Lpr Form Insurance

Lpr Form Insurance - If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. If your vehicle is still uninsured after 90 days, your driver’s license will be suspended. To avoid these penalties, you must This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.) Web insurance industry standards setting organization acord has announced changes to two forms commonly used by iiabny members. If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. An lpr is signed by the insured party and signifies that the policy in question has been lost. By so doing, you will ensure you do not have a lapse or duplication of coverage. Web this form, which the insured signs, releases the insurance company from any further responsibility. Web a lost policy release (lpr) is a statement releasing an insurance company from its liabilities.

To avoid these penalties, you must Just open and print the cancel previous insurance letter , fill in your information, and then mail it to your previous insurer. This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.) Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. If your vehicle is still uninsured after 90 days, your driver's license will be suspended. Web this form, which the insured signs, releases the insurance company from any further responsibility. Web insurance industry standards setting organization acord has announced changes to two forms commonly used by iiabny members. Remarks (acord 101, additional remarks schedule, may be attached if more space is required) policy number effective date company subject to. Web surrender your registration certificate and plates before your insurance expires. You can find a blank lpr here.

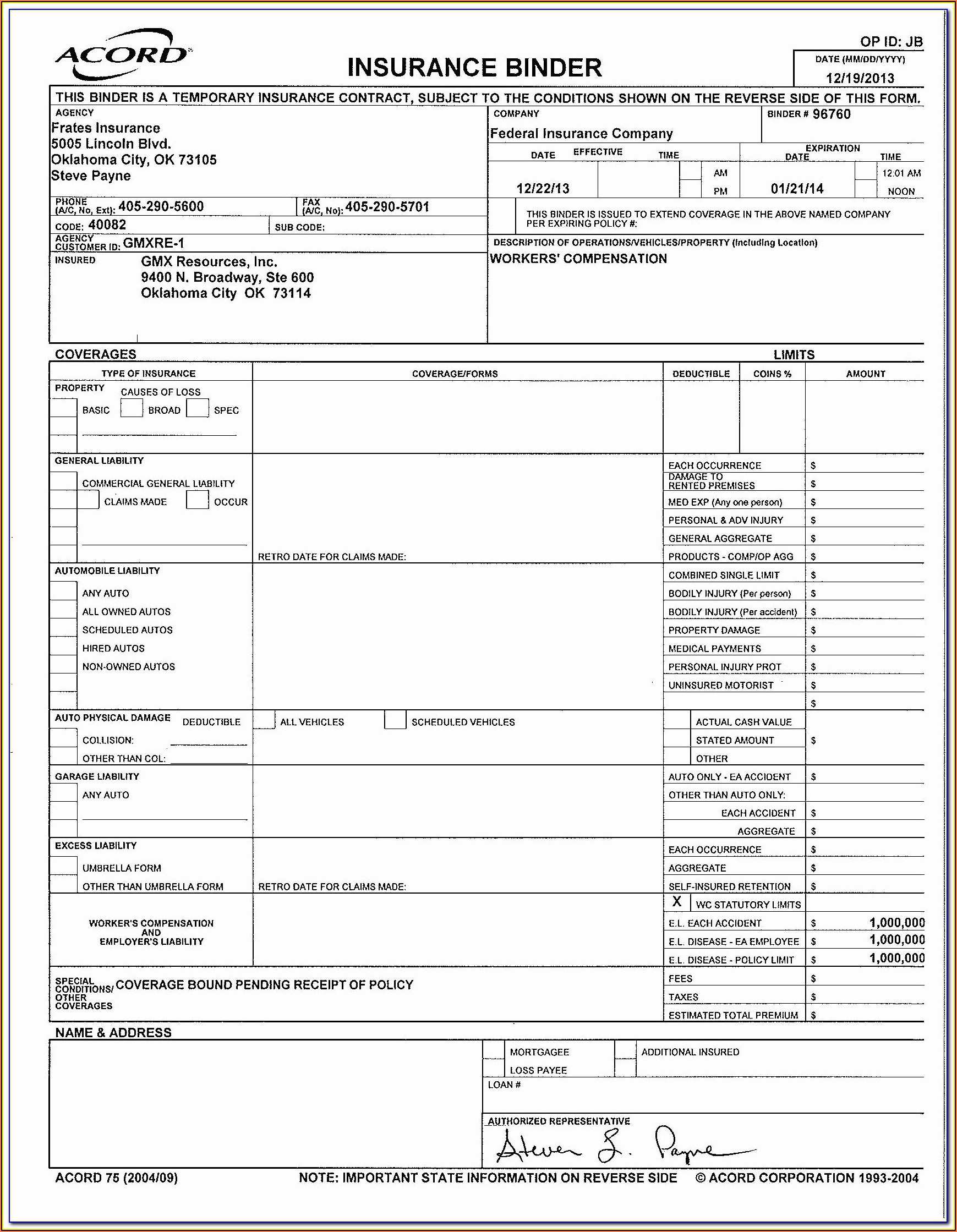

Form acord 35 (2017/05), cancellation request / policy release (also known as a lost policy release. By law, we must report the termination of auto insurance coverage to the department of motor vehicles. If your vehicle is still uninsured after 90 days, your driver's license will be suspended. This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.) The revised forms, announced in the organization's april forms notification, are effective may 1, 2017. Web this form, which the insured signs, releases the insurance company from any further responsibility. Web surrender your registration certificate and plates before your insurance expires. By so doing, you will ensure you do not have a lapse or duplication of coverage. If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. Web insurance industry standards setting organization acord has announced changes to two forms commonly used by iiabny members.

