Late 1099 Form

Late 1099 Form - If they can't get the forms, they must still file their tax return on time. This form should be filed with the irs, on paper or electronically, and sent to recipients by february 1, 2021. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. You can mail in documentation, or use the irs filing information returns electronically system (fire) to expedite the process. You can access the system at irs fire. The different penalty levels are determined by the size. Web the penalty for filing form 1099 less than 30 days late is $50 per form with a maximum penalty of $194,500 for small businesses and $556,500 for large businesses. Web while balancing multiple deadlines and different forms to file, you may miss a deadline or submit an inaccurate return. Web the penalty rate for late filing form 1099 misc will vary based on the time you filed the return. Your all inclusive payroll suite!

After 30 days and before august 1 $110 /form $1,669,500 per year ($556,500 for small businesses) The major deadline to put down on your calendar is jan. Filed within 30 days $50 /form filed within 30 days. Web while balancing multiple deadlines and different forms to file, you may miss a deadline or submit an inaccurate return. Web there are penalties on companies that issue forms 1099 late, but some come as late as april or may when you may have already filed your return. When that happens, the irs will send you a notice of a 1099 late filing penalty (or penalties) detailing what you owe to correct the situation. There are more independent contractors working now than ever before. Web the penalty for filing form 1099 less than 30 days late is $50 per form with a maximum penalty of $194,500 for small businesses and $556,500 for large businesses. You may also have a filing requirement. You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account.

The major deadline to put down on your calendar is jan. Web if you issue 1099s just a little late — within 30 days of the deadline — you'll pay $50 per. Web what happens if you submit a late 1099? See the instructions for form 8938. Web the penalty rate for late filing form 1099 misc will vary based on the time you filed the return. When that happens, the irs will send you a notice of a 1099 late filing penalty (or penalties) detailing what you owe to correct the situation. Web how much is the 1099 late filing penalty? This form should be filed with the irs, on paper or electronically, and sent to recipients by february 1, 2021. Web what happens if a 1099 is late? The irs also charges interest on the penalties it levies.

Filing Form 1099 Misc Late Form Resume Examples e79Q7ZgVkQ

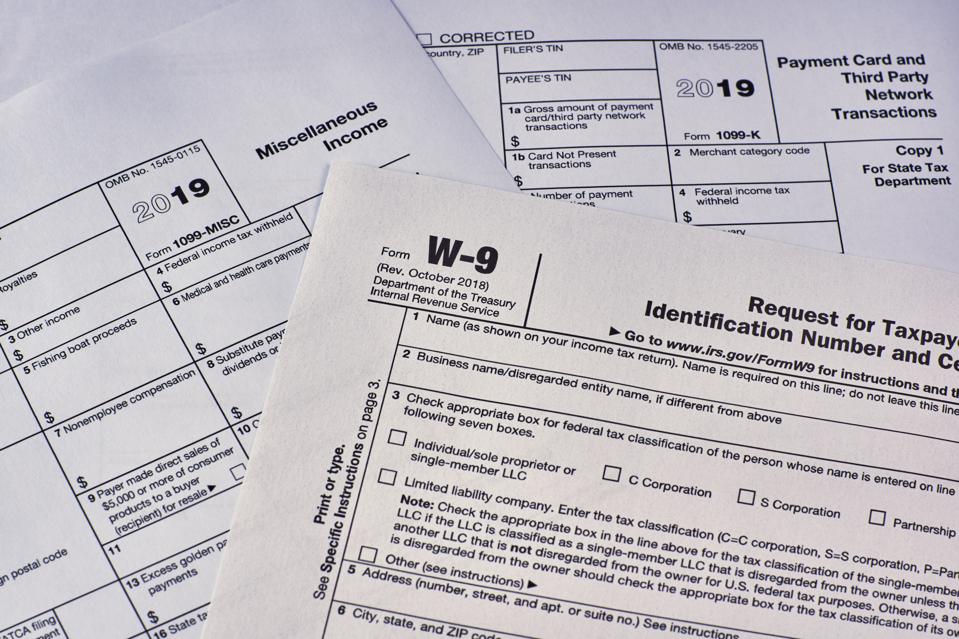

Web what happens if a 1099 is late? Web there are penalties on companies that issue forms 1099 late, but some come as late as april or may when you may have already filed your return. Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. 1099 filing deadlines 1099 late filing and reporting penalties.

