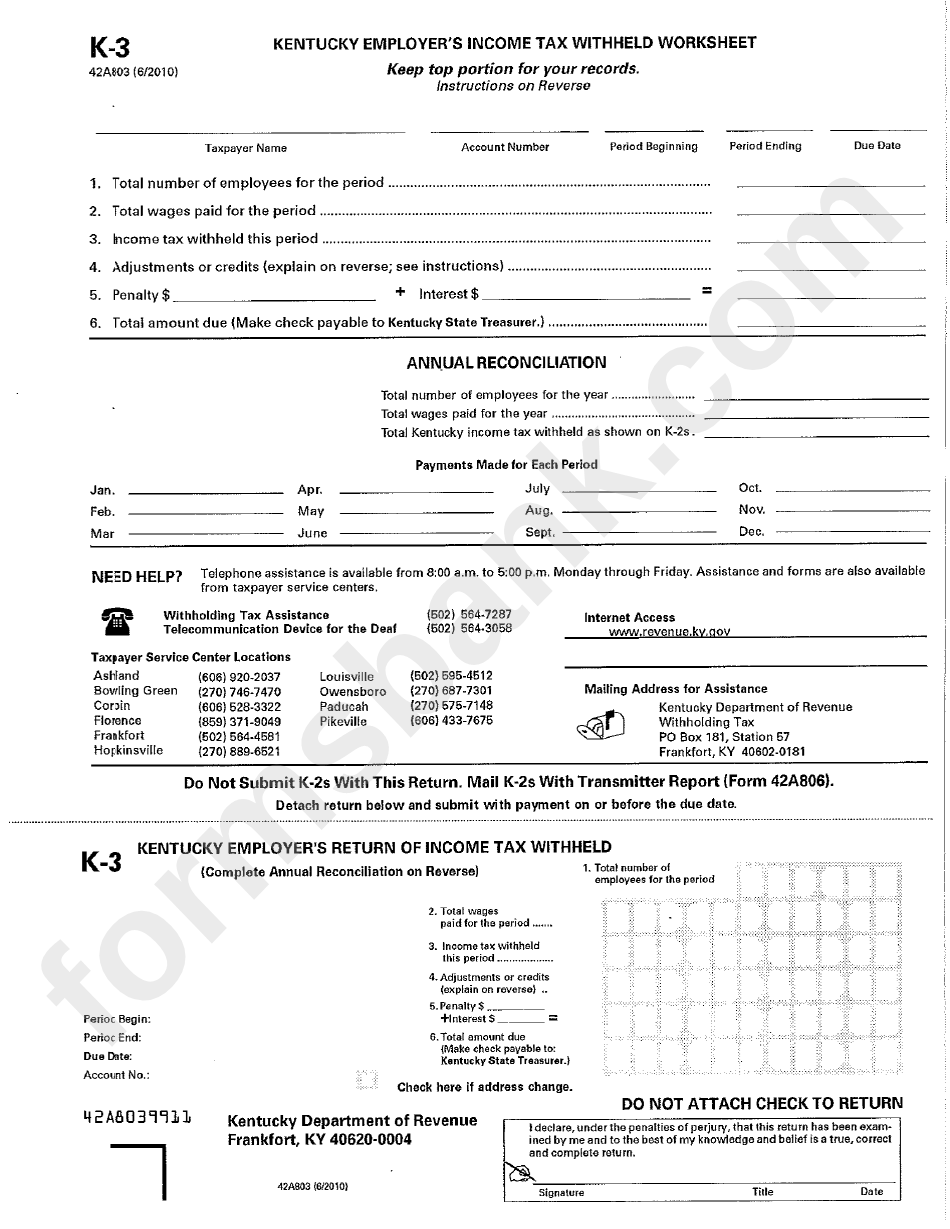

Form K3 Kentucky Employer'S Tax Withheld Worksheet printable

Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms. Web printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet..

