Maryland Form 510 Instructions 2022

Maryland Form 510 Instructions 2022 - Web (investment partnerships see specific instructions.) 5. Nonresident members other than individuals may not. Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. Web instructions for form 500. Formula of receipts and property, with receipts from intangible items. 2022 individual income tax instruction booklets 2022 business income tax instruction booklets Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. The request for extension of time to file will be granted provided. Maryland schedules a and b instructions form 511 2022 6. List credit on form 502cr, part cc, lines 6 and/or 9.

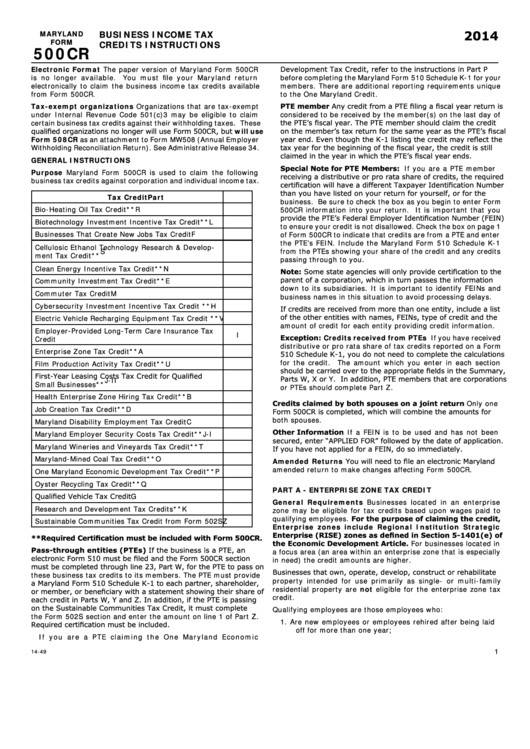

Web 2022 instruction booklets note: Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Form 504, see instructions for form 504. Visit any of our taxpayer service offices to obtain forms. List credit on form 502cr, part cc, lines 6 and/or 9. Formula of receipts and property, with receipts from intangible items. 2022 individual income tax instruction booklets 2022 business income tax instruction booklets Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss. File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. See instructions for form 505:

List credit on form 500cr. See instructions for form 505: Web 2022 individual income tax forms 2022 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. For forms, visit the 2022 individual tax forms or business tax forms pages. This form may be used if the pte is paying tax only on behalf of nonresident members and not electing to remit on all members' share of income. Resident individual members filingform 502: Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. List credit on form 502cr, part cc, lines 6 and/or 9. File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Nonresident members other than individuals may not.

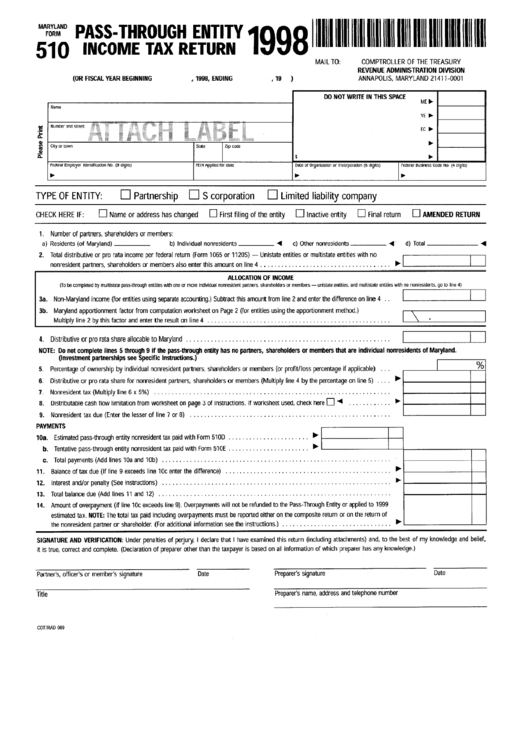

Fillable Maryland Form 510 PassThrough Entity Tax Return

Formula of receipts and property, with receipts from intangible items. 2022 individual income tax instruction booklets 2022 business income tax instruction booklets File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Web instructions for form 500. See instructions for form 505:

MD Comptroller MW508 20202021 Fill out Tax Template Online US

The request for extension of time to file will be granted provided. File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Web 2022 instruction booklets note: Nonresident members other than individuals may not. Forms are available for downloading in the resident individuals income tax forms section below.

