Life Insurance Plans Chapter 9 Lesson 5 Answers

Life Insurance Plans Chapter 9 Lesson 5 Answers - An arrangement in which an individual will receive financial protection or reimbursement of losses from an insurer. Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. There is a lack of incentive to economize due to the abundance of healthcare entitlements and insurance. Who does not need life insurance. The amount of money paid for an insurance policy. Decide on what kind of signature. Long term care insurance (60years old) 6. The amount of time after the premium is due in. Choose an answer and hit 'next'. Choose an answer and hit 'next'.

Provides a monetary (financial) payment to a specified beneficiary in the event that the insured person dies. Web open the life insurance plans chapter 9 lesson 5 answers and follow the instructions. An arrangement in which an individual will receive financial protection or reimbursement of losses from an insurer. Web about this quiz & worksheet. Long term care insurance (60years old) 6. Web open the life insurance plans chapter 9 lesson 5 answers and follow the instructions. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount of coverage he would receive? Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. Joe makes $48,000 per year and has $200 budgeted per month to spend on life insurance.

Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. Homeowner's or renter's insurance 2. Easily sign the which insurance policies are needed worksheet answers with. Web 1 / 17 flashcards learn test match created by jamieotto teacher terms in this set (17) needs approach method used to determine an adequate amount of life insurance. Web teach your students about protecting their assets with insurance. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount. The amount of money paid for an insurance policy. There is a lack of incentive to economize due to the abundance of healthcare entitlements and insurance. Web name life insurance plans chapter 9, lesson 5 joe is 30. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount of coverage he would receive?

canonprintermx410 25 Images What Is A Private Insurance Company

Web terms in this set (15) life insurance. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount. T/f false life insurance for a specified period of time is called what term insurance the amount you pay annually, quarterly or monthly for insurance. Web page 2 of 3 life insurance plans chapter.

Does Whole Life Insurance Work as Part of a Retirement Strategy

Web about this quiz & worksheet. Web terms in this set (15) life insurance. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount. Choose an answer and hit 'next'. Decide on what kind of signature.

Taxsaving life insurance plans you need to consider this yearAegon

Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. The amount of time after the premium is due in. Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. Easily sign the which insurance policies are needed worksheet answers with. Free insurance lesson plans, activities and more for grades 9.

Life Insurance 101 Everything You Need to Know [Infographic

For each insurance option, how much would joe pay in total premiums over 20 years compared the amount. Choose an answer and hit 'next'. Web page 1 of 3date directions review the information on the chart below and then answer the questions.namelife insurance plans chapter 9,lesson 5 joe is 30 years old, married, and his wife is expecting their first.