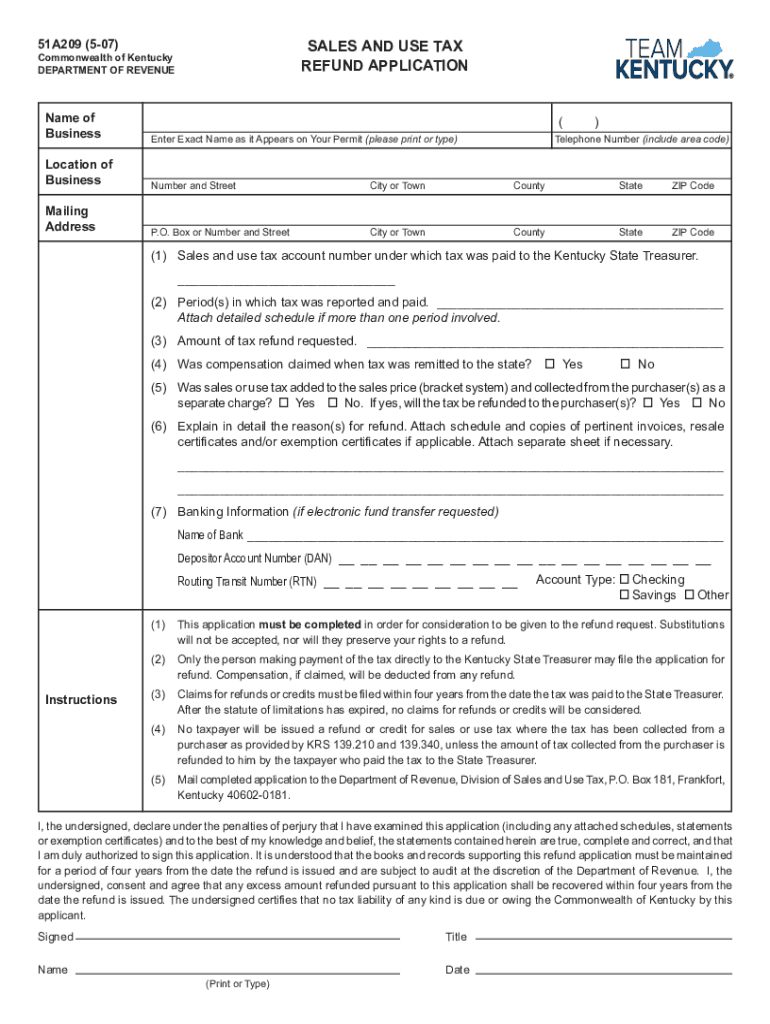

Refund Kentucky Form Fill Out and Sign Printable PDF Template signNow

(103 kar 18:150) to register and file online, please visit wraps.ky.gov. Individual income tax laws are found in chapter 141 of the kentucky revised statutes. Web kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue. The state income tax rate is displayed on the kentucky 740 form and can also be.

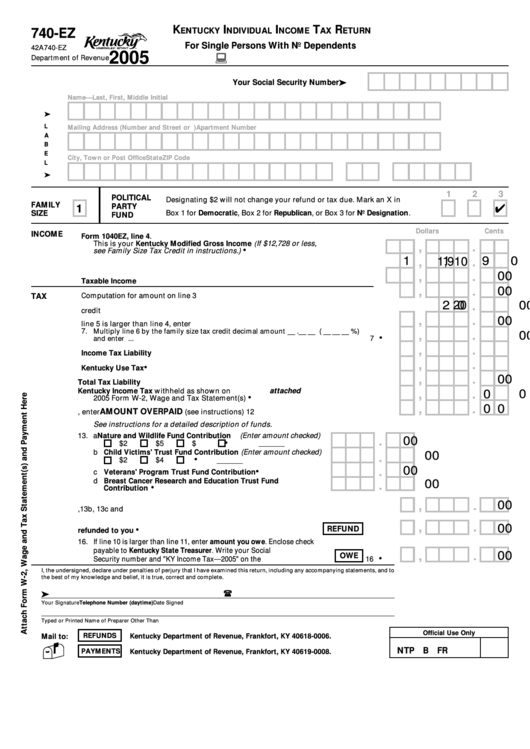

Fillable Form 740Ez Kentucky Individual Tax Return 2005

Web kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue. Web effective may 5, 2020, kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2021. Web corporation income and limited.

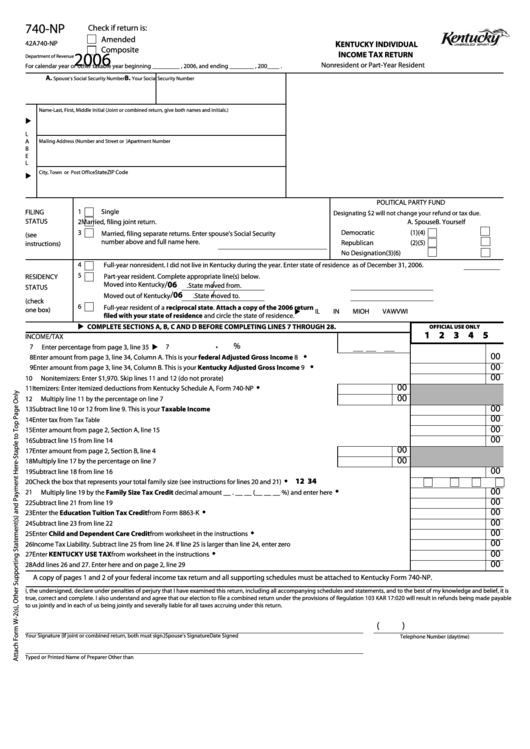

Fillable Form 740Np Kentucky Individual Tax Return

Web state zip code all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet. Web printable kentucky state tax forms for the 2022 tax year will be based on.

