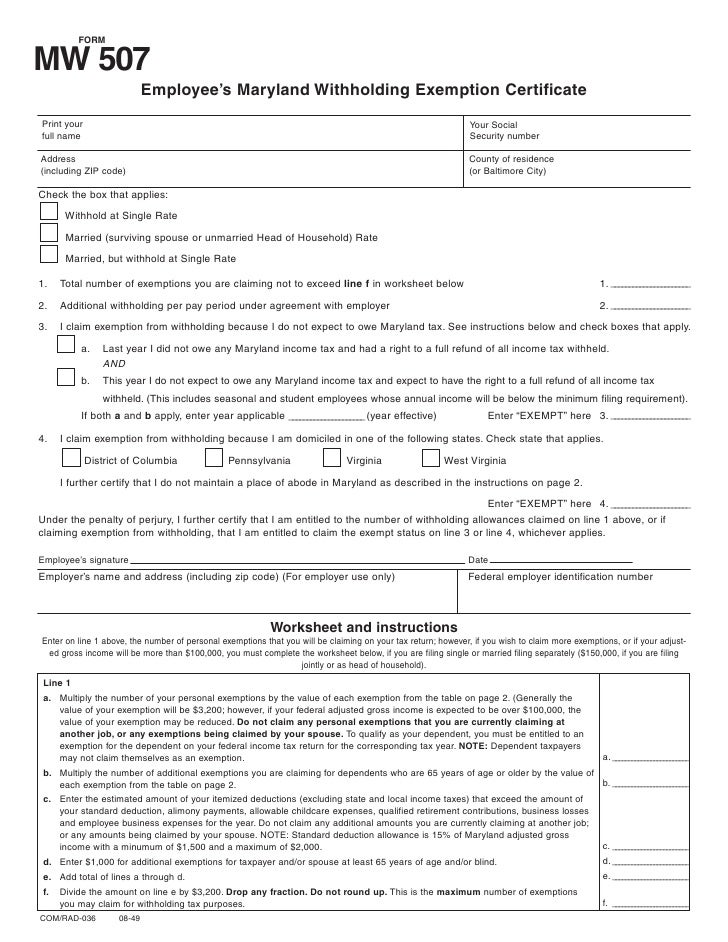

Maryland State Withholding Form 2023

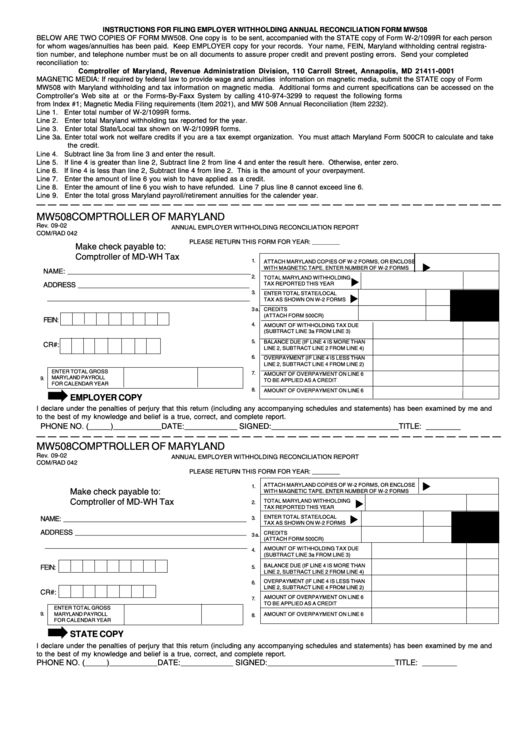

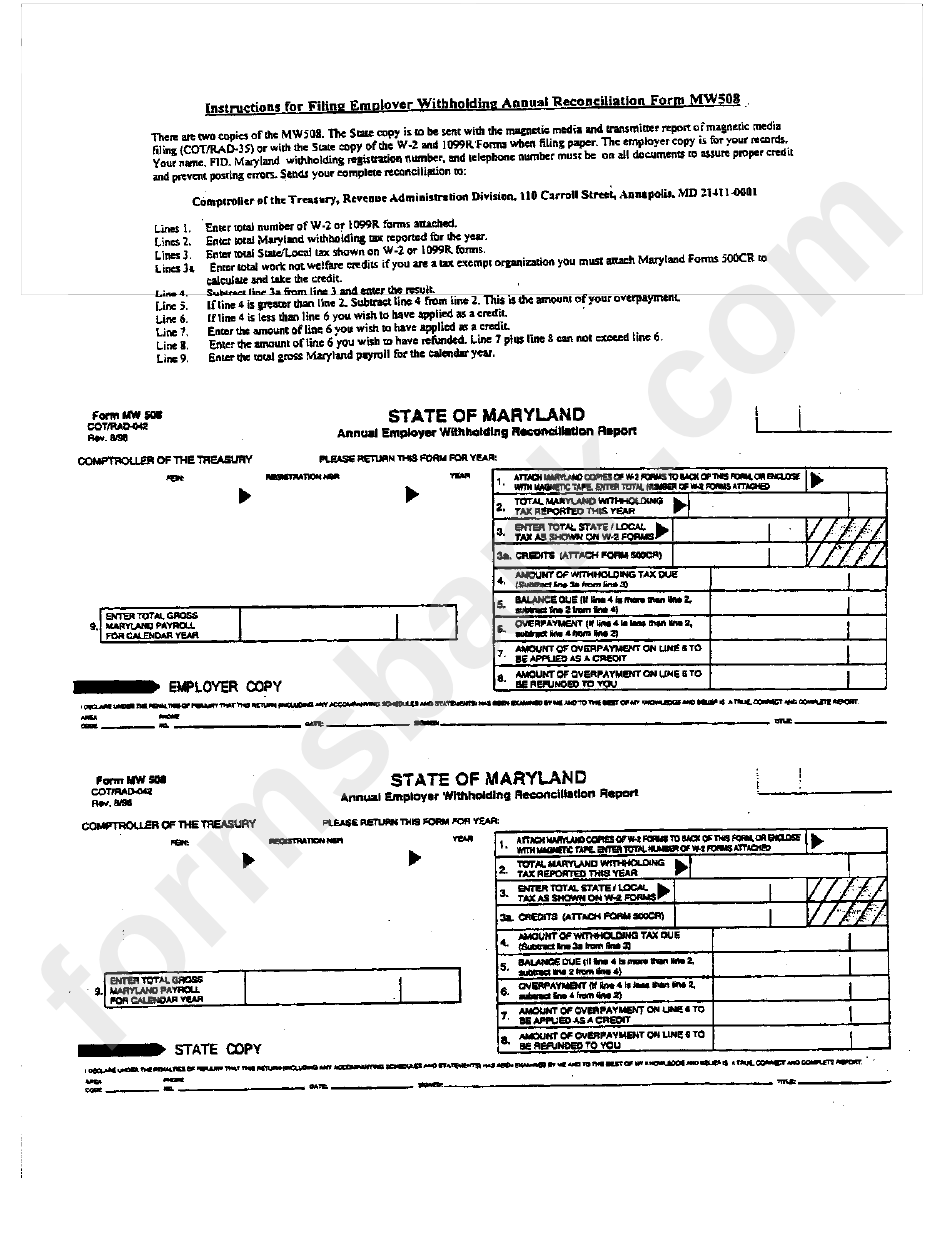

Maryland State Withholding Form 2023 - Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%. Web form used to report the total amount of withholding tax received during the reporting period. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. For most employees who are not residents of maryland the nonresident rate (7.0%) is used, which includes no local tax; These rates were current at the time this guide was developed. The maryland legislature may change this tax rate when in session. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Form used by employers who have discontinued or. This guide is effective january 2023 and includes local income tax rates. Form mw508 is available at www.marylandtaxes.gov.