Timing Issues for Lawful Permanent Residents (“LPR”) Who Never

You can find a blank lpr here. Web a lost policy release (lpr) is a statement releasing an insurance company from its liabilities. Web surrender your registration certificate and plates before your insurance expires. Web this form, which the insured signs, releases the insurance company from any further responsibility. Form acord 35 (2017/05), cancellation request / policy release (also known.

FREE 9+ Sample Insurance Release Forms in MS Word PDF

On this page additional information Web need help canceling your prior insurance? You can find a blank lpr here. Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. The revised forms,.

“LPR Tax Limbo” Formal Abandonment of LPR (Form I407) BIG GAP with

The revised forms, announced in the organization's april forms notification, are effective may 1, 2017. Web a lost policy release (lpr) is a statement releasing an insurance company from its liabilities. Web this form, which the insured signs, releases the insurance company from any further responsibility. Remarks (acord 101, additional remarks schedule, may be attached if more space is required).

Insurance Acord Form 126 Form Resume Examples MoYowZLYZB

Web need help canceling your prior insurance? If you change auto insurance companies, you will need to sign this form in order to cancel the policy with the same effective date as the new policy. The revised forms, announced in the organization's april forms notification, are effective may 1, 2017. Just open and print the cancel previous insurance letter ,.

LPR by TMA Digital Company Limited

If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. Web insurance industry standards setting organization acord has announced changes to two forms commonly used by iiabny members. Just open and print the cancel previous insurance letter , fill in your information, and then mail it to your.

