Ma Withholding Form

Ma Withholding Form - Keep this certificate with your records. Go to mailing addresses for massachusetts tax forms for fiduciary and other addresses. Reconciliation of massachusetts income taxes withheld for employers. Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue (dor). Your withholding is subject to review by the irs. Web withholding state income taxes from your employees who reside in or are employed in massachusetts and sending in those taxes, along with the appropriate form or electronic return, on time. You can print other massachusetts tax forms here. Make quarterly payments of amounts withheld, and; All of the above must be done online through masstaxconnect.

Store employees’ state tax withholding forms in your records. Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue (dor). Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. All of the above must be done online through masstaxconnect. If the employee is believed to have claimed excessive exemptions, the massachusetts department of revenue should be so advised. Go to mailing addresses for massachusetts tax forms for fiduciary and other addresses. Keep this certificate with your records. Previously, most withholding allowances were based on the employee’s personal exemptions. You can print other massachusetts tax forms here. Your withholding is subject to review by the irs.

Reconciliation of massachusetts income taxes withheld for employers. Keep this certificate with your records. You can print other massachusetts tax forms here. Your withholding is subject to review by the irs. Web withholding state income taxes from your employees who reside in or are employed in massachusetts and sending in those taxes, along with the appropriate form or electronic return, on time. If the employee is believed to have claimed excessive exemptions, the massachusetts department of revenue should be so advised. Store employees’ state tax withholding forms in your records. Go to mailing addresses for massachusetts tax forms for fiduciary and other addresses. All of the above must be done online through masstaxconnect. Otherwise, massachusetts income taxes will be withheld from your wages without exemptions.

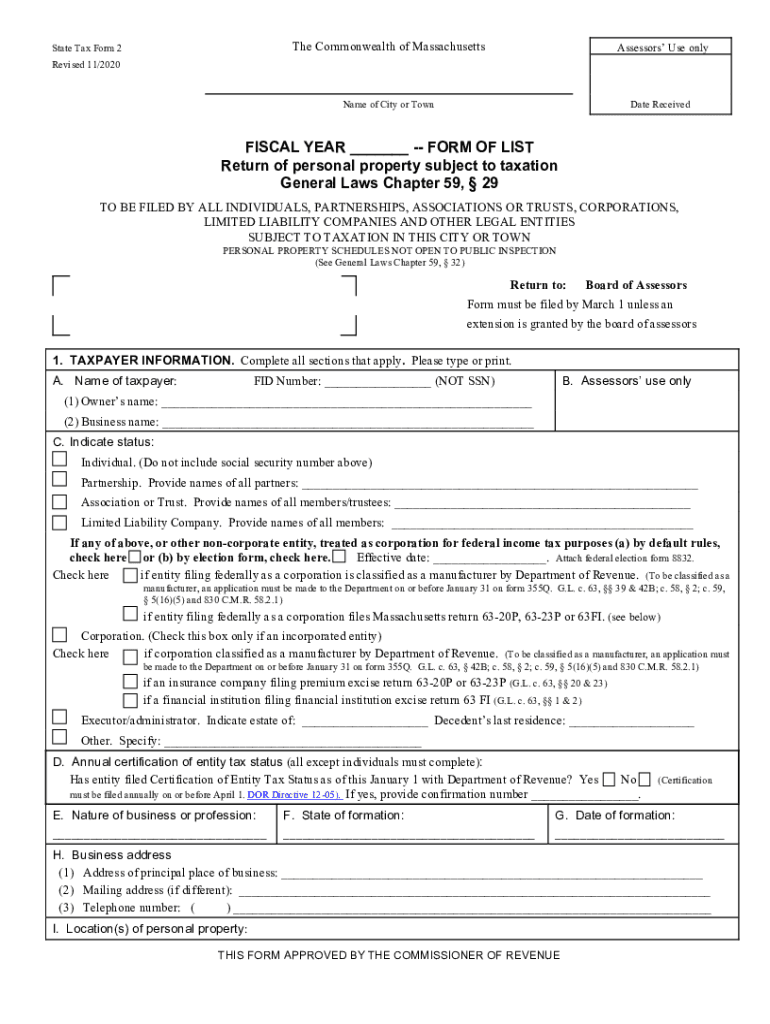

MA State Tax Form 2 20202021 Fill out Tax Template Online US Legal

Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue (dor). Your withholding is subject to review by the irs. Make quarterly payments of amounts withheld, and; Keep this certificate with your records. Web withholding state income taxes from your employees who reside in or are employed in massachusetts and sending.

