Lockup Expiration Calendar

Lockup Expiration Calendar - Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering. Web typically, lockup periods last between 90 and 180 days. An ipo lockup is an agreement signed by those who own shares prior to an ipo (i.e., insiders and early. Web the terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180. Web what are ipo lockups? Lockup periods are important for investors to monitor because. Company symbol proposed lead managers shares. Web 14 rows quiet period expiration;

Company symbol proposed lead managers shares. Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering. Lockup periods are important for investors to monitor because. Web what are ipo lockups? Web typically, lockup periods last between 90 and 180 days. An ipo lockup is an agreement signed by those who own shares prior to an ipo (i.e., insiders and early. Web the terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180. Web 14 rows quiet period expiration;

Web typically, lockup periods last between 90 and 180 days. Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering. An ipo lockup is an agreement signed by those who own shares prior to an ipo (i.e., insiders and early. Web the terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180. Lockup periods are important for investors to monitor because. Company symbol proposed lead managers shares. Web 14 rows quiet period expiration; Web what are ipo lockups?

Ipo Lockup Expiration Calendar Outlook Calendar 2022

Web what are ipo lockups? Web typically, lockup periods last between 90 and 180 days. Web 14 rows quiet period expiration; Company symbol proposed lead managers shares. Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering.

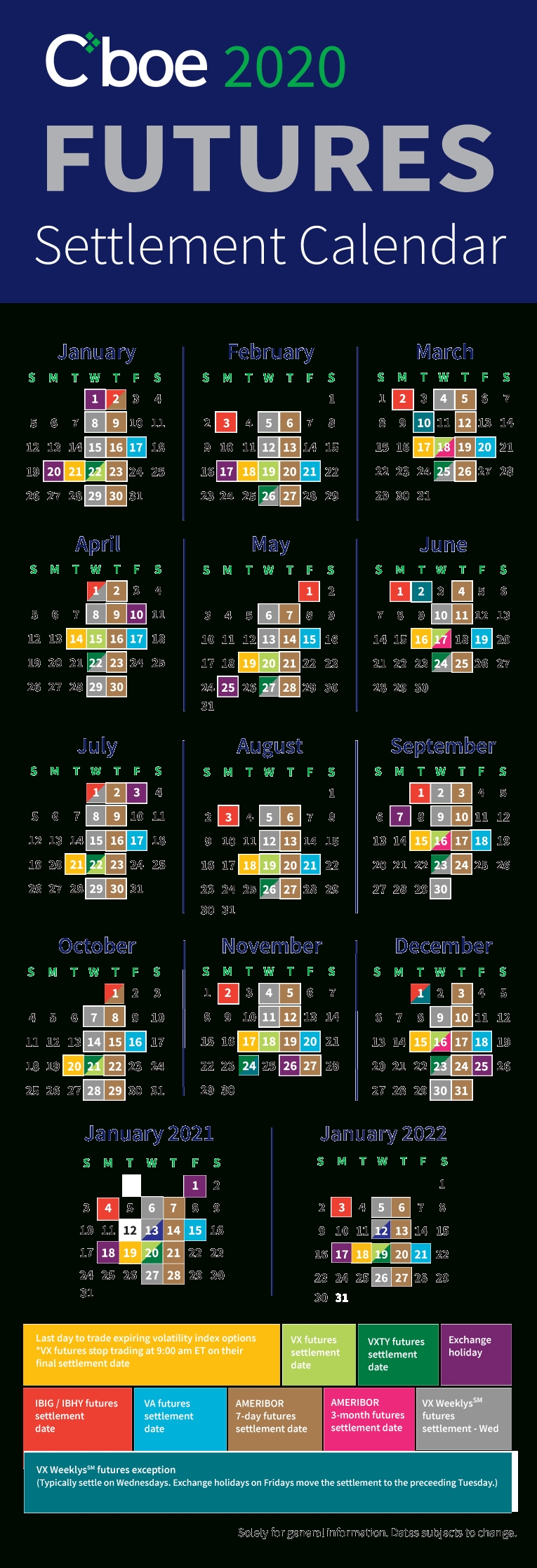

Free 30 Day Expiration Calendar Get Your Calendar Printable

Lockup periods are important for investors to monitor because. An ipo lockup is an agreement signed by those who own shares prior to an ipo (i.e., insiders and early. Web typically, lockup periods last between 90 and 180 days. Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering. Company symbol proposed lead.