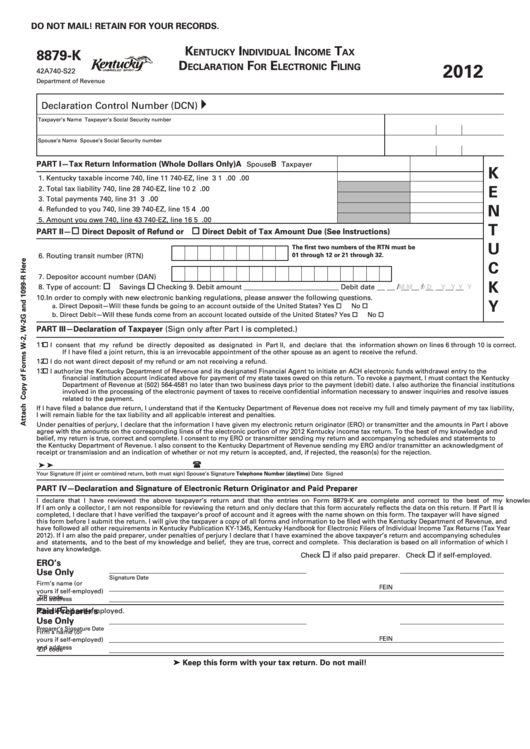

Form 8879, (State Form 42a740S22) Kentucky Individual Tax

Web printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. Web state zip code all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Kentucky income tax liability is not expected this year (see instructions) ̈ 2..

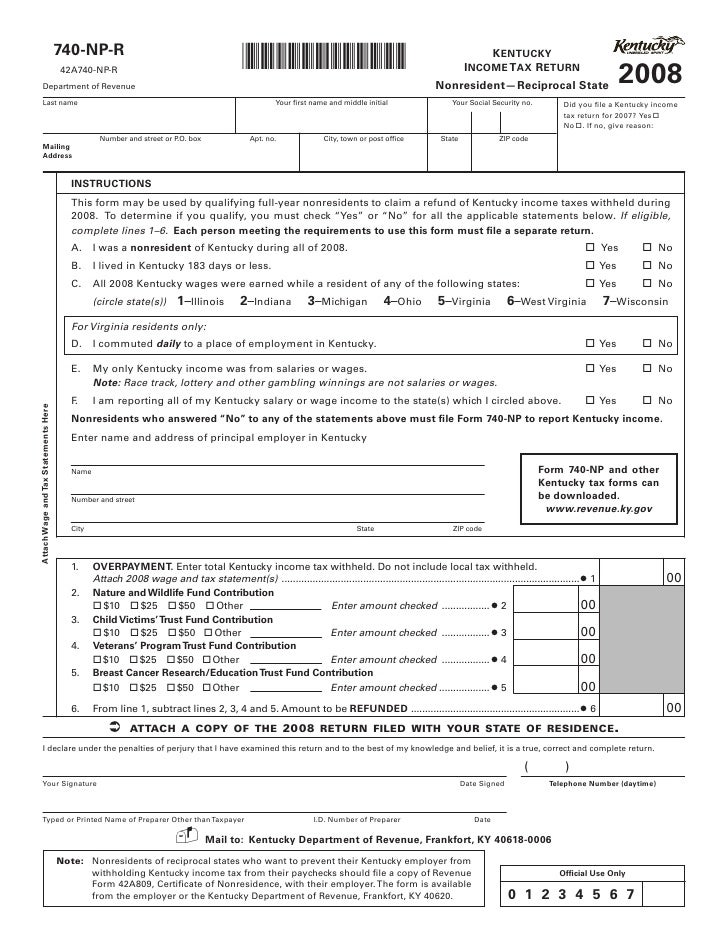

740NPR Kentucky Tax Return NonresidentReciprocal State

Motor vehicle rental/ride share excise tax; Web effective may 5, 2020, kentucky's tax law requires employers filing on a twice monthly and monthly frequency to electronically file and pay the income tax withheld for periods beginning on or after january 1, 2021. Choose one of these easy methods! Keep in mind that some states will not update their tax forms.

(103 Kar 18:150) To Register And File Online, Please Visit Wraps.ky.gov.

Web corporation income and limited liability entity tax; The current tax year is 2022, and most states will release updated tax forms between january and april of 2023. Individual income tax laws are found in chapter 141 of the kentucky revised statutes. Kentucky income tax liability is not expected this year (see instructions) ̈ 2.

The Department Of Revenue Annually Adjust The Standard Deduction In Accordance With Krs 141.081(2)(A).

The kentucky income tax rate for tax year 2022 is 5%. Web kentucky has a flat state income tax of 5%, which is administered by the kentucky department of revenue. Insurance premiums tax and surcharge; Taxformfinder provides printable pdf copies of 130 current kentucky income tax forms.

Web Effective May 5, 2020, Kentucky's Tax Law Requires Employers Filing On A Twice Monthly And Monthly Frequency To Electronically File And Pay The Income Tax Withheld For Periods Beginning On Or After January 1, 2021.

Web state zip code all kentucky wage earners are taxed at a flat 5% rate with a standard deduction allowance of $2,690. Be sure to verify that the form you are downloading is for the correct year. Web printable kentucky state tax forms for the 2022 tax year will be based on income earned between january 1, 2022 through december 31, 2022. The state income tax rate is displayed on the kentucky 740 form and can also be found inside the kentucky 740 instructions booklet.

Choose One Of These Easy Methods!

Keep in mind that some states will not update their tax forms for 2023 until january 2024. Web 2021 kentucky individual income tax forms electronic filing —it’s to your advantage! Motor vehicle rental/ride share excise tax;