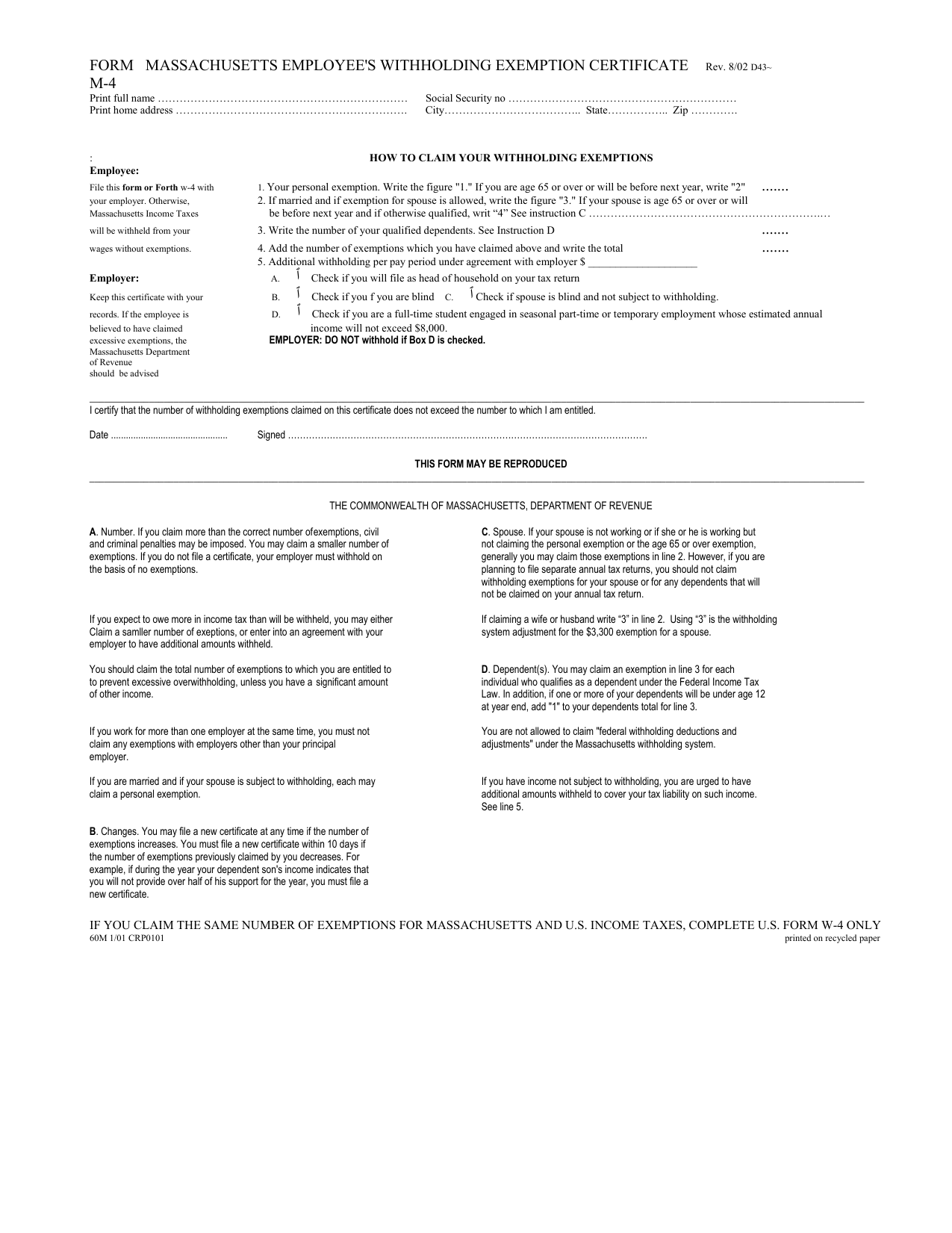

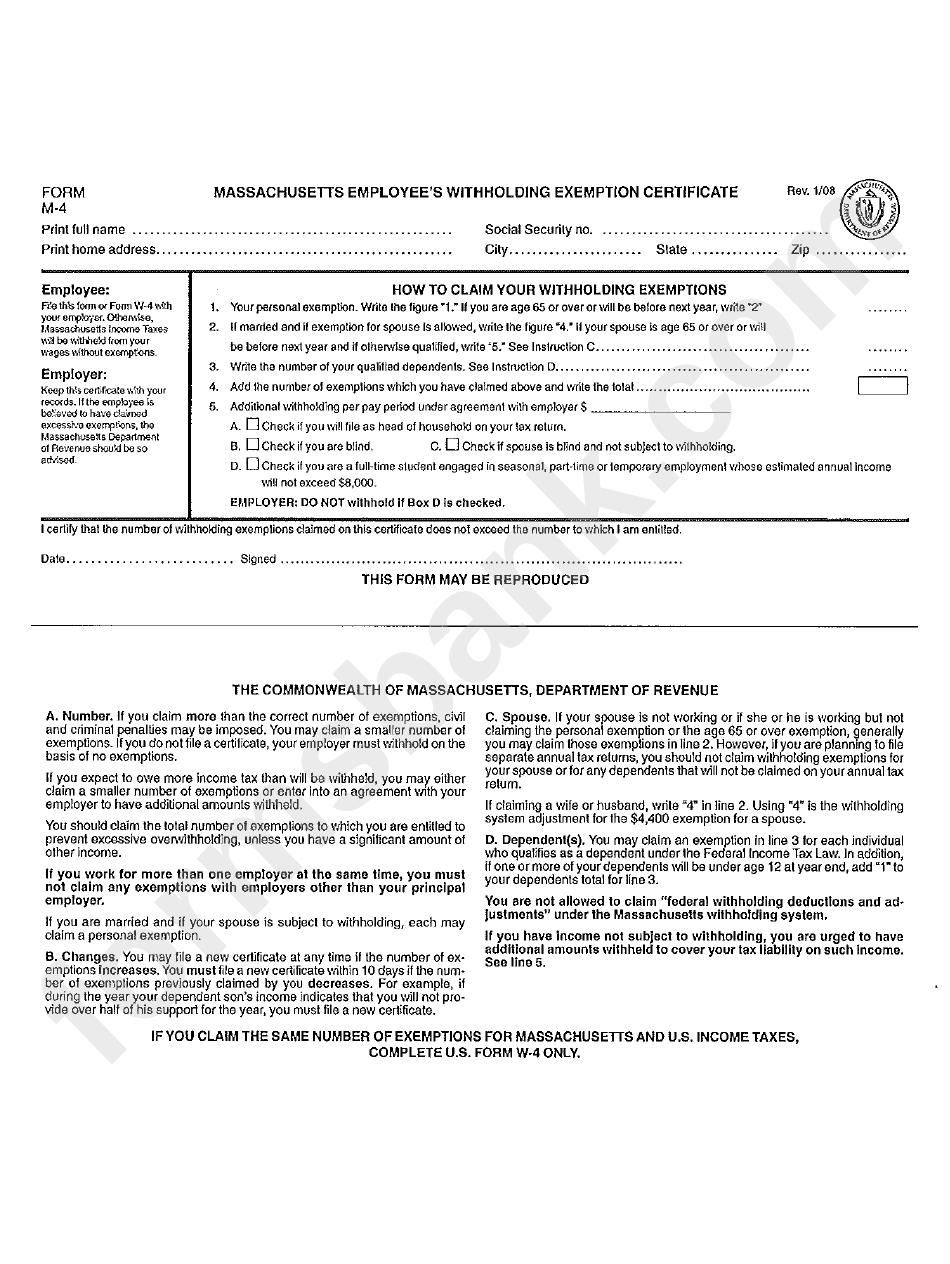

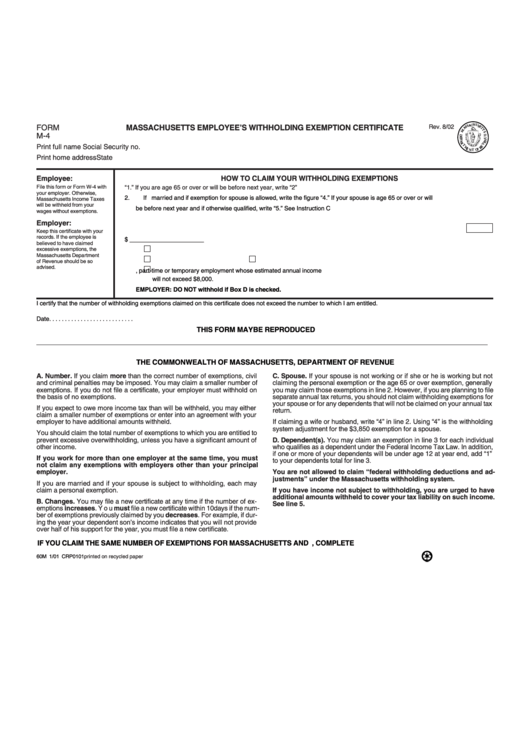

FORM MASSACHUSETTS EMPLOYEE'S WITHHOLDING

You can print other massachusetts tax forms here. Store employees’ state tax withholding forms in your records. Previously, most withholding allowances were based on the employee’s personal exemptions. Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue (dor). Otherwise, massachusetts income taxes will be withheld from your wages without exemptions.