This guide is effective january 2023 and includes local income tax rates. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. Web maryland employer withholding guide. Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%. Web form used to report the total amount of withholding tax received during the reporting period. Web return due january 31, 2023 the annual employer withholding reconciliation return (form mw508) for tax year 2022 is due january 31, 2023. Form used by employers who have discontinued or. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. Consider completing a new form mw507 each year and when your personal or financial situation changes. These rates were current at the time this guide was developed.

These rates were current at the time this guide was developed. Web return due january 31, 2023 the annual employer withholding reconciliation return (form mw508) for tax year 2022 is due january 31, 2023. This guide is effective january 2023 and includes local income tax rates. Web maryland employer withholding guide. Form mw508 is available at www.marylandtaxes.gov. Your withholding is subject to review by the. Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%. Web form used to report the total amount of withholding tax received during the reporting period. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. Consider completing a new form mw507 each year and when your personal or financial situation changes.

Maryland State Employees

But does include the special 2.25% nonresident rate. Web return due january 31, 2023 the annual employer withholding reconciliation return (form mw508) for tax year 2022 is due january 31, 2023. Your withholding is subject to review by the. The maryland legislature may change this tax rate when in session. Form used by employers who have discontinued or.

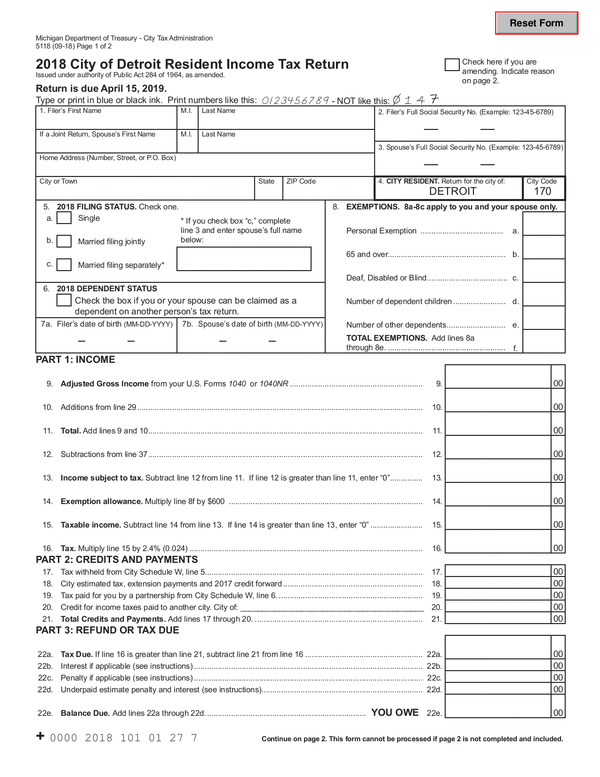

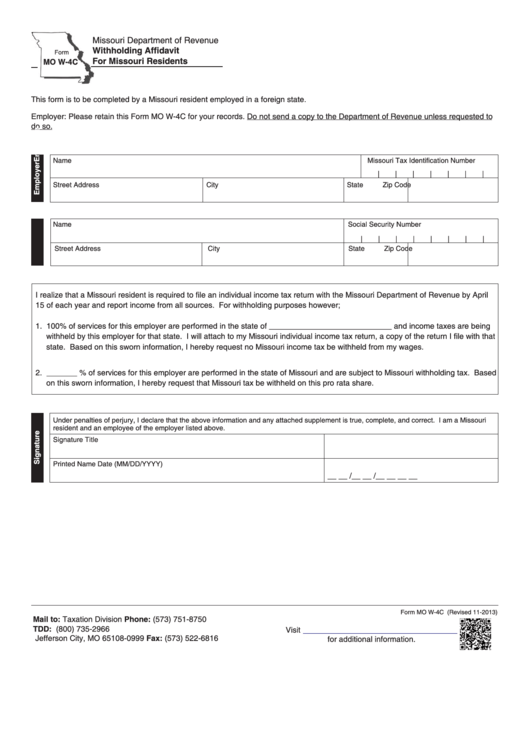

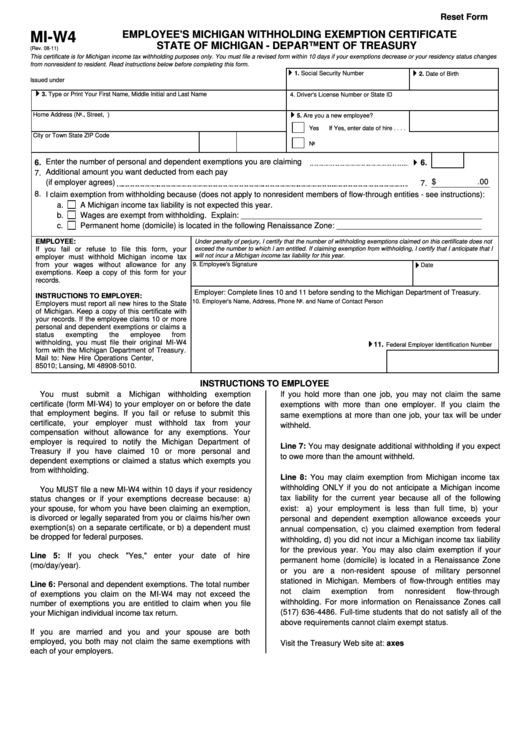

Mi State Withholding Form 2022

This guide is effective january 2023 and includes local income tax rates. Web form used to report the total amount of withholding tax received during the reporting period. Form used by employers who have discontinued or. Web return due january 31, 2023 the annual employer withholding reconciliation return (form mw508) for tax year 2022 is due january 31, 2023. Complete.