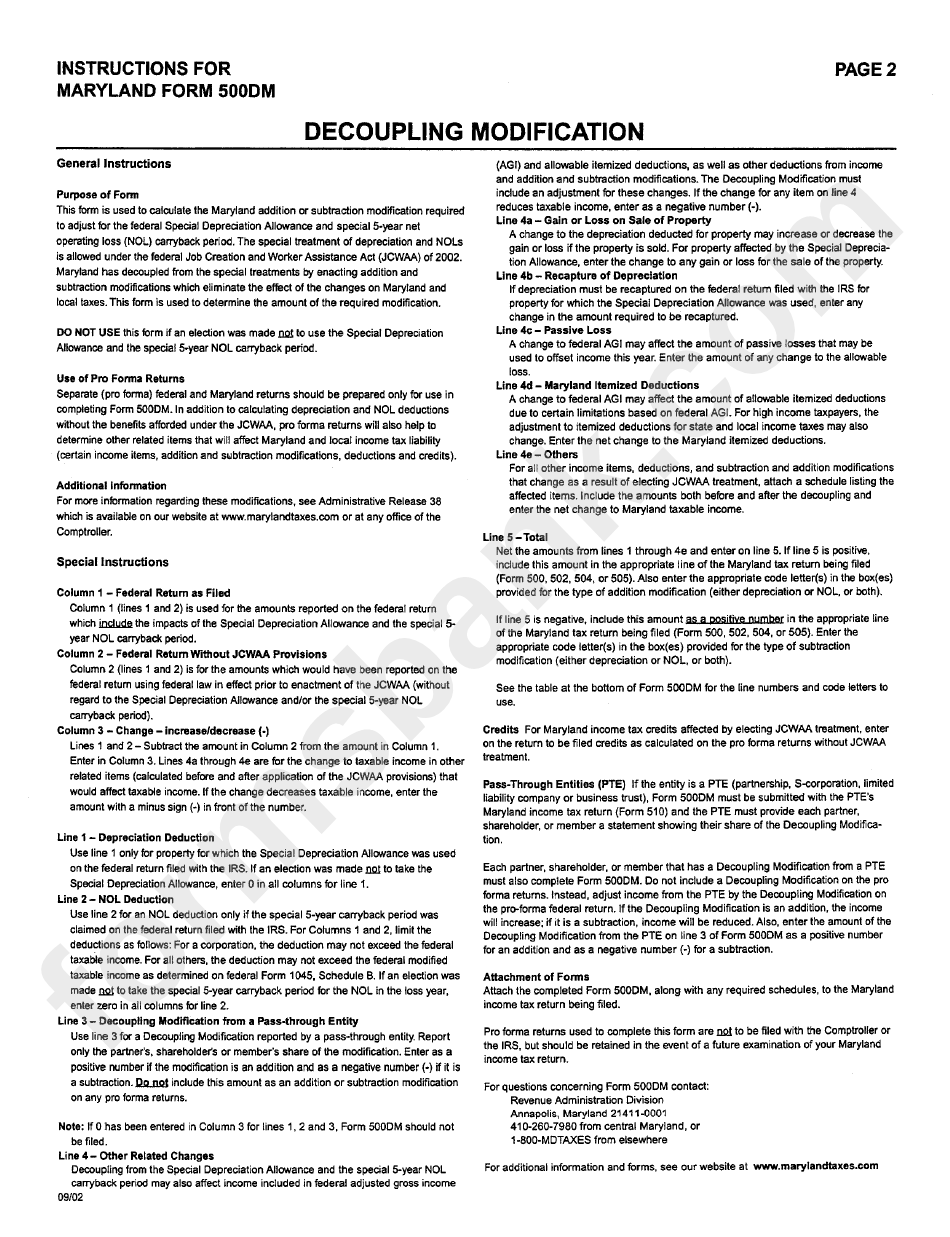

Instructions For Maryland Form 500dm printable pdf download

Form 504, see instructions for form 504. Formula of receipts and property, with receipts from intangible items. Resident individual members filingform 502: Visit any of our taxpayer service offices to obtain forms. File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members.

