Llc Extension Form

Llc Extension Form - Web for 2022, llcs filing as sole proprietors must submit form 1040 by april 18 without an extension. With an extension, the deadline for filing is october 17. Create an account in expressextensin or log in to your existing. Web single member llcs (smllcs) disregarded for tax purposes will be granted an automatic six month extension, with the exception of an smllc owned by a partnership or an llc. Web there are three ways to request an automatic extension of time to file a u.s. Web where to file form 7004. Web file irs form 4868 to obtain an extension for a single member llc. Open an llc to register. Web review information about a limited liability company (llc) and the federal tax classification process. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to.

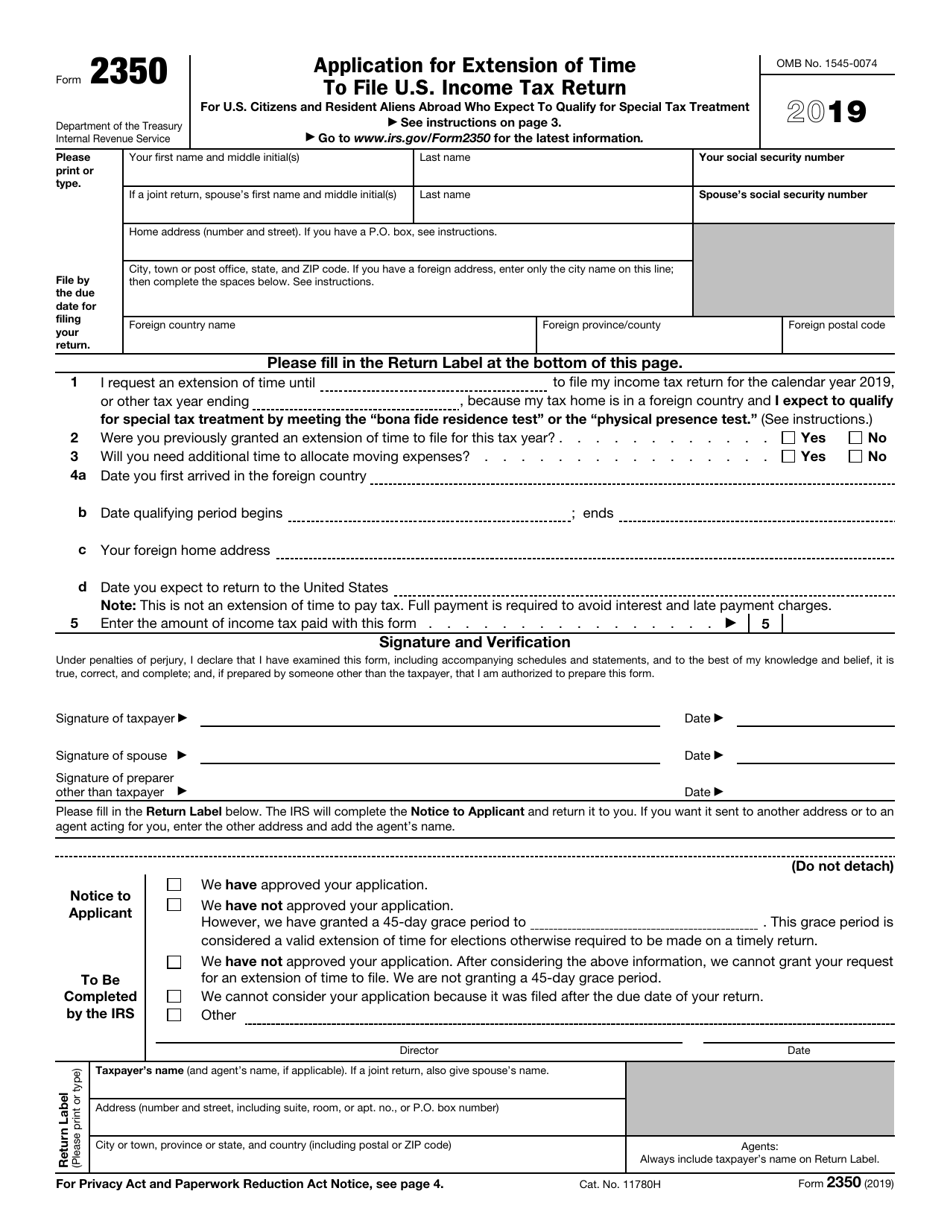

Web there are three ways to request an automatic extension of time to file a u.s. Web review information about a limited liability company (llc) and the federal tax classification process. Web for 2022, llcs filing as sole proprietors must submit form 1040 by april 18 without an extension. Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004. Create an account in expressextensin or log in to your existing. Web if you need an extension for llc with regard to paying your business tax return, you must fill out form 7004. Web where to file form 7004. Kickstart your llc for free in minutes. You can pay all or part of your estimated income tax due and indicate. Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california and federal tax purposes.