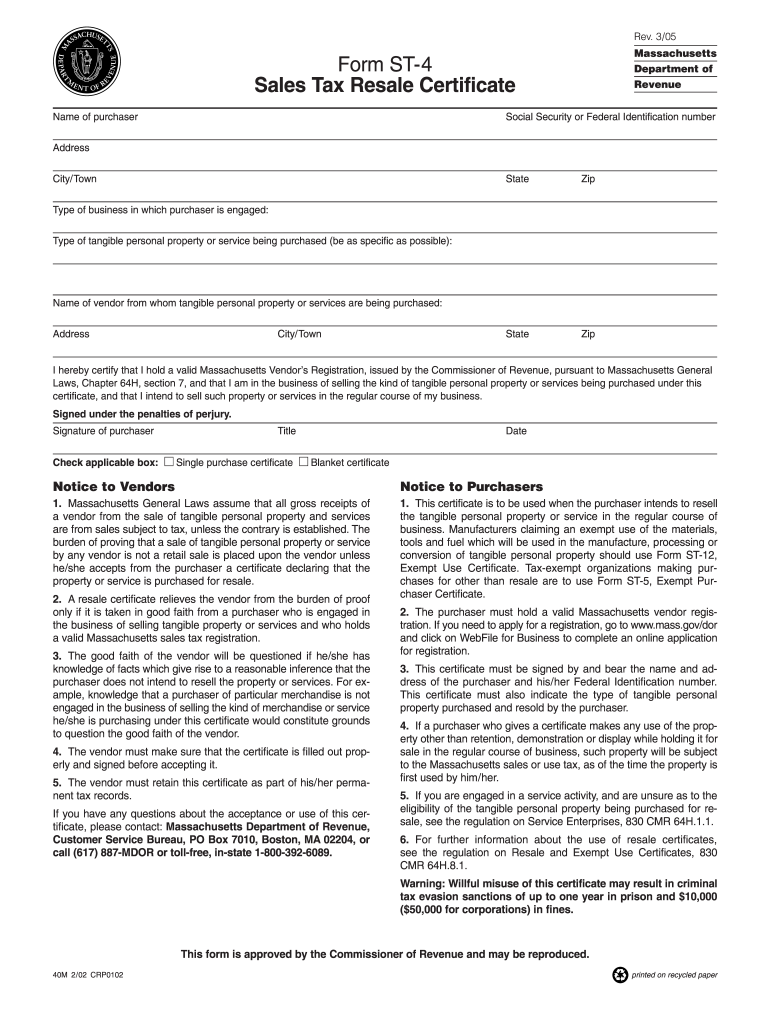

2005 Form MA DoR ST4 Fill Online, Printable, Fillable, Blank pdfFiller

Web withholding state income taxes from your employees who reside in or are employed in massachusetts and sending in those taxes, along with the appropriate form or electronic return, on time. All of the above must be done online through masstaxconnect. You can print other massachusetts tax forms here. Web here you will find an alphabetical listing of withholding tax.