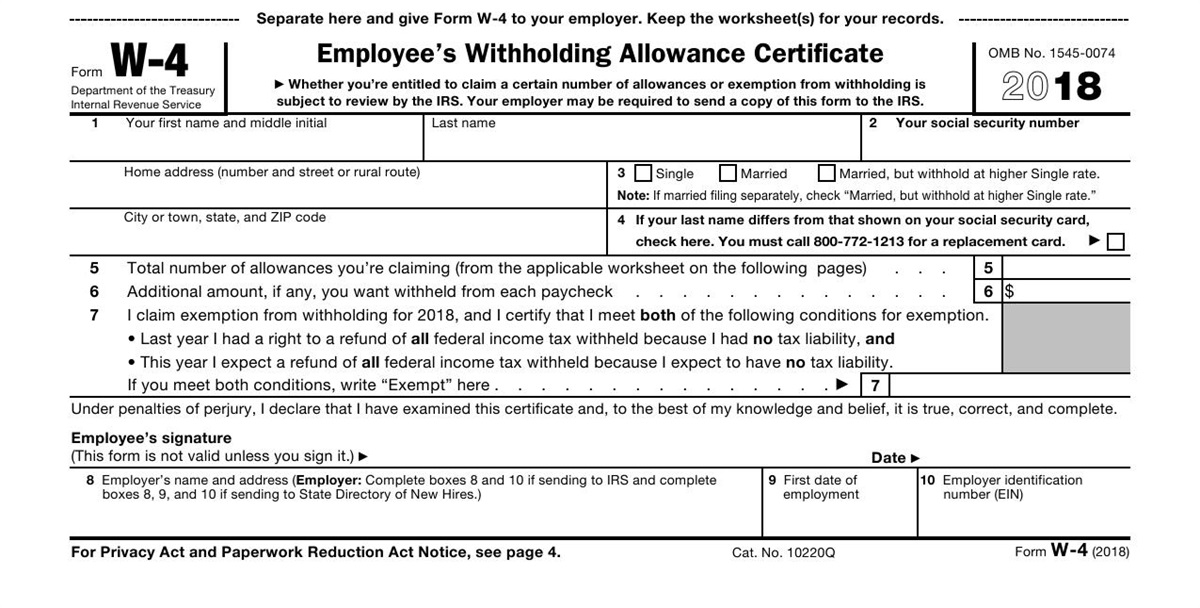

Maryland Withholding Form 2021 2022 W4 Form

These rates were current at the time this guide was developed. Web return due january 31, 2023 the annual employer withholding reconciliation return (form mw508) for tax year 2022 is due january 31, 2023. Web form used to report the total amount of withholding tax received during the reporting period. This guide is effective january 2023 and includes local income.

Maryland State Tax Withholding Form

Consider completing a new form mw507 each year and when your personal or financial situation changes. The maryland legislature may change this tax rate when in session. Web form used to report the total amount of withholding tax received during the reporting period. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay..