Web to extend the llc's filing date by six (6) months, file a business online tax extension or the paper version of irs form 7004 and mail it via the u.s. Web where to file form 7004. Web to file an extension for your llc through expressextension, follow the steps below: Web if you need an extension for llc with regard to paying your business tax return, you must fill out form 7004. Form yours for $0 + filing fees. Web these where to file addresses are to be used only by taxpayers and tax professionals filing form 4868 during calendar year 2022 to 2023. Web there are three ways to request an automatic extension of time to file a u.s. Create an account in expressextensin or log in to your existing. Kickstart your llc for free in minutes. Web review information about a limited liability company (llc) and the federal tax classification process.

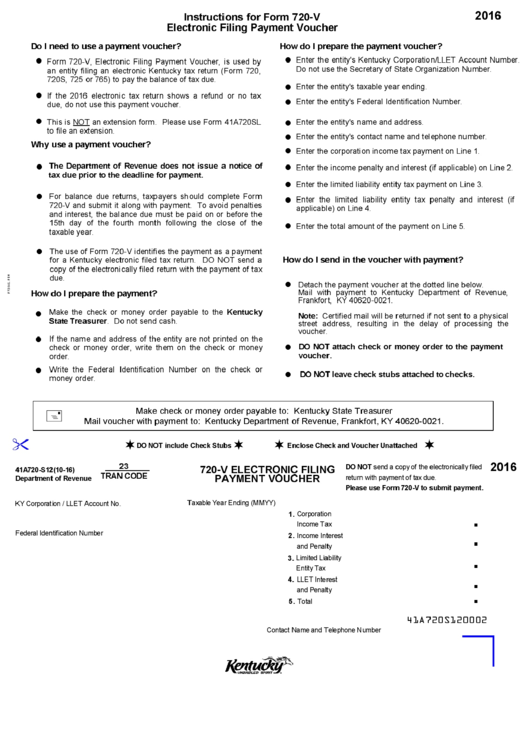

2016 extension form for llc csdad

Before the end of the federal automatic extension period. Web where to file form 7004. Kickstart your llc for free in minutes. Web however, an extension of time to file the limited partnership (lp), limited liability partnership (llp), or real estate mortgage investment conduit (remic) return is. Create an account in expressextensin or log in to your existing.

How to File an Extension for Your SubChapter S Corporation

You can pay all or part of your estimated income tax due and indicate. Web for 2022, llcs filing as sole proprietors must submit form 1040 by april 18 without an extension. Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to. Ad filing your tax extension.

Irs Fillable Extension Form Printable Forms Free Online

Before the end of the federal automatic extension period. Web to file an extension for your llc through expressextension, follow the steps below: Web for 2022, llcs filing as sole proprietors must submit form 1040 by april 18 without an extension. Web an llc tax return extension due date may give you six additional months to file or make your.

Llc Extension Form 1065 Universal Network

And the total assets at the end of the tax year are: Web where to file form 7004. Web file irs form 4868 to obtain an extension for a single member llc. Web single member llcs (smllcs) disregarded for tax purposes will be granted an automatic six month extension, with the exception of an smllc owned by a partnership or.

5 Common Mistakes People Make When Forming a California LLC

Ad filing your tax extension just became easier! This form requests an extension for partnerships as well as llcs that are. Just pay state filing fees. Use the following irs center address:. Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004.

What You Need To Know To File A Tax Extension For An LLC Blog

File your taxes like a pro. Web there are three ways to request an automatic extension of time to file a u.s. Web however, an extension of time to file the limited partnership (lp), limited liability partnership (llp), or real estate mortgage investment conduit (remic) return is. A limited liability company (llc) is a business structure. Just pay state filing.

