Maryland Form 502Su

Maryland Form 502Su - Credits for income tax paid in other states. Enter the sum of all subtractions from form 502su on line 13 of form 502. Web maryland tax return (form 502) as follows: Web maryland form 502su line ab. Web more about the maryland form 502su we last updated maryland form 502su in january 2023 from the maryland comptroller of maryland. Web the form 2020: All interest and dividends amounts should be entered in federal. Web net subtraction modification to maryland taxable income resulting from the federal ratable inclusion of deferred income arising from business indebtedness discharged by. Web use this screen to enter amounts needed for forms 502, 502su, and the poverty level credit worksheet. You can download or print.

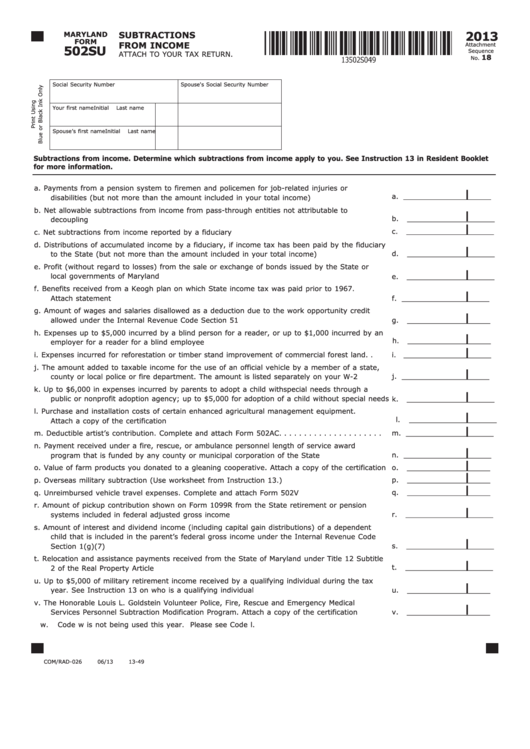

Web form 502su subtractions from income attach to your ta return 2020 name ssn w.unreimbursed expenses incurred by a foster parent on behalf of a foster. Download or email form 502 & more fillable forms, register and subscribe now! This serves as a subtraction from your income which will reduce your taxable net income on line 20 (form 502). Web maryland tax return (form 502) as follows: This form is for income earned in tax. Web use this screen to enter amounts needed for forms 502, 502su, and the poverty level credit worksheet. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Enter the sum of all subtractions from form 502su on line 13 of form 502. .00 the amount added to taxable income for the use of an official vehicle by. Web we last updated the subtractions from income in january 2023, so this is the latest version of form 502su, fully updated for tax year 2022.

Enter the sum of all subtractions from form 502su on line 13 of form 502. Determine which subtractions from income apply to you. Web.00 expenses incurred for reforestation or timber stand improvement of commercial forest land. Web we last updated the subtractions from income in january 2023, so this is the latest version of form 502su, fully updated for tax year 2022. 502su income subtractions from maryland subtractions (comptroller of maryland) form is 3 pages long and contains: Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. Web use this screen to enter amounts needed for forms 502, 502su, and the poverty level credit worksheet. Web find maryland form 502 instructions at esmart tax today. You can download or print current or. .00 the amount added to taxable income for the use of an official vehicle by.

Fillable Maryland Form 502su Subtractions From 2013

Web find maryland form 502 instructions at esmart tax today. Web the form 2020: .00 the amount added to taxable income for the use of an official vehicle by. Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances from which the state of maryland has decoupled. Web form 502su subtractions from income attach to your.