IPO Lockup Period Expirations

An ipo lockup is an agreement signed by those who own shares prior to an ipo (i.e., insiders and early. Web 14 rows quiet period expiration; Lockup periods are important for investors to monitor because. Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering. Web typically, lockup periods last between 90 and.

The Best 18 Printable Calendar Template Multi Dose Vial 28 Day

Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering. Web typically, lockup periods last between 90 and 180 days. Web the terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180. Web 14 rows quiet period expiration; Web what are ipo lockups?

Ipo Lockup Expiration Calendar Outlook Calendar 2022

Web 14 rows quiet period expiration; Web what are ipo lockups? Web the terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180. Lockup periods are important for investors to monitor because. Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering.

Next Test for Tech IPOs Lockup Expirations — The Information

Web the terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180. Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering. Company symbol proposed lead managers shares. Web 14 rows quiet period expiration; Lockup periods are important for investors to monitor because.

LOCKUP & QUIET PERIOD EXPIRATIONS r/Daytrading

Lockup periods are important for investors to monitor because. Company symbol proposed lead managers shares. An ipo lockup is an agreement signed by those who own shares prior to an ipo (i.e., insiders and early. Web 14 rows quiet period expiration; Web the terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180.

Ipo Lockup Expiration Calendar Outlook Calendar 2022

Web what are ipo lockups? Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering. An ipo lockup is an agreement signed by those who own shares prior to an ipo (i.e., insiders and early. Web the terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180..

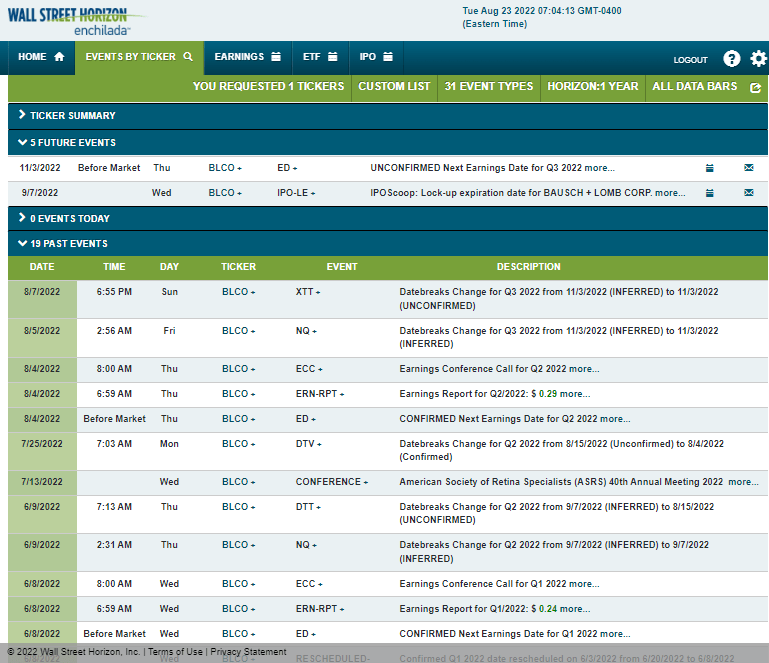

Bausch + Lomb Traders Eye A Key IPO Lockup Date On This Stock (NYSE

Web 14 rows quiet period expiration; Web typically, lockup periods last between 90 and 180 days. An ipo lockup is an agreement signed by those who own shares prior to an ipo (i.e., insiders and early. Company symbol proposed lead managers shares. Lockup periods are important for investors to monitor because.

Ipo Lockup Expiration Calendar Outlook Calendar 2022

Web typically, lockup periods last between 90 and 180 days. Web what are ipo lockups? Web ipo calendar upcoming ipos with underwriters, number of shares, offering price, and timing of the offering. Web 14 rows quiet period expiration; Lockup periods are important for investors to monitor because.

Web Ipo Calendar Upcoming Ipos With Underwriters, Number Of Shares, Offering Price, And Timing Of The Offering.

Web 14 rows quiet period expiration; Web the terms of lockup agreements may vary, but most prevent insiders from selling their shares for 180. Web typically, lockup periods last between 90 and 180 days. An ipo lockup is an agreement signed by those who own shares prior to an ipo (i.e., insiders and early.

Web What Are Ipo Lockups?

Company symbol proposed lead managers shares. Lockup periods are important for investors to monitor because.