Maryland State Withholding Form Mw507 In Spanish

Web return due january 31, 2023 the annual employer withholding reconciliation return (form mw508) for tax year 2022 is due january 31, 2023. Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%. For most employees who are not residents of maryland the nonresident.

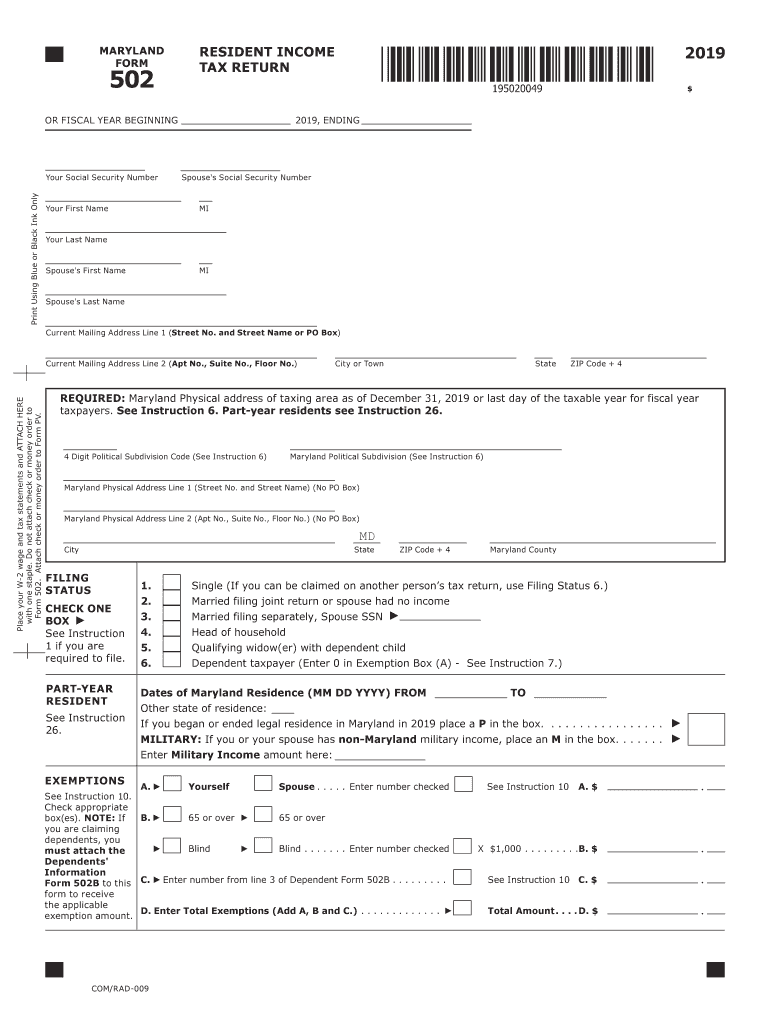

Maryland Tax Form 502 2019 Fill Out and Sign Printable PDF Template

But does include the special 2.25% nonresident rate. Web form used to report the total amount of withholding tax received during the reporting period. The maryland legislature may change this tax rate when in session. Form used by employers who have discontinued or. Web return due january 31, 2023 the annual employer withholding reconciliation return (form mw508) for tax year.

