Maine 1040 Tax Form

Maine 1040 Tax Form - For tax years beginning on. Schedule 2 (pdf) itemized deductions: Form 2210me (pdf) underpayment of estimated tax penalty. This form is for income earned in tax year 2022, with tax returns due in april 2023. And you are enclosing a payment, then use this. Worksheets for tax credits claimed on. Download or email 1040me long & more fillable forms, register and subscribe now! Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. Complete, edit or print tax forms instantly. Web form 1040me due date:

Form number form title instructions; Form 2210me (pdf) underpayment of estimated tax penalty. Web a lien (maine resident) check here if you are filing schedule nrh you spouse 14. Web enclose schedule nr and worksheets a and b (and worksheet c, if used) with your maine return, form 1040me. And you are not enclosing a payment, then use this address. Web we last updated maine form 1040me in january 2023 from the maine revenue services. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Web live chat maine tax forms select a different state: Worksheets for tax credits claimed on. Web enclose schedule nr and worksheets a and b (and worksheet c, if used) with your maine return, form 1040me.

Web you may pay your income taxes electronically at www.maine.gov/ revenue. And you are not enclosing a payment, then use this address. Web enclose schedule nr and worksheets a and b (and worksheet c, if used) with your maine return, form 1040me. Complete, edit or print tax forms instantly. Web worksheet for form 1040me, schedule 1, line 2k: This form is for income earned in tax year 2022, with tax returns due in april 2023. Web if you live in maine. Important changes for 2020 reporting use tax on income tax return. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Get ready for tax season deadlines by completing any required tax forms today.

2011 Form ME REW11040 Fill Online, Printable, Fillable, Blank PDFfiller

Include a complete copy of your federal tax return, including. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web you may pay your income taxes electronically at www.maine.gov/ revenue. Web live chat maine tax forms select a different state: Schedule 2 (pdf) itemized deductions:

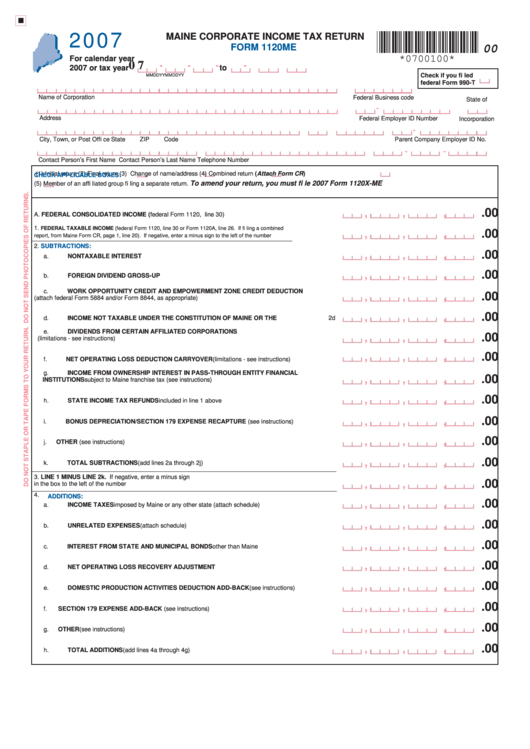

Form 1120me Maine Corporate Tax Return 2007 printable pdf

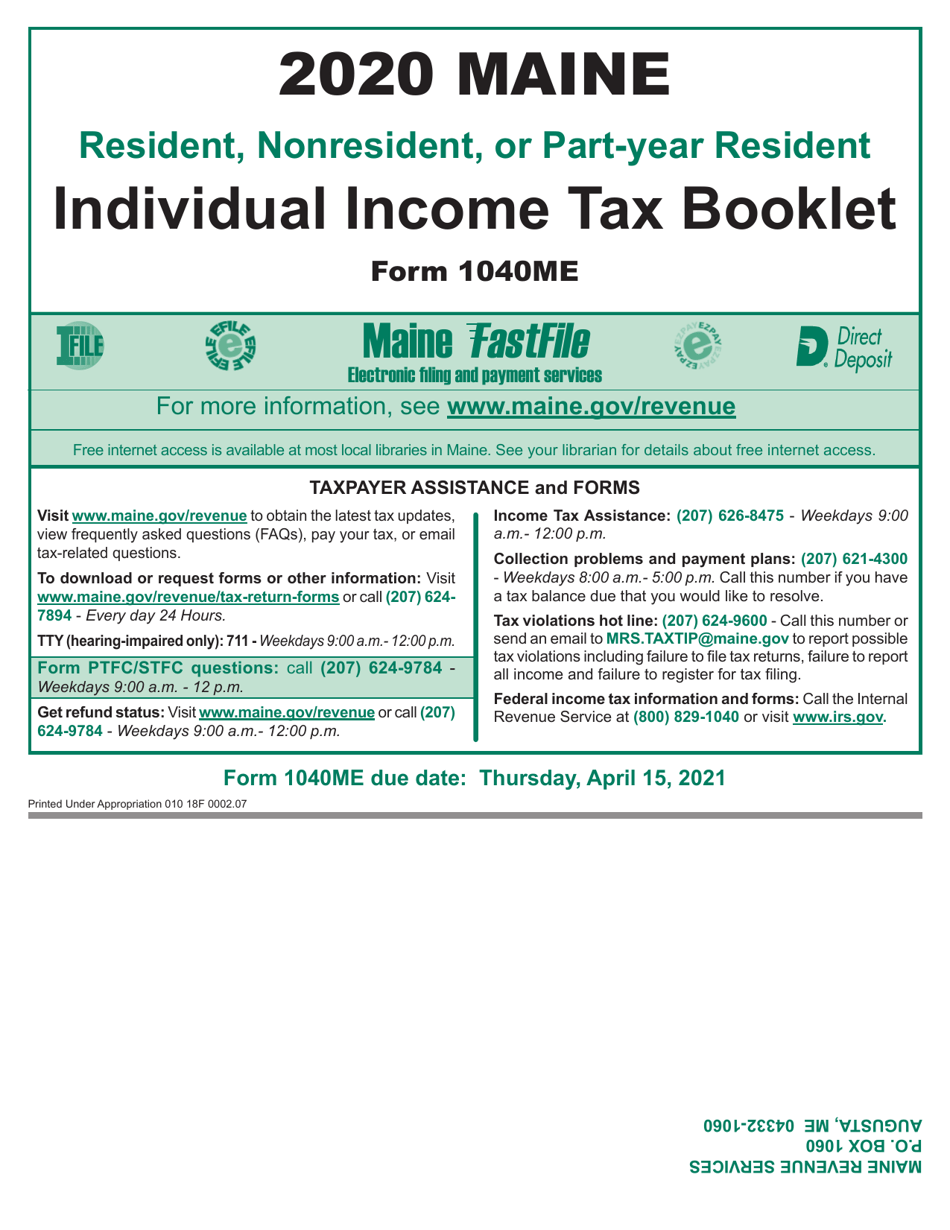

This booklet includes instructions as well as the form itself. Form 2210me (pdf) underpayment of estimated tax penalty. Web as of july 19, the average credit card interest rate is 20.44%, down slightly from the 20.58% recorded the week before, according to bankrate.com. This form is for income earned in tax year 2022, with tax returns due in april 2023..