It’s time to file 1099s Avoid 50100 plus late penalties per form

Web how much is the 1099 late filing penalty? If you are late, be sure to file within 30 days to avoid receiving a larger penalty. Web there are penalties on companies that issue forms 1099 late, but some come as late as april or may when you may have already filed your return. You can mail in documentation, or.

Late IRS Form 1099? Don’t Request It, Here’s Why

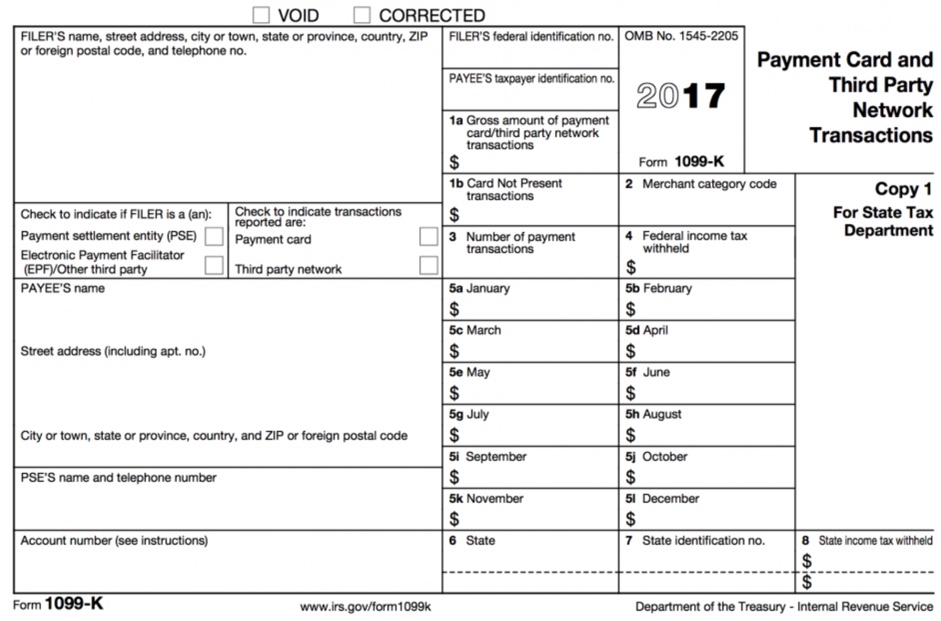

Web one possible exception: You can access the system at irs fire. Filed within 30 days $50 /form filed within 30 days. The different penalty levels are determined by the size. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.

Irs Form 1099 Late Filing Penalty Form Resume Examples

Web the penalty rate for late filing form 1099 misc will vary based on the time you filed the return. The different penalty levels are determined by the size. You can access the system at irs fire. After 30 days and before august 1 $110 /form $1,669,500 per year ($556,500 for small businesses) You can instantly download a printable copy.

How Not To Deal With A Bad 1099

Send out a 1099 form by that date to the person or company that you paid for their services. Web how much is the 1099 late filing penalty? Shows your total compensation of excess golden parachute payments subject to a 20% excise tax. Web what happens if you submit a late 1099? Even if you never receive a form 1099,.

1099NEC Software to Create, Print & EFile IRS Form 1099NEC

Web there are penalties on companies that issue forms 1099 late, but some come as late as april or may when you may have already filed your return. Filed within 30 days $50 /form filed within 30 days. However, if you paper file your 1099 forms you may be penalized for failing to include your 1096. Web the penalty for.