maryland form 510 instructions 2021

2022 individual income tax instruction booklets 2022 business income tax instruction booklets Nonresident members other than individuals may not. Resident individual members filingform 502: Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Formula of receipts and property, with receipts from intangible items.

2013 Form MD MW506FR Fill Online, Printable, Fillable, Blank pdfFiller

Maryland schedules a and b instructions form 511 2022 6. 2022 individual income tax instruction booklets 2022 business income tax instruction booklets Forms are available for downloading in the resident individuals income tax forms section below. See instructions for form 505: The request for extension of time to file will be granted provided.

Form 202 Maryland Fill Online, Printable, Fillable, Blank pdfFiller

Resident individual members filingform 502: Form 504, see instructions for form 504. Line 45 for credits from form 510 and for electing ptes, list credit on form 502cr, part cc, line 9. Forms are available for downloading in the resident individuals income tax forms section below. Percentage of ownership by individual nonresident members shown on line 1b (or profit/loss.

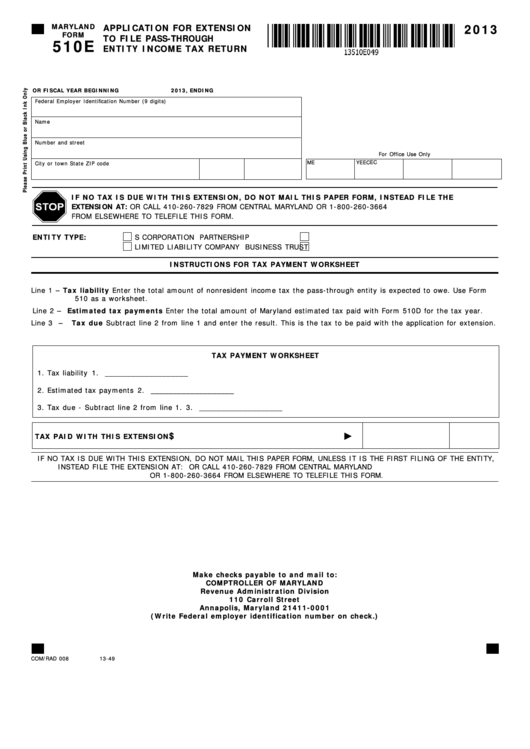

Fillable Maryland Form 510e Application For Extension To File Pass

File maryland form 510 electronically to pass on business tax credits from maryland form 500cr and/or maryland form 502s to your members. Nonresident members other than individuals may not. The instruction booklets listed here do not include forms. See instructions for form 505: 2022 individual income tax instruction booklets 2022 business income tax instruction booklets