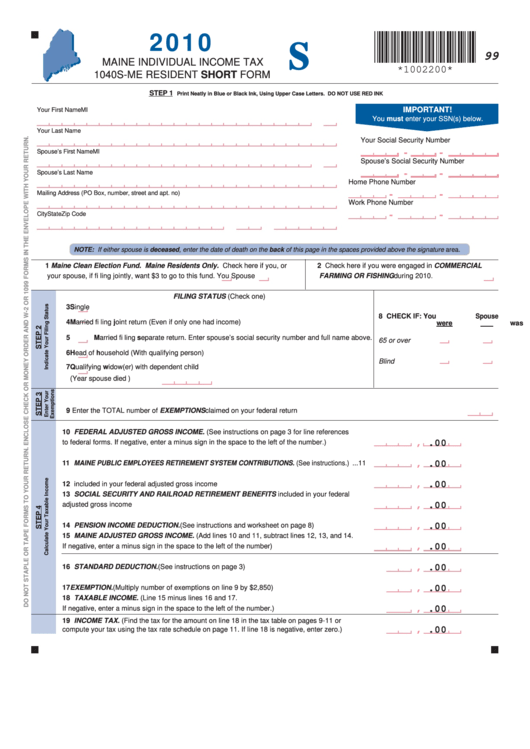

Form 1040sMe Maine Individual Tax 2010 printable pdf download

Form 2210me (pdf) underpayment of estimated tax penalty. Include a complete copy of your federal tax return, including. Complete, edit or print tax forms instantly. Web worksheet for form 1040me, schedule 1s, line 28: Form 2210me (pdf) underpayment of estimated tax penalty.

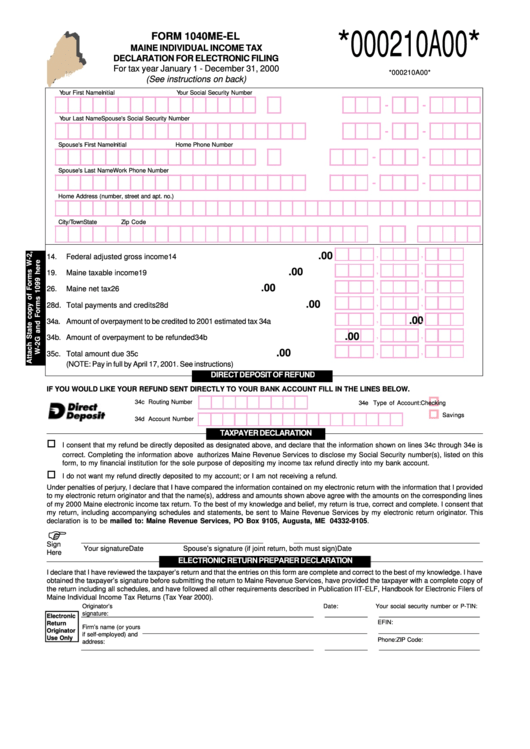

Form 1040meEl Maine Individual Tax Declaration For Electronic

And you are filing a form. Schedule 2 (pdf) itemized deductions: Form number form title instructions; Web form 1040me due date: Web enclose schedule nr and worksheets a and b (and worksheet c, if used) with your maine return, form 1040me.