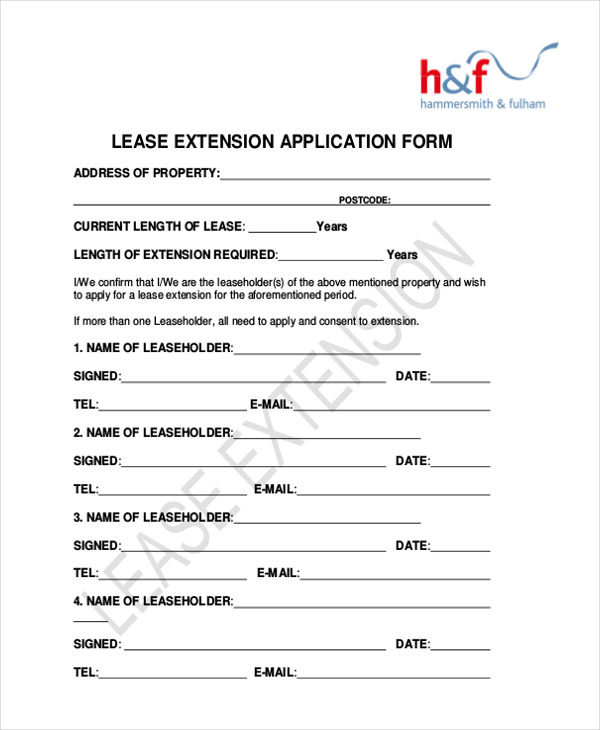

FREE 10+ Sample Lease Extension Forms in PDF Word Excel

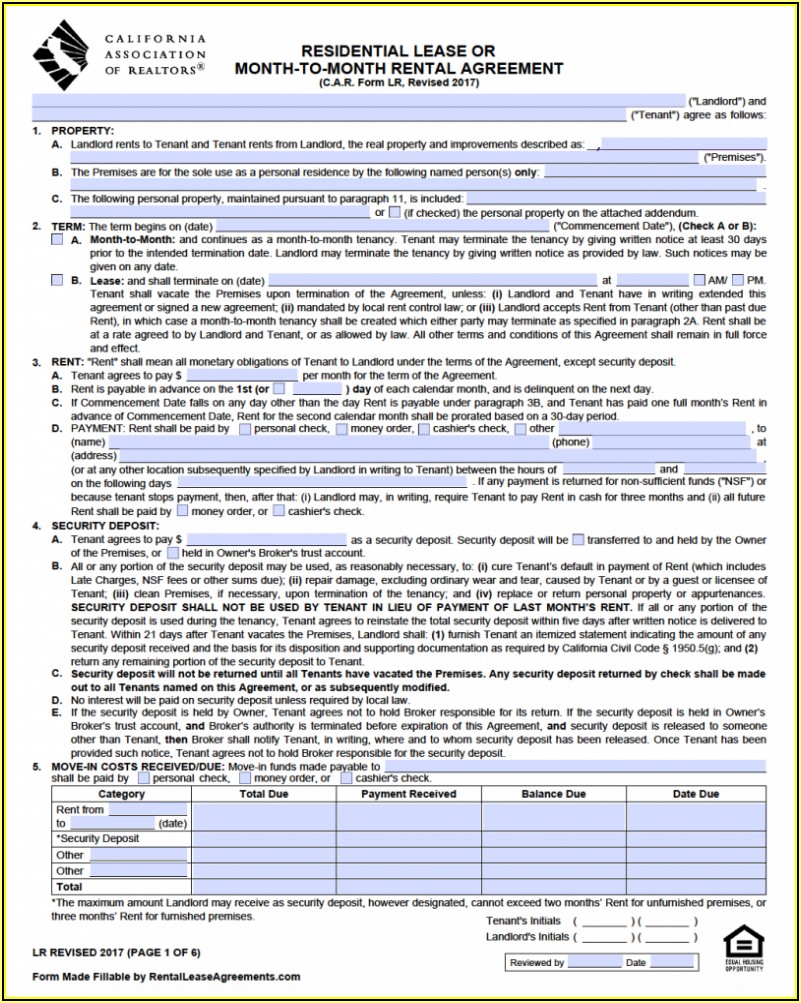

Ad filing your tax extension just became easier! Web single member llcs (smllcs) disregarded for tax purposes will be granted an automatic six month extension, with the exception of an smllc owned by a partnership or an llc. Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california.

Us Gov Irs Tax Forms Extension Form Resume Examples l6YNxJo23z

Web for 2022, llcs filing as sole proprietors must submit form 1040 by april 18 without an extension. Web however, an extension of time to file the limited partnership (lp), limited liability partnership (llp), or real estate mortgage investment conduit (remic) return is. Ad filing your tax extension just became easier! Web review information about a limited liability company (llc).