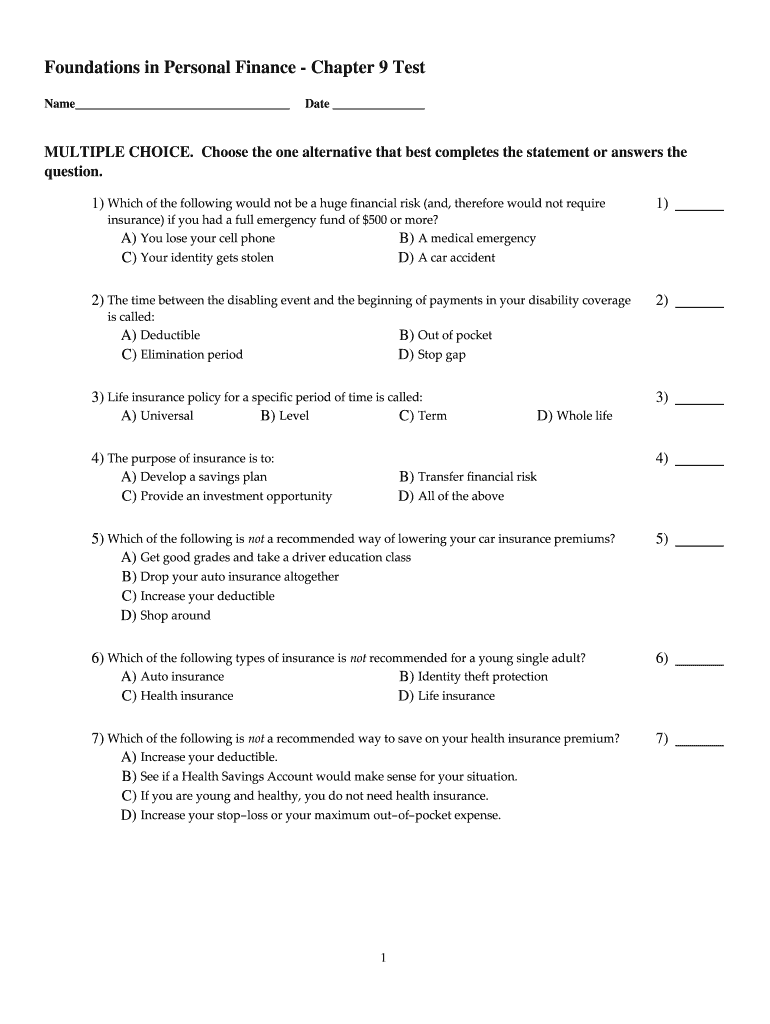

Foundations In Personal Finance Chapter 9 Answer Key Pdf Fill Online

Web name life insurance plans chapter 9, lesson 5 joe is 30. Web strengthen your preparations for the life & health insurance exam by taking advantage of the resources in this online course. The amount of time after the premium is due in. Web terms in this set (15) life insurance. Web open the life insurance plans chapter 9 lesson.

Types of Life Insurance Plans

The amount of money paid for an insurance policy. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount of coverage he would receive? The amount of liability protection offered to an individual through an insurance policy. Question 1 of 3 which characteristic of life… Web teach your students about protecting their.

[Updated 2023] Top 25 Insurance PowerPoint Templates Agents and

Easily sign the which insurance policies are needed worksheet answers with. Web page 2 of 3 life insurance plans chapter 9, lesson 5 1. The amount of money paid for an insurance policy. Choose an answer and hit 'next'. Web open the life insurance plans chapter 9 lesson 5 answers and follow the instructions.