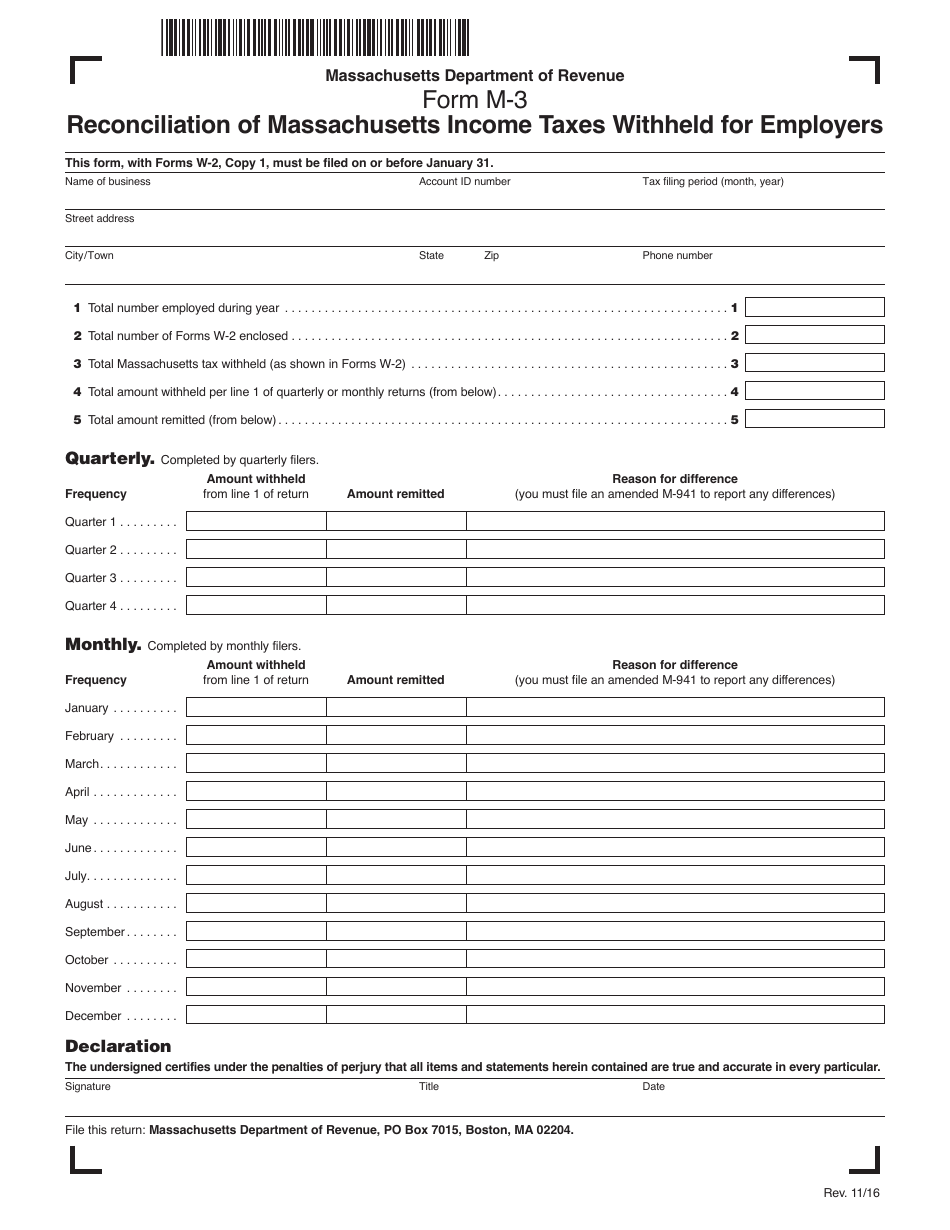

Form M3 Download Printable PDF or Fill Online Reconciliation of

Keep this certificate with your records. Web withholding state income taxes from your employees who reside in or are employed in massachusetts and sending in those taxes, along with the appropriate form or electronic return, on time. You can print other massachusetts tax forms here. Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. Previously, most withholding.

Form M4 Massachusetts Employee'S Withholding Exemption Certificate

Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue (dor). Web withholding state income taxes from your employees who reside in or are employed in massachusetts and sending in those taxes, along with the appropriate form or electronic return, on time. Previously, most withholding allowances were based on the employee’s.

2022 Tax Table Weekly Latest News Update

You can print other massachusetts tax forms here. Store employees’ state tax withholding forms in your records. Your withholding is subject to review by the irs. Make quarterly payments of amounts withheld, and; All of the above must be done online through masstaxconnect.

Fillable Form M4 Massachusetts Employee'S Withholding Exemption

Previously, most withholding allowances were based on the employee’s personal exemptions. Reconciliation of massachusetts income taxes withheld for employers. Store employees’ state tax withholding forms in your records. Your withholding is subject to review by the irs. Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue (dor).

MA DoR M942 20002021 Fill out Tax Template Online US Legal Forms

Go to mailing addresses for massachusetts tax forms for fiduciary and other addresses. Previously, most withholding allowances were based on the employee’s personal exemptions. All of the above must be done online through masstaxconnect. Make quarterly payments of amounts withheld, and; Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue.