How To File Form 1099NEC For Contractors You Employ VacationLord

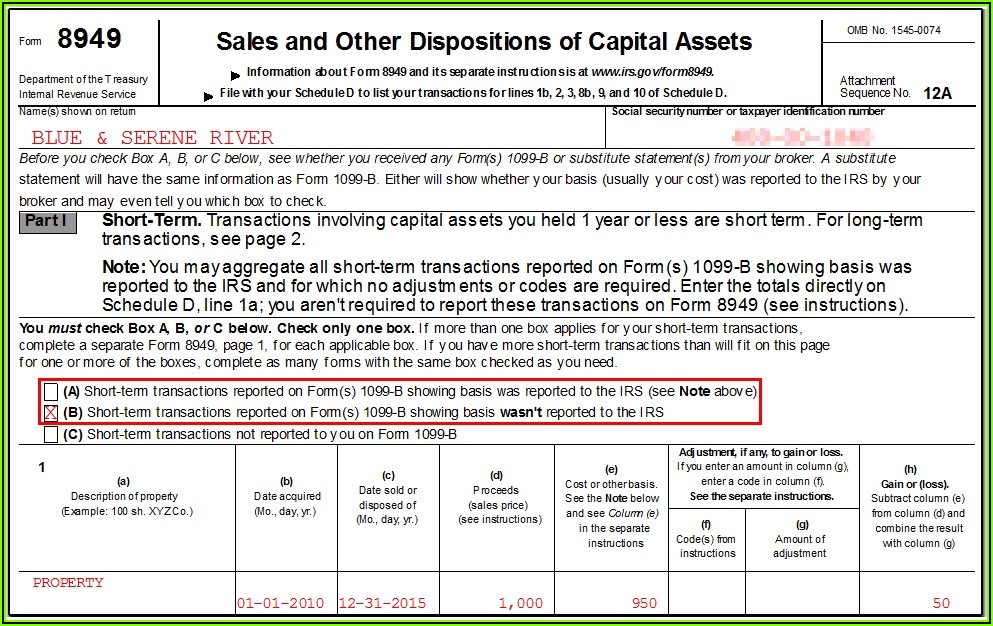

1099 filing deadlines 1099 late filing and reporting penalties penalty for failing to report 1099 income frequently asked questions (faqs) photo: After 30 days and before august 1 $110 /form $1,669,500 per year ($556,500 for small businesses) Web there are penalties on companies that issue forms 1099 late, but some come as late as april or may when you may.

Free Printable 1099 Misc Forms Free Printable

When that happens, the irs will send you a notice of a 1099 late filing penalty (or penalties) detailing what you owe to correct the situation. Web one possible exception: If they can't get the forms, they must still file their tax return on time. The irs also charges interest on the penalties it levies. The major deadline to put.

Filing 1099 Forms Late Universal Network

You can instantly download a printable copy of the tax form by logging in to or creating a free my social security account. Send out a 1099 form by that date to the person or company that you paid for their services. Web the penalty for filing form 1099 less than 30 days late is $50 per form with a.

When is tax form 1099MISC due to contractors? GoDaddy Blog

If they can't get the forms, they must still file their tax return on time. What happens if you submit a late 1099? The different penalty levels are determined by the size. Web what happens if you submit a late 1099? If you own a business, no matter its size, you will likely need to prepare a 1099.

Send Out A 1099 Form By That Date To The Person Or Company That You Paid For Their Services.

Web while balancing multiple deadlines and different forms to file, you may miss a deadline or submit an inaccurate return. Web there are penalties on companies that issue forms 1099 late, but some come as late as april or may when you may have already filed your return. Web the penalty for filing form 1099 less than 30 days late is $50 per form with a maximum penalty of $194,500 for small businesses and $556,500 for large businesses. See your tax return instructions for where to report.

You Can Instantly Download A Printable Copy Of The Tax Form By Logging In To Or Creating A Free My Social Security Account.

See the instructions for form 8938. Web one possible exception: Even if you never receive a form 1099, if you. You can report a late 1099 to the irs directly by speaking with one of their representatives over the phone.

You Can Mail In Documentation, Or Use The Irs Filing Information Returns Electronically System (Fire) To Expedite The Process.

If they can't get the forms, they must still file their tax return on time. There are maximum fines per year for small businesses. If you own a business, no matter its size, you will likely need to prepare a 1099. What happens if you submit a late 1099?

The Irs Also Charges Interest On The Penalties It Levies.

This form should be filed with the irs, on paper or electronically, and sent to recipients by february 1, 2021. There are more independent contractors working now than ever before. Web in general, though, if you call or write the payer and ask for a form 1099, you may end up with two forms 1099, one issued in the ordinary course (even if you never received it), and one. Web on this form 1099 to satisfy its account reporting requirement under chapter 4 of the internal revenue code.