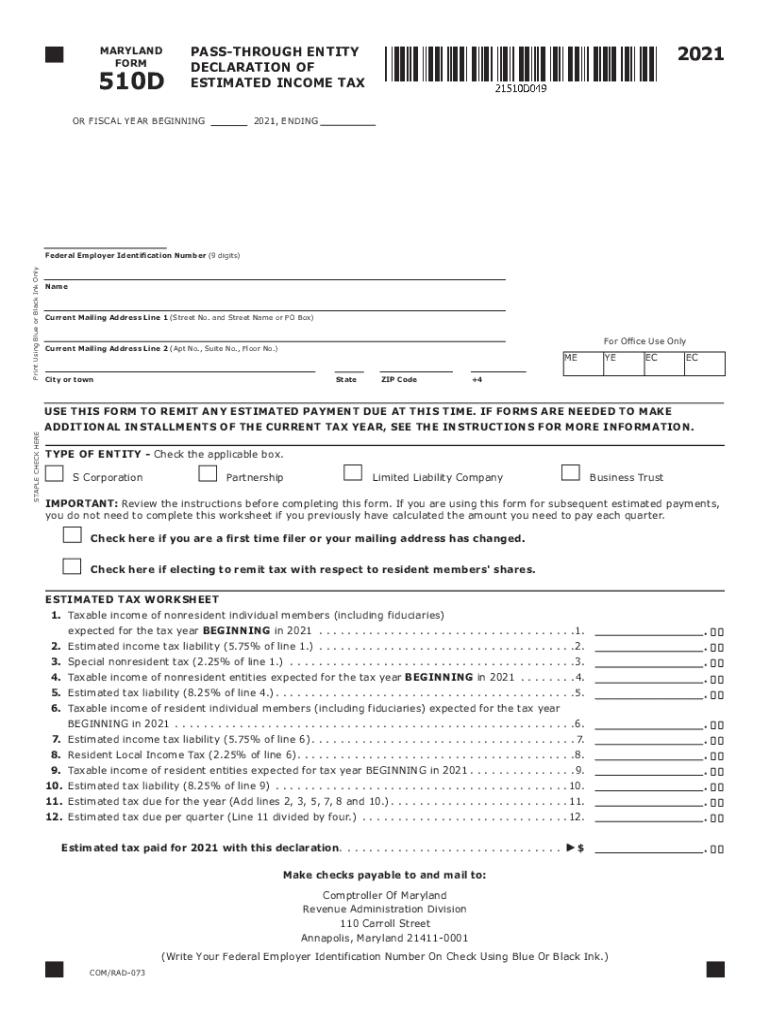

2021 MD Form 510D Fill Online, Printable, Fillable, Blank pdfFiller

The instruction booklets listed here do not include forms. You can download tax forms using the links listed below. Web (investment partnerships see specific instructions.) 5. Web 2022 instruction booklets note: Nonresident members other than individuals may not.

Maryland Form 202 Fill and Sign Printable Template Online US Legal

See instructions for form 505: Web 510c filed this tax year's beginning and ending dates are different from last year's due to an acquisition or consolidation. The instruction booklets listed here do not include forms. Visit any of our taxpayer service offices to obtain forms. Web 2022 instruction booklets note:

elliemeyersdesigns Maryland Form 510

Maryland schedules a and b instructions form 511 2022 6. Web (investment partnerships see specific instructions.) 5. Web we offer several ways for you to obtain maryland tax forms, booklets and instructions: Web 2022 instruction booklets note: Web 2022 individual income tax forms 2022 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information.

Web We Offer Several Ways For You To Obtain Maryland Tax Forms, Booklets And Instructions:

List credit on form 502cr, part cc, lines 6 and/or 9. The request for extension of time to file will be granted provided. Resident individual members filingform 502: Web (investment partnerships see specific instructions.) 5.

Visit Any Of Our Taxpayer Service Offices To Obtain Forms.

Line 45 for credits from form 510 and for electing ptes, list credit on form 502cr, part cc, line 9. The instruction booklets listed here do not include forms. List credit on form 500cr. Form 504, see instructions for form 504.

File Maryland Form 510 Electronically To Pass On Business Tax Credits From Maryland Form 500Cr And/Or Maryland Form 502S To Your Members.

Web 2022 individual income tax forms 2022 individual income tax forms for additional information, visit income tax for individual taxpayers > filing information. Web instructions for form 500. Maryland schedules a and b instructions form 511 2022 6. This form may be used if the pte is paying tax only on behalf of nonresident members and not electing to remit on all members' share of income.

Formula Of Receipts And Property, With Receipts From Intangible Items.

See instructions for form 505: You can download tax forms using the links listed below. Forms are available for downloading in the resident individuals income tax forms section below. Nonresident members other than individuals may not.