MA Form PWHRW 2015 Fill out Tax Template Online US Legal Forms

Make quarterly payments of amounts withheld, and; You can print other massachusetts tax forms here. Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue (dor). All of the above must be done online through masstaxconnect. Web withholding state income taxes from your employees who reside in or are employed in.

mass_dorwithholdingformm4 • Mass State Cleaning

You can print other massachusetts tax forms here. Your withholding is subject to review by the irs. Previously, most withholding allowances were based on the employee’s personal exemptions. Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. Keep this certificate with your records.

Store Employees’ State Tax Withholding Forms In Your Records.

You can print other massachusetts tax forms here. Web here you will find an alphabetical listing of withholding tax forms administered by the massachusetts department of revenue (dor). Otherwise, massachusetts income taxes will be withheld from your wages without exemptions. Make quarterly payments of amounts withheld, and;

Web Withholding State Income Taxes From Your Employees Who Reside In Or Are Employed In Massachusetts And Sending In Those Taxes, Along With The Appropriate Form Or Electronic Return, On Time.

Keep this certificate with your records. Reconciliation of massachusetts income taxes withheld for employers. If the employee is believed to have claimed excessive exemptions, the massachusetts department of revenue should be so advised. Your withholding is subject to review by the irs.

Go To Mailing Addresses For Massachusetts Tax Forms For Fiduciary And Other Addresses.

All of the above must be done online through masstaxconnect. Previously, most withholding allowances were based on the employee’s personal exemptions.