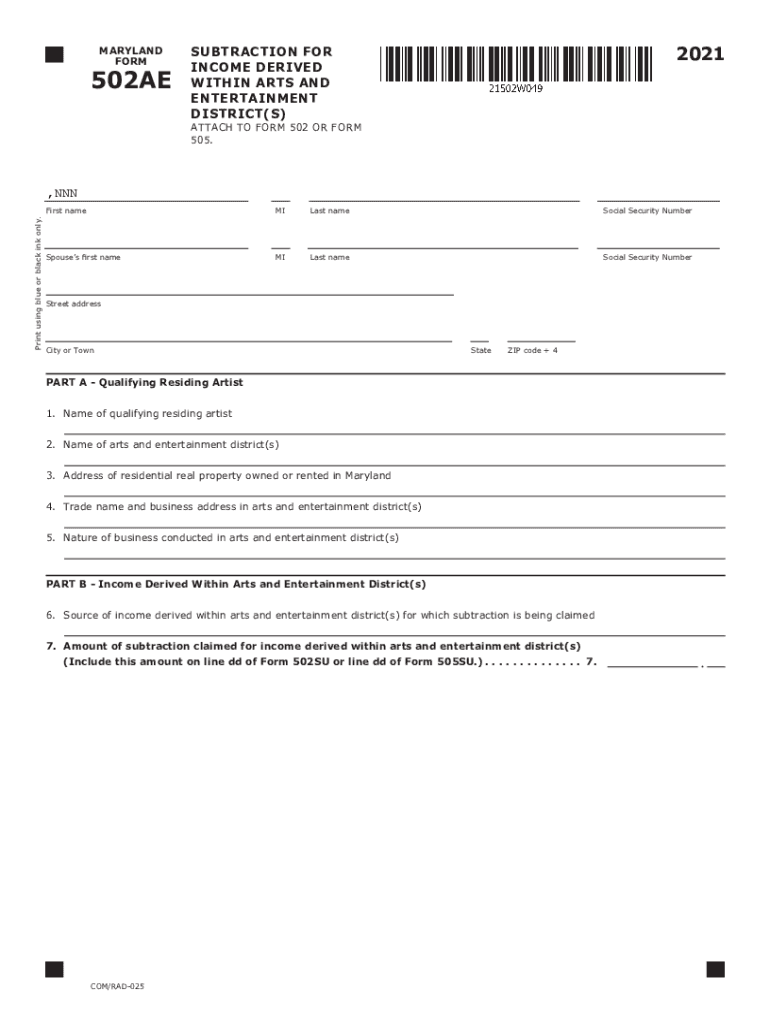

Fill Free fillable forms Comptroller of Maryland

Determine which subtractions from income apply to you. You can download or print. All interest and dividends amounts should be entered in federal. This serves as a subtraction from your income which will reduce your taxable net income on line 20 (form 502). Web more about the maryland form 502su we last updated maryland form 502su in january 2023 from.

Maryland Form 502 Instructions ESmart Tax Fill Out and Sign Printable

Web a fillable maryland 502cr form is used to claim personal tax allegations and is required for the following cases: Enter the sum of all subtractions from form 502su on line 13 of form 502. 502su income subtractions from maryland subtractions (comptroller of maryland) form is 3 pages long and contains: Web net subtraction modification to maryland taxable income resulting.