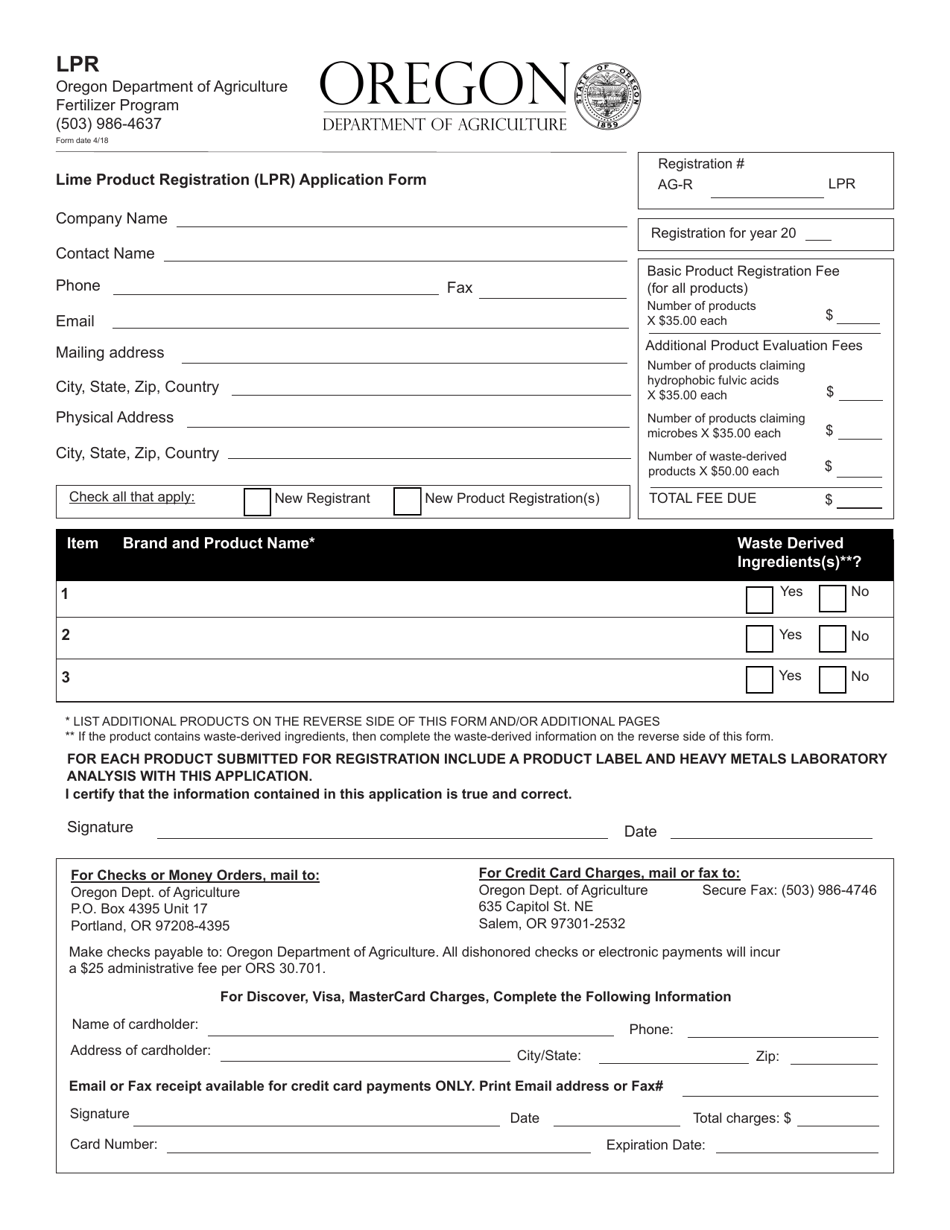

Oregon Lime Product Registration (Lpr) Application Form Download

Web insurance industry standards setting organization acord has announced changes to two forms commonly used by iiabny members. Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. If you do not.

US government shares citizens' border crossings with insurance

By law, we must report the termination of auto insurance coverage to the department of motor vehicles. Web need help canceling your prior insurance? If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. By so doing, you will ensure you do not have a lapse or duplication.

Insurance Lpr Pdf

This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.) If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. To avoid these penalties, you must Web a lost policy release is a statement signed by the named.

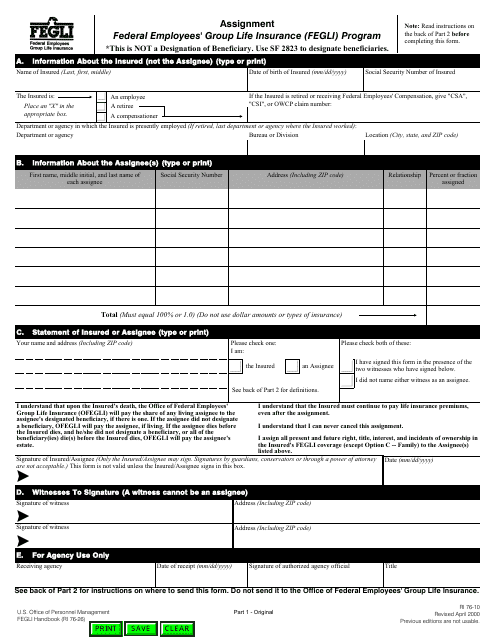

OPM Form RI 7610 Download Fillable PDF, Assignment of Federal Employee

Web need help canceling your prior insurance? Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. You can find a blank lpr here. If you change auto insurance companies, you will.

Low hour TEAC LPR400 all in one system can record Vinyl to CD even has

Web surrender your registration certificate and plates before your insurance expires. Web insurance industry standards setting organization acord has announced changes to two forms commonly used by iiabny members. By law, we must report the termination of auto insurance coverage to the department of motor vehicles. Web need help canceling your prior insurance? Web this form, which the insured signs,.

If You Do Not Keep Your Auto Insurance In Force During The Entire Registration Period, Your Motor Vehicle Registration Will Be Suspended.

Web surrender your registration certificate and plates before your insurance expires. Remarks (acord 101, additional remarks schedule, may be attached if more space is required) policy number effective date company subject to. Web a lost policy release (lpr) is a statement releasing an insurance company from its liabilities. Just open and print the cancel previous insurance letter , fill in your information, and then mail it to your previous insurer.

If You Change Auto Insurance Companies, You Will Need To Sign This Form In Order To Cancel The Policy With The Same Effective Date As The New Policy.

Web a lost policy release is a statement signed by the named insured releasing the insurer from all liability under a lost or mislaid contract of insurance in cases in which the insured wishes to cancel the policy. Web need help canceling your prior insurance? You can find a blank lpr here. This form is used for policy cancellation requests, commonly referred to as a lost policy release (or lpr, for short.)

Web A Lost Policy Release Is A Statement Signed By The Named Insured Releasing The Insurer From All Liability Under A Lost Or Mislaid Contract Of Insurance In Cases In Which The Insured Wishes To Cancel The Policy.

Web insurance industry standards setting organization acord has announced changes to two forms commonly used by iiabny members. By so doing, you will ensure you do not have a lapse or duplication of coverage. An lpr is signed by the insured party and signifies that the policy in question has been lost. On this page additional information

Web This Form, Which The Insured Signs, Releases The Insurance Company From Any Further Responsibility.

If you do not keep your auto insurance in force during the entire registration period, your motor vehicle registration will be suspended. If your vehicle is still uninsured after 90 days, your driver's license will be suspended. To avoid these penalties, you must Web in this video, james shows you how to fill out an acord 35 form.

/cdn.vox-cdn.com/assets/1311028/lpr_border_crossing.jpg)