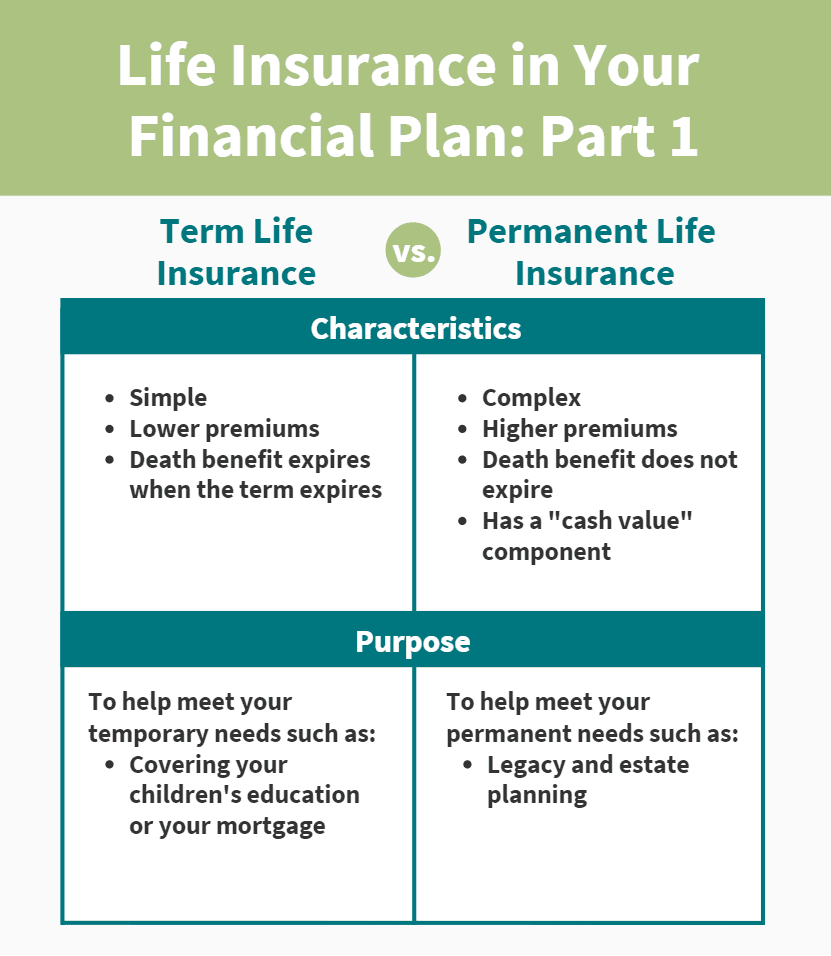

Life Insurance in Your Financial Plan Part 1 Aspen Wealth Management

Long term care insurance (60years old) 6. Web about this quiz & worksheet. T/f false life insurance for a specified period of time is called what term insurance the amount you pay annually, quarterly or monthly for insurance. Decide on what kind of signature. Web name life insurance plans chapter 9, lesson 5 joe is 30.

Essential Tips to Get Started with Life Insurance Plans

An arrangement in which an individual will receive financial protection or reimbursement of losses from an insurer. Decide on what kind of signature. Web teach your students about protecting their assets with insurance. Web open the life insurance plans chapter 9 lesson 5 answers and follow the instructions. Web about this quiz & worksheet.

Need and Benefits of Buying Life Insurance Plan by Alankit Insurance

Web web open the life insurance plans chapter 9 lesson 5 answers and follow the instructions. Web terms in this set (15) life insurance. Long term care insurance (60years old) 6. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount of coverage he would receive? Who does not need life insurance.

Web Name Life Insurance Plans Chapter 9, Lesson 5 Joe Is 30.

Who does not need life insurance. Long term care insurance (60years old) 6. Free insurance lesson plans, activities and more for grades 9. T/f false life insurance for a specified period of time is called what term insurance the amount you pay annually, quarterly or monthly for insurance.

There Is A Lack Of Incentive To Economize Due To The Abundance Of Healthcare Entitlements And Insurance.

Easily sign the which insurance policies are needed worksheet answers with. Select the document you want to sign and click upload. Web terms in this set (15) life insurance. Web page 2 of 3 life insurance plans chapter 9, lesson 5 1.

Web Page 1 Of 3Date Directions Review The Information On The Chart Below And Then Answer The Questions.namelife Insurance Plans Chapter 9,Lesson 5 Joe Is 30 Years Old, Married, And His Wife Is Expecting Their First Baby.

Web strengthen your preparations for the life & health insurance exam by taking advantage of the resources in this online course. Homeowner's or renter's insurance 2. The amount of liability protection offered to an individual through an insurance policy. An arrangement in which an individual will receive financial protection or reimbursement of losses from an insurer.

Web 1 / 17 Flashcards Learn Test Match Created By Jamieotto Teacher Terms In This Set (17) Needs Approach Method Used To Determine An Adequate Amount Of Life Insurance.

Joe makes $48,000 per year and has $200 budgeted per month to spend on life insurance. Easily sign the which insurance policies are needed worksheet answers with. The amount of money paid for an insurance policy. For each insurance option, how much would joe pay in total premiums over 20 years compared the amount of coverage he would receive?

![[Updated 2023] Top 25 Insurance PowerPoint Templates Agents and](https://www.slideteam.net/wp/wp-content/uploads/2020/01/Life-Insurance-Policies-And-Plan.png)