Maryland Form 502 Instructions 2019

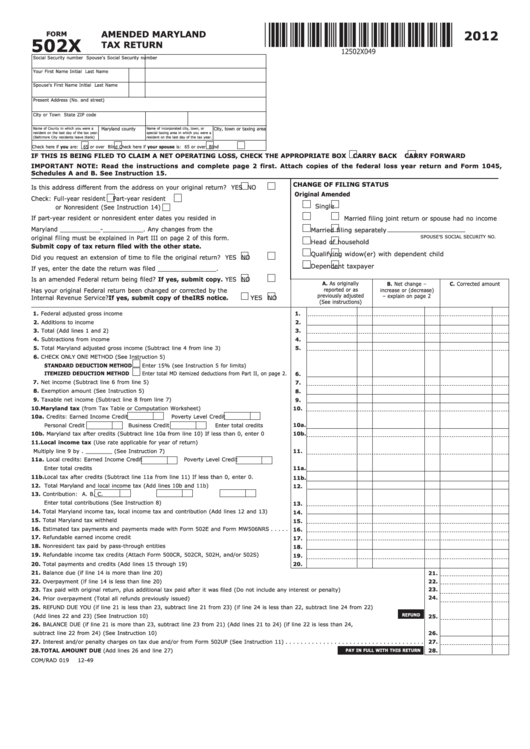

Enter the sum of all subtractions from form 502su on line 13 of form 502. Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. Web a fillable maryland 502cr form is used to claim personal tax allegations and is required for.

Fill Free fillable Form 2020 502SU SUBTRACTIONS FROM MARYLAND

Web maryland form 502su line ab. You can download or print. Web please attach the form 502su to the form 502. Web.00 expenses incurred for reforestation or timber stand improvement of commercial forest land. Web maryland tax return (form 502) as follows:

Fill Free fillable forms Comptroller of Maryland

Web form 502su subtractions from income attach to your ta return 2020 name ssn w.unreimbursed expenses incurred by a foster parent on behalf of a foster. This form is for income earned in tax. You can download or print current or. Web net subtraction modification to maryland taxable income resulting from the federal ratable inclusion of deferred income arising from.

Fill Free fillable forms Comptroller of Maryland

Enter the sum of all subtractions from form 502su on line 13 of form 502. 502su income subtractions from maryland subtractions (comptroller of maryland) form is 3 pages long and contains: Download or email form 502 & more fillable forms, register and subscribe now! Web please attach the form 502su to the form 502. Credits for income tax paid in.

Fill Free fillable forms Comptroller of Maryland

All interest and dividends amounts should be entered in federal. Web maryland form 502su line ab. Web a fillable maryland 502cr form is used to claim personal tax allegations and is required for the following cases: Complete, edit or print tax forms instantly. Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs

Fillable Form 502x Amended Maryland Tax Return 2012 printable pdf

.00 the amount added to taxable income for the use of an official vehicle by. Web maryland form 502su line ab. Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances from which the state of maryland has decoupled. Determine which subtractions from income apply to you. Web please attach the form 502su to the form.

Fill Free fillable forms Comptroller of Maryland

You can download or print. Web maryland tax return (form 502) as follows: Web net subtraction modification to maryland taxable income resulting from the federal ratable inclusion of deferred income arising from business indebtedness discharged by. All interest and dividends amounts should be entered in federal. Download or email form 502 & more fillable forms, register and subscribe now!

You Can Download Or Print Current Or.

This serves as a subtraction from your income which will reduce your taxable net income on line 20 (form 502). Web form 502su subtractions from income attach to your ta return 2020 name ssn w.unreimbursed expenses incurred by a foster parent on behalf of a foster. Determine which subtractions from income apply to you. Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022.

Web Maryland Tax Return (Form 502) As Follows:

Web net subtraction modification to maryland taxable income resulting from the federal ratable inclusion of deferred income arising from business indebtedness discharged by. Web we last updated the subtractions from income in january 2023, so this is the latest version of form 502su, fully updated for tax year 2022. Web maryland form 502su line ab. You can download or print.

Web Net Subtraction Modification To Maryland Taxable Income When Claiming The Federal Depreciation Allowances From Which The State Of Maryland Has Decoupled.

Web more about the maryland form 502su we last updated maryland form 502su in january 2023 from the maryland comptroller of maryland. Web find maryland form 502 instructions at esmart tax today. Web the form 2020: Web.00 expenses incurred for reforestation or timber stand improvement of commercial forest land.

Web Comptroller Of Maryland's Www.marylandtaxes.gov All The Information You Need For Your Tax Paying Needs

.00 the amount added to taxable income for the use of an official vehicle by. Web please attach the form 502su to the form 502. Credits for income tax paid in other states. This form is for income earned in tax.