Maryland Withholding

For most employees who are not residents of maryland the nonresident rate (7.0%) is used, which includes no local tax; The maryland legislature may change this tax rate when in session. Your withholding is subject to review by the. But does include the special 2.25% nonresident rate. Form mw508 is available at www.marylandtaxes.gov.

Maryland State Tax Withholding Form 2022

Consider completing a new form mw507 each year and when your personal or financial situation changes. Web maryland employer withholding guide. This guide is effective january 2023 and includes local income tax rates. But does include the special 2.25% nonresident rate. For most employees who are not residents of maryland the nonresident rate (7.0%) is used, which includes no local.

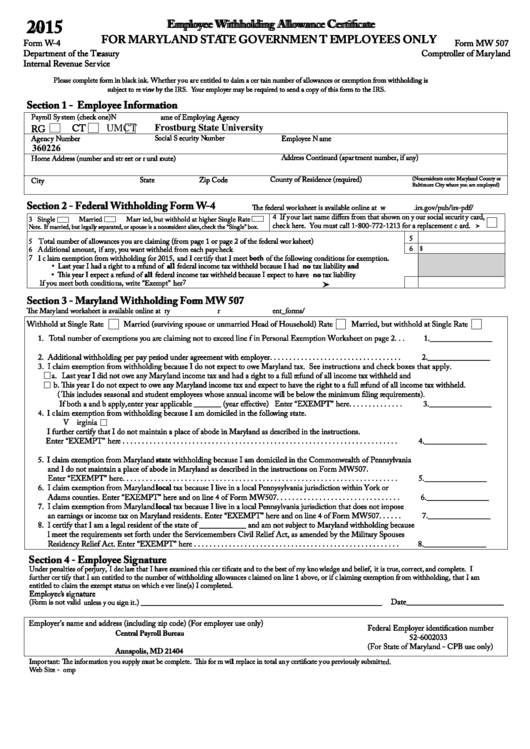

Form W4 Employee Withholding Allowance Certificate For Maryland

Web return due january 31, 2023 the annual employer withholding reconciliation return (form mw508) for tax year 2022 is due january 31, 2023. Enter on line 1 below, the number of personal exemptions you will claim on your tax return. Consider completing a new form mw507 each year and when your personal or financial situation changes. Web form used to.

Mi State Withholding Form 2022

These rates were current at the time this guide was developed. Complete form mw507 so that your employer can withhold the correct maryland income tax from your pay. The maryland legislature may change this tax rate when in session. For most employees who are not residents of maryland the nonresident rate (7.0%) is used, which includes no local tax; Web.

Complete Form Mw507 So That Your Employer Can Withhold The Correct Maryland Income Tax From Your Pay.

This guide is effective january 2023 and includes local income tax rates. Form mw508 is available at www.marylandtaxes.gov. Web maryland employer withholding guide. For most employees who are not residents of maryland the nonresident rate (7.0%) is used, which includes no local tax;

Enter On Line 1 Below, The Number Of Personal Exemptions You Will Claim On Your Tax Return.

Web employees that do not submit a withholding certificate are defaulted to the highest rate of local tax, which for the year 2023 will be 3.20%. Form used by employers who have discontinued or. The maryland legislature may change this tax rate when in session. Web return due january 31, 2023 the annual employer withholding reconciliation return (form mw508) for tax year 2022 is due january 31, 2023.

Your Withholding Is Subject To Review By The.

But does include the special 2.25% nonresident rate. Consider completing a new form mw507 each year and when your personal or financial situation changes. These rates were current at the time this guide was developed. Web form used to report the total amount of withholding tax received during the reporting period.