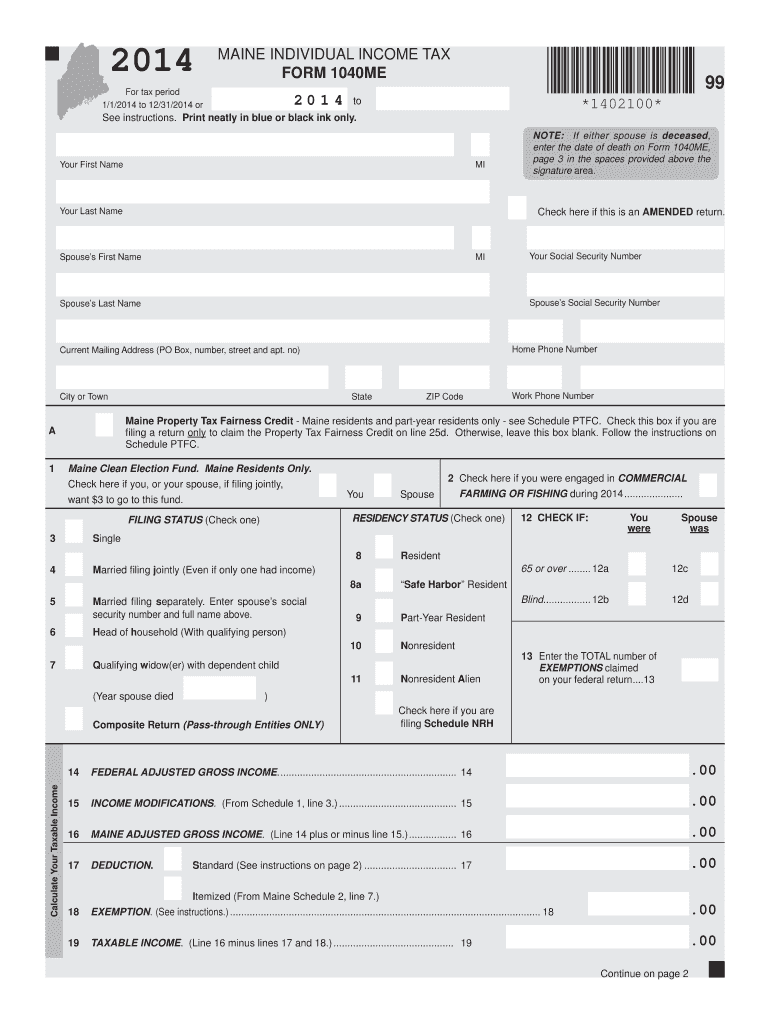

2014 Form ME 1040ME Fill Online, Printable, Fillable, Blank pdfFiller

This form is for income earned in tax year 2022, with tax returns due in april 2023. Include a complete copy of your federal tax return, including. Web a lien (maine resident) check here if you are filing schedule nrh you spouse 14. Web you may pay your income taxes electronically at www.maine. Form number form title instructions;

Form 1040Me Maine Individual Tax Return Form printable pdf

Include a complete copy of your federal tax return, including. Form number form title instructions; Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. § 5122(1)(nn) may be recaptured, up to 25% per taxable year, to the.

Download Instructions for Form 1040ME Maine Individual Tax PDF

This form is for income earned in tax year 2022, with tax returns due in april 2023. Form 2210me (pdf) underpayment of estimated tax penalty. This booklet includes instructions as well as the form itself. Web if you live in maine. Schedule 2 (pdf) itemized deductions:

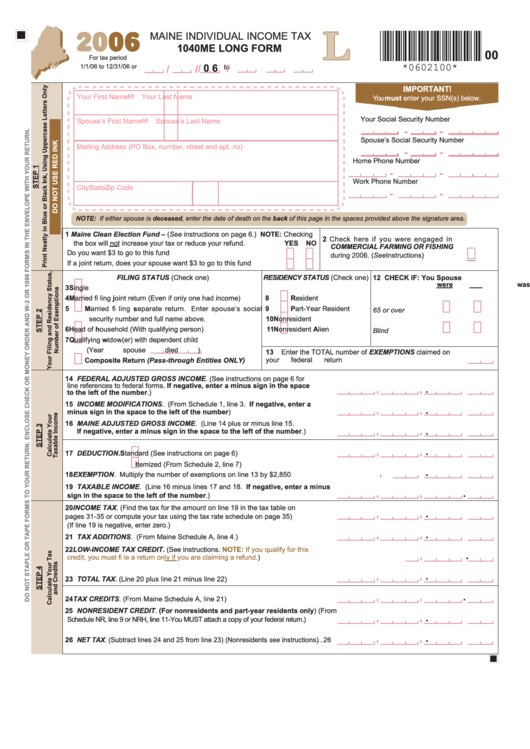

Form 1040me Maine Individual Tax Long Form 2006 printable

Web worksheet for form 1040me, schedule 1, line 2k: Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue department, which will result in either a tax. Worksheets for tax credits claimed on. This form is for income earned in tax year 2022, with tax returns.