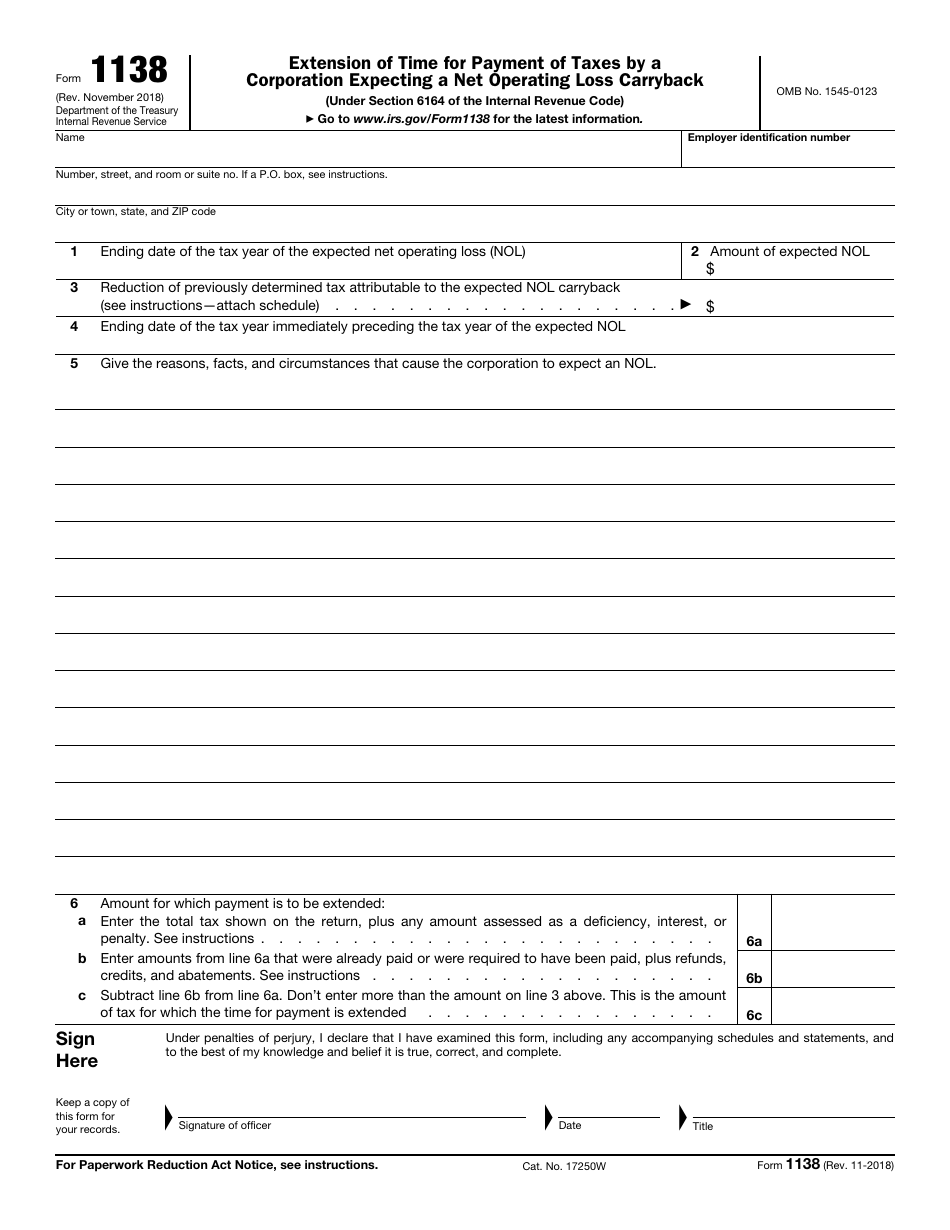

IRS Form 1138 Download Fillable PDF or Fill Online Extension of Time

With an extension, the deadline for filing is october 17. Kickstart your llc for free in minutes. Before the end of the federal automatic extension period. Use the following irs center address:. This form requests an extension for partnerships as well as llcs that are.

Form 12 Extension Why You Should Not Go To Form 12 Extension AH

Kickstart your llc for free in minutes. Ad filing your tax extension just became easier! Web file irs form 4868 to obtain an extension for a single member llc. Web however, an extension of time to file the limited partnership (lp), limited liability partnership (llp), or real estate mortgage investment conduit (remic) return is. With an extension, the deadline for.

Before The End Of The Federal Automatic Extension Period.

Select the appropriate form from the table below to determine where to send the form 7004, application for automatic extension of time to. Use the following irs center address:. A limited liability company (llc) is a business structure. File your taxes like a pro.

Web However, An Extension Of Time To File The Limited Partnership (Lp), Limited Liability Partnership (Llp), Or Real Estate Mortgage Investment Conduit (Remic) Return Is.

Kickstart your llc for free in minutes. Web series limited liability company an llc being taxed as a corporation an llc must have the same classification for both california and federal tax purposes. Web an llc tax return extension due date may give you six additional months to file or make your business tax payment if you submit form 7004. Web there are three ways to request an automatic extension of time to file a u.s.

Web To File An Extension For Your Llc Through Expressextension, Follow The Steps Below:

Web where to file form 7004. Web for 2022, llcs filing as sole proprietors must submit form 1040 by april 18 without an extension. Ad filing your tax extension just became easier! Web these where to file addresses are to be used only by taxpayers and tax professionals filing form 4868 during calendar year 2022 to 2023.

Form Yours For $0 + Filing Fees.

This form requests an extension for partnerships as well as llcs that are. Web file irs form 4868 to obtain an extension for a single member llc. Just pay state filing fees. Web review information about a limited liability company (llc) and the federal tax classification process.