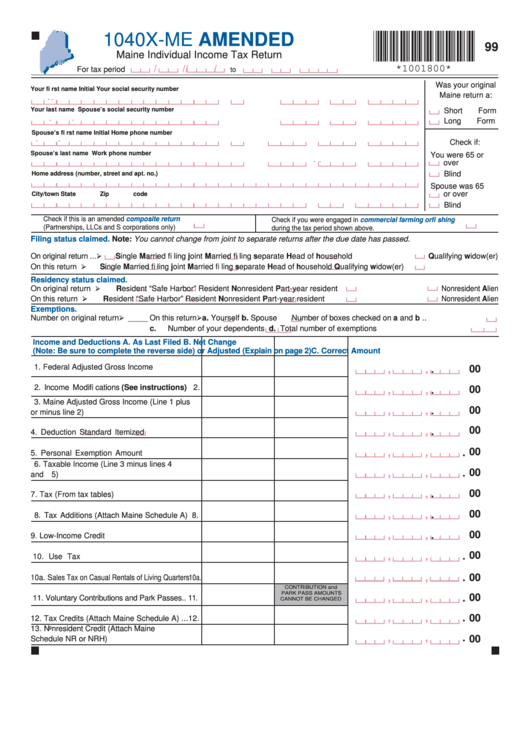

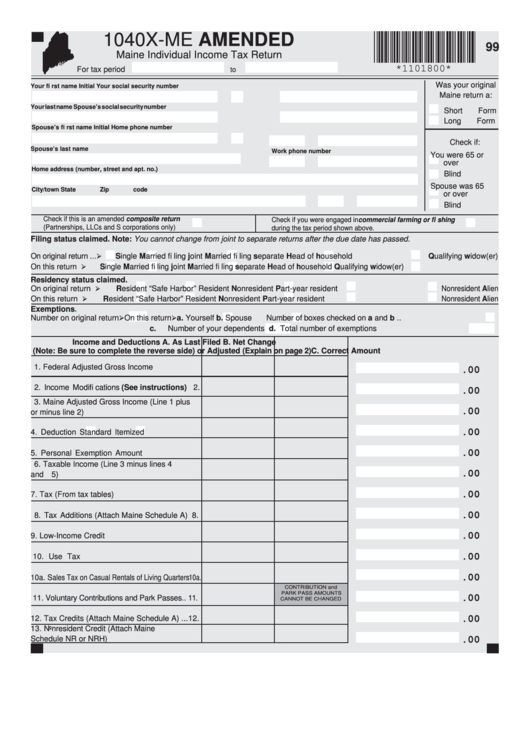

Form 1040xMe Maine Individual Tax Return printable pdf download

And you are not enclosing a payment, then use this address. Web you may pay your income taxes electronically at www.maine.gov/ revenue. Web live chat maine tax forms select a different state: This form is for income earned in tax year 2022, with tax returns due in april 2023. This booklet includes instructions as well as the form itself.

Withholding Order Maine

Worksheets for tax credits claimed on. And you are not enclosing a payment, then use this address. Web worksheet for form 1040me, schedule 1s, line 28: Include a complete copy of your federal tax return, including. Web most taxpayers are required to file a yearly income tax return in april to both the internal revenue service and their state's revenue.

Web As Of July 19, The Average Credit Card Interest Rate Is 20.44%, Down Slightly From The 20.58% Recorded The Week Before, According To Bankrate.com.

This booklet includes instructions as well as the form itself. Web enclose schedule nr and worksheets a and b (and worksheet c, if used) with your maine return, form 1040me. Web form 1040me due date: Schedule 2 (pdf) itemized deductions:

Web Most Taxpayers Are Required To File A Yearly Income Tax Return In April To Both The Internal Revenue Service And Their State's Revenue Department, Which Will Result In Either A Tax.

Web live chat maine tax forms select a different state: Form number form title instructions; Complete, edit or print tax forms instantly. For tax years beginning on.

Complete, Edit Or Print Tax Forms Instantly.

Web we last updated maine form 1040me in january 2023 from the maine revenue services. § 5122(1)(nn) may be recaptured, up to 25% per taxable year, to the extent that maine taxable income is. Web you may pay your income taxes electronically at www.maine. Download or email 1040me long & more fillable forms, register and subscribe now!

Web A Lien (Maine Resident) Check Here If You Are Filing Schedule Nrh You Spouse 14.

Worksheets for tax credits claimed on. And you are not enclosing a payment, then use this address. These 2021 forms and more are available: This form is for income earned in tax year 2022, with tax returns due in april 2023.